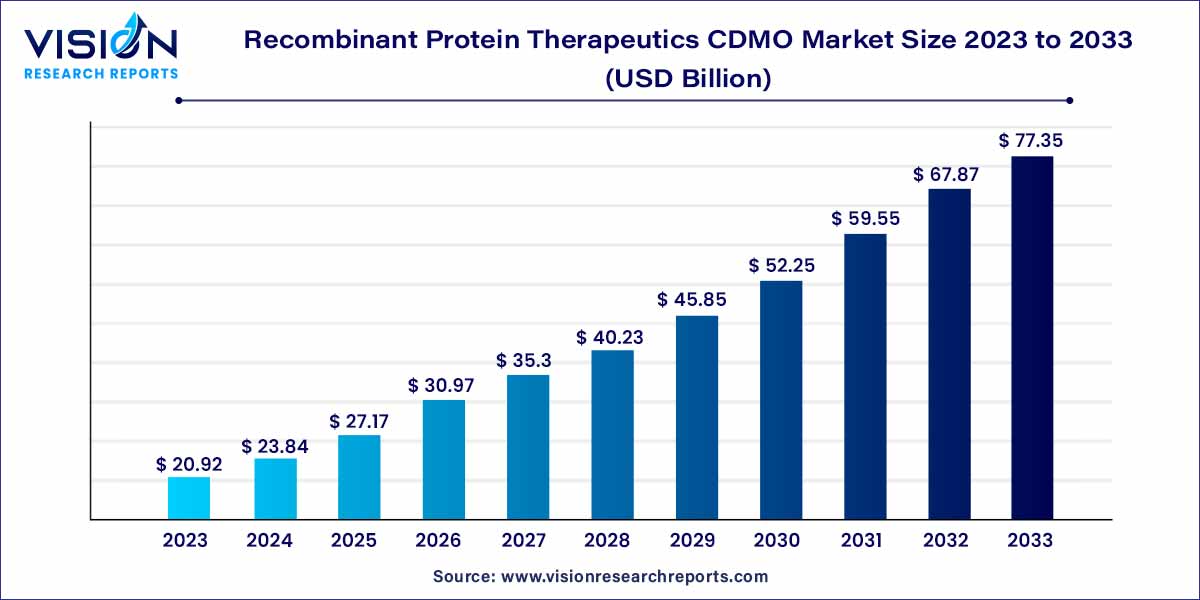

The global recombinant protein therapeutics CDMO market size was estimated at around USD 20.92 billion in 2023 and it is projected to hit around USD 77.35 billion by 2033, growing at a CAGR of 13.97% from 2024 to 2033. The recombinant protein therapeutics CDMO market is driven by an increasing demand for advanced biopharmaceuticals, advancements in genetic engineering, outsourcing trends in biopharmaceutical manufacturing, and rise of personalized medicine.

The recombinant protein therapeutics contract development and manufacturing organization (CDMO) market is witnessing significant growth as the demand for advanced biopharmaceuticals continues to rise. This sector plays a crucial role in providing comprehensive services for the development, production, and commercialization of recombinant protein-based therapeutics. This overview delves into the key aspects shaping the Recombinant Protein Therapeutics CDMO market, including market trends, key players, and growth prospects.

The growth of the recombinant protein therapeutics contract development and manufacturing organization (CDMO) market is propelled by several key factors. Firstly, the increasing demand for advanced biopharmaceuticals, driven by a growing understanding of molecular pathways and the rise of personalized medicine, fuels the need for specialized CDMOs. These organizations offer expertise in the development and production of recombinant protein therapeutics, meeting the evolving requirements of the biopharmaceutical industry. Additionally, the surge in research and development investments in biopharmaceuticals, coupled with regulatory support for biologics, contributes to the expansion of the CDMO market. Furthermore, the trend of outsourcing manufacturing processes to CDMOs by biopharmaceutical companies enhances operational efficiency and accelerates the time-to-market for novel therapeutics. Collaborations and partnerships between CDMOs and biopharmaceutical firms are also significant growth facilitators, fostering innovation and addressing the increasing complexity of biologics. Overall, these factors collectively drive the robust growth of the Recombinant Protein Therapeutics CDMO market.

