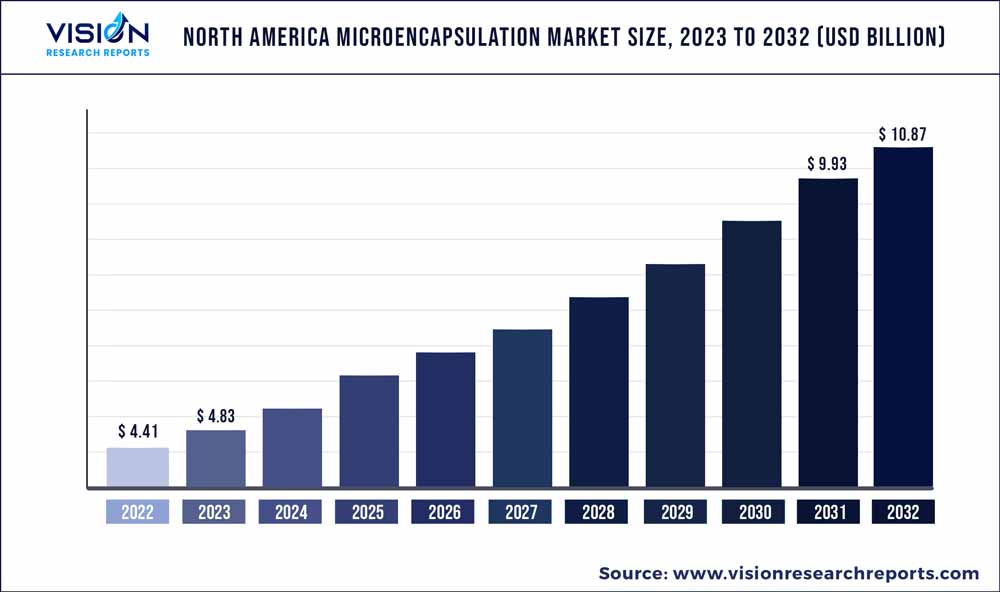

The North America microencapsulation market size was estimated at around USD 4.41 billion in 2022 and it is projected to hit around USD 10.87 billion by 2032, growing at a CAGR of 9.44% from 2023 to 2032.

Key Pointers

Report Scope of the North America Microencapsulation Market

| Report Coverage | Details |

| Market Size in 2022 | USD 4.41 billion |

| Revenue Forecast by 2032 | USD 10.87 billion |

| Growth rate from 2023 to 2032 | CAGR of 9.44% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Capsulae; LycoRed Group; BASF SE; Balchem; Encapsys LLC; AVEKA Group; Reed Pacific Pty Ltd.; Microtek Laboratories, Inc.; TasteTech Ltd.; GAT Microencapsulation GmbH |

The growth of the market is anticipated to be driven by the rising demand for fragrances, flavors, essential oils, vitamins, enzymes, minerals, and bioactive compounds in food and beverage products. North America is the largest market for microencapsulation globally, owing to the high development of the pharmaceutical, food processing, and home & personal care industries, along with increasing investments in R&D to identify new areas for market growth.

Microencapsulation can be used to improve the stability, shelf-life, and bioavailability of functional food and nutraceutical products, thereby increasing their demand across the food and beverages industry. In addition, the use of microencapsulation to encapsulate flavors and fragrances, which can be released over time, is also expected to boost the growth of the market in the home care and personal care industries. The regional industry players are often engaged in strategic partnerships with microencapsulation technology users from the target industries.

High investments in R&D to improve technological efficiency and the rising adoption of the technology by small and medium-scale end-users are factors expected to drive market growth. For instance, in October 2022, Aenova Group, a contract manufacturer for the healthcare and pharmaceutical industries, announced a partnership with Microcaps AG, a provider of high-precision and innovative microencapsulation technology.

The goal of the partnership is to improve and accelerate the production and development of food supplements, pharmaceuticals, and a variety of other products. Microcaps AG will contribute its expertise in innovative and high-precision microencapsulation. The process employs a patented technology platform that allows for customized formulations in areas such as texture, protective coating, and release.

Microencapsulation technology provides value-added structures that serve as essential components in a variety of industries, including textiles, building materials, personal and home care, food and beverages, pharmaceuticals, and many others. For instance, Cognis, a textile chemical company, has a microencapsulation-based cosmetic treatment for textiles called Skintex, marketed with cooling, energizing, moisturizing, relaxing, anti-heavy-legs, and mosquito repellent properties. The rising demand for cosmetotextiles from consumers for their cosmetic & healing effects is poised to drive market growth over the forecast period.

