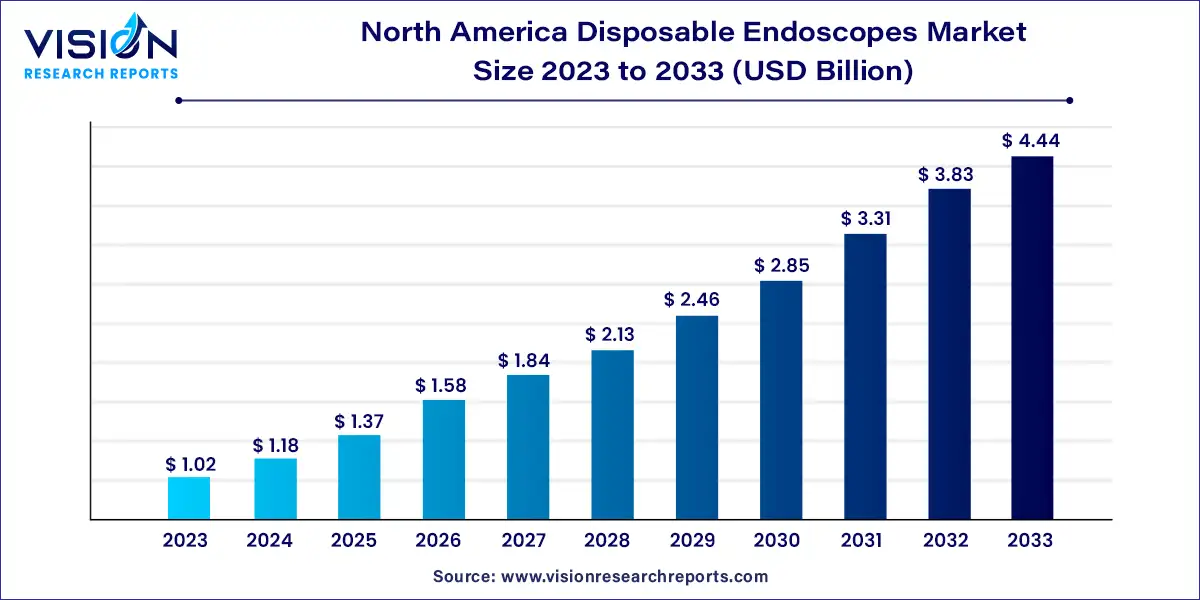

The North America disposable endoscopes market size was estimated at around USD 1.02 billion in 2023 and it is projected to hit around USD 4.44 billion by 2032, growing at a CAGR of 15.84% from 2024 to 2033.

The North America disposable endoscopes market is currently undergoing a significant transformation, driven by advancements in medical technology and a growing emphasis on patient safety. Disposable endoscopes, once a novel concept, have now become integral to the healthcare landscape in North America. These single-use, flexible instruments have gained widespread acceptance due to their numerous advantages over traditional reusable endoscopes.

The North America disposable endoscopes market is experiencing rapid growth driven by an increasing prevalence of gastrointestinal diseases and respiratory disorders in the region. The rising incidence of conditions like colorectal cancer and chronic obstructive pulmonary disease (COPD) has led to a higher demand for accurate and efficient diagnostic tools, boosting the adoption of disposable endoscopes. Additionally, there is a growing emphasis on infection control and patient safety in healthcare facilities. Disposable endoscopes, being single-use instruments, significantly reduce the risk of cross-contamination and healthcare-associated infections, making them a preferred choice for medical professionals. Furthermore, continuous advancements in endoscopic imaging technologies have resulted in disposable endoscopes with superior imaging quality and maneuverability, enhancing the overall diagnostic experience.

| Report Coverage | Details |

| Market Size in 2023 | USD 1.02 billion |

| Revenue Forecast by 2033 | USD 4.44 billion |

| Growth rate from 2024 to 2033 | CAGR of 15.84% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The bronchoscopy segment generated the maximum market share of 31% in 2023. Bronchoscopy, a critical diagnostic and therapeutic tool in pulmonology, has seen a surge in the utilization of disposable endoscopes. The flexibility and precision of these devices make them ideal for exploring the respiratory tract, diagnosing lung diseases, and conducting procedures like bronchoalveolar lavage. The elimination of cross-contamination risks associated with reusable endoscopes has made disposable options particularly attractive in bronchoscopy, ensuring enhanced patient safety and infection control protocols in healthcare facilities across North America.

