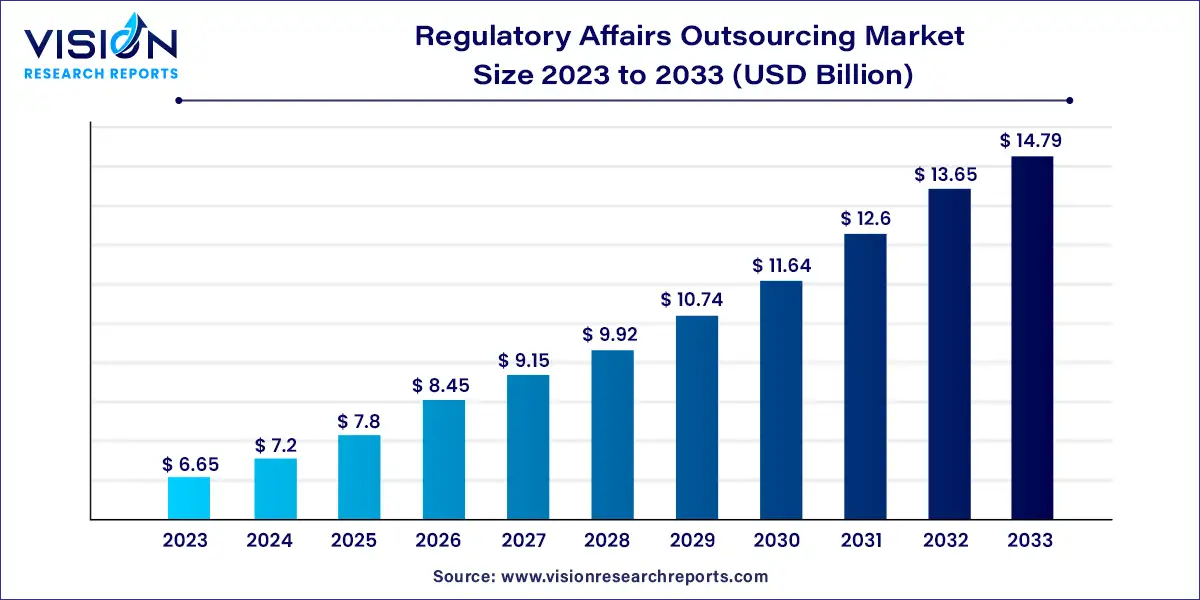

The global regulatory affairs outsourcing market size was valued at USD 6.65 billion in 2023 and is anticipated to reach around USD 14.79 billion by 2033, growing at a CAGR of 8.32% from 2024 to 2033.

The regulatory affairs outsourcing market is witnessing significant growth and evolution in response to the dynamic regulatory landscape governing industries such as pharmaceuticals, medical devices, biotechnology, and food and beverages. Regulatory affairs outsourcing involves delegating regulatory tasks and responsibilities to third-party service providers, offering expertise in navigating complex regulatory requirements and ensuring compliance with stringent regulations.

The growth of the regulatory affairs outsourcing market is driven by the ever-evolving and increasingly complex regulatory landscape across industries such as pharmaceuticals, biotechnology, and medical devices necessitates specialized expertise to navigate. Outsourcing regulatory affairs allows companies to tap into a pool of experienced professionals who possess in-depth knowledge of regulatory requirements, ensuring compliance while mitigating risks. Secondly, globalization has expanded market opportunities but also introduced the challenge of complying with diverse regulatory frameworks. Outsourcing regulatory functions enables companies to access regional expertise and regulatory intelligence, facilitating market entry and expansion strategies. Additionally, cost efficiency plays a significant role as companies seek to optimize resources and streamline operations.

Based on service offerings, the market is segmented into regulatory consulting, legal representation, regulatory writing and publishing, product registration and clinical trial applications, regulatory submissions, regulatory operations, and others. Among these, the product registration and clinical trial applications segment emerged as the market leader, contributing to over 27% of the total global revenue. This dominance can be attributed to the rising number of clinical trials worldwide, stringent regulations in developed markets, and regulatory reforms in emerging markets like Asia Pacific, fostering the outsourcing trend for clinical trial applications.

Forecasts suggest that the legal representation services segment will experience the highest growth rate, anticipated at 9.03% during the forecast period. This surge is driven by the escalating demand for legal representatives globally, propelled by the globalization of medical devices and pharmaceutical companies. Given the intricate and ever-evolving regulatory landscape, the need for legal representation is paramount.

Based on company sizes, the market is segmented into small, medium, and large enterprises. In 2023, the medium-sized companies segment held the largest revenue share at 47%, and it is anticipated to maintain its leading position throughout the forecast period. This dominance is attributed to the presence of numerous established mid-sized providers, particularly those privately held, expected to bolster this segment's share. Additionally, medium-sized pharmaceutical and medical device firms often lack the resources to establish an in-house regulatory affairs team, thus driving the demand for outsourcing in this sector.

