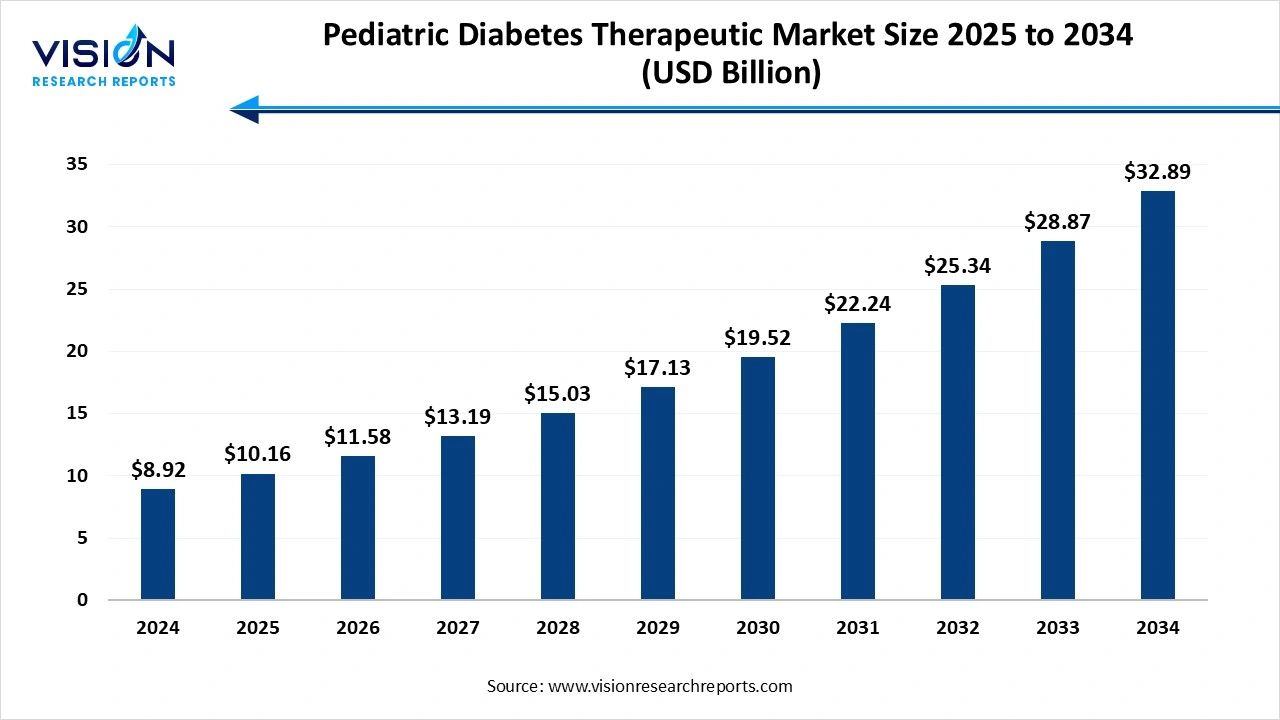

The pediatric diabetes management market size stood at USD 8.92 billion in 2024 and is estimated to reach USD 10.16 billion in 2025 It is projected to hit USD 32.89 billion by 2034, registering a robust CAGR of 13.94% from 2025 to 2034. The market growth is driven by the rising prevalence of type 1 diabetes among children, the pediatric diabetes management market is experiencing robust growth.

Pediatric diabetes management refers to the tools, technologies and therapeutic approaches that are designed to monitor and control diabetes in children and adolescents. This includes insulin delivery

systems, continuous glucose monitoring devices and digital platforms that can connect caregivers, healthcare providers and patients.

The pediatric diabetes management market is experiencing steady growth, driven by the increasing prevalence of type 1 and type 2 diabetes among children and adolescents. Advances in insulin delivery technologies, continuous glucose monitoring (CGM) systems and digital health tools have significantly improved disease management, offering more precise and child-friendly solutions. The rising awareness among parents and caregivers coupled with supportive government and healthcare initiatives has further boosted market growth and development.

The growth of the pediatric diabetes management market is primarily driven by the rising incidence of diabetes in children, particularly type 1 diabetes. This trend has led to an increased demand for effective and child-friendly diabetes management solutions. Advances in insulin pump, smart glucose meters, and continuous glucose monitoring (CGM) systems are playing a critical role in enhancing disease control, reducing complications, and improving the quality of life for pediatric patients.

