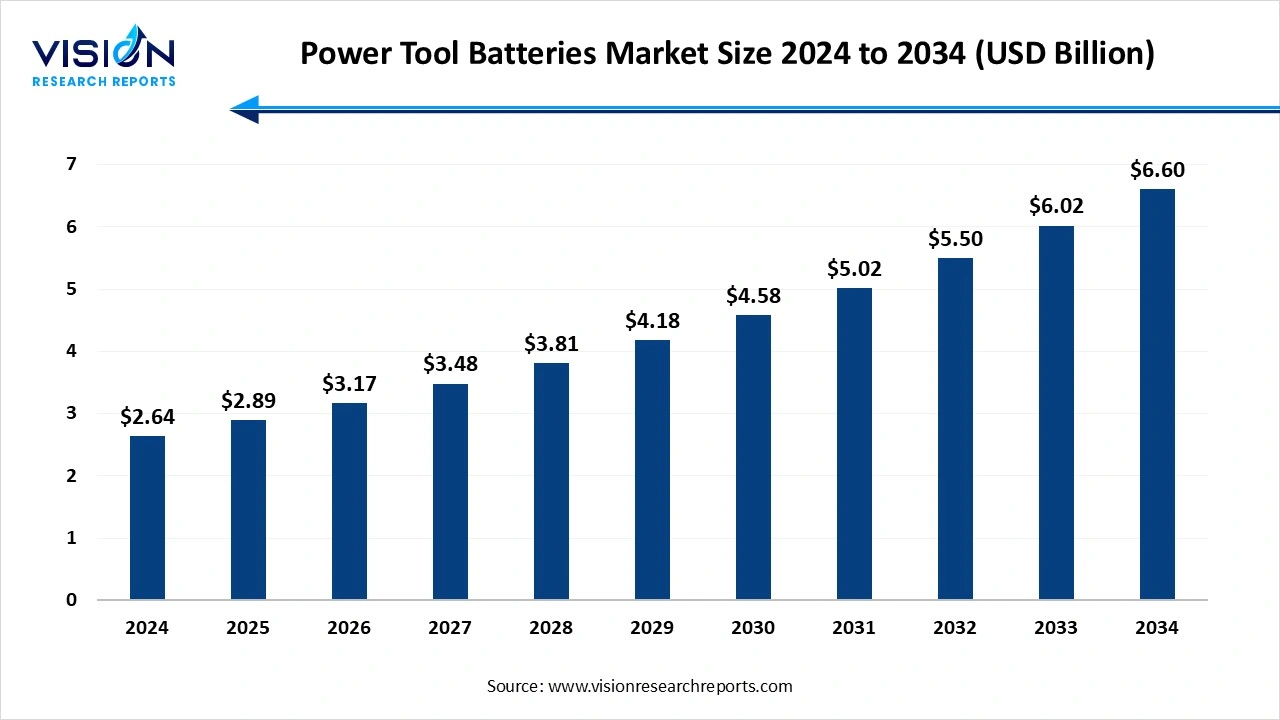

The global power tool batteries market size was estimated at around USD 2.64 billion in 2024 and it is projected to hit around USD 6.60

billion by 2034, growing at a CAGR of 9.60% from 2025 to 2034.

The global power tool batteries market is experiencing significant growth, driven by increasing demand for cordless power tools across residential, commercial, and industrial sectors. Advances in battery technology, particularly the widespread adoption of lithium-ion batteries, have enhanced the performance, energy density, and lifespan of power tool batteries, making them more efficient and reliable. Additionally, the growing preference for portable and eco-friendly tools, coupled with rising DIY activities and construction projects worldwide, is further propelling market expansion. Key players are investing in research and development to introduce innovative battery solutions that offer faster charging times and longer run durations.

The growth of the power tool batteries market is primarily fueled by the rising demand for cordless power tools in various sectors, including construction, manufacturing, and home improvement. Consumers and professionals alike prefer cordless tools due to their portability, convenience, and ease of use, eliminating the restrictions posed by power cords. Additionally, the increasing popularity of DIY (do-it-yourself) projects, coupled with urbanization and infrastructural development, has led to higher consumption of power tools and, consequently, their batteries. The surge in construction activities, especially in emerging economies, further boosts the demand for efficient and long-lasting battery solutions that can withstand rigorous use on job sites.