In terms of type segmentation, the market is categorized into growth hormones, interferons, vaccines, immunostimulating agents, and other therapeutic proteins. Leading the market, the interferons segment claimed a significant share, contributing to 22% of the global revenue in 2023. Interferons, including α, β, and γ types, play a crucial role in curbing infection spread, making them pivotal in medical applications. The escalating prevalence of diseases has spurred pharmaceutical companies' interest in developing new protein therapeutics, with interferons finding diverse applications in treating various human cancers and viral diseases, thus positively impacting the market.

Moreover, the growth hormones segment is poised for rapid growth during the forecast period. This surge is fueled by the rising demand for proteins that regulate cellular processes and the increasing need for treating patients with growth hormone deficiency. Recombinant growth hormones, being identical to the main form of human growth hormones, effectively stimulate tissue growth, linear growth (height), and metabolic processes (protein, carbohydrate, lipid, & mineral). Additionally, growth hormones exhibit immunomodulatory actions, contributing to the overall market drive.

Within the source segment, the market is categorized into mammalian systems, microbial systems, and other sources. Leading the market, the mammalian systems segment held a dominant position in 2023, contributing to a substantial revenue share of 68%. Mammalian cells are extensively utilized for producing complex human glycoproteins, offering advantages such as accurate protein folding and post-translational modifications. Approximately 60% of therapeutic proteins, particularly antibodies, are manufactured using mammalian cells. As a result, many Contract Development and Manufacturing Organizations (CDMOs) provide services related to mammalian upstream process development, utilizing cell lines like CHO, baby hamster kidney, human embryo kidney, VERO, and human retinal cells. The approval of 37 biological and therapeutic drugs by the Center for Drug Evaluation and Research (CDER) in 2022 underscores the efficiency of genetically engineered mammalian biological drugs, driving the growth of the mammalian systems segment.

Concurrently, the microbial systems segment is anticipated to experience a Compound Annual Growth Rate (CAGR) of 13.91% over the forecast period. Currently, microbial cell lines play a crucial role in the production of recombinant protein therapeutics. The development of microbial cell systems involves consideration of factors such as host cell lines, expression vectors, and process parameters. Host cells are engineered to produce specific proteins, and microbial systems are valued for their cost-effectiveness and consistent results across batches. Consequently, research and development companies widely adopt microbial systems for the efficient production of therapeutic products.

In the indication segment, the market is categorized into oncology, infectious diseases, immunological disorders, metabolic disorders, hematological disorders, and others. Notably, the metabolic disorders segment secured a substantial 22% share in 2023, driven by the global increase in metabolic disorders. Factors contributing to this growth include a rising aging population, higher disease prevalence, and ongoing research in recombinant protein therapeutics. Unfavorable lifestyle changes and rapid urbanization have further elevated the incidence of metabolic disorders. Consequently, the escalating prevalence is expected to fuel research endeavors focused on utilizing recombinant protein therapeutics for the effective treatment of metabolic disorders.

Additionally, the oncology segment is poised for robust growth, with an anticipated Compound Annual Growth Rate (CAGR) of 14.83% over the forecast period. Recent trends highlight significant advancements in the application of recombinant protein therapeutics in cancer treatment. These therapeutics are increasingly used in combination treatments for various types of cancer. The diverse range of product offerings in recombinant protein therapeutics across manufacturers has spurred core competencies, accelerating the development of new products.

