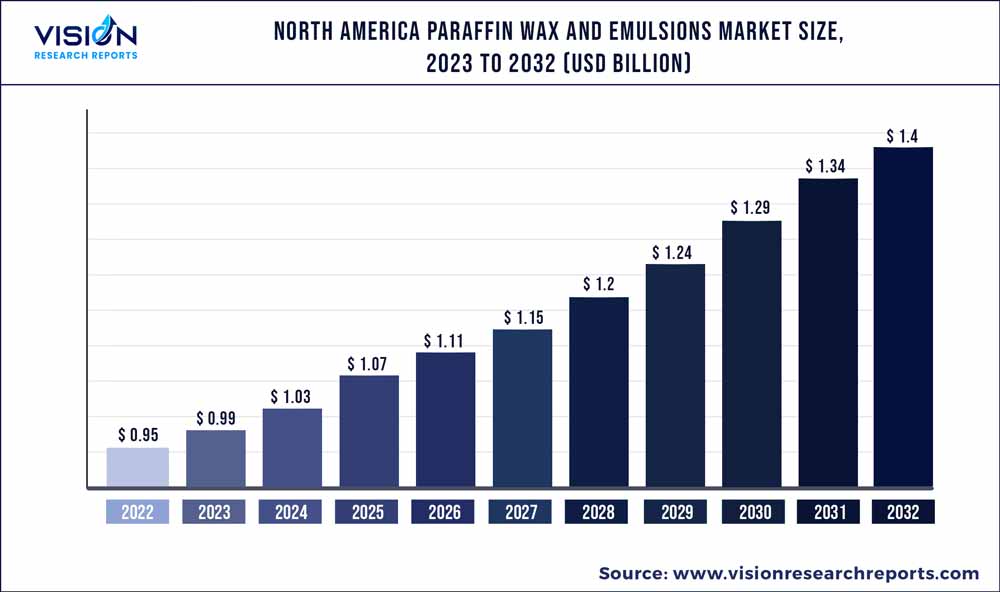

The North America paraffin wax and emulsions market was estimated at USD 0.95 billion in 2022 and it is expected to surpass around USD 1.4 billion by 2032, poised to grow at a CAGR of 3.93% from 2023 to 2032.

Key Pointers

Report Scope of the North America Paraffin Wax And Emulsions Market

| Report Coverage | Details |

| Market Size in 2022 | USD 0.95 billion |

| Revenue Forecast by 2032 | USD 1.4 billion |

| Growth rate from 2023 to 2032 | CAGR of 3.93% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Dominion Chemical Company; Hexion; The International Group, Inc.; Walker Industries; Willamette Valley Company; Accu-Blend Corporation; King Honor International Ltd.; Clariant; Moretex Chemical |

The industry growth is majorly driven by the increased demand for the candles, packaging, and cosmetic industries. The increase in demand for candle manufacturing is attributed to the fact that candles are majorly used as decorative items in homes and restaurants. Moreover, the rising demand for scented candles to enhance the aesthetic appeal and aura of different places favors the growth of the product market.

The packaging industry is one of the major consumers of paraffin wax owing to its factors such as available in unlimited quantities, inexpensive, and others. The demand for paraffin wax has increased in the North American region due to the rising preference for flexible packaging owing to its benefits such as longer shelf life, environmental benefits, low shipping costs, and less storage requirements.

Along with package coatings and packaging, candles account for a prominent share in the North American market. As per National Candle Association, candles sold in the U.S. are produced from more than 1.0 billion pounds of wax annually. Color, shape, cost, and scent are the most important factors that affect their sales. Consumers in North America are increasingly purchasing candles for aromatherapy such as for stress reduction and relaxation as well as for home decoration. The aromatherapy market has seen continuous growth over the years owing to the widespread usage of aroma candles for therapeutic applications

Inks and coatings are used in various industries including construction, automotive, electrical & electronics, and industrial manufacturing owing to their ability to protect materials or substances from wear & tear and rusting. Paraffin wax and emulsions manufacturers in U.S. & North America are Dominion Chemical Company, Hexion, The International Group, Inc., Walker Industries. The industry is marked by the presence of key multinationals that have established a strong regional presence.

