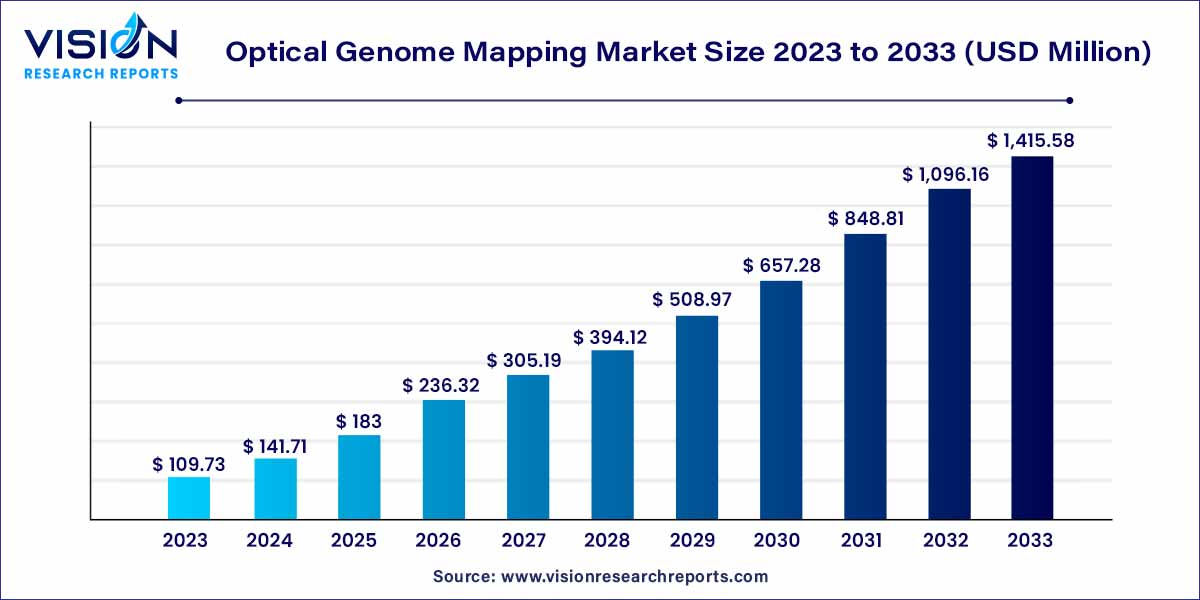

The global optical genome mapping market size was estimated at around USD 109.73 million in 2023 and it is projected to hit around USD 1,415.58 million by 2033, growing at a CAGR of 29.14% from 2024 to 2033.

In the dynamic landscape of genomic technologies, optical genome mapping (OGM) stands out as a revolutionary approach, promising transformative impacts on genetic research, diagnostics, and personalized medicine. OGM represents a paradigm shift from traditional sequencing methods, offering a comprehensive and precise analysis of genomes. This overview provides insights into the key aspects driving the optical genome mapping market, including its technology, applications, market growth drivers, and potential challenges.

The growth of the optical genome mapping market is propelled by several key factors. Advancements in imaging technologies and bioinformatics have significantly enhanced the accuracy and efficiency of optical genome mapping platforms, making them more accessible and reliable for researchers and healthcare professionals. Additionally, the increasing demand for personalized medicine, driven by a growing understanding of the importance of tailored treatments, has boosted the adoption of optical genome mapping techniques. Collaborations between biotechnology companies, research institutions, and healthcare organizations have facilitated research and development efforts in the field, leading to the introduction of more streamlined and cost-effective solutions.

| Report Coverage | Details |

| Revenue Share of North America in 2023 | 45% |

| Revenue Forecast by 2033 | USD 1,415.58 million |

| Growth Rate from 2024 to 2033 | CAGR of 29.14% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The services segment led the market with the largest revenue share of 41% in 2023. These services encompass sample preparation, data analysis, and interpretation. Skilled professionals employ cutting-edge technologies to ensure the accurate mapping and analysis of genomic structures. Researchers benefit from these services, as they can outsource the complex task of optical genome mapping, enabling them to focus on their scientific inquiries without the burden of intricate technical processes.

The consumables and reagents segment is anticipated to grow at the fastest CAGR from 2024 to 2033. Consumables in the optical genome mapping market comprise a variety of essential items. Microfluidic chips, optical chips, and other specialized materials form the backbone of the technology. These consumables are meticulously designed to facilitate the precise handling and analysis of genetic samples. Researchers and technicians rely on these consumables to ensure the integrity of the genetic material throughout the mapping process.

