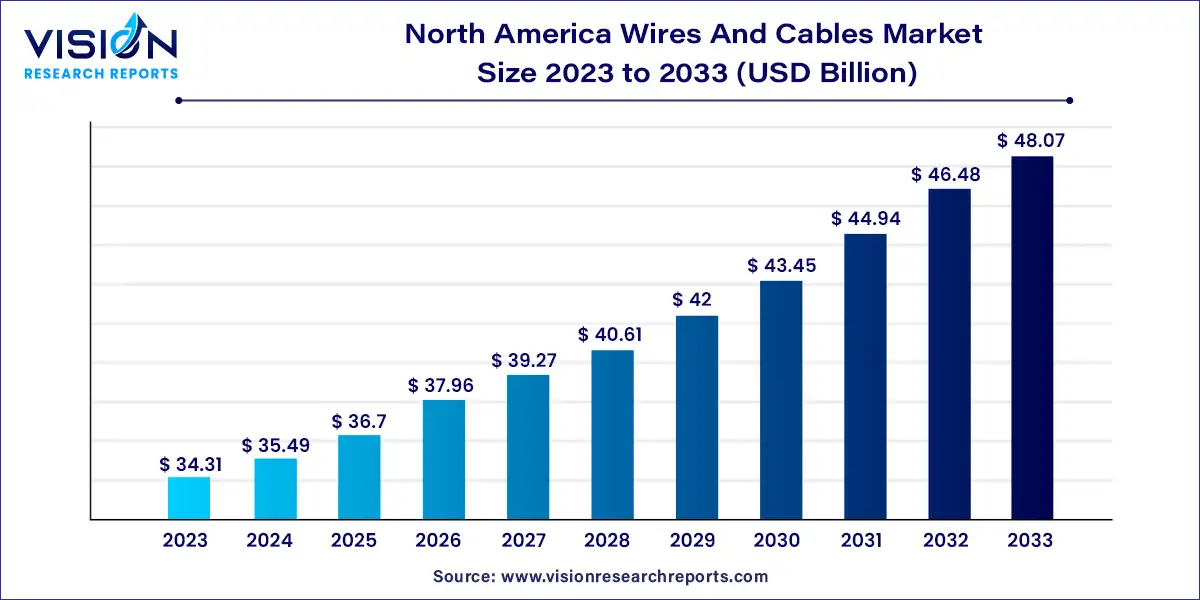

The North America wires and cables market was estimated at USD 34.31 billion in 2023 and it is expected to surpass around USD 48.07 billion by 2033, poised to grow at a CAGR of 3.43% from 2024 to 2033.

The robust growth of the North America wires and cables market can be attributed to a confluence of factors propelling its expansion. Primarily, the burgeoning demand for reliable and efficient energy transmission solutions across diverse industries, including telecommunications, energy, and construction, acts as a significant growth driver. The region's ongoing infrastructure development projects and the increasing deployment of smart technologies further fuel the demand for advanced wiring and cabling systems. Technological innovations, such as the shift towards fiber-optic cables for high-speed data transmission, contribute to the market's upward trajectory by addressing the evolving connectivity needs of businesses and consumers.

| Report Coverage | Details |

| Market Size in 2023 | USD 34.31 billion |

| Revenue Forecast by 2033 | USD 48.07 billion |

| Growth rate from 2024 to 2033 | CAGR of 3.43% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Based on voltage, the market is segmented into low voltage, medium voltage, high voltage, and extra high voltage. The low voltage segment accounted for the largest revenue share of 46% in 2023, owing to high usage in LAN cables, appliance wires, building wires, distribution networks, and others. These wires and cables offer a better provision of electricity for the end-user and simultaneously support smart grids for good-quality transmission. The renovation of existing buildings across North America is expected to support market growth over the forecast period. Besides, the energy and power sector across the region is undergoing rapid changes. Hence, most countries are experiencing significant electricity demand and are moving towards integrating large-scale renewable resources. Thus, is attributed to the increased need for low-voltage wires and cables.

