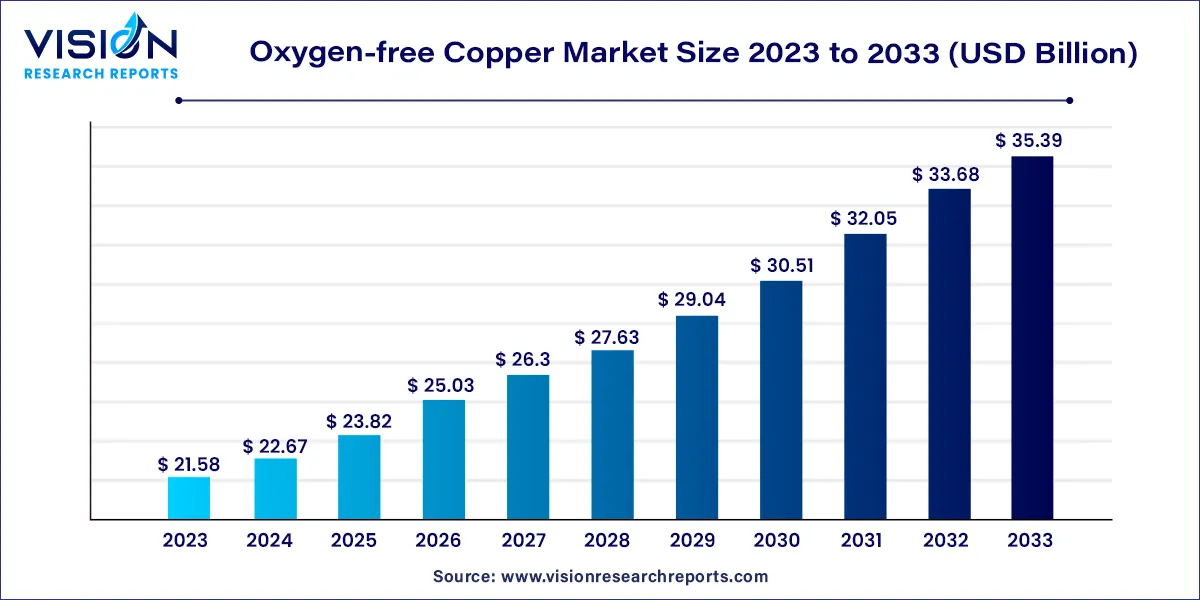

The global oxygen-free copper market was estimated at USD 21.58 billion in 2023 and it is expected to surpass around USD 35.39 billion by 2033, poised to grow at a CAGR of 5.07% from 2024 to 2033.

The oxygen-free copper market is a vital segment within the broader metals industry, characterized by its unique properties and diverse applications across various sectors. This overview delves into the key aspects shaping the oxygen-free copper market, from its composition to its applications and market trends.

The growth of the oxygen-free copper market is propelled by several key factors. Firstly, the increasing demand for high-performance electronic devices, such as smartphones, tablets, and computers, drives the need for superior conductivity materials like oxygen-free copper in the production of printed circuit boards (PCBs) and electrical connectors. Additionally, the automotive industry's shift towards electric vehicles (EVs) and the growing emphasis on energy efficiency stimulate demand for OFC in wiring harnesses and battery systems. Furthermore, the expansion of renewable energy infrastructure, particularly in solar and wind power generation, amplifies the requirement for oxygen-free copper in cables and busbars due to its low resistance and excellent thermal conductivity properties. Moreover, stringent regulations governing energy efficiency and emissions reduction further boost the adoption of OFC in various applications, contributing to the overall growth of the market.

In 2023, the electrical and electronics segment emerged as the market leader, commanding a substantial revenue share of over 35%. This dominance is attributed to the escalating adoption of automation, electronic devices, and smart gadgets, driving an upsurge in printed circuit board (PCB) production. Consequently, there's a burgeoning demand for oxygen-free copper, a trend expected to persist throughout the forecast period.

Oxygen-free copper finds versatile applications across various industries, including the manufacturing of copper anodes, busbars, coaxial cables, transmitter components, medical devices, tubes, waveguides, hollow conductors, and glass-to-metal seals, among others. Its preference in specific applications stems from its exceptional thermal conductivity and robustness. Notably, OFC copper wires exhibit slower heating compared to alternative metals like aluminum, owing to their high thermal conductivity.

In 2023, the Cu-OFE segment emerged as the market leader, capturing a significant revenue share of approximately 58%. This segment is poised to experience substantial growth at a notable compound annual growth rate (CAGR) throughout the forecast period. Its popularity is attributed to its exceptional formability, weldability, and brazability, surpassing other grades available. Comprising 99.99% copper and 0.0005% oxygen content, Cu-OFE is expected to witness market expansion driven by technological advancements. Furthermore, upgrades in technology are anticipated to highlight the advantages of hard-pitch electrolytic copper (ETP) and phosphorus-deoxidized copper.

Cu-OFE oxygen-free copper finds extensive applications in the printed circuit board (PCB) industry, owing to its flexibility and conductivity. Moreover, it serves as a preferred raw material for the production of high-frequency PCBs, boasting superior quality.

The Cu-OF grade of oxygen-free copper is particularly well-suited for critical electrical, electronic, and communication components. Comprising 99.95% copper and 0.001% oxygen content, it offers exceptional copper purity. These materials are commonly utilized in circuit boards due to their ability to easily bond with insulating layers and form circuit patterns post-etching. Additionally, they can be printed with protective layers for enhanced durability.

