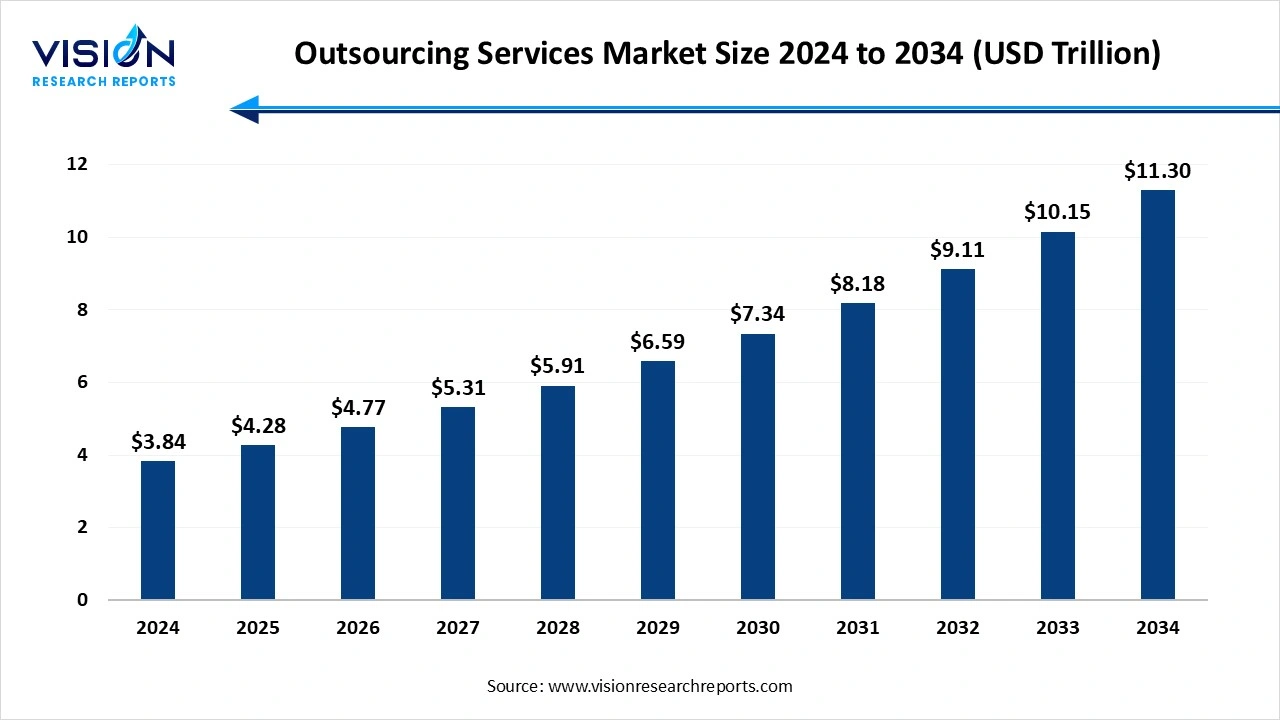

The global outsourcing services market size was calculated at around USD 3.84 trillion in 2024 and it is projected to hit around USD 11.30 trillion by 2034, growing at a CAGR of 11.40% from 2025 to 2034.

The global outsourcing services market has witnessed significant expansion in recent years, driven by increasing demand for cost optimization, operational efficiency, and access to specialized skills. Businesses across various industries are increasingly turning to outsourcing providers to handle non-core functions such as IT services, customer support, finance, and human resources. The rise of digital transformation, cloud computing, and automation technologies has further accelerated this trend, enabling service providers to deliver high-quality, scalable solutions across borders.

One of the primary growth factors driving the outsourcing services market is the increasing emphasis on cost efficiency and operational scalability. Organizations are seeking ways to reduce overhead costs and improve productivity by outsourcing non-core functions to specialized service providers. This allows companies to reallocate internal resources to more strategic areas of their business while benefiting from the expertise, infrastructure, and technologies offered by outsourcing firms.

Another significant growth factor is the rapid pace of digital transformation across industries. As companies adopt new technologies and shift to hybrid work models, there is a growing need for agile, tech-enabled outsourcing partners that can support IT operations, cybersecurity, customer engagement, and data analytics. Additionally, globalization has expanded the talent pool and created opportunities for businesses to tap into skilled labor in emerging markets. This not only enhances service delivery but also ensures 24/7 support and multilingual capabilities.

