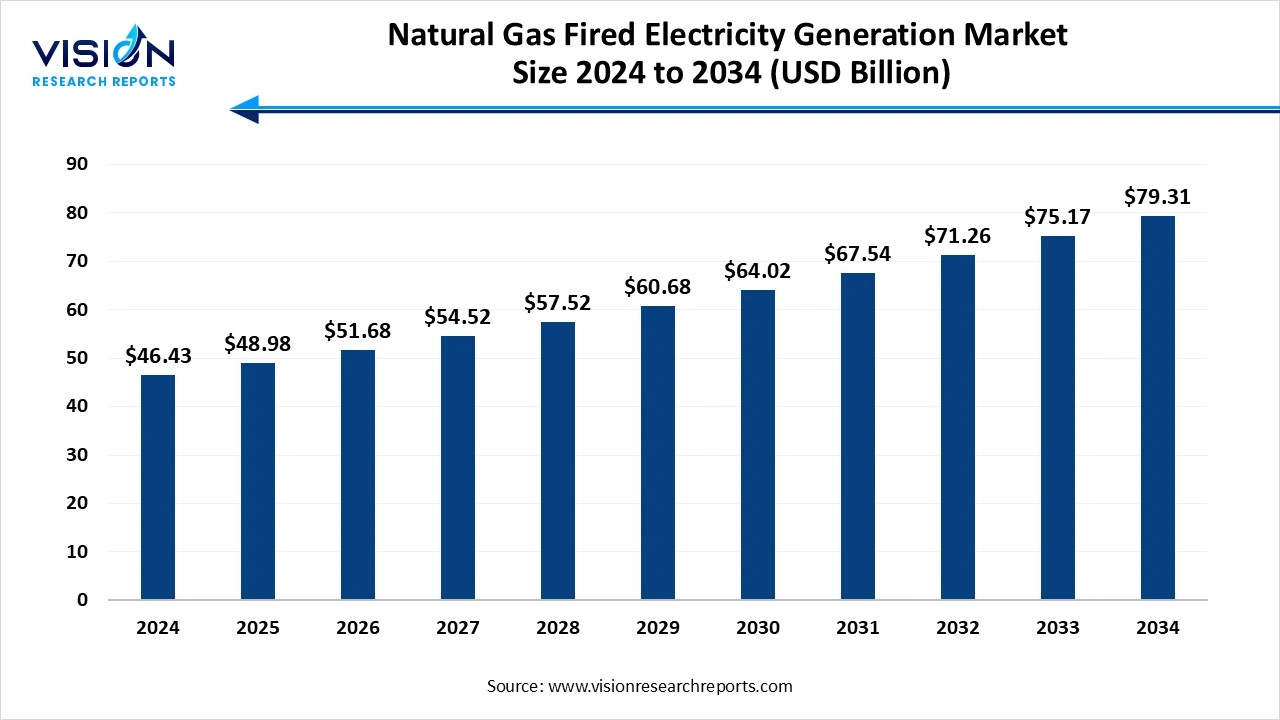

The global natural gas fired electricity generation market size was valued at around USD 46.43 billion in 2024 and it is projected to hit around USD 79.31 billion by 2034, growing at a CAGR of 5.50% from 2025 to 2034. The market growth is driven by increasing global electricity demand and a shift toward cleaner energy sources, the natural gas fired electricity generation market is experiencing robust growth.

The natural gas fired electricity generation market plays a pivotal role in global power production, driven by its efficiency, lower emissions compared to coal, and widespread availability. As countries transition toward cleaner energy sources, natural gas remains a key bridge fuel in the shift from coal-fired plants to renewable energy. Technological advancements in combined-cycle gas turbines have significantly improved efficiency and reduced greenhouse gas emissions, further boosting the appeal of natural gas power plants. Additionally, the global push for energy security and reliable baseload power supports continued investment in this segment.

Growing urbanization and industrialization, particularly in developing economies, have heightened the demand for stable electricity, contributing to market expansion. Regions such as North America and Asia Pacific dominate the market due to abundant natural gas reserves and well-developed infrastructure. However, market dynamics are also influenced by fluctuating gas prices, regulatory policies, and the pace of renewable energy integration. Despite increasing renewable adoption, natural gas is expected to retain a significant share in the global energy mix over the coming decades due to its reliability and lower carbon footprint compared to other fossil fuels.

