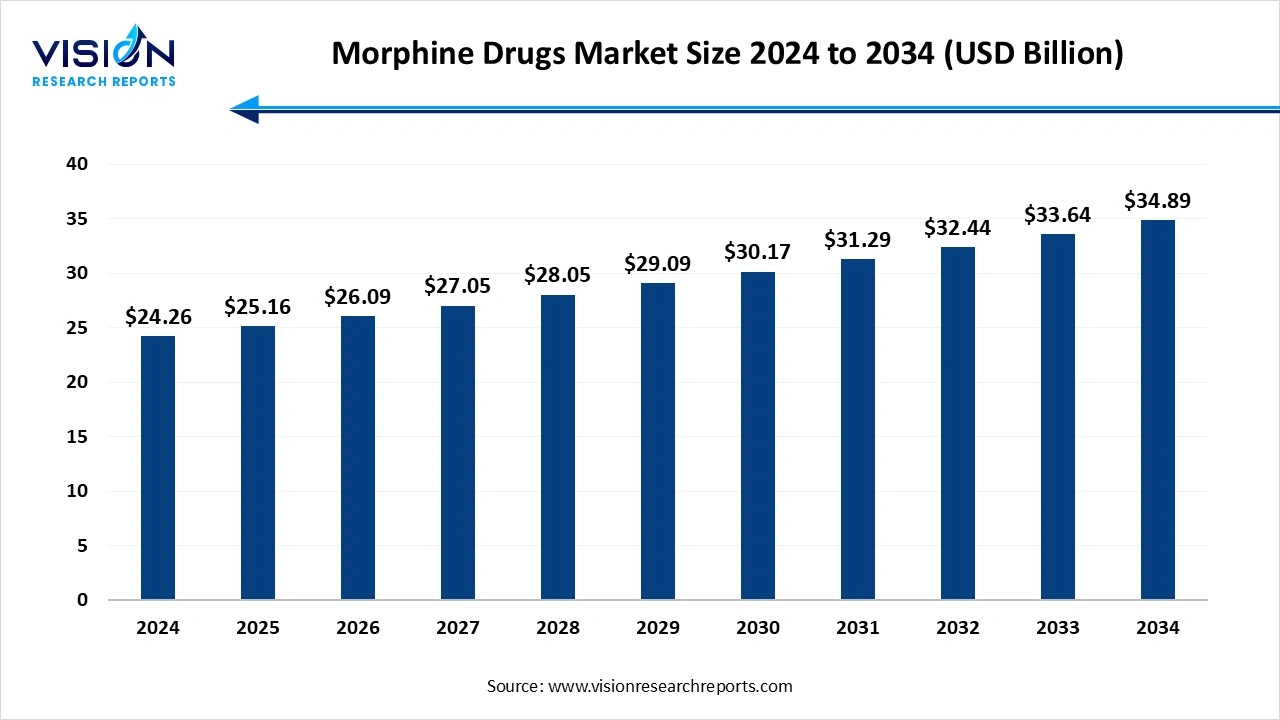

The global morphine drugs market size was valued at USD 24.26 billion in 2024 and is expected to grow from USD 25.16 billion in 2025, to reach USD 34.89 billion by 2034, growing at a CAGR of 3.7% over the forecast period. The morphine drugs market growth is driven by rising chronic pain cases, increasing surgeries, an aging population, and growing awareness of morphine’s effectiveness. Advancements in formulations, expanded healthcare access, and strategic initiatives by key players also support market growth despite regulatory and addiction challenges.

The morphine drugs market encompasses a significant segment within the pharmaceutical industry, focusing on medications derived from the opium poppy plant. Morphine, a potent opioid analgesic, is widely used for pain management in various medical settings, including post-surgical care, palliative care, and treatment of chronic pain conditions.

The growth of the morphine drugs market is fueled by several key factors. Firstly, the increasing prevalence of chronic pain conditions worldwide, coupled with an aging population, is driving the demand for effective pain management solutions. Additionally, the rising number of surgical procedures, particularly in areas such as orthopedics and oncology, contributes to the market's growth. Furthermore, the growing awareness among healthcare professionals regarding the efficacy of morphine in pain management, along with advancements in drug delivery technologies, is expanding the market's reach. Moreover, strategic initiatives by key market players, including product launches and partnerships, are further stimulating market growth. Despite challenges such as concerns about opioid addiction and regulatory constraints, the morphine drugs market is poised for significant expansion in the coming years, driven by the increasing need for safe and efficient pain relief options.

| Report Coverage | Details |

| Market Size in 2024 | USD 24.26 Billion |

| Revenue Forecast by 2034 | USD 34.89 Billion |

| Growth rate from 2025 to 2034 | CAGR of 3.7% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Pfizer Inc., Sun Pharmaceutical Industries Ltd., Verve Health Care Ltd., Mallinckrodt Pharmaceuticals, Purdue Pharma, Qinghai Pharmaceuticals, and AbbVie Inc. |

North America led the market in 2024, driven by the strong presence of established pharmaceutical players and a high prevalence of chronic pain conditions such as arthritis, neuropathic pain, and back pain. The region also experiences rising cases of musculoskeletal disorders, which further increases the demand for morphine-based treatments. Additionally, North America benefits from an advanced healthcare ecosystem comprising well-developed hospital networks, specialized clinics, and comprehensive palliative care services where morphine drugs are widely accessible and integrated into standard pain management protocols. These factors collectively support the region’s market dominance.