The structural variant detection segment contributed the largest market share of 51% in 2023. Structural variants, such as insertions, deletions, duplications, and translocations, are significant contributors to genetic diversity and can also lead to various diseases, including cancer and genetic disorders. Optical genome mapping's high-resolution imaging techniques allow researchers and clinicians to identify these variations comprehensively. By capturing detailed genomic maps, the technology enables a deeper understanding of the genetic underpinnings of diseases, paving the way for targeted therapies and personalized medicine approaches.

The genome assembly segment expected to grow at the notable CAGR of 33.85% over the forecast period. Genome assembly represents another critical area where optical genome mapping excels. Assembling a complete and accurate representation of a genome is fundamental for understanding its functional elements and regulatory regions. Traditional sequencing methods, while valuable, often struggle with complex genomic regions, repetitive sequences, and large-scale structural variations. Optical Genome Mapping offers a solution to these challenges.

The academic research institutes segment generated the highest market share of 61% in 2023. Academic research institutes, as bastions of scientific exploration, play a fundamental role in advancing genomics knowledge. Researchers within these institutions employ optical genome mapping to delve deep into the intricacies of the human genome and other species. This advanced technology allows academics to conduct in-depth genetic analyses, exploring structural variations and understanding disease mechanisms at a profound level. These insights fuel groundbreaking discoveries, driving progress in areas such as cancer research, genetics, and evolutionary biology.

The hospitals and clinical laboratories segment is anticipated to register a lucrative CAGR over the forecast period. Clinical laboratories form a pivotal end-user group for optical genome mapping, bridging the gap between research advancements and real-world patient care. The technology's precision and ability to detect structural variants are instrumental in clinical diagnostics. By utilizing Optical Genome Mapping, clinicians can develop targeted therapies tailored to a patient's unique genomic profile, ushering in a new era of personalized medicine. Clinical laboratories act as vital hubs where cutting-edge genomics technologies directly impact patient outcomes, driving the adoption of Optical Genome Mapping in the healthcare.

The North America dominated the market with highest revenue share of 45% in 2023. North America stands as a frontrunner in the adoption of optical genome mapping, with the presence of prominent biotechnology companies, research institutions, and a robust healthcare infrastructure. The region's well-established research ecosystem and significant investments in genomics research drive the market. Moreover, strategic collaborations between academia and industry players further propel the growth, leading to breakthroughs in genomic studies and clinical applications.

Europe is predicted to grow at the remarkable CAGR during the forecast period. In Europe, the Optical Genome Mapping market experiences steady growth, supported by a strong emphasis on scientific research and innovation. European countries boast a rich scientific heritage and host several leading research institutes and universities. The region's focus on genomics research, coupled with favorable government initiatives, fosters the adoption of Optical Genome Mapping technologies. European researchers and healthcare professionals actively explore the technology's applications, leading to a continuous evolution of genomics-based solutions for various diseases.

By Product

By Application

By End-user

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Optical Genome Mapping Market

5.1. COVID-19 Landscape: Optical Genome Mapping Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Optical Genome Mapping Market, By Product

8.1. Optical Genome Mapping Market, by Product, 2024-2033

8.1.1 Instruments

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Consumables and Reagents

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Software

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Services

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Optical Genome Mapping Market, By Application

9.1. Optical Genome Mapping Market, by Application, 2024-2033

9.1.1. Structural Variant Detection

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Genome Assembly

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Microbial Strain Typing

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Optical Genome Mapping Market, By End-user

10.1. Optical Genome Mapping Market, by End-user, 2024-2033

10.1.1. Biotechnology and Pharmaceutical Companies

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Clinical Laboratories

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Academic research institutes

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Optical Genome Mapping Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by End-user (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-user (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-user (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-user (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-user (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by End-user (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-user (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-user (2021-2033)

Chapter 12. Company Profiles

12.1. Bionano Genomics.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Nucleome Informatics Private Limited.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Praxis Genomics, LLC.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. SourceBio International Limited (Source BioScience).

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. MedGenome.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. INRAE (French Plant Genomic Resources Center (CNRGV))

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. PerkinElmer (PerkinElmer Genomics).

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Genohub Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Hofkens Lab.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Cerba

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others