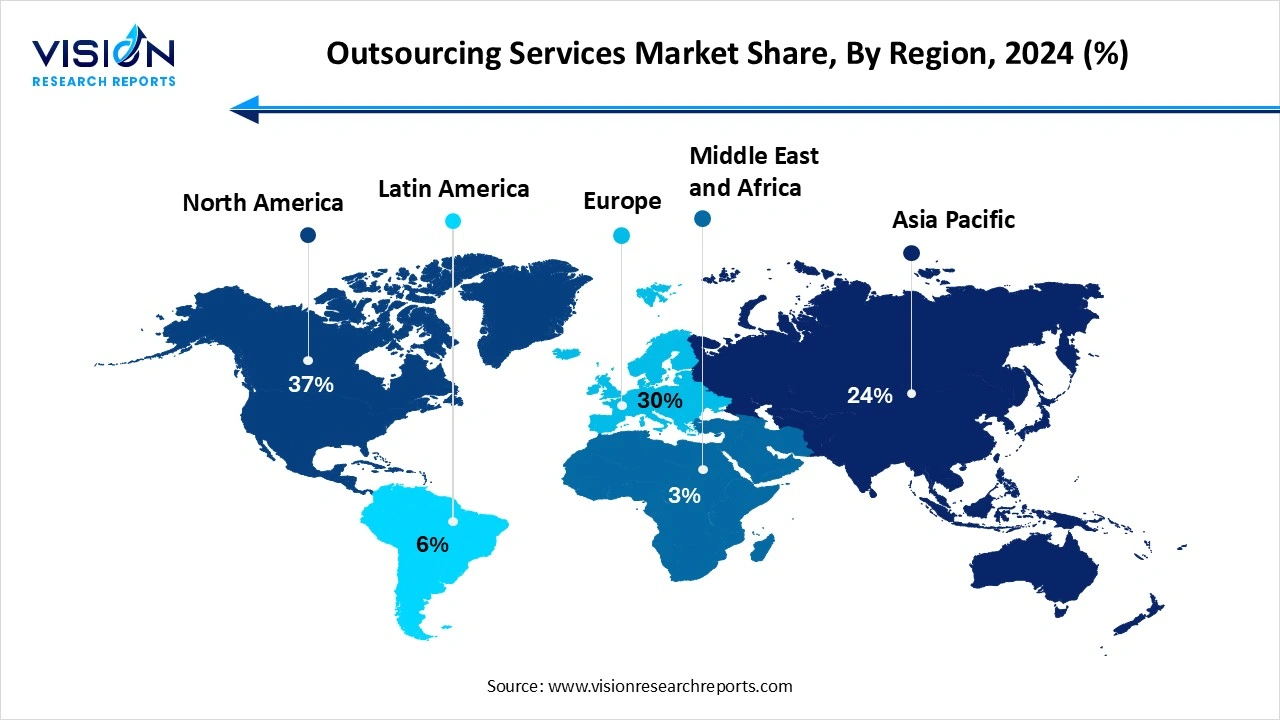

North America held a substantial portion of the outsourcing services market, capturing over 37% of the share in 2024. This growth is largely fueled by strong demand for digital transformation across various industries, including healthcare and technology. The increasing need for scalable IT infrastructure, enhanced customer service, and specialized business process outsourcing is driving market expansion. Additionally, the swift adoption of cloud computing, artificial intelligence, and automation technologies is encouraging companies to partner with experts to deploy and manage these advanced digital solutions, further sustaining the market’s growth.

The Asia Pacific outsourcing services industry is projected to grow at a compound annual growth rate CAGR of over 13.1% between 2025 and 2034. This growth is driven by a cost-effective labor force, accelerating digital transformation initiatives, and government policies designed to attract foreign investment. The region is witnessing strong demand for outsourcing solutions, fueled by the rapid expansion of its IT and business process outsourcing (BPO) sectors. Additionally, the development of multilingual skills and cultural adaptability in regional service centers strengthens APAC’s role as a leading global provider of outsourcing services, further propelling market growth.

The Asia Pacific outsourcing services industry is projected to grow at a compound annual growth rate CAGR of over 13.1% between 2025 and 2034. This growth is driven by a cost-effective labor force, accelerating digital transformation initiatives, and government policies designed to attract foreign investment. The region is witnessing strong demand for outsourcing solutions, fueled by the rapid expansion of its IT and business process outsourcing (BPO) sectors. Additionally, the development of multilingual skills and cultural adaptability in regional service centers strengthens APAC’s role as a leading global provider of outsourcing services, further propelling market growth.

