Moderna, Inc., BioNTech SE, CureVac N.V., Arcturus Therapeutics, Translate Bio, Inc., GSK plc., Argos Therapeutics Inc., Sangamo Therapeutics, Inc., Pfizer Inc., AstraZeneca plc., and CRISPR Therapeutics AG.

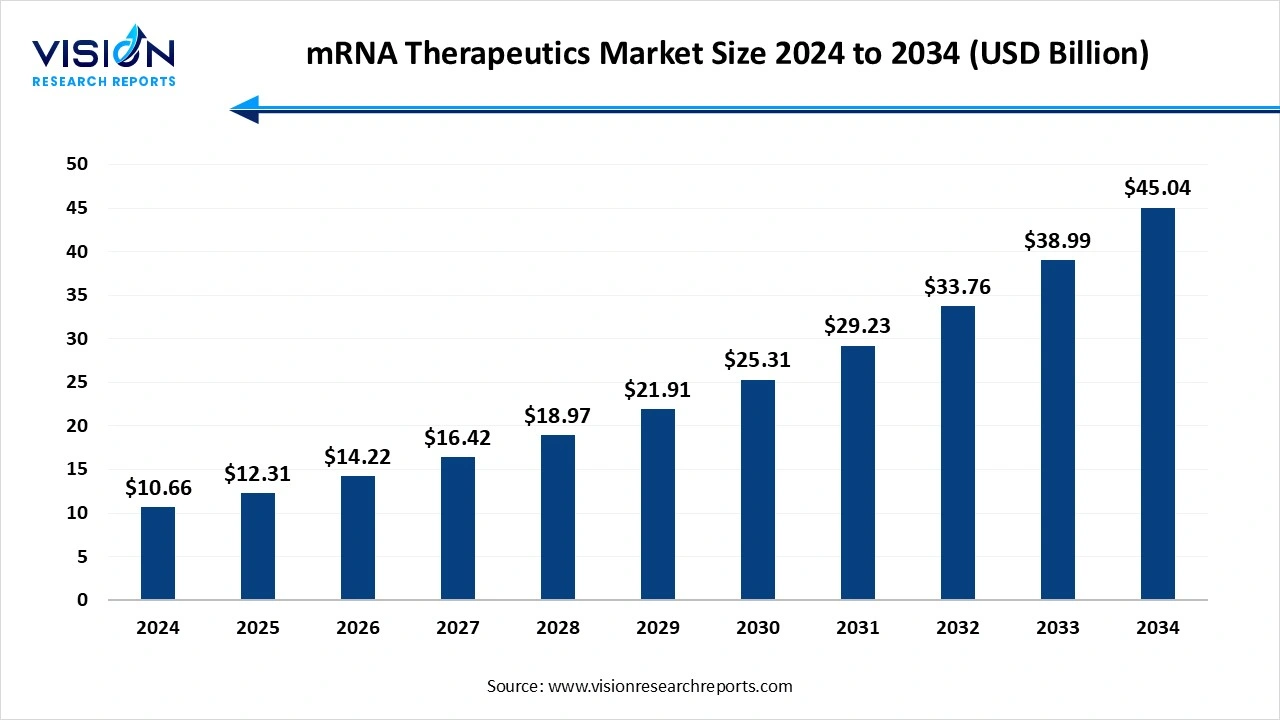

The global mRNA therapeutics market reached USD 10.66 billion in 2024 and is expected to reach USD 12.31 billion in 2025, projected to hit USD 45.04 billion by 2034, growing at a CAGR of 15.5% from 2025 to 2034. The growth of the mRNA therapeutics market is driven by the proven success of mRNA-based COVID-19 vaccines, which boosted confidence in the technology’s safety and effectiveness. Expanding research into cancer, rare genetic disorders, and infectious diseases, along with advances in lipid nanoparticle delivery systems, is further propelling growth.