One of the primary growth factors for the natural gas fired electricity generation market is the increasing global demand for cleaner and more efficient energy sources. Compared to coal and oil, natural gas produces significantly lower carbon emissions, making it a preferred option amid tightening environmental regulations and international commitments to reduce greenhouse gas emissions.

Another key driver is the rising need for reliable and flexible power generation to complement intermittent renewable energy sources such as solar and wind. Natural gas-fired plants can quickly ramp up or down production, providing essential grid stability in systems with high renewable penetration.

One of the major challenges faced by the natural gas fired electricity generation market is the volatility of natural gas prices. Global supply disruptions, geopolitical tensions, and fluctuating demand can lead to unpredictable fuel costs, making long-term planning and investment in natural gas infrastructure more difficult. This volatility can reduce the competitiveness of natural gas compared to increasingly affordable renewable energy sources like solar and wind.

Another significant challenge is the growing pressure to transition toward zero-emission power generation. While natural gas is cleaner than coal and oil, it is still a fossil fuel and contributes to carbon dioxide and methane emissions. This has prompted stricter environmental regulations and calls for net-zero policies, leading to reduced support for fossil-fuel-based energy infrastructure in some countries.

The Asia Pacific natural gas fired electricity generation market led the global industry, capturing the highest revenue share of 37% in 2024. Governments in these countries are investing in gas-based power generation to meet energy needs while reducing air pollution from coal-fired plants. The expansion of LNG infrastructure, along with international partnerships to secure long-term gas supply agreements, is accelerating the adoption of natural gas in the power sector across this region. Additionally, policy support and incentives are further boosting the market outlook.

.webp) The natural gas fired electricity generation market in North America is projected to expand at a CAGR of 5.9% throughout the forecast period. The shift from coal to gas for environmental reasons has been a major trend in the U.S., where natural gas has become the dominant fuel for electricity generation. Canada also contributes to the regional market, supported by a mix of domestic gas resources and a stable demand for clean power.

The natural gas fired electricity generation market in North America is projected to expand at a CAGR of 5.9% throughout the forecast period. The shift from coal to gas for environmental reasons has been a major trend in the U.S., where natural gas has become the dominant fuel for electricity generation. Canada also contributes to the regional market, supported by a mix of domestic gas resources and a stable demand for clean power.

The combined cycle segment dominated the market, capturing the highest revenue share of 76% in 2024. In the global natural gas fired electricity generation market, combined cycle technology holds a dominant position due to its superior efficiency and lower emissions compared to traditional power generation methods. Combined cycle plants utilize both gas and steam turbines to generate electricity, harnessing waste heat from the gas turbine to produce additional power through a steam turbine.

The open cycle segment is projected to expand at a CAGR of 5.8% throughout the forecast period. Open cycle gas turbines (OCGTs) are often deployed for peaking power and emergency backup due to their ability to start up and shut down rapidly. This makes them particularly valuable in energy grids with high penetration of intermittent renewable sources, where quick-response power is essential to maintaining grid stability.

The power & utility segment led the global natural gas-fired electricity generation industry, contributing the largest revenue share of 74% in 2024. Natural gas-fired plants are widely adopted by utility companies to supply base-load and peak-load electricity to residential and commercial users. The increased focus on reducing carbon emissions from the power sector has led many countries to replace aging coal-fired power stations with natural gas-based facilities.

The industrial sector is anticipated to grow at a CAGR of 5.4% between 2025 and 2034. Industries such as chemicals, cement, steel, and food processing rely heavily on consistent and cost-effective power to maintain operational efficiency. On-site natural gas generators offer these facilities a dependable energy source, reducing their reliance on often unreliable grid power and enhancing overall productivity.

By Technology

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Natural Gas Fired Electricity Generation Market

5.1. COVID-19 Landscape: Natural Gas Fired Electricity Generation r Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Natural Gas Fired Electricity Generation Market, By Technology

8.1. Natural Gas Fired Electricity Generation Market, by Technology, 2024-2033

8.1.1. Open Cycle

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Combined Cycle

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Natural Gas Fired Electricity Generation Market, By Application

9.1. Natural Gas Fired Electricity Generation Market, by Application, 2024-2033

9.1.1. Power & Utility

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Industrial

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Pharmaceutical Water Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Technology (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. General Electric Company (GE)

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Siemens Energy AG

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Mitsubishi Power, Ltd.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Ansaldo Energia S.p.A.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Caterpillar Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Wärtsilä Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Rolls-Royce Holdings plc

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Doosan Enerbility Co., Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. MAN Energy Solutions SE

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Cummins Inc.

11.10. Nexus Pharmaceuticals

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others