The engineering services outsourcing segment led the market, capturing more than 78% of the total share in 2024. Companies across industries such as automotive, aerospace, electronics, and industrial machinery are increasingly outsourcing engineering tasks like design, simulation, prototyping, testing, and product lifecycle management to third-party providers. These outsourcing partners bring in advanced tools, skilled engineering talent, and domain-specific knowledge, enabling faster innovation cycles and reduced time-to-market. The growing adoption of digital engineering, Industry 4.0 technologies, and embedded systems has further elevated the demand for ESO as businesses strive to stay competitive and focus on their core R&D activities.

The business process outsourcing (BPO) segment is projected to experience a notable compound annual growth rate CAGR of over 6.1% between 2025 and 2034. Organizations leverage BPO to handle a wide range of non-core operations including customer support, human resources, finance and accounting, procurement, and data management. The BPO model allows companies to improve efficiency, lower operational costs, and enhance customer experience by utilizing dedicated resources and automation technologies offered by service providers. The rise of omnichannel communication, AI-driven customer service, and cloud-based platforms has significantly transformed the BPO landscape, enabling more personalized, data-driven, and scalable service delivery.

The onshore outsourcing segment held the largest share of the outsourcing services industry in 2024. This deployment type is gaining traction in industries where close collaboration, cultural alignment, and regulatory compliance are critical. Onshore outsourcing offers several advantages, such as easier communication, better control over service quality, and faster issue resolution due to proximity and shared time zones. Additionally, it often facilitates stronger client-vendor relationships and improved alignment with local market dynamics.

The offshore outsourcing segment is projected to experience the highest compound annual growth rate between 2025 and 2034. Companies often outsource IT services, customer support, engineering, and back-office operations to destinations such as India, the Philippines, and Eastern Europe. This approach enables businesses to scale operations quickly, reduce operational expenditures, and leverage time zone differences to ensure round-the-clock productivity. However, it also presents challenges related to communication, quality control, and data security.

The banking, financial services, and insurance (BFSI) segment held the largest share of the market in 2024. Institutions within this industry increasingly rely on outsourcing to manage complex regulatory requirements, reduce operational costs, and enhance customer service. Services such as risk management, fraud detection, compliance support, transaction processing, and customer relationship management are frequently outsourced to specialized providers with deep domain expertise and advanced technological capabilities. The integration of digital banking, AI-driven analytics, and robotic process automation has further elevated the strategic value of outsourcing in BFSI, enabling firms to streamline workflows, ensure data security, and maintain regulatory compliance while focusing on core financial operations.

The manufacturing segment is anticipated to achieve the highest compound annual growth rate between 2025 and 2034. Manufacturers outsource a range of services including product design, supply chain management, logistics, quality control, and IT support to improve operational efficiency and reduce time-to-market. This trend is particularly prominent in industries such as automotive, electronics, and industrial equipment, where continuous innovation, cost management, and global competitiveness are essential. Outsourcing allows manufacturers to access specialized expertise, flexible resource allocation, and scalable infrastructure, which are crucial for handling the complexities of global production and distribution

By Service Type

By Deployment Type

By Industry Vertical

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Service Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Outsourcing Services Market

5.1. COVID-19 Landscape: Outsourcing Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Outsourcing Services Market, By Service Type

