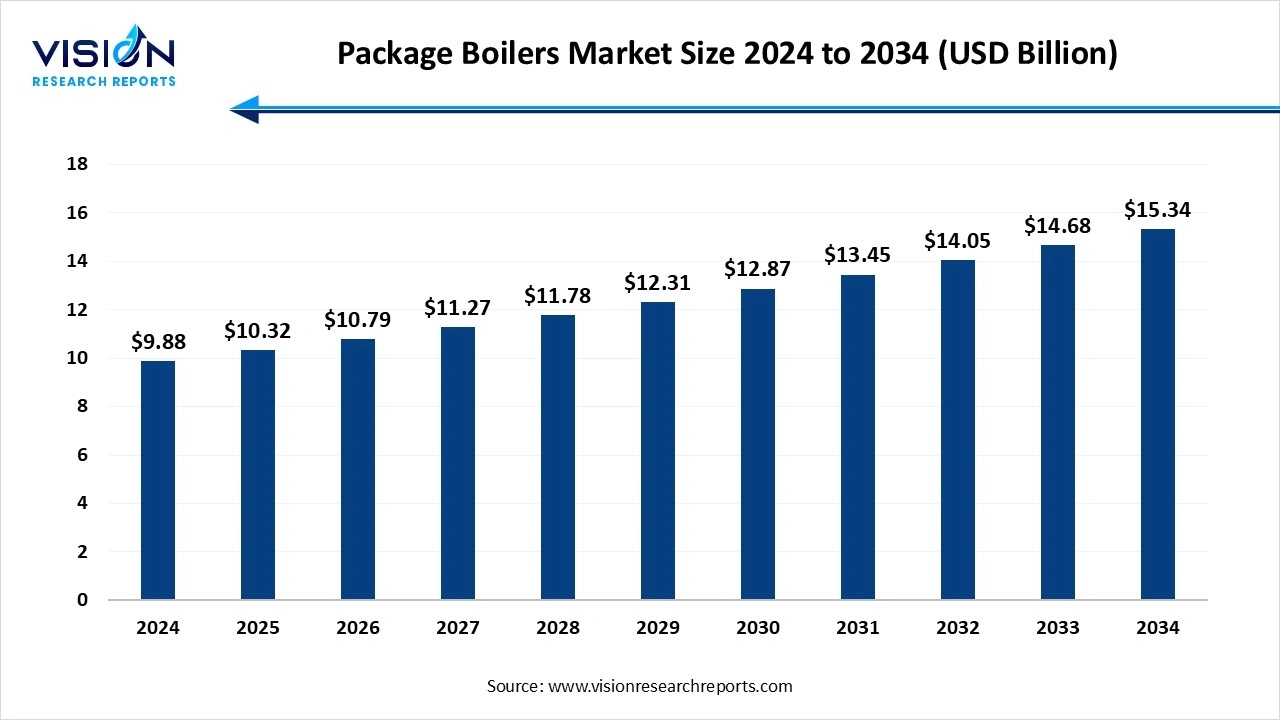

The global package boilers market size was estimated at around USD 9.88 billion in 2024 and it is projected to hit around USD 15.34 billion by 2034, growing at a CAGR of 4.50% from 2025 to 2034.

The package boilers market is experiencing steady growth driven by increasing demand for efficient and compact steam generation systems across various industries. Package boilers are prefabricated units designed to deliver steam quickly and reliably, offering advantages such as ease of installation, space-saving design, and lower operational costs. These boilers are widely used in sectors like power generation, manufacturing, chemical processing, and food production, where consistent steam supply is crucial. Technological advancements focusing on energy efficiency and emission reduction are further fueling market expansion, as industries strive to meet stringent environmental regulations and reduce their carbon footprint.

The growth of the package boilers market is primarily driven by the increasing industrialization and urbanization worldwide, which has led to higher demand for efficient and reliable steam generation solutions. Industries such as power generation, oil and gas, chemicals, and food processing require compact and easy-to-install boilers that can deliver consistent performance with minimal downtime. Package boilers, being prefabricated and modular, offer these advantages, making them a preferred choice for industries aiming to optimize their operations and reduce installation time and costs.

Another significant factor contributing to the market growth is the stringent environmental regulations aimed at reducing harmful emissions. Manufacturers are increasingly incorporating eco-friendly technologies into package boilers, such as low NOx burners and advanced combustion control systems, to comply with these norms. This shift toward greener technologies not only helps industries meet regulatory requirements but also enhances sustainability efforts, which is becoming a critical business priority.