Paraffin Wax Application Insights

The candle segment dominated the market with a revenue share of 29.78 % in 2022. This is attributable to its increasing usage in homes and restaurants for decoration purposes. Moreover, the rising demand for scented candles to enhance the aesthetic appeal and aura of different places favors the growth of the product market

Paraffin wax-based candles are inert and burn well. The melting point of candle is generally between 1100 Fahrenheit and 1500 Fahrenheit, and it is the primary property that helps determine the type of candle that can be made using this wax. For instance, paraffin wax with a melting point of less than 1300 Fahrenheit is used for manufacturing jar, glass, and other container-based candles, while paraffin wax with a melting point between 1300 Fahrenheit and 1500 Fahrenheit is used for manufacturing votive candles and other standing candles.

The packaging application segment is anticipated to offer a number of opportunities during the forecast period owing to rising demand for packaging material and the growth of e-commerce across the globe. Paraffin wax is widely used in the packaging industry on account of its moisture and odor absorbing characteristic. Paraffin wax is a saturated hydrocarbon mixture, which is often added with PE molecules to improve their melting point. However, these waxes are mixed with antioxidants to enhance their properties. Key players manufacturing flexible packaging materials are Mars Inc., Tyson Foods Inc., Nestle SA, and PepsiCo Inc.

Paraffin waxes are derived from petroleum, which got recognition in the early 20th century owing to its rising application in the cosmetics sector. The main petroleum products used in the cosmetic industry are Vaseline oils and Vaseline and crystalline paraffin. It has application in various products, such as antiperspirants, hair serums, facial care products, beauty masks, and creams. Macro crystalline paraffin wax is mainly used as a protective cream by workers to protect their skin from any harmful chemicals. It is also used in manufacturing of lipsticks and other cosmetics such as skin foundation.

Paraffin Wax Emulsion Application Insights

The inks and coatings application dominated the market with a revenue share of over 32.08% in 2022 owing to increasing construction activities in North America, due to rapid urbanization and increasing repair & renovation activities of old buildings and structures, and rising use of inks & coatings in automotive industry.Inks and coatings are used in various industries including construction, automotive, electrical and electronics, and industrial manufacturing owing to their ability to protect materials or substances from wear and tear and rusting.

In paper industry, it has its application in reducing the moisture absorption tendency of papers. In addition, they promote the uniform distribution of fibrous structure in papers. Paraffin wax emulsions support the function of resin adhesives in papers. For instance, about 1-5 weight% addition of paraffin wax emulsion leads to a considerable anti-moisture effect. Paraffin wax emulsions prevent the adhesive from mixing with other pigments and improve the print efficiency of papers.

In textile industry, the product is used as a textile and yarn finishing agent. It is used to enhance softness, glossiness, and smoothness as well as and improve the quality of the final product. In textile industry, paraffin wax emulsions are used during the sewing process to protect the thread from breakage, improve water resistance, and reduce friction. The increasing use of textiles in various end-use industries including apparel and home furnishing is expected to drive the demand for product market over the forecast period.

North America Paraffin Wax And Emulsions Market Segmentations:

By Paraffin Wax Application

By Paraffin Wax Emulsions Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on North America Paraffin Wax And Emulsions Market

5.1. COVID-19 Landscape: North America Paraffin Wax And Emulsions Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. North America Paraffin Wax And Emulsions Market, By Paraffin Wax Application

8.1. North America Paraffin Wax And Emulsions Market, by Paraffin Wax Application, 2023-2032

8.1.1. Candles

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Packaging

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Cosmetics

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Hotmelts

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Board Sizing

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Rubber

8.1.6.1. Market Revenue and Forecast (2020-2032)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 9. North America Paraffin Wax And Emulsions Market, By Paraffin Wax Emulsions Application

9.1. North America Paraffin Wax And Emulsions Market, by Paraffin Wax Emulsions Application, 2023-2032

9.1.1. Woodworking

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Inks & Coatings

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Paper

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Textile & Fiber

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. North America Paraffin Wax And Emulsions Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Paraffin Wax Application (2020-2032)

10.1.2. Market Revenue and Forecast, by Paraffin Wax Emulsions Application (2020-2032)

Chapter 11. Company Profiles

11.1. Dominion Chemical Company

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Hexion

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. The International Group, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Walker Industries

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Willamette Valley Company

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Accu-Blend Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. King Honor International Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Clariant

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Moretex Chemical

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others