For instance, according to the American lung association, about 37 million Americans are living with chronic lung diseases like COPD and asthma.

ENT endoscopy segment is expected to grow at the fastest growth rate over the forecast years. ENT endoscopy, disposable endoscopes have become indispensable. These instruments are extensively used by otolaryngologists for visualizing and diagnosing various disorders in the ear, nose, and throat regions. Disposable endoscopes offer high-quality imaging, enabling detailed examinations of nasal passages, larynx, and middle ear, among other areas. In ENT procedures, maintaining a sterile environment is paramount, and disposable endoscopes fulfill this requirement effectively. By eliminating the need for intricate sterilization processes, they streamline workflow in busy ENT clinics and hospitals. Additionally, these endoscopes have proven invaluable for emergency cases and outpatient procedures, enhancing the overall efficiency of ENT healthcare services.

For instance, in June 2020, a single-use ENT endoscope “Colibri Micro ENT Scope” was launched by 3NT Medical, in the U.S.

The hospital segment dominated the global market with the largest market share of 49% in 2023. Hospitals, being the backbone of the healthcare system, have swiftly integrated disposable endoscopes into their operational protocols. These institutions benefit significantly from the elimination of time-consuming sterilization processes associated with reusable endoscopes. The single-use nature of disposable endoscopes not only ensures a sterile environment for each procedure but also simplifies the workflow in busy hospital settings. This efficiency is crucial, especially in emergency situations where rapid, accurate diagnoses are paramount. As a result, hospitals across North America have increasingly adopted disposable endoscopes, enhancing patient care while optimizing resource utilization.

The clinics segment predicted to grow at the CAGR during the forecast period. Clinics, ranging from specialized medical facilities to general practitioner offices, have also embraced the convenience and reliability offered by disposable endoscopes. These clinics cater to a diverse range of patients, each with unique medical needs. Disposable endoscopes, with their flexibility and ease of use, have empowered healthcare providers in clinics to conduct various diagnostic examinations, from gastroenterological assessments to ENT procedures, efficiently and safely. Clinics often have limited space and resources compared to larger hospitals. The compact nature of disposable endoscope systems and the absence of complex reprocessing equipment make them particularly suitable for these settings. Moreover, the reduced risk of cross-contamination aligns with the high standards of care that clinics aim to provide, instilling confidence in both healthcare professionals and patients.

By Application

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on North America Disposable Endoscopes Market

5.1. COVID-19 Landscape: North America Disposable Endoscopes Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8.North America Disposable Endoscopes Market, By Application

8.1. North America Disposable Endoscopes Market, by Application, 2024-2033

8.1.1. Bronchoscopy

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Urologic endoscopy

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Arthroscopy

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. GI endoscopy

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. ENT endoscopy

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. North America Disposable Endoscopes Market, By End-use

9.1. North America Disposable Endoscopes Market, by End-use, 2024-2033

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Clinics

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Diagnostics Centers

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. North America Disposable Endoscopes Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Application (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. Ambu A/S

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Prosurg Inc. (Neoscape, Inc.)

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. AirStrip Technologies

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Boston Scientific Corporation

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Parburch Medical

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. OBP Medical Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Welch Allyn (Hill-Rom Services Inc.)

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Allscripts Healthcare Solutions

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Flexicare Medical Limited

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Timesco Healthcare Ltd.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others