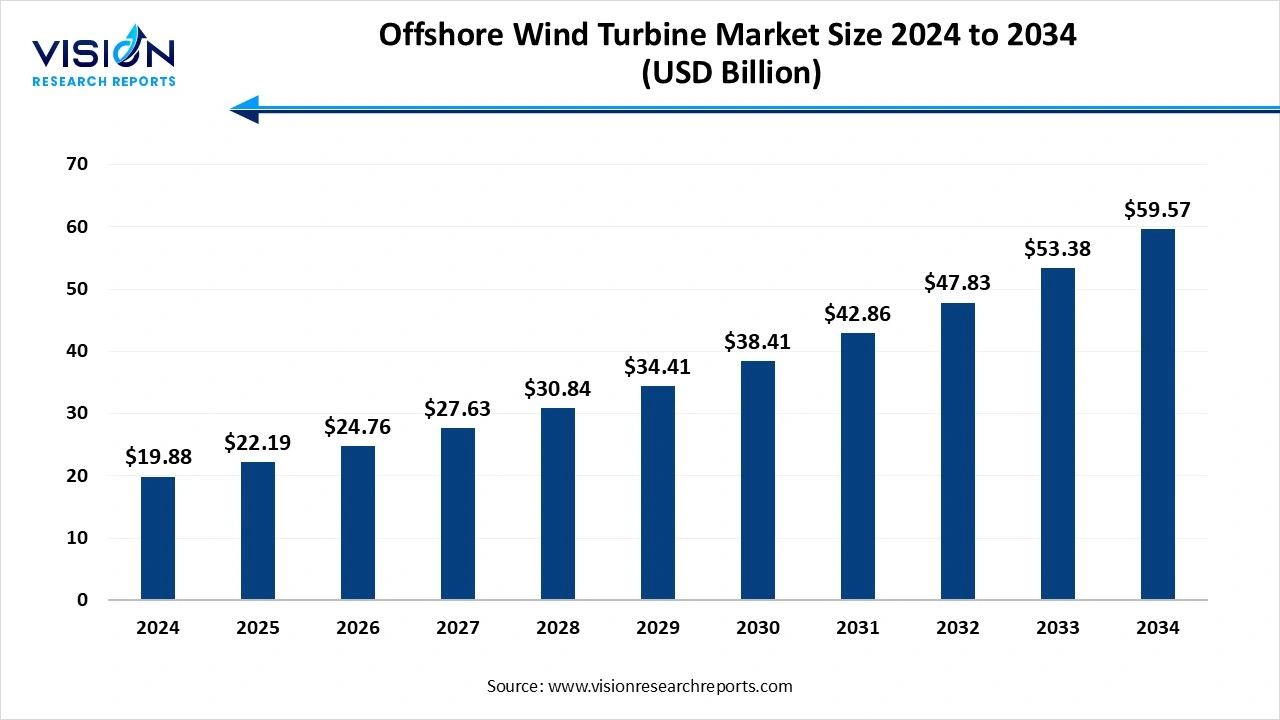

The global offshore wind turbine market size was valued at around USD 19.88 billion in 2024 and it is projected to hit around USD 59.57 billion by 2034, growing at a CAGR of 11.60% from 2025 to 2034.

The offshore wind turbine market has witnessed substantial growth in recent years, driven by the rising demand for clean and sustainable energy sources. Offshore wind turbines, located in bodies of water where wind speeds are generally higher and more consistent, offer a significant advantage over onshore installations in terms of energy output. Governments across the globe, particularly in Europe, North America, and parts of Asia-Pacific, are increasingly investing in offshore wind infrastructure to meet their carbon reduction goals and diversify their energy portfolios.

One of the primary growth factors driving the offshore wind turbine market is the increasing global focus on reducing carbon emissions and transitioning to renewable energy sources. Many countries have set ambitious net-zero targets, which has led to large-scale investments in offshore wind projects. In addition, policy support in the form of subsidies, feed-in tariffs, and favorable regulatory frameworks has encouraged private sector participation. Offshore locations offer higher and more consistent wind speeds compared to onshore sites, making them highly efficient for power generation.

