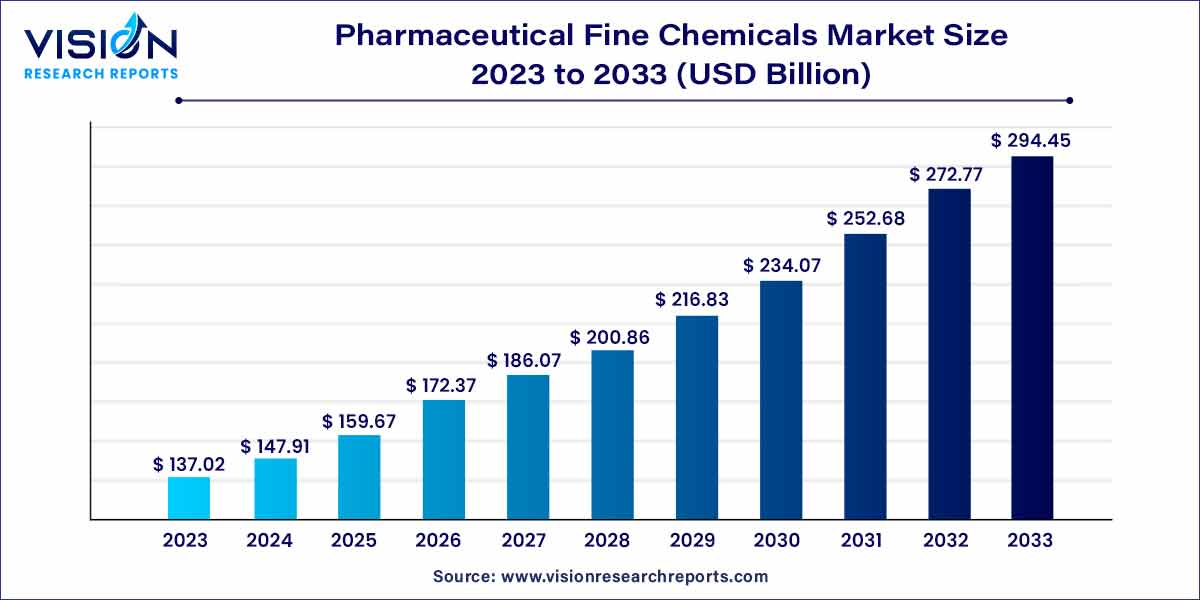

The global pharmaceutical fine chemicals market size was estimated at around USD 137.02 billion in 2023 and it is projected to hit around USD 294.45 billion by 2033, growing at a CAGR of 7.95% from 2024 to 2033.

The pharmaceutical fine chemicals market plays a pivotal role in the intricate tapestry of the pharmaceutical industry, providing essential components for the synthesis of active pharmaceutical ingredients (APIs). This overview delves into the key facets of this dynamic market, examining its structure, trends, and the driving forces that shape its trajectory.

The growth of the pharmaceutical fine chemicals market is propelled by several key factors. Firstly, the increasing demand for specialized pharmaceuticals, driven by the rising prevalence of complex diseases, fuels the need for high-quality fine chemicals as essential building blocks in drug synthesis. Stringent regulatory standards further contribute to the market's expansion, as fine chemical manufacturers strive to meet the exacting requirements for safety, efficacy, and purity set by regulatory bodies worldwide. Technological advancements in drug development, including innovative synthetic routes and sustainable practices, play a pivotal role in shaping the market's growth trajectory. Moreover, the globalization of the pharmaceutical industry and the ensuing collaborations and competition among companies contribute to the market's dynamism. Lastly, the industry's growing emphasis on green chemistry initiatives aligns with global sustainability goals, driving the adoption of environmentally friendly practices in pharmaceutical fine chemical production. As these factors converge, the pharmaceutical fine chemicals market is poised for sustained growth, underlining its crucial role in advancing pharmaceutical innovation.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 294.45 billion |

