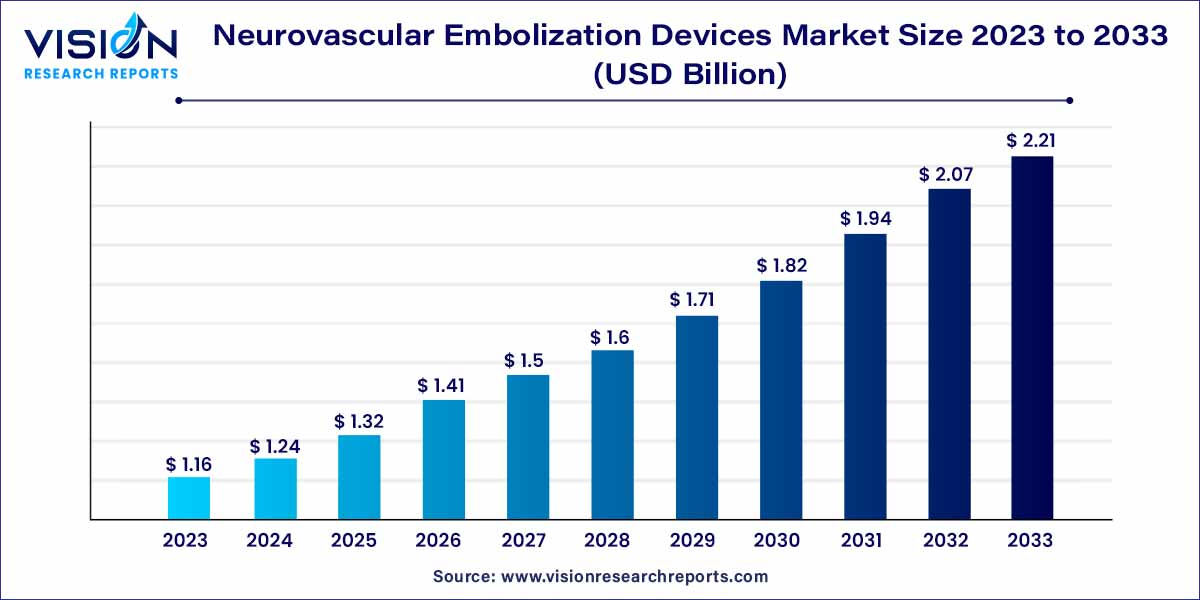

The global neurovascular embolization devices market size was estimated at around USD 1.16 billion in 2023 and it is projected to hit around USD 2.21 billion by 2033, growing at a CAGR of 6.65% from 2024 to 2033.

The neurovascular embolization devices market represents a critical segment within the broader medical devices industry, focusing on innovative solutions for cerebrovascular disorders. These disorders, including aneurysms and arteriovenous malformations, demand advanced medical interventions to prevent life-threatening complications. This overview provides a comprehensive insight into the neurovascular embolization devices market, exploring its current status, key players, market drivers, challenges, and future prospects.

The growth of the neurovascular embolization devices market is propelled by several key factors. One of the primary drivers is the increasing prevalence of cerebrovascular disorders globally. As awareness about these conditions rises and diagnostic techniques improve, there is a growing demand for advanced medical interventions, fueling the market expansion. Technological advancements, especially in imaging technologies and materials science, have led to the development of more precise and effective embolization devices. Favorable reimbursement policies and a steady increase in healthcare expenditure worldwide also play a significant role in stimulating market growth. Moreover, continuous investments in research and development by industry players, focusing on innovation and the introduction of minimally invasive techniques, contribute to the market's positive trajectory. Additionally, strategic collaborations between key market players and healthcare institutions foster innovation and drive the development of safer and more efficient neurovascular embolization devices.

