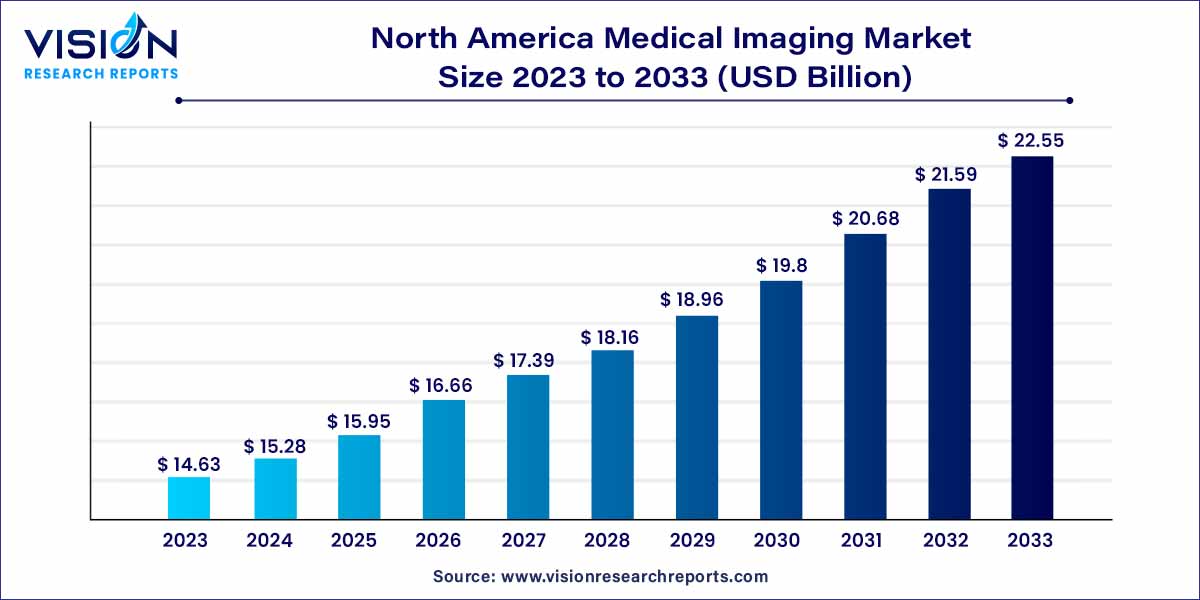

The North America medical imaging market size was estimated at around USD 14.63 billion in 2023 and it is projected to hit around USD 22.55 billion by 2033, growing at a CAGR of 4.42% from 2024 to 2033. The North America medical imaging market is driven by advancements in technology, increasing healthcare awareness, and a growing aging population.

The robust growth of the North America medical imaging market can be attributed to several key factors. Foremost among these is the continual advancement in medical imaging technologies, such as magnetic resonance imaging (MRI), computed tomography (CT), and ultrasound. These technological innovations have significantly enhanced diagnostic precision and imaging capabilities, driving increased adoption across healthcare facilities. Additionally, the escalating prevalence of chronic diseases, including cardiovascular conditions and cancer, has spurred demand for sophisticated diagnostic tools, further fueling market expansion. The growing aging population in the region has also played a pivotal role, as elderly individuals necessitate more frequent and specialized medical imaging procedures. Moreover, supportive government initiatives and substantial investments in healthcare infrastructure have created a conducive environment for market growth, emphasizing the importance of medical imaging in modern healthcare. Overall, these factors collectively contribute to the upward trajectory of the North America Medical Imaging Market.

The magnetic resonance imaging segment held the largest share of 31% in 2023 and is expected to maintain its lead over the forecast period. MRI systems have applications in imaging of various organs, including the abdomen, pelvis, brain, spine, heart, and breast as well as musculoskeletal structure. MRI systems are expected to drive the market as scans produced are of superior quality because of an exceptional contrast resolution. Thus, MRI techniques can provide quantitative information about the biological and physical properties of tissue. As MRI is free from ionizing radiation, they are selected over CT, especially in patients and children requiring multiple imaging examinations.

The CT segment is expected to witness the fastest growth during the forecast period. High demand for point of care CT device and the development of a high-precision CT scanner by the integration of AI & ML and advanced visualization systems are the primary factors driving the segment. In March 2020, GE Healthcare increased their manufacturing capacity by opening new production facilities, to curb the growing demand for advanced imaging tools, especially during the Covid-19 pandemic.

Hospitals captured the largest share of 42% in 2023. Rising demand for advanced imaging modalities and the integration of surgical suits with imaging technologies are some of the factors driving the segment growth. Over the years, there has been a sharp rise in demand for these modalities in teaching hospitals as compared to general or special hospitals. New hospitals generally provide dedicated space for imaging modalities. Rising competition and increasing demand for world-class healthcare services are the factors expected to fuel the segment growth in upcoming years.

The diagnostic imaging centers segment is expected to witness significant growth during the forecast period, owing to an increase in awareness about chronic diseases such as cancer, neurological diseases, and neurodegenerative disorders. This has accelerated the demand for CT and MRI procedures used for diagnosis, treatment planning, and prevention of chronic disorders. The increased adoption of advanced technology, improved infrastructure, and high funding for the development of these centers is supplementing the segmental growth.

North America medical imaging market share was estimated to be 37% of the market in 2023. The presence of a large number of industry players and the high frequency of new product launches within the region are the factors contributing to the regional market growth. The region exhibits high adoption of advanced, high-end medical imaging equipment due to favorable reimbursement scenario and fundings from market players. The aforementioned factors, coupled with the increasing aging population, the rise of chronic diseases, and the growing trend of preventive diagnostic practices, are expected to drive the medical imaging industry in the region.

By Product

By End-use

By Country

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on North America Medical Imaging Market

5.1. COVID-19 Landscape: North America Medical Imaging Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. North America Medical Imaging Market, By Product

8.1. North America Medical Imaging Market, by Product, 2024-2033

8.1.1. X-ray Devices

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Ultrasound

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Computed Tomography

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Magnetic Resonance Imaging

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Nuclear Imaging

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. North America Medical Imaging Market, By End-use

9.1. North America Medical Imaging Market, by End-use, 2024-2033

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Diagnostic Imaging Centres

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. North America Medical Imaging Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. GE Healthcare

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Koninklijke Philips N.V.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Siemens Healthineers

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Canon Medical Systems Corporation

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Mindray Medical International

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Esaote

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Hologic, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Samsung Medison Co., Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Koning Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. PerkinElmer Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others