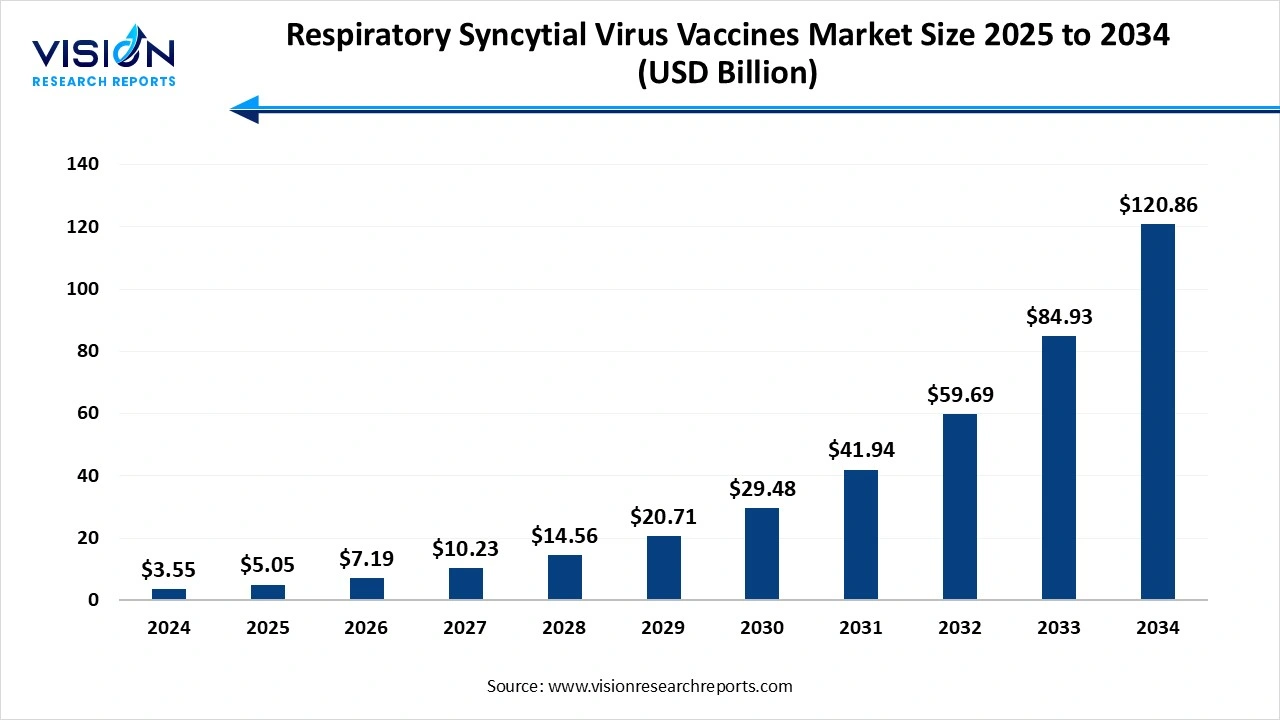

The global respiratory syncytial virus vaccines market size was worth at USD 3.55 billion in 2024 and is estimated to reach USD 5.05 billion in 2025 to around USD 120.86 billion by 2034, growing at a CAGR of 42.3% from 2025 to 2034. The high disease burden and public awareness, advancement in vaccine technology, and expanding vaccination program and regulatory supports, expansion of the market growth.

The biological preparations are designed to stimulate the body's immunity system to produce protection against respiratory syncytial virus infection. The market growth is driven by the increasing prevalence of RSV infections and, expanding targeted population in the world. The ongoing trials for material immunization, pediatric vaccines, and the immunocompromised population create opportunities to broaden the addressable market. The increasing awareness and preventive healthcare focus.

The increasing burden of RSV is fueling demand for an effective vaccine, with limited treatment options and a high risk of complications, such as bronchiolitis and pneumonia. Preventive vaccination is becoming increasingly critical. The growing prevalence has attracted strong R&D focus from pharmaceutical companies, leading to the development of several RSV vaccines targeting various populations. A growing number of cases increases the need for preventive measures to alleviate this burden.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.55 billion |

| Revenue Forecast by 2034 | USD 120.86 billion |

| Growth rate from 2025 to 2034 | CAGR of 42.3% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | GSK plc, Pfizer Inc., AstraZeneca plc, Moderna, Inc., Sanofi S.A., Bavarian Nordic A/S, Novavax, Inc., Johnson & Johnson (Janssen Pharmaceuticals), Merck & Co., Inc., Meissa Vaccines, Inc. |

Adoption of Novel Vaccine Platforms: The development of recent RSV vaccines, building on lessons from the COVID-19 pandemic, to accelerate research and approvals. The RSV vaccine market now features innovative technologies like messenger RNA (mRNA), recombinant protein subunits, and monoclonal antibodies (mAbs), which offer improved safety and effectiveness for different high-risk populations.