Another key factor fueling market growth is the integration of digital health technologies, including mobile health apps and telehealth platforms, which allow for real-time tracking and remote care. These innovations are particularly beneficial for children, as they enable better parental oversight and healthcare provider support without constant in-person visits.

| Report Coverage | Details |

| Market Size in 2024 | USD 8.92 billion |

| Revenue Forecast by 2034 | USD 32.89 billion |

| Growth rate from 2025 to 2034 | CAGR of 13.94% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Medtronic plc, Dexcom, Inc., F. Hoffmann-La Roche Ltd, Insulet Corporation, Tandem Diabetes Care, Inc., Novo Nordisk A/S, Sanofi S.A., Eli Lilly and Company, and Ypsomed AG. |

Rising Prevalence of Pediatric Diabetes and Expansion of Health Insurance Coverages

The increasing incidence of pediatric diabetes globally is a key driver propelling the Pediatric Diabetes Therapeutics Market. The rising prevalence of type 1 diabetes among children has been rising along the years. This alarming trend necessitates the development and the availability of effective therapeutic options, thus pushing market growth. As awareness regarding diabetes management improves, healthcare providers are more likely to prescribe advanced therapies, contributing to market expansion.

The expansion of health insurance coverage for diabetes management is also another driver that is significantly impacting the market. As more families gain access to comprehensive health plans that include diabetes care, the financial burden associated with treatment decreases. This increased accessibility encourages families to seek necessary therapies and management tools for their children, creating safety and ease.

High Treatment Costs

One of the major challenges hindering the growth of the pediatric diabetes management market is the high cost that is associated with advanced treatment technologies. Devices such as continuous glucose monitors (CGMs), insulin pumps and integrated digital platforms often come with significant expenses, making them less accessible for families who belong to low and middle income regions. Limited insurance coverage and reimbursement barriers further add to the financial burden on caregivers, restricting the adoption of innovative tools.

Education Initiatives and Technological Advancements

The rising awareness campaigns and educational initiatives regarding pediatric diabetes is a key market opportunity, opening up new avenues for growth and development. Organizations and healthcare providers are increasingly focusing on educating families about diabetes management, leading to better adherence to treatment processes. This increased awareness results in the rise in the demand for therapeutic options as families seek effective solutions for managing their children's health conditions.

Technological innovations in diabetes management, such as continuous glucose monitoring systems and insulin delivery devices, are also significantly influencing the market. These advancements help in better glycemic control and enhance the quality of life for pediatric patients. The integration of smart technology in insulin pumps allows for real-time data sharing with healthcare providers, improving treatment outcomes. As these technologies become more and more accessible, they are expected to push the market forward in the upcoming years.

North America led the pediatric diabetes management market, holding the largest revenue share of 41% in 2024. Primarily due to the high prevalence of type 1 diabetes among children and the widespread availability of advanced healthcare infrastructure. The United States, in particular, benefits from strong support systems including government-funded healthcare programs, private insurance coverage, and proactive disease awareness campaigns. The region has seen significant adoption of connected glucose monitoring systems, insulin pumps, and digital health platforms tailored for pediatric patients.

Asia Pacific is projected to experience the fastest growth throughout the forecast period. Countries such as India, China and Japan are witnessing increased public health awareness and government-led initiatives that are aimed at strengthening pediatric diabetes care. Although access to advanced technologies remains limited in certain rural areas, urban centers are rapidly adopting CGMs and insulin pumps. Moreover, the expansion of telehealth services and mobile-based diabetes management tools is expected to enhance disease monitoring and treatment across the region.

Which product segment is dominating the market in 2024?

The continuous glucose monitors (CGM) segment held the largest revenue share, accounting for 35% of the market in 2024. These devices enable real-time glucose monitoring, allowing for better glycemic control and reducing the risks associated with hypoglycemia and hyperglycemia. Their advantage lies in the fact that they provide a less invasive and more comfortable solutions than compared to frequent finger-stick testing, making diabetes management easy for children. Parents and caregivers benefit significantly from CGMs as they offer constant data updates and alerts through connected apps and devices, ensuring timely interventions.

The insulin pump segment is projected to experience the fastest rate of growth throughout the forecast period. These devices offer a continuous, programmable insulin delivery system that mimics the natural functioning of the pancreas, providing children with greater flexibility and accuracy in managing their insulin needs. Insulin pumps reduce the frequency of injections and improve overall glycemic control, which has made it popular in today’s market.

Which technology led the market this year?

The connected devices segment held the largest market share in 2024. These devices include connected continuous glucose monitors (CGMs), smart insulin pens and app-integrated insulin pumps. They offer real-time data sharing and also have remote monitoring capabilities. This allows caregivers, healthcare providers and parents to closely track a child's glucose levels, insulin usage and dietary patterns through smartphones and cloud-based platforms, making it convenient and safe.

Non-connected devices are estimated to have the fastest growth over the forecast period. These devices include traditional blood glucose meters and manual insulin delivery systems that function independently on internet connectivity or mobile applications. These non-connected devices remain reliable for basic diabetes management, especially whenit comes to low-resource settings. Many families still rely on these tools due to their lower cost and ease of use.

Which end user held the largest market share?

The hospital segment captured the highest revenue share of 43% based on end-use in 2024. This is because healthcare institutions are already equipped with advanced diagnostic tools, trained endocrinologists, diabetes educators and multidisciplinary teams that offer comprehensive care tailored to pediatric needs. Hospitals also play a pivotal role in conducting clinical trials and implementing new technologies, such as closed-loop insulin delivery systems and integrated telehealth platforms.