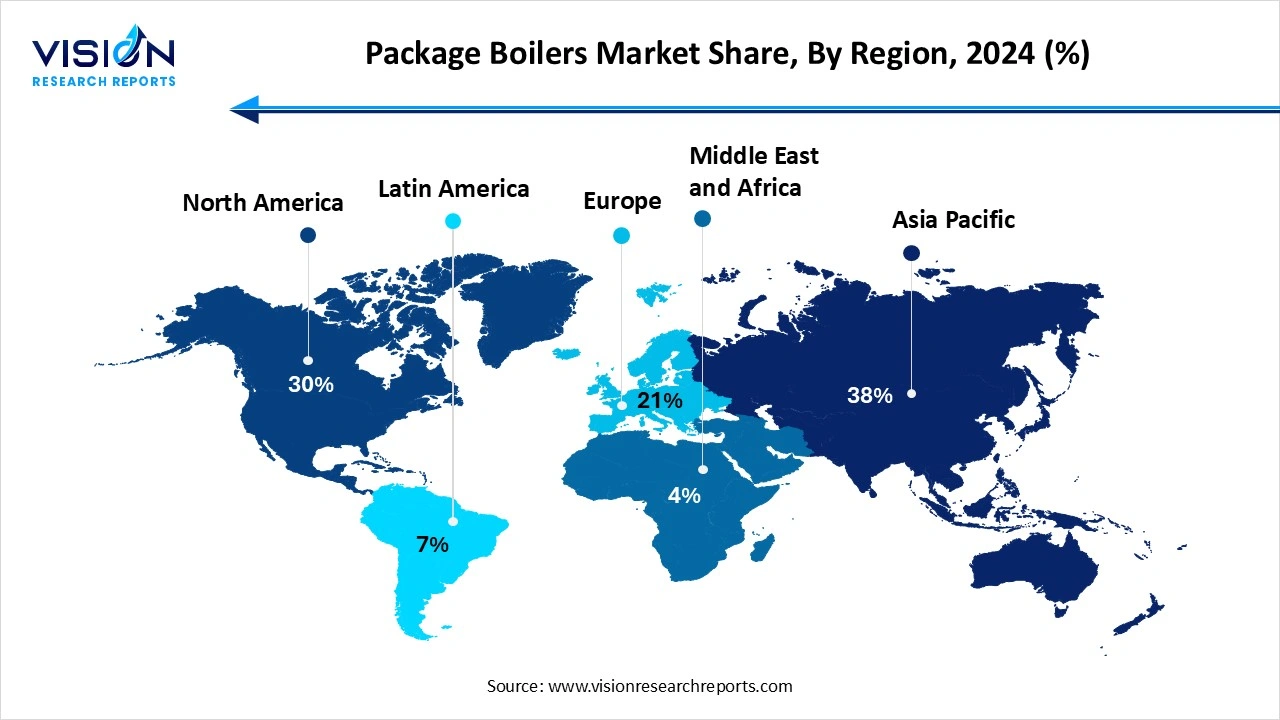

The Asia Pacific region led the market with a 38% share in 2024. The market is experiencing rapid growth fueled by ongoing industrialization, urbanization, and rising energy demands in emerging economies. Significant investments are being made in infrastructure, manufacturing, and the energy sector. Although environmental concerns pose certain challenges, market expansion is bolstered by the adoption of efficient boiler technologies and government policies encouraging cleaner energy solutions.

Europe the package boilers market is propelled by strict emission control policies and the region’s commitment to sustainability and renewable energy integration. European industries are increasingly adopting package boilers with low emissions and high efficiency to comply with regulatory standards and reduce their carbon footprint. The region also benefits from technological innovation and strong government support for energy-efficient solutions, which further bolster market growth.

Europe the package boilers market is propelled by strict emission control policies and the region’s commitment to sustainability and renewable energy integration. European industries are increasingly adopting package boilers with low emissions and high efficiency to comply with regulatory standards and reduce their carbon footprint. The region also benefits from technological innovation and strong government support for energy-efficient solutions, which further bolster market growth.

The fire-tube boilers segment led the market, capturing a dominant share of 46% in 2024. These boilers function by passing hot gases through tubes surrounded by water, efficiently transferring heat to generate steam. Their design allows for relatively easy maintenance and they are favored in industries requiring moderate steam pressure and volume. Fire-tube boilers are particularly popular in small to medium-scale applications such as heating, food processing, and textile manufacturing, where consistent and stable steam output is essential.

The electric boilers are gaining attention as a clean and environmentally friendly alternative to conventional boilers. These boilers utilize electrical energy to generate steam or hot water, eliminating direct fuel combustion and thereby reducing emissions. Electric boilers offer advantages such as compact size, quiet operation, and precise control over steam production, making them suitable for industries focused on sustainability and those operating in regions with stringent environmental regulations. Although the operating costs can be higher due to electricity consumption, advancements in renewable energy integration are enhancing the appeal of electric boilers in the global market, especially in applications where zero emissions and energy efficiency are prioritized.