Asia-Pacific is projected to grow at the fastest rate during the forecast period, supported by rapidly developing economies like China, India, Thailand, Indonesia, and Vietnam. Rising disposable incomes and an expanding middle-class population are contributing to increased healthcare spending. The region also continues to strengthen its healthcare infrastructure through substantial government investments in medical facilities and palliative care services. As these improvements progress, the accessibility and use of morphine drugs are expected to increase significantly, fueling robust market growth across the region.

The injectable morphine dominated the market in 2024, primarily due to its rapid onset of action and suitability for acute and surgical care settings. Unlike oral formulations, which undergo delayed metabolization, injectable morphine delivers immediate pain relief critical for managing severe pain, trauma, and postoperative conditions. Its high bioavailability and consistent absorption make intravenous (IV) morphine the preferred choice across emergency departments, operating rooms, and intensive care units.

The oral segment is poised to be the fastest-growing category during the forecast period. Oral morphine offers convenience, flexibility, and ease of use for both acute and chronic pain management. With the availability of immediate-release and extended-release formulations, clinicians can tailor treatment plans based on pain severity, duration, and patient response, driving strong adoption across diverse healthcare environments.

The pain management segment led the morphine drugs market this year. Morphine is widely used to alleviate pain from surgery, childbirth, cancer, and severe trauma caused by accidents. It plays a critical role in treating acute, chronic, and cancer-related pain across various medical settings. Key applications include palliative care for terminally ill patients, management of acute injuries and trauma, cancer pain relief, and postoperative pain reduction.

The cold and cough segment is experiencing the fastest growth this year. This surge is driven by the increasing integration of respiratory care, where codeine alternatives often fall short. Additionally, emerging low-histamine formulations are being explored to minimize antitussive side effects.

In 2024, hospital pharmacies emerged as the most dominant segment. This segment facilitates the distribution of morphine medications across various hospital settings, including inpatient units, outpatient clinics, emergency departments, and surgical centers. Administration is carried out under the supervision of medical professionals such as doctors, nurses, and pharmacists, ensuring the safe and effective delivery of morphine to patients.

The retail pharmacies are projected to be the fastest-growing segment over the forecast period. These outlets provide patients with prescribed morphine for both acute and chronic pain management. By offering personalized counseling, medication distribution, and refill services, retail pharmacies play a crucial role in enhancing patient education, adherence, and overall treatment outcomes.

In 2024, hospitals and clinics held the largest share of the morphine market. This segment provides a wide range of healthcare services, including acute care, surgical procedures, and specialized treatments. Morphine is extensively used in these settings for pain management across various therapeutic contexts, such as postoperative pain relief, trauma and acute injury management, cancer-related pain, and palliative care for terminally ill patients. To address diverse pain management needs across multiple departments, hospitals and clinics maintain comprehensive formularies that include morphine in injectable, oral, and transdermal forms.

The ambulatory surgical centers (ASCs) segment is projected to grow at the fastest rate during the forecast period. ASCs offer convenient outpatient alternatives to traditional hospital care for elective or minimally invasive procedures. Morphine is employed for perioperative pain control, delivered through oral medications, intravenous (IV) injections, or patient-controlled analgesia (PCA) pumps, depending on the procedure, patient medical history, and anesthesia plan.

By Dosage Form

By Application

By Distribution Channel

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Morphine Drugs Market

5.1. COVID-19 Landscape: Morphine Drugs Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Morphine Drugs Market, By Dosage Form

8.1. Morphine Drugs Market, by Dosage Form,

8.1.1. Injection

8.1.1.1. Market Revenue and Forecast

8.1.2. Oral

8.1.2.1. Market Revenue and Forecast

8.1.3. Other

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Morphine Drugs Market, By Application

9.1. Morphine Drugs Market, by Application,

9.1.1. Pain Management

9.1.1.1. Market Revenue and Forecast

9.1.2. Diarrhea Suppressant

9.1.2.1. Market Revenue and Forecast

9.1.3. Cold & Cough Suppressant

9.1.3.1. Market Revenue and Forecast

9.1.4. Others

9.1.4.1. Market Revenue and Forecast

Chapter 10. Global Morphine Drugs Market, By Distribution Channel

10.1. Morphine Drugs Market, by Distribution Channel,

10.1.1. Retail Pharmacies

10.1.1.1. Market Revenue and Forecast

10.1.2. Hospital Pharmacies

10.1.2.1. Market Revenue and Forecast

10.1.3. Online Pharmacies

10.1.3.1. Market Revenue and Forecast

10.1.4. Others

10.1.4.1. Market Revenue and Forecast

Chapter 11. Global Morphine Drugs Market, By End-use

11.1. Morphine Drugs Market, by End-use,

11.1.1. Hospitals & Clinics

11.1.1.1. Market Revenue and Forecast

11.1.2. Ambulatory Surgical Centers

11.1.2.1. Market Revenue and Forecast

11.1.3. Others

11.1.3.1. Market Revenue and Forecast

Chapter 12. Global Morphine Drugs Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Dosage Form