The extra high-voltage is estimated to witness the fastest CAGR of 5.25% over the forecast period owing to increasing demand from the energy and power industries. Additionally, government initiatives taken for the implementation of smart grids are significantly driving the market. In November 2023, the U.S. Department of Energy (DOE) announced new financing opportunities worth USD 13 billion to enhance and upgrade the country's electric grid. These federal investments will serve as a catalyst, unlocking substantial capital from state and private sector sources.

Based on the installation segment, the market is sub-segmented into overhead and underground. The overhead segment held the largest revenue share of 63% in 2023. It is an installation method where cables are laid overhead from poles to poles for electricity transmission and distribution. The overhead installation system is the utmost used approach in less polluted countries. The overhead approach is the easiest and cheapest form of installation. Moreover, countries with a high occurrence of natural disasters like earthquakes incline to have overhead cable installations.

The underground segment is expected to grow at the fastest CAGR of 3.86% during the forecast period. The underground installation is an installation method where wires and cables are laid beneath the ground at a certain distance from the surface level for transmission and distribution purposes. It lowers maintenance costs, incurs fewer transmission losses, and efficiently absorbs the power loads. The underground wires and cables installation release no electric fields; thus, several regional states are adopting underground installation.

Based on end-use, the market is segmented into aerospace and defense, building & construction, oil and gas, energy and power, IT & telecommunication, and others. The energy and power segment held the highest revenue share of 39% in 2023. Government initiatives and regulations play a significant role in driving the growth of the energy and power segment in the wires and cables market. Governments in North America have implemented various policies to promote energy efficiency, grid modernization, and renewable energy integration. In April 2023, the U.S. Department of Energy (DOE) announced USD 52 billion for 19 selected initiatives as part of President Biden's Investing in America agenda, including USD 10 billion from the Bipartisan Infrastructure Law to bolster America's local solar supply network and USD 30 billion in financing for innovations that would assist with integrating solar power into the grid.

The building & construction segment is anticipated to grow at the fastest CAGR of 4.37% over the forecast period. The growing population, along with the need for modernized infrastructure, has led to an increase in construction projects. It includes constructing residential buildings, commercial complexes, industrial facilities, and transportation infrastructure. The rising demand for wires and cables in the building and construction sector drives the market's growth.

IT and telecommunication sector is expected to grow significantly over the forecast period. In the IT and telecommunication sector, wires and cables are used for telecommunication lines, such as multiple phone lines, internet services, data and security services, and fax machines. Cables such as communication cables and power cables are widely used in the IT and telecommunication sectors. North America has seen a massive increase in data consumption, which has resulted in investments by companies such as Verizon and AT&T in fiber networks.

Oil and gas segment is expected to grow significantly over the forecast period. In the oil and gas sector, wires and cables ensure safety and operational integrity in the onshore, offshore, and subsea sectors. These products handle very harsh and severe drilling activities. Thus, these cables are needed to be replaced after a regular interval of time. Besides, the communication cables carry critical information to the stations, and variable frequency cable ensures smooth operation

By Voltage

By Installation

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Voltage Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on North America Wires And Cables Market

5.1. COVID-19 Landscape: North America Wires And Cables Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. North America Wires And Cables Market, By Voltage

8.1. North America Wires And Cables Market, by Voltage, 2024-2033

8.1.1 Low Voltage

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Medium Voltage

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. High Voltage

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Extra High Voltage

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. North America Wires And Cables Market, By Installation

9.1. North America Wires And Cables Market, by Installation, 2024-2033

9.1.1. Overhead

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Underground

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. North America Wires And Cables Market, By End-use

10.1. North America Wires And Cables Market, by End-use, 2024-2033

10.1.1. Aerospace and Defense

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Building & Construction

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Oil and Gas

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Energy and Power

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. IT & Telecommunication

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 11. North America Wires And Cables Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Voltage (2021-2033)

11.1.2. Market Revenue and Forecast, by Installation (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Belden, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Encore Wire Corporation.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Fujikura Ltd.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Furukawa Electric Co., Ltd.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. LEONI.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. LS Cable & System Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Prysmian Group.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Hitachi, Ltd.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Nexans.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Siemon

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others