The homecare segment is projected to record the fastest growth. This is driven by advancements in digital health tools and wearable monitoring systems as parents can now manage their child’s diabetes from the comfort of home with minimal clinical intervention. Home-based diabetes care is especially beneficial for children who require regular glucose monitoring and insulin administration, as it reduces hospital visits and supports a more stable and personalized routine.

By Product

By Technology

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Pediatric Diabetes Management Market

5.1. COVID-19 Landscape: Pediatric Diabetes Management Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Pediatric Diabetes Management Market, By Product

8.1. Pediatric Diabetes Management Market, by Product

8.1.1 Blood Glucose Monitors (BGM)

8.1.1.1. Market Revenue and Forecast

8.1.2. Continuous Glucose Monitors (CGM)

8.1.2.1. Market Revenue and Forecast

8.1.3. Insulin Pumps

8.1.3.1. Market Revenue and Forecast

8.1.4. Insulin Pens

8.1.4.1. Market Revenue and Forecast

8.1.5. Insulin Syringes

8.1.5.1. Market Revenue and Forecast

Chapter 9. Global Pediatric Diabetes Management Market, By Technology

9.1. Pediatric Diabetes Management Market, by Technology

9.1.1. Connected Devices

9.1.1.1. Market Revenue and Forecast

9.1.2. Non-connected Devices

9.1.2.1. Market Revenue and Forecast

Chapter 10. Global Pediatric Diabetes Management Market, By End Use

10.1. Pediatric Diabetes Management Market, by End Use

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast

10.1.2. General Hospitals

10.1.2.1. Market Revenue and Forecast

10.1.3 Children Hospitals

10.1.3.1. Market Revenue and Forecast

10.1.4. Homecare

10.1.4.1. Market Revenue and Forecast

10.1.5. Pediatric Clinics

10.1.5.1. Market Revenue and Forecast

Chapter 11. Global Pediatric Diabetes Management Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product

11.1.2. Market Revenue and Forecast, by Technology

11.1.3. Market Revenue and Forecast, by End Use

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product

11.1.4.2. Market Revenue and Forecast, by Technology

11.1.4.3. Market Revenue and Forecast, by End Use

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product

11.1.5.2. Market Revenue and Forecast, by Technology

11.1.5.3. Market Revenue and Forecast, by End Use

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product

11.2.2. Market Revenue and Forecast, by Technology

11.2.3. Market Revenue and Forecast, by End Use

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product

11.2.4.2. Market Revenue and Forecast, by Technology

11.2.4.3. Market Revenue and Forecast, by End Use

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product

11.2.5.2. Market Revenue and Forecast, by Technology

11.2.5.3. Market Revenue and Forecast, by End Use

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product

11.2.6.2. Market Revenue and Forecast, by Technology

11.2.6.3. Market Revenue and Forecast, by End Use

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product

11.2.7.2. Market Revenue and Forecast, by Technology

11.2.7.3. Market Revenue and Forecast, by End Use

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product

11.3.2. Market Revenue and Forecast, by Technology

11.3.3. Market Revenue and Forecast, by End Use

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product

11.3.4.2. Market Revenue and Forecast, by Technology

11.3.4.3. Market Revenue and Forecast, by End Use

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product

11.3.5.2. Market Revenue and Forecast, by Technology

11.3.5.3. Market Revenue and Forecast, by End Use

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product

11.3.6.2. Market Revenue and Forecast, by Technology

11.3.6.3. Market Revenue and Forecast, by End Use

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product

11.3.7.2. Market Revenue and Forecast, by Technology

11.3.7.3. Market Revenue and Forecast, by End Use

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product

11.4.2. Market Revenue and Forecast, by Technology

11.4.3. Market Revenue and Forecast, by End Use

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product

11.4.4.2. Market Revenue and Forecast, by Technology

11.4.4.3. Market Revenue and Forecast, by End Use

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product

11.4.5.2. Market Revenue and Forecast, by Technology

11.4.5.3. Market Revenue and Forecast, by End Use

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product

11.4.6.2. Market Revenue and Forecast, by Technology

11.4.6.3. Market Revenue and Forecast, by End Use

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product

11.4.7.2. Market Revenue and Forecast, by Technology

11.4.7.3. Market Revenue and Forecast, by End Use

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product

11.5.2. Market Revenue and Forecast, by Technology

11.5.3. Market Revenue and Forecast, by End Use

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product

11.5.4.2. Market Revenue and Forecast, by Technology

11.5.4.3. Market Revenue and Forecast, by End Use

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product

11.5.5.2. Market Revenue and Forecast, by Technology

11.5.5.3. Market Revenue and Forecast, by End Use

Chapter 12. Company Profiles

12.1. Medtronic plc

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Dexcom, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. F. Hoffmann-La Roche Ltd

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Insulet Corporation

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Tandem Diabetes Care, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Novo Nordisk A/S

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Sanofi S.A.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Eli Lilly and Company

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Ypsomed AG

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others