| Growth Rate from 2024 to 2033 | CAGR of 7.95% |

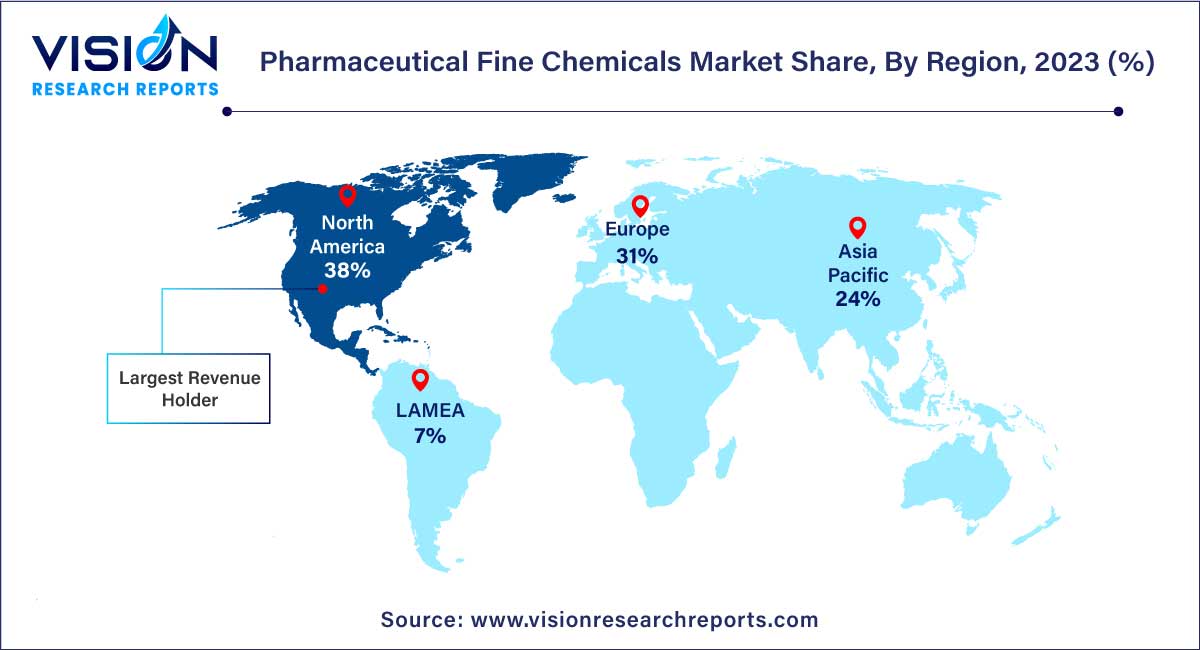

| Revenue Share of North America in 2023 | 38% |

| CAGR of Asia Pacific from 2024 to 2033 | 8.45% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The proprietary segment accounted for the largest revenue share of 82% in 2023. Proprietary drugs are drugs that are protected by patents and have a trading name. Companies strive to develop proprietary drugs for achieving maximum profit share. The industry participants are using technologies to manufacture drugs, which are cost-competitive as well as effective. Most of the pharmaceutical fine chemicals are used as building blocks for proprietary products.

The non proprietary segment is expected to grow at the fastest CAGR of 8.25% during the forecast period. The utilization of pharmaceutical fine chemicals in the production of non-proprietary drugs is anticipated to experience substantial growth throughout the projected period. Non-proprietary drugs, also known as generic drugs, are those whose patents have expired. They are typically sold at a lower cost compared to their proprietary equivalents. Increasing awareness about generic drugs, coupled with the expiration of patents for proprietary drugs, is projected to contribute to the market demand for this sector over the forecast period.