The D-type design segment held the leading position in the market in 2024. The D-type design is characterized by its robust and compact structure where the water and steam drums are arranged vertically, forming a shape resembling the letter "D." This design facilitates efficient heat transfer and allows for higher steam pressures, making it suitable for industrial processes that demand substantial steam output. D-type boilers are favored in power generation, chemical processing, and other heavy industries because of their durability, ability to handle high temperatures, and ease of maintenance.

The A-type package boiler features a layout where the two water drums are positioned vertically with a single steam drum on top, creating an “A” shape. This design is known for its stability and efficient steam production at moderate pressures. A-type boilers are commonly used in commercial and medium-scale industrial applications where reliable and steady steam supply is required. Their relatively simpler design compared to the D-type allows for easier installation and operation, making them popular in sectors such as food processing, pharmaceuticals, and textile manufacturing. Both designs contribute to the market by catering to diverse industrial needs with tailored performance and operational advantages.

The gas fuel type segment led the market, capturing a 43% share in 2024. They primarily use natural gas as fuel, which burns more cleanly and provides consistent heat output, making these boilers suitable for industries focused on reducing their environmental impact while maintaining high operational efficiency. The widespread availability of natural gas infrastructure and the growing emphasis on cleaner energy sources continue to drive the adoption of gas-fired package boilers in various sectors, including power generation, manufacturing, and commercial facilities.

The biomass-fired package boilers represent an eco-friendly alternative by utilizing renewable organic materials such as wood chips, agricultural residues, and other biomass fuels. These boilers are gaining traction as industries and governments push towards sustainable energy solutions and carbon neutrality goals. Biomass-fired boilers not only help in reducing dependence on fossil fuels but also contribute to waste management by converting organic waste into usable energy. Despite challenges related to fuel handling and variability, technological advancements have improved the efficiency and reliability of biomass boilers, making them a viable choice for sectors such as agriculture, paper and pulp, and food processing that seek to lower their carbon footprint while ensuring stable steam production.

The chemical and petrochemical end-use segment held the largest market share, accounting for 25% in 2025. Package boilers are essential in this sector for providing consistent steam used in heating, distillation, and chemical reactions. The ability of package boilers to deliver precise and controlled steam makes them well-suited to meet the stringent operational requirements of chemical and petrochemical plants. Additionally, the need for energy-efficient and environmentally compliant boilers is driving the adoption of advanced package boiler systems within this industry, as companies strive to optimize process efficiency while minimizing emissions.

The food and beverage industry also constitutes a vital end-use segment for package boilers, as steam is critical for various applications such as cooking, sterilization, drying, and cleaning. Package boilers in this sector are favored for their compact design, quick installation, and ability to provide high-quality steam that meets hygiene and safety standards. The growing demand for processed and packaged foods globally has increased the need for efficient steam generation solutions, prompting food and beverage manufacturers to invest in reliable package boilers.

By Type

By Fuel Type

By Design

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Package Boilers Market

5.1. COVID-19 Landscape: Package Boilers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Package Boilers Market, By Type

8.1. Package Boilers Market, by Type

8.1.1. Fire-Tube Boilers

8.1.1.1. Market Revenue and Forecast

8.1.2. Water-Tube Boilers

8.1.2.1. Market Revenue and Forecast

8.1.3. Electric Boilers

8.1.3.1. Market Revenue and Forecast

8.1.4. Hybrid Boilers

8.1.4.1. Market Revenue and Forecast

Chapter 9. Global Package Boilers Market, By Fuel Type

9.1. Package Boilers Market, by Fuel Type

9.1.1. Oil

9.1.1.1. Market Revenue and Forecast

9.1.2. Gas

9.1.2.1. Market Revenue and Forecast

9.1.3. Coal

9.1.3.1. Market Revenue and Forecast

9.1.4. Biomass

9.1.4.1. Market Revenue and Forecast

9.1.5. Electric

9.1.5.1. Market Revenue and Forecast

Chapter 10. Global Package Boilers Market, By Design

10.1. Package Boilers Market, by Design

10.1.1. D-Type

10.1.1.1. Market Revenue and Forecast

10.1.2. A-Type

10.1.2.1. Market Revenue and Forecast

10.1.3. O-Type

10.1.3.1. Market Revenue and Forecast

Chapter 11. Global Package Boilers Market, By End Use

11.1. Package Boilers Market, by End Use

11.1.1. Food & Beverage

11.1.1.1. Market Revenue and Forecast

11.1.2. Chemical & Petrochemical

11.1.2.1. Market Revenue and Forecast

11.1.3. Oil & Gas

11.1.3.1. Market Revenue and Forecast

11.1.4. Paper & Pulp

11.1.4.1. Market Revenue and Forecast

11.1.5. Pharmaceuticals

11.1.5.1. Market Revenue and Forecast

11.1.6. Textile

11.1.6.1. Market Revenue and Forecast

11.1.7. Others

11.1.7.1. Market Revenue and Forecast

Chapter 12. Global Package Boilers Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type