The global mRNA therapeutics market has emerged as one of the most dynamic segments in the biotechnology industry, driven by rapid advancements in genetic research and vaccine development technologies. mRNA-based therapies utilize messenger RNA to instruct cells to produce specific proteins that can prevent, treat, or cure various diseases. Following the success of mRNA vaccines for COVID-19, the technology has gained significant momentum, expanding its potential applications beyond infectious diseases to include cancer, cardiovascular disorders, and rare genetic conditions. Pharmaceutical and biotech companies are heavily investing in R&D to enhance mRNA stability, delivery systems, and manufacturing scalability. In addition, growing government support, favorable regulatory policies, and strategic collaborations are fueling innovation and commercialization. As a result, the mRNA therapeutics market is projected to witness robust growth over the coming years, positioning it as a key frontier in next-generation medicine.

The growth of the mRNA therapeutics market can be attributed to several key factors driving its upward trajectory. Firstly, the successful deployment of mRNA-based vaccines for infectious diseases, exemplified by the response to the COVID-19 pandemic, has bolstered confidence in the efficacy and adaptability of mRNA technology. Additionally, strategic collaborations between prominent pharmaceutical entities and innovative biotech firms have played a pivotal role. These partnerships bring together diverse expertise and resources, accelerating the development and commercialization of mRNA therapies. The expanding clinical landscape, with ongoing trials spanning various therapeutic areas, further contributes to market growth, signifying increased acceptance of mRNA as a viable therapeutic modality.

Despite existing challenges, including delivery optimization and potential immune responses, the continuous commitment to overcoming these obstacles underscores the resilience and potential of mRNA therapeutics. As research and development efforts persist, the future of the mRNA therapeutics market appears poised for sustained expansion, offering innovative solutions for a wide array of medical conditions.

| Report Coverage | Details |

| Market Size in 2024 | USD 10.66 Billion |

| Revenue Forecast by 2034 | USD 45.04 Billion |

| Growth rate from 2025 to 2034 | CAGR of 15.5% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered |

|

Despite its promising potential, the mRNA therapeutics market faces several challenges that could limit its large-scale adoption and commercialization. One of the primary hurdles is the complexity of mRNA delivery systems. Because mRNA molecules are inherently unstable and easily degraded by enzymes in the body, developing effective delivery vehicles—such as lipid nanoparticles (LNPs)—remains crucial yet difficult. Manufacturing these delivery systems at scale while maintaining purity, stability, and efficacy poses technical and cost-related challenges. Additionally, the storage and transport requirements of mRNA products, which often demand ultra-low temperatures, add logistical burdens that can hinder distribution, particularly in low- and middle-income regions.

Furthermore, the market is also constrained by high R&D costs, intellectual property issues, and stringent regulatory requirements. Developing safe and effective mRNA-based therapies requires extensive preclinical and clinical testing, which can prolong timelines and increase financial risks for developers. Concerns related to immune reactions, long-term safety data, and patient acceptance are also limiting factors that need to be addressed through continuous innovation and transparency. To overcome these obstacles, industry players are focusing on optimizing formulations, advancing delivery technologies, and building robust supply chains to make mRNA therapeutics more accessible and cost-effective worldwide.

In 2024, North America asserted its dominance, capturing a significant market share of over 38%, and is poised to emerge as the fastest-growing region in the forecast period. The region's leadership is attributed to the availability of substantial research funding, the expansion of federal programs dedicated to RNA-based medicines, and a growing number of clinical trials. Notably, in November 2020, pivotal research support from entities like The National Institutes of Health (NIH), the Defense Department, and federally funded academic laboratories played a crucial role in the rapid development of COVID-19 vaccinations. The government's additional investment of $10.5 billion in vaccine manufacturers during the pandemic further accelerates product delivery.

Meanwhile, Europe secured the second-largest revenue share in 2024, driven by an increasing patient population and heightened awareness regarding rare genetic diseases. The presence of major industry players and a rising demand for mRNA vaccines and therapeutics underscore the region's need for transformative treatments. For instance, as part of its expansion strategy to facilitate the local delivery of mRNA vaccines and therapies, Moderna is extending its footprint across Europe, encompassing Denmark, Belgium, the Netherlands, Poland, Norway, and Sweden. This strategic move is anticipated to intensify the demand for mRNA vaccines, contributing to the market's growth in the forecast period.