12.1.2. Market Revenue and Forecast, by Application

12.1.3. Market Revenue and Forecast, by Distribution Channel

12.1.4. Market Revenue and Forecast, by End-use

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Dosage Form

12.1.5.2. Market Revenue and Forecast, by Application

12.1.5.3. Market Revenue and Forecast, by Distribution Channel

12.1.5.4. Market Revenue and Forecast, by End-use

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Dosage Form

12.1.6.2. Market Revenue and Forecast, by Application

12.1.6.3. Market Revenue and Forecast, by Distribution Channel

12.1.6.4. Market Revenue and Forecast, by End-use

12.2. Europe

12.2.1. Market Revenue and Forecast, by Dosage Form

12.2.2. Market Revenue and Forecast, by Application

12.2.3. Market Revenue and Forecast, by Distribution Channel

12.2.4. Market Revenue and Forecast, by End-use

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Dosage Form

12.2.5.2. Market Revenue and Forecast, by Application

12.2.5.3. Market Revenue and Forecast, by Distribution Channel

12.2.5.4. Market Revenue and Forecast, by End-use

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Dosage Form

12.2.6.2. Market Revenue and Forecast, by Application

12.2.6.3. Market Revenue and Forecast, by Distribution Channel

12.2.6.4. Market Revenue and Forecast, by End-use

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Dosage Form

12.2.7.2. Market Revenue and Forecast, by Application

12.2.7.3. Market Revenue and Forecast, by Distribution Channel

12.2.7.4. Market Revenue and Forecast, by End-use

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Dosage Form

12.2.8.2. Market Revenue and Forecast, by Application

12.2.8.3. Market Revenue and Forecast, by Distribution Channel

12.2.8.4. Market Revenue and Forecast, by End-use

12.3. APAC

12.3.1. Market Revenue and Forecast, by Dosage Form

12.3.2. Market Revenue and Forecast, by Application

12.3.3. Market Revenue and Forecast, by Distribution Channel

12.3.4. Market Revenue and Forecast, by End-use

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Dosage Form

12.3.5.2. Market Revenue and Forecast, by Application

12.3.5.3. Market Revenue and Forecast, by Distribution Channel

12.3.5.4. Market Revenue and Forecast, by End-use

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Dosage Form

12.3.6.2. Market Revenue and Forecast, by Application

12.3.6.3. Market Revenue and Forecast, by Distribution Channel

12.3.6.4. Market Revenue and Forecast, by End-use

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Dosage Form

12.3.7.2. Market Revenue and Forecast, by Application

12.3.7.3. Market Revenue and Forecast, by Distribution Channel

12.3.7.4. Market Revenue and Forecast, by End-use

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Dosage Form

12.3.8.2. Market Revenue and Forecast, by Application

12.3.8.3. Market Revenue and Forecast, by Distribution Channel

12.3.8.4. Market Revenue and Forecast, by End-use

12.4. MEA

12.4.1. Market Revenue and Forecast, by Dosage Form

12.4.2. Market Revenue and Forecast, by Application

12.4.3. Market Revenue and Forecast, by Distribution Channel

12.4.4. Market Revenue and Forecast, by End-use

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Dosage Form

12.4.5.2. Market Revenue and Forecast, by Application

12.4.5.3. Market Revenue and Forecast, by Distribution Channel

12.4.5.4. Market Revenue and Forecast, by End-use

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Dosage Form

12.4.6.2. Market Revenue and Forecast, by Application

12.4.6.3. Market Revenue and Forecast, by Distribution Channel

12.4.6.4. Market Revenue and Forecast, by End-use

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Dosage Form

12.4.7.2. Market Revenue and Forecast, by Application

12.4.7.3. Market Revenue and Forecast, by Distribution Channel

12.4.7.4. Market Revenue and Forecast, by End-use

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Dosage Form

12.4.8.2. Market Revenue and Forecast, by Application

12.4.8.3. Market Revenue and Forecast, by Distribution Channel

12.4.8.4. Market Revenue and Forecast, by End-use

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Dosage Form

12.5.2. Market Revenue and Forecast, by Application

12.5.3. Market Revenue and Forecast, by Distribution Channel

12.5.4. Market Revenue and Forecast, by End-use

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Dosage Form

12.5.5.2. Market Revenue and Forecast, by Application

12.5.5.3. Market Revenue and Forecast, by Distribution Channel

12.5.5.4. Market Revenue and Forecast, by End-use

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Dosage Form

12.5.6.2. Market Revenue and Forecast, by Application

12.5.6.3. Market Revenue and Forecast, by Distribution Channel

12.5.6.4. Market Revenue and Forecast, by End-use

Chapter 13. Company Profiles

13.1. Pfizer Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Sun Pharmaceutical Industries Ltd.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Verve Health Care Ltd.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Mallinckrodt Pharmaceuticals

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Purdue Pharma

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Qinghai Pharmaceuticals

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. AbbVie Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others