Technological advancements are another critical factor propelling market growth. Lithium-ion batteries, known for their superior energy density, lightweight nature, and longer lifecycle compared to traditional nickel-cadmium and nickel-metal hydride batteries, are becoming the preferred choice for power tool manufacturers. Innovations such as fast-charging capabilities, improved thermal management, and enhanced safety features contribute to better battery performance and user experience. Furthermore, growing environmental awareness and stringent regulations encouraging the use of rechargeable batteries over disposable ones are driving adoption.

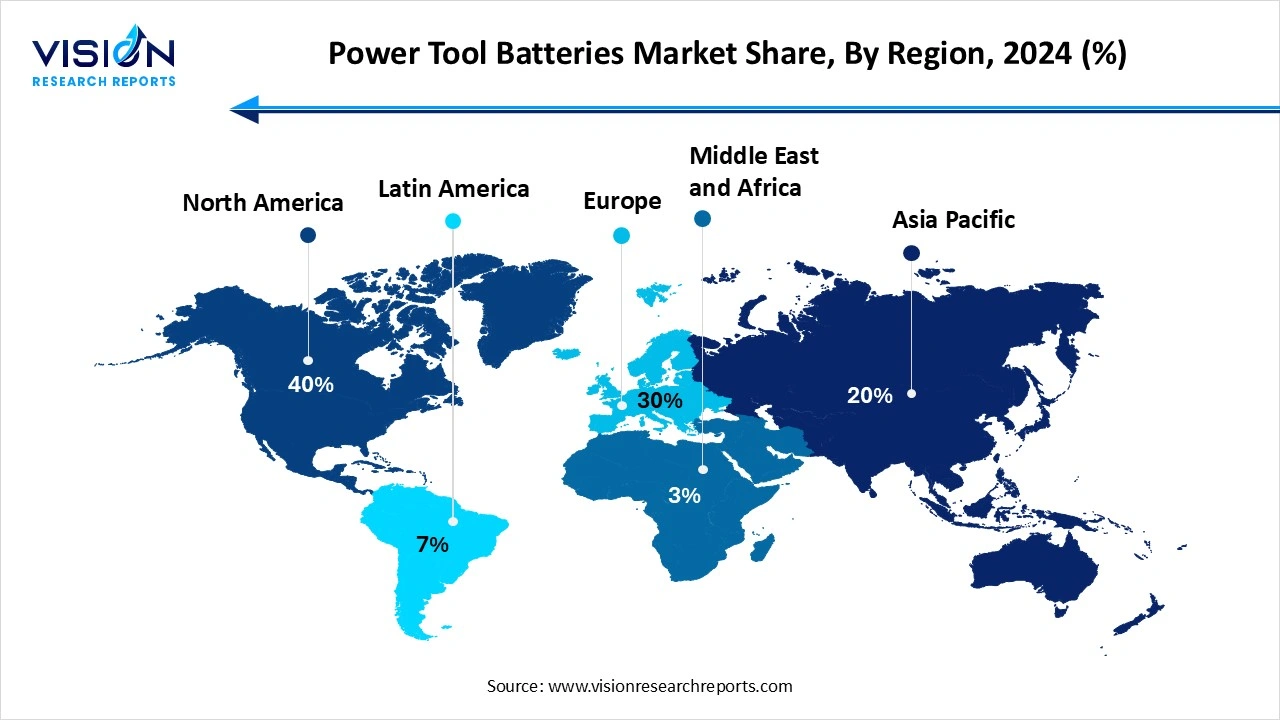

North America dominated the global market with highest share of 40% in 2024. The widespread adoption of cordless tools across both professional and consumer segments is fueled by a strong emphasis on productivity, worker safety, and energy efficiency. Innovation in lithium-ion battery technology remains a key growth driver, with U.S.-based manufacturers making significant investments in next-generation chemistries, rapid charging capabilities, and smart battery systems. Additionally, rising DIY culture and government incentives promoting energy-efficient tools continue to boost battery sales throughout the region. While the U.S. leads the market, Canada is also experiencing increased demand, spurred by a surge in residential renovations and ongoing infrastructure development.