The large enterprises segment is forecasted to exhibit significant growth at a rate of 7.72% during the forecast period. Large companies typically prioritize long-term partnerships with service providers to ensure operational stability and minimize disruptions. They seek providers capable of fulfilling their diverse regulatory requirements and supporting their extensive operations seamlessly. Furthermore, as per a study by GEP (2020), major pharmaceutical companies typically outsource approximately 50% of their regulatory affairs functions, further contributing to the growth of this segment.

The category segment is divided into drugs, biologics, and medical devices. In 2023, the drugs segment dominated the market, capturing the largest share at 40%. This segment currently leads the regulatory affairs outsourcing market, driven by the escalating demand for regulatory support services within the pharmaceutical industry. With a rising influx of new drug applications and increasingly intricate regulatory requirements, pharmaceutical companies are turning to specialized service providers to outsource their regulatory affairs functions. Outsourcing offers these companies access to regulatory professionals' expertise while reducing the costs associated with maintaining an in-house regulatory affairs team.

Conversely, the medical device segment is anticipated to witness a substantial compound annual growth rate (CAGR) of 7.93% over the forecast period. This growth can be attributed to medical device companies prioritizing their core competencies and outsourcing non-core functions to enhance productivity and operational efficiency.

In 2023, the oncology segment emerged as the dominant force in the market, capturing a significant share of over 34%. Recent advancements in cancer biology, coupled with the emergence of new genome analysis tools, have revolutionized the clinical landscape of oncology, paving the way for personalized medicine. This scientific progress has spurred the development of personalized medicine products and services, subject to regulatory scrutiny, thereby fueling market expansion. Other medical indications covered in the study include neurology, cardiology, immunology, and others.

The immunology segment is poised to exhibit the fastest compound annual growth rate (CAGR) of 9.83% over the forecast period. This growth trajectory is attributed to its potential in enhancing the treatment of various cardiovascular, neurological, oncological, and inflammatory conditions. Strategic initiatives undertaken by market players in the field of immunology are expected to further bolster segment growth.

In 2023, the clinical studies segment emerged as the market leader, commanding the largest revenue share of 46.8%. This dominance is attributed to the increasing number of registered clinical trials observed in recent years. According to data from ClinicalTrials.gov, there were approximately 33,613 new trials registered in 2023, compared to around 32,540 in 2020. Additionally, the growing prevalence of biologics, heightened demand for advanced technologies, and the necessity for personalized orphan drugs and medicines are anticipated to further propel the growth of this segment during the forecast period.

Conversely, the preclinical segment is forecasted to experience the highest compound annual growth rate (CAGR) of 9.04% from 2024 to 2033. This growth trajectory is fueled by increasing demand for novel treatments for diseases such as COVID-19, Zika virus, and Ebola, as well as the rising prevalence of existing conditions including cardiovascular diseases, cancer, and neurological disorders. Furthermore, stringent regulations governing preclinical studies set forth by global regulatory bodies such as the International Conference on Harmonization (ICH), World Health Organization (WHO), Food and Drug Administration (FDA), European Medicines Agency (EMEA), Pharmaceuticals and Medical Devices Agency (PMDA) of Japan, Agência Nacional de Vigilância Sanitária (ANVISA) of Brazil, Medicines and Healthcare products Regulatory Agency (MHRA) of the UK, and Regulatory Operations and Enforcement Branch (ROEB) of Canada, are driving the demand for regulatory affairs outsourcing agencies specializing in preclinical studies.

In 2023, the pharmaceutical companies segment emerged as the market leader, commanding a significant share of over 41%. This growth is primarily driven by advancements in areas such as biosimilars, orphan drugs, and personalized medicines, which have generated increased demand for regulatory services, thereby bolstering segmental growth. Additionally, the influx of new drugs entering the pharmaceutical industry has further fueled the expansion of this segment.

Both the medical device and biotechnology companies segments also secured substantial shares in the market in 2023. This can be attributed to the rising demand for biopharmaceuticals, vaccines, advanced medical devices, and other related products. The increasing adoption of wearable technologies, coupled with recent epidemic events, has further contributed to the significant shares of these segments. Moreover, the growing number of product launches in the medical device sector is another key factor driving the demand for regulatory affairs services, thus facilitating the growth of these segments.

In 2023, the Asia Pacific region emerged as the dominant force in the regulatory affairs outsourcing market, capturing the largest revenue share of over 40%. Moreover, it is projected to witness the fastest compound annual growth rate (CAGR) over the forecast period. This surge can be attributed to the increasing number of clinical trials and the growing interest of companies in penetrating developing markets like India and China. Additionally, the availability of a skilled workforce in the region at lower costs compared to the U.S. further fuels market growth.

The North America regional market also holds a significant share in the global industry. Factors such as the presence of major pharmaceutical and medical device companies and the escalating R&D spending in the region contribute to the market's growth in North America. Both North America and Europe are expected to remain key markets for regulatory affairs outsourcing, primarily due to the presence of two major international regulatory agencies: the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA), which collectively regulate more than half of the medical devices worldwide.

By Service

By Company Size

By Category

By Indication

By Product Stage

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others