Another key factor contributing to market growth is the rapid advancement in turbine and foundation technologies. Innovations such as floating wind turbines, larger rotor diameters, and more robust grid integration systems have enabled installations in deeper waters and more challenging environments. These innovations not only expand the geographical potential of offshore wind but also reduce overall costs over time through economies of scale and improved energy capture.

The offshore wind turbine market is experiencing several notable trends that are shaping its development. One significant trend is the shift toward larger and more powerful turbines. Manufacturers are increasingly designing turbines with capacities exceeding 15 MW, capable of generating more energy per unit and reducing the overall number of turbines required per project. This trend is helping drive down the levelized cost of electricity (LCOE) and improving project economics.

Another emerging trend is the integration of digital technologies and advanced analytics in offshore wind operations. Predictive maintenance powered by AI and IoT sensors is being used to monitor turbine performance in real time, reducing downtime and improving efficiency. There’s also a growing push toward hybrid energy systems, where offshore wind farms are combined with battery storage or other renewable sources like hydrogen production.

Despite its strong growth trajectory, the offshore wind turbine market faces several key challenges. One major issue is the high capital investment required for offshore projects. Compared to onshore wind farms, offshore installations involve significantly higher costs related to turbine construction, transportation, subsea cabling, and grid connection. These financial hurdles can deter smaller developers and limit participation to large utility companies and government-backed initiatives.

Another critical challenge is the harsh marine environment in which offshore turbines operate. Constant exposure to saltwater, high winds, and unpredictable weather conditions accelerates wear and tear, making maintenance more difficult and costly. While advancements in remote monitoring and autonomous maintenance technologies are helping address these concerns, the logistical complexity of performing repairs at sea remains a major operational obstacle.