The demand for microencapsulation in North America is expected to continue growing in the coming years, driven by the increasing demand for functional food and nutraceutical products, encapsulated fragrances and flavors, and drug delivery systems. Additionally, continued advancements in microencapsulation technology are likely to further advance the market. The high penetration of the technology in the U.S. pharmaceutical industry is also likely to drive the microencapsulation industry growth over the forecast period.

Technology Insights

The spray technology segment led the market and accounted for 34% of the revenue share in 2022. Spray technologies are significantly used in the large-scale commercial production of microcapsules, owing to the low process cost, simple equipment, and reduced storage and transportation cost, resulting in the growing demand for the segment.

The emulsion segment accounted for the second-highest revenue share of 28.22% of the market in 2022. The technique used to produce microcapsules from the emulsion of two or more immiscible liquids is known as the emulsion solidification technique of microencapsulation. The increasing penetration of this technique in the rapidly-advancing food and pharmaceutical industries is expected to drive the regional market for emulsion technology over the forecast period.

On the other hand, the coating segment is expected to expand at a CAGR of 8.83% from 2023 to 2032. Microencapsulation by coating technology includes different processes such as fluid bed coating, pan bed coating, and air suspension coating. Certain advantages of the microencapsulation coating technology, such as maximum protection of active materials, flavor, odor masking, and continued & controlled release, are anticipated to boost the segment growth.

Dripping technologies of microencapsulation primarily includes spinning disk, co-extrusion, and simple extrusion techniques. Certain advantages of the microcapsules obtained from the dripping technique are biocompatibility & low particle size distribution, which are expected to have a major impact on driving the segment growth in terms of their application in the pharmaceuticals, cosmetics, and food industries.

Application Insights

The pharmaceutical & healthcare products application segment dominated the market with 65% of the revenue share in 2022. Microencapsulation has a high potential for application in the pharmaceutical industry, as it allows for the sustained and controlled release of drugs for various medical applications. Specific drug delivery systems, including oral, transdermal, stomach, colon, and small intestine, are expected to have a major impact on the demand for microencapsulation in the pharmaceutical industry.

The home & personal care application segment accounted for 10.45% of revenue share in 2022. The rapidly expanding home & personal care industry in North America, along with the utilization of microencapsulation technology to alter the quality of products such as fragrances & flavors used in perfumes, soaps, lotions, creams, and shampoos, is anticipated to propel the regional market growth over the projection period.

The food & beverage application segment is likely to expand at a substantial CAGR of 11.02% over the forecast period. The growing trend among consumers towards preventing illnesses by adopting a functional food diet, healthier way of living, and improving the nutritional value of food products along with aroma, texture, color, and taste, has a significant impact on driving the demand for microencapsulation from the food & beverage industry.

In the construction sector, microencapsulated active ingredients have several benefits when used in construction materials such as cement, lime, concrete, mortar, sealants, artificial marbles, and functionalized textiles. The technique is used in the production of biocide coatings, pigments, self-healing coatings, phase change materials, and antimicrobial coatings used extensively in the building & construction industry.

North America Microencapsulation Market Segmentations:

By Application

By Technology

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on North America Microencapsulation Market

5.1. COVID-19 Landscape: North America Microencapsulation Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. North America Microencapsulation Market, By Application

8.1. North America Microencapsulation Market, by Application, 2023-2032

8.1.1. Pharmaceutical & Healthcare products

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Home & Personal Care

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Food & Beverages

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Agrochemicals

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Construction

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Textile

8.1.6.1. Market Revenue and Forecast (2020-2032)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 9. North America Microencapsulation Market, By Technology

9.1. North America Microencapsulation Market, by Technology, 2023-2032

9.1.1. Coating

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Emulsion

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Spray Technologies

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Dripping

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. North America Microencapsulation Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Application (2020-2032)

10.1.2. Market Revenue and Forecast, by Technology (2020-2032)

Chapter 11. Company Profiles

11.1. Capsulae

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. LycoRed Group

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. BASF SE

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Balchem

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Encapsys LLC

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. AVEKA Group

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Reed Pacific Pty Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Microtek Laboratories, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. TasteTech Ltd.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. GAT Microencapsulation GmbH

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others