In 2023, the wires segment emerged as the market leader, commanding the largest revenue share of over 31%. Oxygen-free copper wires are extensively utilized in the electrical and electronic industries worldwide. This type of copper is preferred by manufacturers to minimize the occurrence of voids within wires, which can disrupt the transmission process. Oxygen-free copper wires boast several outstanding characteristics, including high conductivity, dimensional accuracy, flexibility without cracking, and a prolonged service life.

The strip segment is poised to witness significant growth at a notable compound annual growth rate (CAGR) over the forecast period. Copper strips find widespread use in the electrical equipment sector for the manufacturing of switchgear, power distribution systems, and transformers. Their high electrical conductivity and malleability make them a cost-effective option compared to other substitutes, further driving their adoption in various applications.

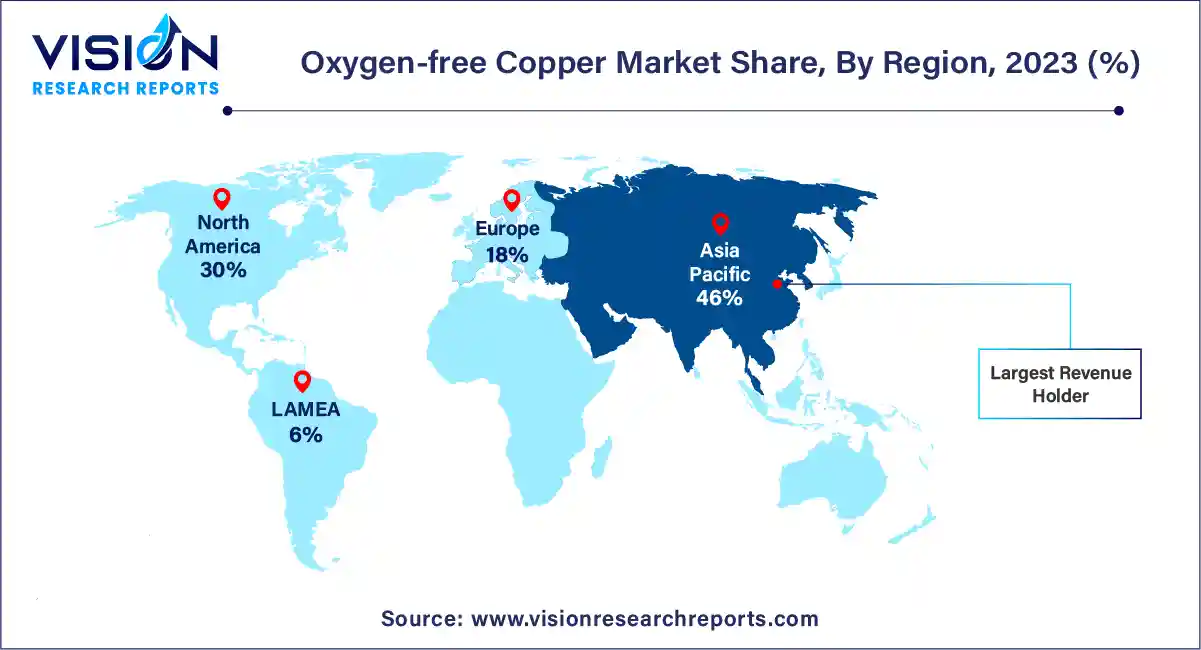

The oxygen-free copper market in North America is poised to experience a noteworthy compound annual growth rate (CAGR) throughout the forecast period. North America stands as a pivotal market for automotive metals globally, with the United States leading the demand within the region. This dominance can be attributed to early industrialization and the rapid adoption of new trends. The significant utilization of oxygen-free copper in electric vehicles further propels market growth, benefiting from the rising demand for electric vehicles in the region.

Asia Pacific emerged as the dominant market in 2023, capturing a revenue share of over 46%. Oxygen-free copper, renowned for its high strength, corrosion resistance, thermal stability, and exceptional electrical conductivity, plays a vital role across various industries in the region, including electronics, automotive, aerospace, and medical sectors. This widespread adoption is a key driver for the market's growth in Asia Pacific.

By Grade

By Product

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Grade Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Oxygen-free Copper Market

5.1. COVID-19 Landscape: Oxygen-free Copper Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Oxygen-free Copper Market, By Grade

8.1. Oxygen-free Copper Market, by Grade, 2024-2033

8.1.1 Cu-OF

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Cu-OFE

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Oxygen-free Copper Market, By Product

9.1. Oxygen-free Copper Market, by Product, 2024-2033

9.1.1. Wires

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Strips

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Busbars & Rods

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Other Products

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Oxygen-free Copper Market, By Application

10.1. Oxygen-free Copper Market, by Application, 2024-2033

10.1.1. Electrical & Electronics

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Automotive

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Other Applications

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Oxygen-free Copper Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Grade (2021-2033)

11.1.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Grade (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Grade (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Grade (2021-2033)

11.2.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Grade (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Grade (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Grade (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Grade (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Grade (2021-2033)

11.3.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Grade (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Grade (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Grade (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Grade (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Grade (2021-2033)

11.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Grade (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Grade (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Grade (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Grade (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Grade (2021-2033)

11.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Grade (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Grade (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. Copper Braid Products.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Cupori.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Hitachi Metals Neomaterial, Ltd.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Hussey Copper.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Metrod Holdings Berhad.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Mitsubishi Materials Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Sam Dong.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Southwire Company, LLC

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Wieland.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Zheijang Libo Holding Group Co., Ltd.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others