Expansion into Paediatric and Maternal Immunization for the Respiratory Syncytial Virus Vaccines Market

The experience has robust expansion into paediatric and maternal immunization, driven by recent regulatory approvals and the significant disease burden in these populations. This growth is supported by key events such as FDA approvals and updated guidance from public health agencies.

Protection Gaps in Older Infants of the Respiratory Syncytial Virus Vaccines Market

The maternal vaccines and monoclonal antibodies protect infants in their first few months; efficacy wanes after six months. This leaves older infants, who still face a significant risk of severe RSV, without a prevention strategy.

The Asia Pacific region held the largest share of the Respiratory Syncytial Virus (RSV) vaccines market, accounting for 31% of the total revenue in 2024. The growing awareness about the severity of RSV infections. Expansion of healthcare facilities and infrastructure is helping with vaccine distribution and accessibility. High rates of respiratory diseases and large birth cohorts in countries such as China and India boost demand for RSV vaccines and therapeutics.

China Respiratory Syncytial Virus Vaccines Market Trends

China has the world's largest pediatric population, a key target group for RSV vaccines, especially monoclonal antibodies for infants. The high dosage burdens government initiatives, and expenditure approval for RSV vaccines and treatments, such as nirsevimab, helps accelerate market access. Increasing healthcare investments and the expansion of hospital infrastructure expand market growth.

Why is North America dominant in the Respiratory Syncytial Virus Vaccines Market?

North America is dominant in the Respiratory Syncytial Virus Vaccines market during the forecast period. The region's advanced healthcare infrastructure system facilitates the development, approval, and distribution of new vaccines. The major key players in the pharmaceutical and biotechnology industries heavily invest in research and development for RSV vaccines, the prevalence of RSV-related hospitalizations, and severe infections in more at-risk groups, fuel the market growth.

Why did the Passive Immunization Segment Dominate the Respiratory Syncytial Virus Vaccines Market?

The passive immunization segment dominated the market, capturing the highest revenue share of 76% in 2024. The infectious initial vaccine development, the success of passive immunization are closely tied to the development of monoclonal antibody (mAb) therapies. Immunity for infants with an immature system, the expansion of long-acting monoclonal antibodies, such as nirsevimab, and passive immunization are gaining significant traction as a targeted approach for vulnerable pediatric populations.

The preventive vaccines segment is anticipated to witness the highest growth, registering a remarkable CAGR of 49.53% during the forecast period. The increasingly high burden risk, growing public and healthcare provider awareness of the serious health consequences of RSV, is driving the demand. The government initiatives and funding contribute to vaccine development and distribution, particularly for high-risk populations, and expand market growth.

How the Monoclonal Antibodies (mAbs)Segment hold the Largest Share in the Respiratory Syncytial Virus Vaccines Market?

The monoclonal antibodies (mAbs) segment held the largest share of market revenue in 2024. A significant breakthrough in this area is the expansion of long-acting monoclonal antibodies, such as nirsevimab (Beyfortus). With a single dose, nirsevimab can deliver infants with protection that lasts an entire RSV season, greatly simplifying the prevention strategy compared to earlier monthly treatments like palivizumab. Nirsevimab is now recommended for all infants under eight months entering their first RSV season, and for certain high-risk children up to 19 months old entering their second season.

The recombinant protein combined with adjuvant segment is experiencing the fastest growth in the market during the forecast period. The recombinant protein vaccines use only specific viral proteins, like the fusion (F) protein, to trigger an immune response, minimizing exposure to other viral components and potentially reducing the risk of adverse reactions compared to live or inactivated virus vaccines. Their strong immunogenicity, targeted approach, and addressing unmet needs fuel the market growth.

How the Infants and Children Segment hold the Largest Share in the Respiratory Syncytial Virus Vaccines Market?

