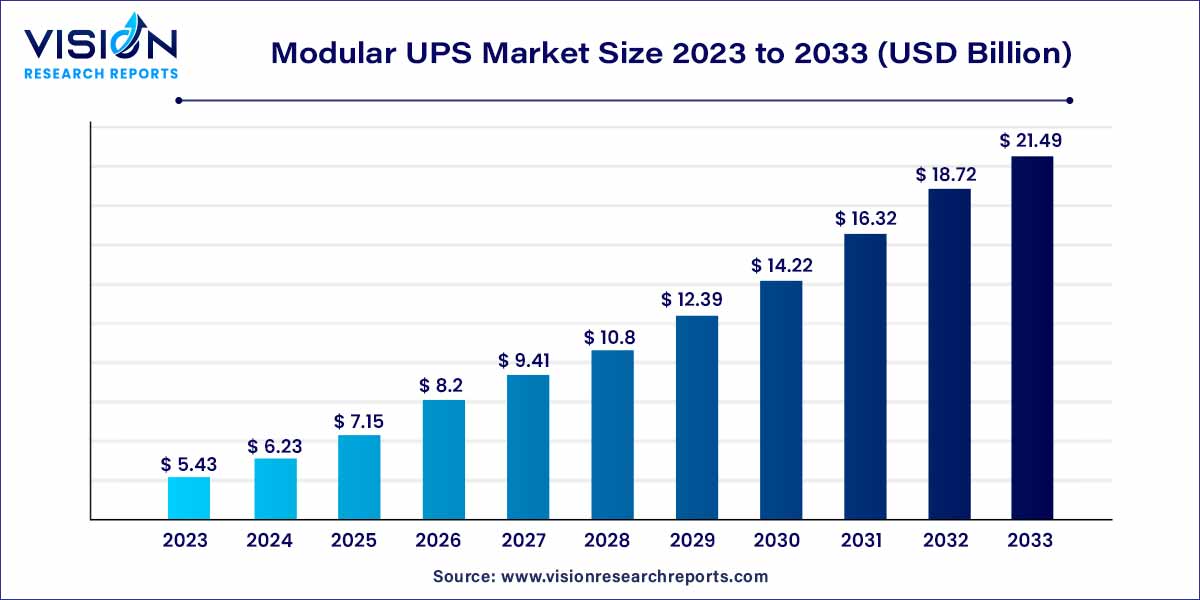

The global modular UPS market size was estimated at around USD 5.43 billion in 2023 and it is projected to hit around USD 21.49 billion by 2033, growing at a CAGR of 14.75% from 2024 to 2033. The global modular UPS market driven by the growing demand for technology advancements, cloud computing adoption, digital services, data storage needs, regulatory requirements, expanding user base, and business scalability across regions.

The modular uninterruptible power supply (UPS) market has witnessed significant growth in recent years, driven by advancements in technology, increasing demand for reliable power solutions, and the growing awareness of energy efficiency. This article provides a comprehensive overview of the modular UPS market, exploring key trends, market drivers, challenges, and opportunities.

The growth of the Modular UPS market can be attributed to several key factors. Firstly, the scalability and flexibility inherent in modular UPS systems have garnered substantial attention, allowing businesses to easily adapt to evolving power requirements without major infrastructure overhauls. Additionally, the heightened focus on energy efficiency in today's environmentally conscious landscape has driven the adoption of modular UPS solutions, which feature advanced technologies promoting optimal energy utilization. The increased reliability offered by the modular architecture, with its redundancy capabilities ensuring uninterrupted power supply, particularly benefits sectors like data centers and manufacturing facilities. Furthermore, the integration of IoT technology has empowered modular UPS systems with remote monitoring and management capabilities, enabling real-time performance tracking and proactive maintenance. The rising demand for data centers, driven by the digital transformation era, further propels the market's growth, as these systems provide the scalability and reliability crucial for supporting critical data center operations. Lastly, the growing awareness of power quality and its impact on electronic equipment has positioned modular UPS systems as essential for maintaining stable and clean power, fostering their adoption across diverse industries.

| Report Coverage | Details |

| Growth rate from 2024 to 2033 | CAGR of 14.75% |

| Market Size in 2023 | USD 5.43 billion |

| Revenue Forecast by 2033 | USD 21.49 billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Based on the offerings, the modular UPS market is segmented into solutions and services. The solution segment held the largest market share in 2023. The Power requirements for enterprises can increase as they grow, mandating an adaptable power infrastructure. Modularity meets this requirement by providing an extensible UPS solution. A modular UPS design facilitates capacity upgrades and decreases downtime during servicing or expansion by allowing for the simple addition or removal of power modules.