The Asia-Pacific region is witnessing the fastest growth in the power tool batteries market, fueled by rapid urbanization, industrial growth, and rising disposable incomes in countries like China, India, Japan, and South Korea. The expanding construction industry and increasing use of cordless tools in both commercial and residential sectors are key factors driving demand. Additionally, favorable government initiatives promoting smart manufacturing and energy-efficient technologies are accelerating market development in this region.

The Asia-Pacific region is witnessing the fastest growth in the power tool batteries market, fueled by rapid urbanization, industrial growth, and rising disposable incomes in countries like China, India, Japan, and South Korea. The expanding construction industry and increasing use of cordless tools in both commercial and residential sectors are key factors driving demand. Additionally, favorable government initiatives promoting smart manufacturing and energy-efficient technologies are accelerating market development in this region.

The Lithium-ion segment led the power tool batteries market in 2024, capturing the highest share of industry revenue. Lithium-ion batteries have emerged as the preferred choice in recent years due to their superior energy density, lighter weight, and longer lifespan compared to traditional nickel-cadmium batteries. These characteristics make lithium-ion batteries highly suitable for modern cordless power tools, where portability and performance are critical. The ability of lithium-ion batteries to hold a charge longer and recharge faster has significantly enhanced user convenience, making them increasingly popular among both professional tradespeople and DIY enthusiasts.

Nickel-cadmium batteries, once widely used in power tools, are gradually being phased out due to environmental concerns and their lower efficiency. Although nickel-cadmium batteries offer benefits such as robustness and the ability to perform well under extreme temperatures, their heavier weight and memory effect which reduces battery capacity over time have limited their appeal in the evolving market. Moreover, stringent environmental regulations and growing awareness about the toxic nature of cadmium have accelerated the shift towards more eco-friendly alternatives like lithium-ion batteries. Despite this, nickel-cadmium batteries still find niche applications where cost-effectiveness and durability under harsh conditions are prioritized.

The industrial segment dominated the power tool batteries market in 2024, accounting for the largest share of revenue. The industrial sector represents one of the largest consumers of power tool batteries due to the extensive use of cordless tools in manufacturing, construction, and heavy machinery maintenance. Industrial applications demand batteries that offer high durability, long runtime, and the ability to withstand harsh environments. This has encouraged manufacturers to develop robust battery solutions capable of supporting intensive, continuous use while maintaining safety and efficiency standards.

In the commercial sector, power tool batteries are widely used by contractors, electricians, plumbers, and other service professionals who rely on cordless tools for mobility and convenience across various job sites. The commercial application emphasizes battery technologies that deliver fast charging, lightweight design, and consistent power output to ensure productivity and reduce downtime. This segment benefits significantly from advancements in battery management systems and innovations that enhance battery life and reliability during frequent use. The residential segment is characterized by growing consumer interest in DIY projects, home repairs, and gardening, which has fueled demand for user-friendly, affordable power tool batteries. Homeowners typically seek batteries that are easy to handle, safe, and provide sufficient power for occasional use. As a result, manufacturers are focusing on compact, lightweight batteries with adequate charge cycles and simplified charging solutions to cater to the residential market.

By Type

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Power Tool Batteries Market

5.1. COVID-19 Landscape: Power Tool Batteries Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Power Tool Batteries Market, By Type

8.1. Power Tool Batteries Market, by Type

8.1.1. Lithium-ion

8.1.1.1. Market Revenue and Forecast

8.1.2. Nickel-Cadmium

8.1.2.1. Market Revenue and Forecast

8.1.3. Nickel-Metal Hydride

8.1.3.1. Market Revenue and Forecast

8.1.4. Others

8.1.4.1. Market Revenue and Forecast

Chapter 9. Power Tool Batteries Market, By Application

9.1. Power Tool Batteries Market, by Application

9.1.1. Residential

9.1.1.1. Market Revenue and Forecast

9.1.2. Commercial

9.1.2.1. Market Revenue and Forecast

9.1.3. Industrial

9.1.3.1. Market Revenue and Forecast

Chapter 10. Power Tool Batteries Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Type

10.1.2. Market Revenue and Forecast, by Application

Chapter 11. Company Profiles

11.1. Samsung SDI Co., Ltd.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. LG Chem Ltd.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Bosch Power Tools

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Makita Corporation

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. DeWalt (a brand of Stanley Black & Decker)

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Hitachi Power Tools

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Black & Decker

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Milwaukee Electric Tool Corporation

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Energizer Holdings, Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others