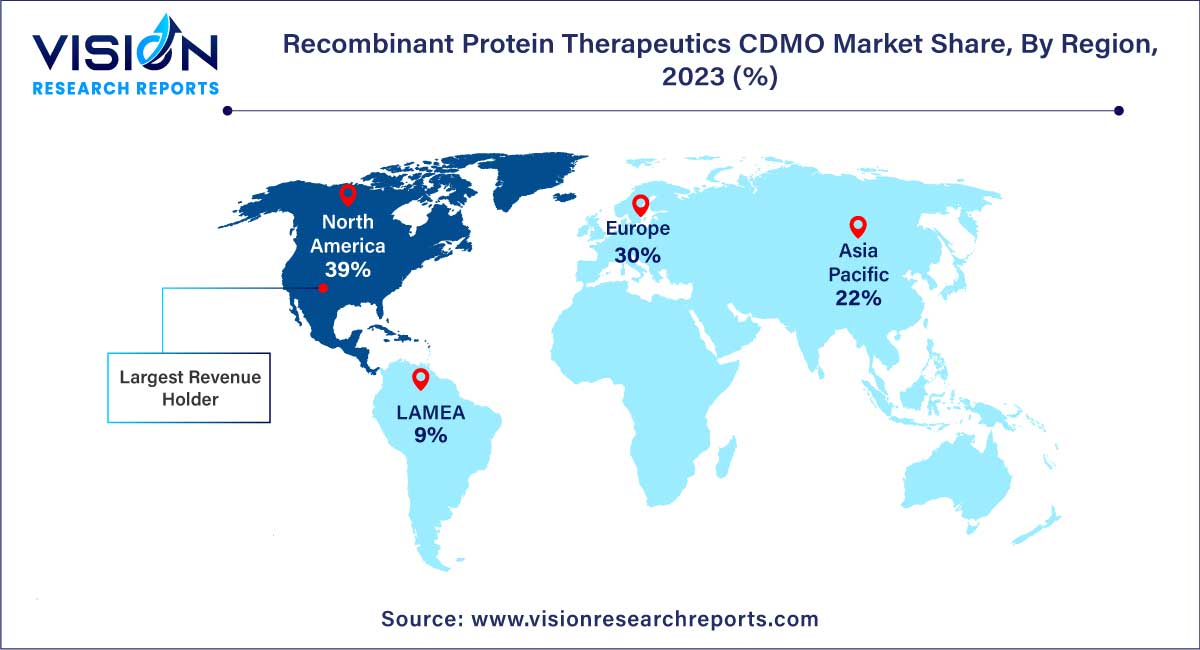

In 2023, North America emerged as the dominant force in the market for recombinant protein therapeutics Contract Development and Manufacturing Organization (CDMO), securing the largest revenue share at 39%. The substantial presence of the U.S. as a global leader in recombinant protein drug production significantly contributes to this regional dominance. The U.S. boasts a robust research and development infrastructure, establishing itself as a key player in the biopharmaceutical industry.

Concurrently, the Asia Pacific region's recombinant protein therapeutics CDMO market is projected to witness a notable Compound Annual Growth Rate (CAGR) of 14.42% over the forecast period. This growth is attributed to regulatory organizations in the region adopting amendments to align clinical trial evaluation standards with global requirements. Moreover, significant investments by major industry players in the Asia Pacific region contribute to the market's expansion.

By Type

By Source

By Indication

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Recombinant Protein Therapeutics CDMO Market

5.1. COVID-19 Landscape: Recombinant Protein Therapeutics CDMO Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Recombinant Protein Therapeutics CDMO Market, By Type

8.1. Recombinant Protein Therapeutics CDMO Market, by Type, 2024-2033

8.1.1 Growth Hormones

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Interferons

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Vaccines

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Immunostimulating Agents

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Recombinant Protein Therapeutics CDMO Market, By Source

9.1. Recombinant Protein Therapeutics CDMO Market, by Source, 2024-2033

9.1.1. Mammalian Systems

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Microbial Systems

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Recombinant Protein Therapeutics CDMO Market, By Indication

10.1. Recombinant Protein Therapeutics CDMO Market, by Indication, 2024-2033

10.1.1. Oncology

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Infectious Diseases

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Immunological Disorders

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Metabolic Disorders

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Haematological Disorders

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Recombinant Protein Therapeutics CDMO Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Source (2021-2033)

11.1.3. Market Revenue and Forecast, by Indication (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Source (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Indication (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Source (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Indication (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Source (2021-2033)

11.2.3. Market Revenue and Forecast, by Indication (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Source (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Indication (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Source (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Indication (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Source (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Indication (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Source (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Indication (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Source (2021-2033)

11.3.3. Market Revenue and Forecast, by Indication (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Source (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Indication (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Source (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Indication (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Source (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Indication (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Source (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Indication (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Source (2021-2033)

11.4.3. Market Revenue and Forecast, by Indication (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Source (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Indication (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Source (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Indication (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Source (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Indication (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Source (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Indication (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Source (2021-2033)

11.5.3. Market Revenue and Forecast, by Indication (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Source (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Indication (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Source (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Indication (2021-2033)

Chapter 12. Company Profiles

12.1. Richter-Helm BioLogics.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Lonza.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Catalent, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. FUJIFILM Diosynth Biotechnologies.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. WuXi Biologics.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Curia Global, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Batavia Biosciences B.V.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. HALIX B.V.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. BIOVIAN.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Enzene Biosciences Ltd

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others