| Report Coverage | Details |

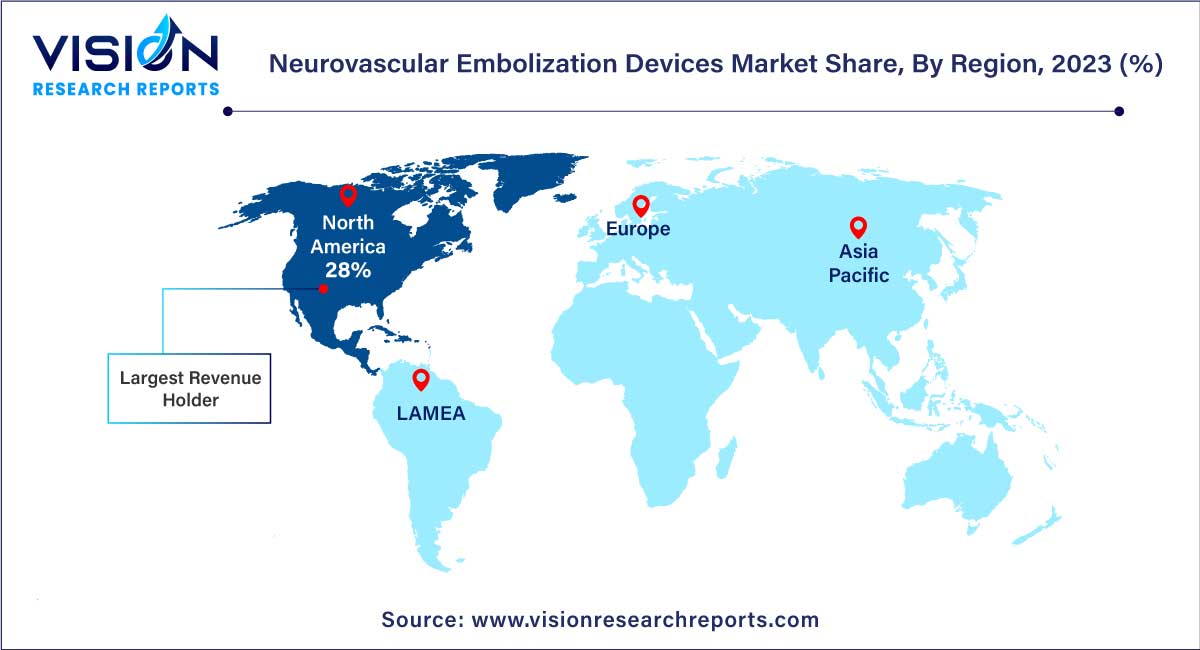

| Revenue Share of North America in 2023 | 28% |

| Revenue Forecast by 2033 | USD 2.21 billion |

| Growth Rate from 2024 to 2033 | CAGR of 6.65% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The embolic coils segment dominated the global market with the largest market share of 79% in 2023. Embolic coils, intricate devices made of platinum, are deployed within blood vessels to induce clot formation. These coils effectively occlude aneurysms and other vascular abnormalities, preventing the risk of rupture and subsequent hemorrhage. Their popularity stems from their versatility, making them suitable for a wide range of anatomical complexities. The ongoing research and development efforts in the field have led to the creation of detachable and bioactive coils, enhancing their efficacy and safety. Additionally, liquid embolic agents represent a pivotal innovation in neurovascular interventions. These agents, often comprising biocompatible polymers, are injected directly into abnormal blood vessels, solidifying upon contact with blood. This process ensures the targeted occlusion of aneurysms and arteriovenous malformations. Liquid embolic agents offer a distinct advantage by reaching anatomically challenging locations that traditional coils might find difficult to access. Their adaptability and ability to conform to the vessel's shape make them instrumental in complex cases, providing physicians with a valuable tool to address intricate vascular conditions effectively.

The liquid embolic agents segment is anticipated to grow at the fastest CAGR of 7.76% during the forecast period. liquid embolic agents have witnessed advancements, with the development of new polymers that enhance biocompatibility and reduce the risk of complications. These innovations reflect the industry's commitment to improving patient outcomes by minimizing procedural risks and maximizing the efficacy of neurovascular embolization procedures. The synergy between research, engineering, and medical expertise has led to a diverse array of embolic coils and liquid embolic agents, each tailored to specific clinical requirements. This diversity enables healthcare professionals to choose the most suitable device, customizing treatments for individual patients. As technology continues to advance, the future of neurovascular embolization devices, especially embolic coils and liquid embolic agents, holds promise for further refinements, ultimately benefiting patients worldwide through safer, more precise, and effective interventions.

The hospital segment captured the largest revenue share of over 73% in 2023. Hospitals serve as primary hubs for advanced medical procedures, including neurovascular embolization, due to their extensive infrastructure, specialized medical staff, and state-of-the-art equipment. These institutions often house specialized neurointerventional units, equipped with the latest imaging technologies and interventional suites, facilitating precise diagnosis and tailored treatments. The presence of skilled neurosurgeons, interventional radiologists, and neurologists within hospital settings ensures comprehensive and multidisciplinary care for patients suffering from conditions such as aneurysms and arteriovenous malformations. Hospitals not only provide the necessary expertise but also create a controlled environment essential for complex procedures, ensuring patient safety and optimal outcomes.

The other segment is predicted to grow at the remarkable CAGR of over the forecast period. The other segment includes ambulatory surgical centers (ASCs), research and academic institutes. Surgical clinics that offer ambulatory services can perform some neurovascular operations. In some cases, hospitals can be replaced by these facilities more practically and affordably. In some circumstances, ASCs might use neurovascular embolization devices. Moreover, many investigations are conducted by academic and research institutions on neurovascular illnesses, therapeutic approaches, and the development of novel embolization devices. They are vital in developing the knowledge and technology of the manufacturing industry which boost the industry growth.

North America dominated the global market with the largest market share of 28% in 2023. In North America, particularly in the United States, the market is characterized by a robust demand for advanced medical technologies. The region's well-established healthcare system, coupled with significant investments in research and development, fosters continuous innovation. Additionally, favorable reimbursement policies and a high prevalence of neurovascular disorders contribute to the market's growth. North America remains a hub for technological advancements and clinical research, attracting key players and ensuring a steady introduction of novel neurovascular embolization devices.

The Asia Pacific market is predicted to grow at the remarkable CAGR during the forecast period. Asia-Pacific emerges as a significant growth frontier for the neurovascular embolization devices market. Countries such as China, Japan, and India witness a rising prevalence of neurovascular disorders due to factors like an aging population and changing lifestyles. In these nations, increasing healthcare expenditure, improving healthcare infrastructure, and growing awareness about advanced treatments drive market expansion. Moreover, local manufacturing capabilities and cost-effective production make Asia-Pacific an attractive region for market players looking to establish a strong foothold.

By Product

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Neurovascular Embolization Devices Market

5.1. COVID-19 Landscape: Neurovascular Embolization Devices Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Neurovascular Embolization Devices Market, By Product

8.1. Neurovascular Embolization Devices Market, by Product, 2024-2033

8.1.1. Embolic Coils

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Flow Diversion Devices

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Liquid Embolic Agents

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Aneurysm Clips

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Neurovascular Embolization Devices Market, By End-use

9.1. Neurovascular Embolization Devices Market, by End-use, 2024-2033

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Specialty Clinics

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Neurovascular Embolization Devices Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. Medtronic

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Stryker

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. MicroVention Inc

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Cerenovus

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Integra LifeSciences

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Penumbra Inc

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Balt SAS

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. B. Braun Melsungen AG

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Phenox GmbH

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others