8.1. Outsourcing Services Market, by Service Type

8.1.1 IT Outsourcing

8.1.1.1. Market Revenue and Forecast

8.1.2. Business Process Outsourcing

8.1.2.1. Market Revenue and Forecast

8.1.3. Knowledge Process Outsourcing

8.1.3.1. Market Revenue and Forecast

8.1.4. Engineering Services Outsourcing

8.1.4.1. Market Revenue and Forecast

Chapter 9. Global Outsourcing Services Market, By Deployment Type

9.1. Outsourcing Services Market, by Deployment Type

9.1.1. Onshore Outsourcing

9.1.1.1. Market Revenue and Forecast

9.1.2. Nearshore Outsourcing

9.1.2.1. Market Revenue and Forecast

9.1.3. Offshore Outsourcing

9.1.3.1. Market Revenue and Forecast

Chapter 10. Global Outsourcing Services Market, By Industry Vertical

10.1. Outsourcing Services Market, by Industry Vertical

10.1.1. BFSI (Banking, Financial Services & Insurance)

10.1.1.1. Market Revenue and Forecast

10.1.2. Healthcare & Life Sciences

10.1.2.1. Market Revenue and Forecast

10.1.3. IT & Telecommunications

10.1.3.1. Market Revenue and Forecast

10.1.4. Retail & E-commerce

10.1.4.1. Market Revenue and Forecast

10.1.5. Manufacturing

10.1.5.1. Market Revenue and Forecast

10.1.6. Transportation & Logistics

10.1.6.1. Market Revenue and Forecast

10.1.6. Government & Public Sector

10.1.6.1. Market Revenue and Forecast

10.1.6. Others (Media & Entertainment, Energy & Utilities)

10.1.6.1. Market Revenue and Forecast

Chapter 11. Global Outsourcing Services Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Service Type

11.1.2. Market Revenue and Forecast, by Deployment Type

11.1.3. Market Revenue and Forecast, by Industry Vertical

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Service Type

11.1.4.2. Market Revenue and Forecast, by Deployment Type

11.1.4.3. Market Revenue and Forecast, by Industry Vertical

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Service Type

11.1.5.2. Market Revenue and Forecast, by Deployment Type

11.1.5.3. Market Revenue and Forecast, by Industry Vertical

11.2. Europe

11.2.1. Market Revenue and Forecast, by Service Type

11.2.2. Market Revenue and Forecast, by Deployment Type

11.2.3. Market Revenue and Forecast, by Industry Vertical

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Service Type

11.2.4.2. Market Revenue and Forecast, by Deployment Type

11.2.4.3. Market Revenue and Forecast, by Industry Vertical

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Service Type

11.2.5.2. Market Revenue and Forecast, by Deployment Type

11.2.5.3. Market Revenue and Forecast, by Industry Vertical

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Service Type

11.2.6.2. Market Revenue and Forecast, by Deployment Type

11.2.6.3. Market Revenue and Forecast, by Industry Vertical

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Service Type

11.2.7.2. Market Revenue and Forecast, by Deployment Type

11.2.7.3. Market Revenue and Forecast, by Industry Vertical

11.3. APAC

11.3.1. Market Revenue and Forecast, by Service Type

11.3.2. Market Revenue and Forecast, by Deployment Type

11.3.3. Market Revenue and Forecast, by Industry Vertical

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Service Type

11.3.4.2. Market Revenue and Forecast, by Deployment Type

11.3.4.3. Market Revenue and Forecast, by Industry Vertical

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Service Type

11.3.5.2. Market Revenue and Forecast, by Deployment Type

11.3.5.3. Market Revenue and Forecast, by Industry Vertical

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Service Type

11.3.6.2. Market Revenue and Forecast, by Deployment Type

11.3.6.3. Market Revenue and Forecast, by Industry Vertical

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Service Type

11.3.7.2. Market Revenue and Forecast, by Deployment Type

11.3.7.3. Market Revenue and Forecast, by Industry Vertical

11.4. MEA

11.4.1. Market Revenue and Forecast, by Service Type

11.4.2. Market Revenue and Forecast, by Deployment Type

11.4.3. Market Revenue and Forecast, by Industry Vertical

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Service Type

11.4.4.2. Market Revenue and Forecast, by Deployment Type

11.4.4.3. Market Revenue and Forecast, by Industry Vertical

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Service Type

11.4.5.2. Market Revenue and Forecast, by Deployment Type

11.4.5.3. Market Revenue and Forecast, by Industry Vertical

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Service Type

11.4.6.2. Market Revenue and Forecast, by Deployment Type

11.4.6.3. Market Revenue and Forecast, by Industry Vertical

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Service Type

11.4.7.2. Market Revenue and Forecast, by Deployment Type

11.4.7.3. Market Revenue and Forecast, by Industry Vertical

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Service Type

11.5.2. Market Revenue and Forecast, by Deployment Type

11.5.3. Market Revenue and Forecast, by Industry Vertical

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Service Type

11.5.4.2. Market Revenue and Forecast, by Deployment Type

11.5.4.3. Market Revenue and Forecast, by Industry Vertical

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Service Type

11.5.5.2. Market Revenue and Forecast, by Deployment Type

11.5.5.3. Market Revenue and Forecast, by Industry Vertical

Chapter 12. Company Profiles

12.1. Accenture.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Tata Consultancy Services (TCS).

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. IBM Corporation.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Capgemini SE.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Cognizant Technology Solutions.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. HCL Technologies

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Wipro Limited.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Genpact

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. DXC Technology.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others