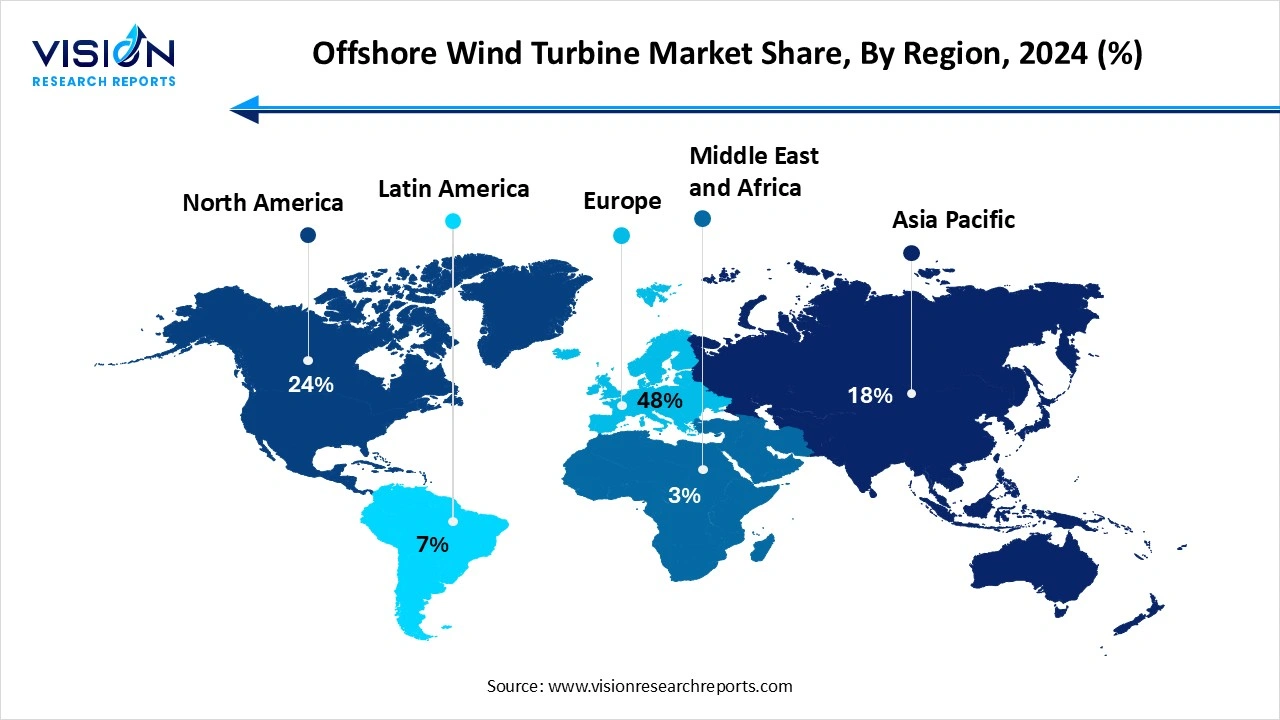

Europe led the global offshore wind turbine market in 2024, capturing the largest revenue share of more than 48%. Europe continues to lead the offshore wind sector, with countries such as the United Kingdom, Germany, the Netherlands, and Denmark spearheading large-scale installations. The region benefits from well-established regulatory frameworks, mature infrastructure, and strong government support, including ambitious renewable energy targets aligned with the EU’s Green Deal.

Asia Pacific is projected to witness the highest compound annual growth rate (CAGR) during the forecast period. China, in particular, has emerged as a global leader in new offshore wind capacity additions, driven by aggressive government initiatives and industrial capabilities. Taiwan and South Korea are also actively expanding their offshore wind infrastructure to diversify energy sources and reduce dependence on fossil fuels.

The above 5 MW segment held the dominant position in the market, accounting for more than 44% of the total revenue in 2024. Turbines in this category are widely adopted for utility-scale offshore wind projects, especially in regions with mature wind energy infrastructure such as Europe and parts of Asia. These turbines offer a strong return on investment by generating substantial electricity while maintaining manageable installation and maintenance costs. As technology advances, many developers continue to favor the 5 MW range because of its reliability and compatibility with both fixed-bottom and floating foundation systems.

The 3 MW to 5 MW segment represents another key application area anticipated to register substantial growth over the forecast period. This capacity range offers a practical solution for projects with limited budget or infrastructure constraints, providing a feasible entry point into offshore energy generation. Turbines within this range are often utilized in smaller offshore wind farms or pilot projects designed to test viability and gather operational data. They are known for their adaptability and easier logistics in terms of transport, installation, and servicing.

The shallow water segment (less than 30 meters depth) led the market in 2024, capturing the largest share of total revenue. These sites offer several logistical and economic advantages, including easier access for construction and maintenance activities, lower foundation costs, and more stable seabed conditions for fixed-bottom turbine structures. As a result, many of the early offshore wind farms, particularly in Europe, were developed in shallow waters. The relative simplicity and cost-effectiveness of installing turbines in these areas have made shallow water zones a strategic starting point for countries entering the offshore wind space.

The transitional water depths, ranging from 30 to 60 meters, are increasingly becoming a focus in the offshore wind turbine market as shallow water opportunities become saturated and developers look to expand capacity. Advances in turbine foundation technologies such as monopiles, jackets, and hybrid structures have made it feasible to install turbines in deeper waters while maintaining structural integrity and performance. Transitional water zones often offer higher and more consistent wind speeds compared to shallower areas, resulting in improved energy yields. While development in these depths presents increased technical and logistical challenges, including more complex installation procedures and higher capital investment, the long-term return through greater energy output is attracting interest from both public and private stakeholders.

By Capacity

By Water Depth

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Offshore Wind Turbine Market

5.1. COVID-19 Landscape: Offshore Wind Turbine r Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Offshore Wind Turbine Market, By Capacity

8.1. Offshore Wind Turbine Market, by Capacity, 2024-2033

8.1.1. Up to 3 MW

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. 3 MW to 5 MW

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Above 5 MW

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Offshore Wind Turbine Market, By Water Depth

9.1. Offshore Wind Turbine Market, by Water Depth, 2024-2033

9.1.1. Shallow Water (<30 M Depth)

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Transitional Water (30-60 M Depth)

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Deepwater (More than 60 M Depth)

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Offshore Wind Turbine Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Capacity (2021-2033)

10.1.2. Market Revenue and Forecast, by Water Depth (2021-2033)

Chapter 11. Company Profiles

11.1. Siemens Gamesa Renewable Energy

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Vestas Wind Systems A/S

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. GE Renewable Energy

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. MingYang Smart Energy

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Goldwind

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Nordex SE

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Suzlon Energy Limited

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Doosan Enerbility

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Envision Energy

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Hitachi Energy Ltd.

11.10. Nexus Pharmaceuticals

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others