Based on the organization size, the modular UPS market is segmented into SMEs and large enterprises. The large enterprise segment held the largest market share in 2023. Large organizations generate and manage massive amounts of data from various sources, such as client transactions, interactions, and activities. Furthermore, there has been an increase in the use of cloud computing to improve operations, increase scalability, and reduce costs. The data center provides support for sophisticated technologies and applications. The increasing reliance on these setups requires an uninterrupted power supply to avoid downtime. Hence, the demand for modular UPS is expected to grow in large enterprises.

Based on the verticals, the modular UPS market is segmented into Telecom & ITES, government, cloud services & colocation providers, BFSI, retail & consumer, healthcare, manufacturing & automotive and others. The telecom & ITES segment held the largest market share in 2023. To manage the growing amount of data processing and storage, cloud computing capabilities in the telecom and ITES industry, power supply plays a pivotal role.

The demand for sustainable power protection to enable continuous operations and avoid data loss expands owing to the nation's increasing reliance on digital technology, data centers, and cloud services. In these instances, UPS systems have become essential to prevent downtime and data corruption, thereby increasing the demand for the market.

Asia Pacific dominated the market in 2023. The developing IT industry and growing traction towards e-commerce and digital payment throughout Asia are increasing the demand for data centers, which require constant power supply, thereby increasing the demand for modular UPS. Moreover, growing concerns over data or asset theft have also prompted authorities to put regularity compliance in place, which is also driving the market growth. Latin America is expected to witness the fastest CAGR over the forecast period.

Latin America has grown in popularity in recent years. Advanced technologies such as lot, big data, and artificial intelligence are becoming more popular in the region. Cloud use is also accelerating in this sector. In addition to establishing microgrids and local power generation, operators purchase redundant power infrastructure, such as UPS systems, to power their facilities, generating income for system makers and propelling the market forward.

Modular UPS Market Segmentations:

By Offering

By Organization Size

By Verticals

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Offering Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Modular UPS Market

5.1. COVID-19 Landscape: Modular UPS Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Modular UPS Market, By Offering

8.1. Modular UPS Market, by Offering, 2024-2033

8.1.1 Solutions

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Modular UPS Market, By Organization Size

9.1. Modular UPS Market, by Organization Size, 2024-2033

9.1.1. SMEs

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Large Enterprises

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Modular UPS Market, By Verticals

10.1. Modular UPS Market, by Verticals, 2024-2033

10.1.1. Telecom

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. ITES

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Government

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Cloud Services

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Colocation Providers

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. BFSI

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Retail & Consumer

10.1.7.1. Market Revenue and Forecast (2021-2033)

10.1.8. Healthcare

10.1.8.1. Market Revenue and Forecast (2021-2033)

10.1.9. Manufacturing & Automotive

10.1.9.1. Market Revenue and Forecast (2021-2033)

10.1.10. Others

10.1.10.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Modular UPS Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Offering (2021-2033)

11.1.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.1.3. Market Revenue and Forecast, by Verticals (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Offering (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Verticals (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Offering (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Verticals (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Offering (2021-2033)

11.2.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.2.3. Market Revenue and Forecast, by Verticals (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Offering (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Verticals (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Offering (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Verticals (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Offering (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Verticals (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Offering (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Verticals (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Offering (2021-2033)

11.3.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.3.3. Market Revenue and Forecast, by Verticals (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Offering (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Verticals (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Offering (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Verticals (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Offering (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Verticals (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Offering (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Verticals (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Offering (2021-2033)

11.4.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.4.3. Market Revenue and Forecast, by Verticals (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Offering (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Verticals (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Offering (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Verticals (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Offering (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Verticals (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Offering (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Verticals (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Offering (2021-2033)

11.5.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.5.3. Market Revenue and Forecast, by Verticals (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Offering (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Verticals (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Offering (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Verticals (2021-2033)

Chapter 12. Company Profiles

12.1. ABB Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Emerson Network Power.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Huawei Technologies Co. Ltd.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Schneider Electric SE.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. General Electric.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Delta Electronics Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. AEG Power Solutions.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Riello Elettronica Group

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Eaton Corporation.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others