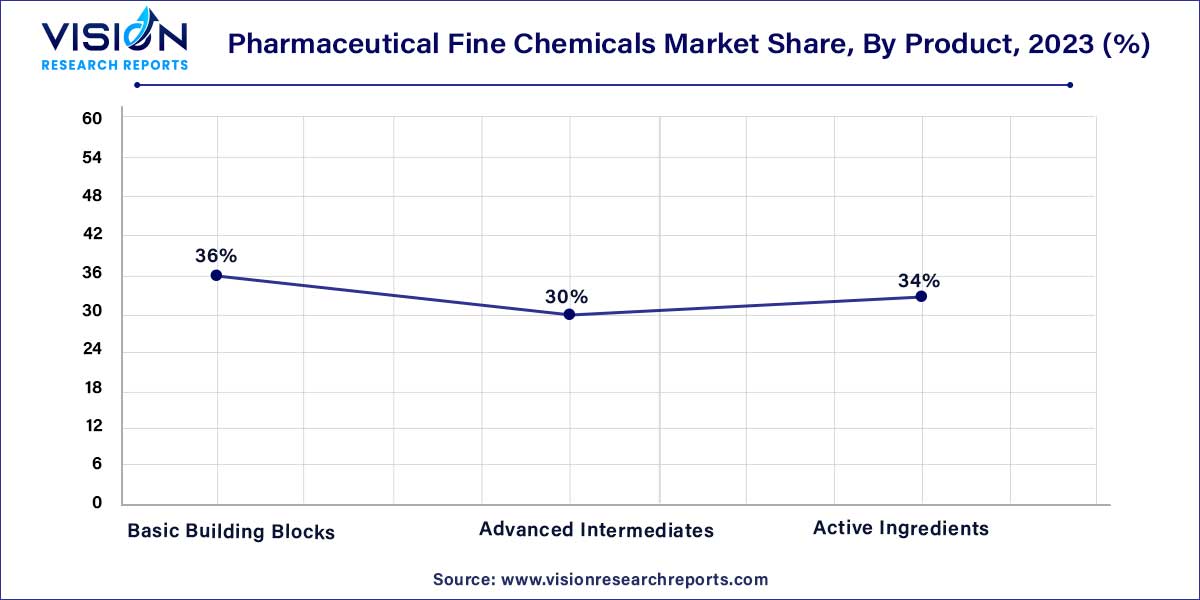

The active ingredients segment held the largest revenue share of 55% in 2023. Companies are maintaining global active pharmaceutical ingredients (API) manufacturing facilities to facilitate efficient service to their customers. The molecules are manufactured under stringent quality checks, as customers demand high purity, quality, strength, and identity.

The basic building blocks segment is expected to register a CAGR of 7.53% over the forecast period. Basic building blocks is a virtual molecular fragment possessing a reactive functional group. Building blocks include acids, acid chlorides, esters, brominated derivatives, ketones, nitrile derivatives, and heterocyclic compounds among others. These compounds are employed in the production of a wide array of medications aimed at addressing a diverse range of illnesses, including cardiovascular, musculoskeletal, and neurological conditions. Companies engaged in the production of these foundational components are intensifying their efforts towards enhancing quality. The extensive versatility of these compounds, along with the tactics embraced by the building block manufacturers, is projected to be a driving force behind the growth of this segment.

Companies are outsourcing their intermediate manufacturing requirements to offset the economic pressure as well as the regulatory barriers. The companies’ manufacturing advanced intermediates work in collaboration with the large as well as small pharmaceutical companies for sourcing lower cost, and high-quality pharmaceutical intermediates.

The big molecules segment held the maximum revenue share of 90% in 2023. These molecules are used in applications such as dipeptides, which are used to treat occurrences of cardiovascular diseases. The application of big molecules in vaccination is also driving the segment demand. Big molecule products have entered the market in the recent past in large numbers as compared to small molecules. Companies have developed small molecules for usage in drug metabolites, drug intermediates, pharmaceutical intermediates, and ingredients.

The small molecules segment is expected to grow at the fastest CAGR of 8.46% over the forecast period. Companies provide various services such as synthesis development, and assistance in setting up commercial production processes for small molecule manufacturing. Industry participants also cater to customers who demand small molecules in small quantities. The small molecules segment dominates in the approval for new molecular entity approvals. Such trends are expected to benefit the market demand over the forecast period. The emergence of contract and manufacturing organizations (CMO) with integrated processes for manufacturing small molecule intermediates, advanced formulations, and concept–to–commercial manufacturing is also favoring market growth.

The cardiovascular segment registered the maximum market share of 22% in 2023. The chemicals are utilized to manufacture medicines & drugs for the treatment of heart and blood vessels diseases. This application segment is expected to have high market penetration and high growth over the forecast period.

Diabetes is one of the most common diseases in the world today. To treat this, individuals living with diabetes are often subjected to a particular diet. This diet often includes products and medicines, which are highly expensive. On account of these factors, the diabetes segment is expected to witness a high growth rate over the forecast period.