The infectious disease segment dominated the market with the highest revenue share in 2024. The market's momentum is fueled by the widespread adoption of mRNA-based vaccines, a substantial number of candidates entering clinical trials for various infectious diseases, and the impact of the COVID-19 outbreak in late 2019. These factors are expected to continue propelling market growth throughout the forecast period.

Meanwhile, the oncology segment is poised for significant expansion at an attractive rate. According to estimates from the World Health Organization (WHO), cancer was responsible for approximately 10 million deaths in 2020, establishing it as the primary global cause of death. Notably, lung, colon, rectum, liver, stomach, and breast cancers are prevalent and contribute significantly to mortality rates. The increasing incidence of chronic illnesses underscores the growing demand for mRNA cancer vaccines and therapies, acting as a key driver for market expansion.

Furthermore, the absence of precise cancer therapy medications has intensified the focus on research and development (R&D). Governments and major industry players are feeling the pressure to make substantial investments in R&D efforts. This concerted push is in response to the rising demand for effective cancer vaccines and treatments, creating a positive trajectory for the industry over the forecast period.

The prophylactic vaccines segment emerged as the market leader with largest revenue share in 2024. According to a Nature opinion article, ongoing research and development (R&D) efforts are predominantly centered around prophylactic vaccines, with 77% of mRNA businesses actively engaged in the development of at least one preventive vaccine. Notably, the article emphasizes the substantial contribution of COVID-19 products to the prophylactic vaccine revenues in the immediate future. Additionally, the segment's growth is bolstered by vaccines addressing other illnesses like influenza and respiratory syncytial virus.

The market landscape is further influenced by an increase in mergers, alliances, and intensified R&D initiatives undertaken by pharmaceutical companies, all aimed at enhancing various types of preventative vaccinations. An illustrative example is the collaborative effort between Pfizer and Valneva, as they announced in June 2022 the successful closure of an equity investment dedicated to the development and commercialization of prophylactic vaccines for infectious diseases. This strategic partnership reflects the industry's commitment to advancing preventative measures and contributes significantly to the overall growth of the prophylactic vaccines segment.

The hospitals and clinics segment dominated the market, securing a substantial revenue share in 2024, and is projected to exhibit the highest growth rate throughout the forecast period. The pervasive utilization of vaccines and therapeutics in managing various chronic diseases is propelling the market for personalized pharmaceuticals. Notably, the segment's advancement is further driven by the escalating number of patients seeking medical attention at hospitals and clinics.

Moreover, the anticipated rise in the prevalence of diseases such as cancer, influenza, infectious diseases, and respiratory illnesses is set to contribute significantly to the expansion of this market segment. For instance, a report from the National Center for Biotechnology Information (NCBI) highlights that, according to the World Health Organization (WHO) estimates in 2019, up to 500,000 individuals worldwide succumb to influenza annually, with approximately one billion people falling ill. This alarming statistic is a contributing factor to the sustained growth of hospitals and healthcare clinics as vital hubs in addressing these health challenges.

By Application

By Type

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on MRNA Therapeutics Market

5.1. COVID-19 Landscape: MRNA Therapeutics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global MRNA Therapeutics Market, By Application