12.1.2. Market Revenue and Forecast, by Fuel Type

12.1.3. Market Revenue and Forecast, by Design

12.1.4. Market Revenue and Forecast, by End Use

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type

12.1.5.2. Market Revenue and Forecast, by Fuel Type

12.1.5.3. Market Revenue and Forecast, by Design

12.1.5.4. Market Revenue and Forecast, by End Use

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type

12.1.6.2. Market Revenue and Forecast, by Fuel Type

12.1.6.3. Market Revenue and Forecast, by Design

12.1.6.4. Market Revenue and Forecast, by End Use

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type

12.2.2. Market Revenue and Forecast, by Fuel Type

12.2.3. Market Revenue and Forecast, by Design

12.2.4. Market Revenue and Forecast, by End Use

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type

12.2.5.2. Market Revenue and Forecast, by Fuel Type

12.2.5.3. Market Revenue and Forecast, by Design

12.2.5.4. Market Revenue and Forecast, by End Use

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type

12.2.6.2. Market Revenue and Forecast, by Fuel Type

12.2.6.3. Market Revenue and Forecast, by Design

12.2.6.4. Market Revenue and Forecast, by End Use

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type

12.2.7.2. Market Revenue and Forecast, by Fuel Type

12.2.7.3. Market Revenue and Forecast, by Design

12.2.7.4. Market Revenue and Forecast, by End Use

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type

12.2.8.2. Market Revenue and Forecast, by Fuel Type

12.2.8.3. Market Revenue and Forecast, by Design

12.2.8.4. Market Revenue and Forecast, by End Use

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type

12.3.2. Market Revenue and Forecast, by Fuel Type

12.3.3. Market Revenue and Forecast, by Design

12.3.4. Market Revenue and Forecast, by End Use

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type

12.3.5.2. Market Revenue and Forecast, by Fuel Type

12.3.5.3. Market Revenue and Forecast, by Design

12.3.5.4. Market Revenue and Forecast, by End Use

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type

12.3.6.2. Market Revenue and Forecast, by Fuel Type

12.3.6.3. Market Revenue and Forecast, by Design

12.3.6.4. Market Revenue and Forecast, by End Use

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type

12.3.7.2. Market Revenue and Forecast, by Fuel Type

12.3.7.3. Market Revenue and Forecast, by Design

12.3.7.4. Market Revenue and Forecast, by End Use

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type

12.3.8.2. Market Revenue and Forecast, by Fuel Type

12.3.8.3. Market Revenue and Forecast, by Design

12.3.8.4. Market Revenue and Forecast, by End Use

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type

12.4.2. Market Revenue and Forecast, by Fuel Type

12.4.3. Market Revenue and Forecast, by Design

12.4.4. Market Revenue and Forecast, by End Use

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type

12.4.5.2. Market Revenue and Forecast, by Fuel Type

12.4.5.3. Market Revenue and Forecast, by Design

12.4.5.4. Market Revenue and Forecast, by End Use

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type

12.4.6.2. Market Revenue and Forecast, by Fuel Type

12.4.6.3. Market Revenue and Forecast, by Design

12.4.6.4. Market Revenue and Forecast, by End Use

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type

12.4.7.2. Market Revenue and Forecast, by Fuel Type

12.4.7.3. Market Revenue and Forecast, by Design

12.4.7.4. Market Revenue and Forecast, by End Use

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type

12.4.8.2. Market Revenue and Forecast, by Fuel Type

12.4.8.3. Market Revenue and Forecast, by Design

12.4.8.4. Market Revenue and Forecast, by End Use

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type

12.5.2. Market Revenue and Forecast, by Fuel Type

12.5.3. Market Revenue and Forecast, by Design

12.5.4. Market Revenue and Forecast, by End Use

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type

12.5.5.2. Market Revenue and Forecast, by Fuel Type

12.5.5.3. Market Revenue and Forecast, by Design

12.5.5.4. Market Revenue and Forecast, by End Use

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type

12.5.6.2. Market Revenue and Forecast, by Fuel Type

12.5.6.3. Market Revenue and Forecast, by Design

12.5.6.4. Market Revenue and Forecast, by End Use

Chapter 13. Company Profiles

13.1. Thermax Limited

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Bosch Thermotechnik GmbH

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Miura Co., Ltd.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Babcock & Wilcox Enterprises, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Cleaver-Brooks, Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Hurst Boiler & Welding Company, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Alfa Laval AB

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Fulton Boiler Works, Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Superior Boiler Works, Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. L & T-MHPS Boilers Pvt. Ltd.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others