The neurological segment is expected to grow at a CAGR of 8.18% over the forecast period. There is a high prevalence of neurological disorders due to factors such as genetic disorders, lifestyle, infections, and malnutrition and brain injury. Pharmaceutical companies have developed products that target the nerve imbalance in the body and try to restore normal neurological function. There are various innovative platforms for drug mechanisms developed recently such as glutamate modulators, which have the capability to treat neurological disorders. Such trends have benefited the segment and are expected to do so over the forecast period.

North America dominated the market and with the largest revenue share of 38% in 2023. North America region is characterized by the presence of strict laws and regulations about manufacturing as well as consumption. The claims made by the drug producers regarding the efficacy of their product need to be validated by the proper regulatory agencies before the product launch. The region is also characterized by people having a strong inclination towards preventive healthcare. Also, a wide awareness of drug use is also a key regional characteristic.

Asia Pacific is expected to grow at the fastest CAGR of 8.45% during the forecast period. High population growth in countries such as China and India coupled with the rising disposable income as well the increasing standard of living is catering to market growth in the region. Rising government healthcare expenditure in the region is also expected to benefit the market demand over the forecast period.

By Type

By Product

By Chemical

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Pharmaceutical Fine Chemicals Market

5.1. COVID-19 Landscape: Pharmaceutical Fine Chemicals Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Pharmaceutical Fine Chemicals Market, By Type

8.1. Pharmaceutical Fine Chemicals Market, by Type, 2024-2033

8.1.1. Proprietary

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Non Proprietary

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Pharmaceutical Fine Chemicals Market, By Product

9.1. Pharmaceutical Fine Chemicals Market, by Product, 2024-2033

9.1.1. Basic Building Blocks

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Advanced Intermediates

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Active Ingredients

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Pharmaceutical Fine Chemicals Market, By Chemical

10.1. Pharmaceutical Fine Chemicals Market, by Chemical, 2024-2033

10.1.1. Small Molecules

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Big Molecules

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Pharmaceutical Fine Chemicals Market, By Application

11.1. Pharmaceutical Fine Chemicals Market, by Application, 2024-2033

11.1.1. Cardiovascular

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Neurological

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Oncological

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Infectious Diseases

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Metabolic System

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Diabetes

11.1.6.1. Market Revenue and Forecast (2021-2033)

11.1.7. Respiratory

11.1.7.1. Market Revenue and Forecast (2021-2033)

11.1.8. Gastrointestinal

11.1.8.1. Market Revenue and Forecast (2021-2033)

11.1.9. Mucoskeletal

11.1.9.1. Market Revenue and Forecast (2021-2033)

11.1.10. Others

11.1.10.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Pharmaceutical Fine Chemicals Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Product (2021-2033)

12.1.3. Market Revenue and Forecast, by Chemical (2021-2033)

12.1.4. Market Revenue and Forecast, by Application (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Product (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Chemical (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Product (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Chemical (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.2. Market Revenue and Forecast, by Product (2021-2033)

12.2.3. Market Revenue and Forecast, by Chemical (2021-2033)

12.2.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Product (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Chemical (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Product (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Chemical (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Product (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Chemical (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Product (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Chemical (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Application (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.2. Market Revenue and Forecast, by Product (2021-2033)

12.3.3. Market Revenue and Forecast, by Chemical (2021-2033)

12.3.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Product (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Chemical (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Product (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Chemical (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Product (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Chemical (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Product (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Chemical (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Application (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.2. Market Revenue and Forecast, by Product (2021-2033)

12.4.3. Market Revenue and Forecast, by Chemical (2021-2033)

12.4.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Product (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Chemical (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Product (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Chemical (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Product (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Chemical (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Product (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Chemical (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Application (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.2. Market Revenue and Forecast, by Product (2021-2033)

12.5.3. Market Revenue and Forecast, by Chemical (2021-2033)

12.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Product (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Chemical (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Product (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Chemical (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Application (2021-2033)

Chapter 13. Company Profiles

13.1. Denisco

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Albemarle Corporation

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Kenko Corporation

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. GRACE

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. CHEMADA

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. JMP Statistical Discovery LLC.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Pfizer Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. GSK plc

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others