8.1. MRNA Therapeutics Market, by Application,

8.1.1 Rare Genetic Diseases

8.1.1.1. Market Revenue and Forecast

8.1.2. Oncology

8.1.2.1. Market Revenue and Forecast

8.1.3. Respiratory Diseases

8.1.3.1. Market Revenue and Forecast

8.1.4. Infectious Diseases

8.1.4.1. Market Revenue and Forecast

8.1.5. Others

8.1.5.1. Market Revenue and Forecast

Chapter 9. Global MRNA Therapeutics Market, By Type

9.1. MRNA Therapeutics Market, by Type,

9.1.1. Prophylactic Vaccines

9.1.1.1. Market Revenue and Forecast

9.1.2. Therapeutic Vaccines

9.1.2.1. Market Revenue and Forecast

9.1.3. Therapeutic Drugs

9.1.3.1. Market Revenue and Forecast

Chapter 10. Global MRNA Therapeutics Market, By End-use

10.1. MRNA Therapeutics Market, by End-use,

10.1.1. Hospitals & Clinics

10.1.1.1. Market Revenue and Forecast

10.1.2. Research Organizations

10.1.2.1. Market Revenue and Forecast

10.1.3. Others

10.1.3.1. Market Revenue and Forecast

Chapter 11. Global MRNA Therapeutics Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Application

11.1.2. Market Revenue and Forecast, by Type

11.1.3. Market Revenue and Forecast, by End-use

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Application

11.1.4.2. Market Revenue and Forecast, by Type

11.1.4.3. Market Revenue and Forecast, by End-use

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Application

11.1.5.2. Market Revenue and Forecast, by Type

11.1.5.3. Market Revenue and Forecast, by End-use

11.2. Europe

11.2.1. Market Revenue and Forecast, by Application

11.2.2. Market Revenue and Forecast, by Type

11.2.3. Market Revenue and Forecast, by End-use

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Application

11.2.4.2. Market Revenue and Forecast, by Type

11.2.4.3. Market Revenue and Forecast, by End-use

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Application

11.2.5.2. Market Revenue and Forecast, by Type

11.2.5.3. Market Revenue and Forecast, by End-use

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Application

11.2.6.2. Market Revenue and Forecast, by Type

11.2.6.3. Market Revenue and Forecast, by End-use

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Application

11.2.7.2. Market Revenue and Forecast, by Type

11.2.7.3. Market Revenue and Forecast, by End-use

11.3. APAC

11.3.1. Market Revenue and Forecast, by Application

11.3.2. Market Revenue and Forecast, by Type

11.3.3. Market Revenue and Forecast, by End-use

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Application

11.3.4.2. Market Revenue and Forecast, by Type

11.3.4.3. Market Revenue and Forecast, by End-use

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Application

11.3.5.2. Market Revenue and Forecast, by Type

11.3.5.3. Market Revenue and Forecast, by End-use

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Application

11.3.6.2. Market Revenue and Forecast, by Type

11.3.6.3. Market Revenue and Forecast, by End-use

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Application

11.3.7.2. Market Revenue and Forecast, by Type

11.3.7.3. Market Revenue and Forecast, by End-use

11.4. MEA

11.4.1. Market Revenue and Forecast, by Application

11.4.2. Market Revenue and Forecast, by Type

11.4.3. Market Revenue and Forecast, by End-use

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Application

11.4.4.2. Market Revenue and Forecast, by Type

11.4.4.3. Market Revenue and Forecast, by End-use

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Application

11.4.5.2. Market Revenue and Forecast, by Type

11.4.5.3. Market Revenue and Forecast, by End-use

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Application

11.4.6.2. Market Revenue and Forecast, by Type

11.4.6.3. Market Revenue and Forecast, by End-use

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Application

11.4.7.2. Market Revenue and Forecast, by Type

11.4.7.3. Market Revenue and Forecast, by End-use

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Application

11.5.2. Market Revenue and Forecast, by Type

11.5.3. Market Revenue and Forecast, by End-use

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Application

11.5.4.2. Market Revenue and Forecast, by Type

11.5.4.3. Market Revenue and Forecast, by End-use

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Application

11.5.5.2. Market Revenue and Forecast, by Type

11.5.5.3. Market Revenue and Forecast, by End-use

Chapter 12. Company Profiles

12.1. Moderna, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. BioNTech SE

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. CureVac N.V.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Arcturus Therapeutics

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Translate Bio, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. GSK plc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Argos Therapeutics Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Sangamo Therapeutics, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Pfizer Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. AstraZeneca plc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others