The Infants and children dominated the market in 2024, accounting for the highest revenue share of 76% in 2024. The development and approval of new vaccines for respiratory syncytial virus (RSV) have created a robust and growing market for older adults. Previously overlooked, the impact of RSV on seniors, particularly those with underlying conditions, such as COPD, asthma, and heart disease, is now a major public health priority. With the launch of effective recombinant protein-based vaccines and increased immunization initiatives, this segment is experiencing significant expansion.

The adult segment is experiencing the fastest growth in the market during the forecast period. The adult and immunocompromised individuals high risk of severe RSV infections, and pharmaceutical companies are investing and launching RSV vaccines and antibodies specifically for adults. The increasing awareness among healthcare providers about the serious health benefits of vaccination drives the market growth.

The hospital and retail pharmacies segment captured the largest share of market revenue at 54% in 2024. The hospital pharmacies are often the initial point of distribution for infants and pregnant individuals. They offer streamlined administration within a clinical setting, typically during routine appointments such as prenatal visits, pediatric check-ups, or elderly care. This integration into clinical care makes it easier to track and ensure that the most vulnerable patients are immunized.

The government suppliers segment is experiencing the fastest growth in the market during the forecast period. The governments worldwide provide financial support and regulatory incentives, which accelerate vaccine expansion and ensure their extensive availability to the public. The government is actively procuring RSV vaccination to be integrated into these programs, accelerating regulatory approvals, such as FDA designations and review for RSV vaccines.

R&D: The respiratory syncytial virus vaccines market focuses on targeting the pre-fusion F protein, the first-ever approach to RSV vaccines, long-acting monoclonal antibodies, and live-attenuated vaccines.

Patient Support and Services: The respiratory syncytial virus vaccines market contains awareness campaigns, educational resources for patients and healthcare providers, vaccine access programs, and post-vaccination surveillance to monitor safety and effectiveness

Distribution to Hospitals, Pharmacies: The vaccine procedure, targeted administration, material vaccination, federal program, and convenience and uptake.

By Type

By Technology

By Targeted Population

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Respiratory Syncytial Virus Vaccines Market

5.1. COVID-19 Landscape: Respiratory Syncytial Virus Vaccines Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Respiratory Syncytial Virus Vaccines Market, By Type

8.1. Respiratory Syncytial Virus Vaccines Market, by Type

8.1.1. Passive Immunization

8.1.1.1. Market Revenue and Forecast

8.1.2. Preventive Vaccines

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global Respiratory Syncytial Virus Vaccines Market, By Technology

9.1. Respiratory Syncytial Virus Vaccines Market, by Technology

9.1.1. Virus-Like Particle (VLP)

9.1.1.1. Market Revenue and Forecast

9.1.2. Monoclonal Antibodies

9.1.2.1. Market Revenue and Forecast

9.1.3. Recombinant Protein + Adjuvant

9.1.3.1. Market Revenue and Forecast

9.1.4. mRNA-Based Vaccine

9.1.4.1. Market Revenue and Forecast

Chapter 10. Global Respiratory Syncytial Virus Vaccines Market, By Targeted Population

10.1. Respiratory Syncytial Virus Vaccines Market, by Targeted Population

10.1.1. Adults

10.1.1.1. Market Revenue and Forecast

10.1.2. Infants and children

10.1.2.1. Market Revenue and Forecast

Chapter 11. Global Respiratory Syncytial Virus Vaccines Market, By Distribution Channel

11.1. Respiratory Syncytial Virus Vaccines Market, by Distribution Channel

11.1.1. Hospital & Retail Pharmacies

11.1.1.1. Market Revenue and Forecast

11.1.2. Government Suppliers

11.1.2.1. Market Revenue and Forecast

11.1.3. Others

11.1.3.1. Market Revenue and Forecast

Chapter 12. Global Respiratory Syncytial Virus Vaccines Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type

12.1.2. Market Revenue and Forecast, by Technology

12.1.3. Market Revenue and Forecast, by Targeted Population

12.1.4. Market Revenue and Forecast, by Distribution Channel

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type

12.1.5.2. Market Revenue and Forecast, by Technology

12.1.5.3. Market Revenue and Forecast, by Targeted Population

12.1.5.4. Market Revenue and Forecast, by Distribution Channel

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type

12.1.6.2. Market Revenue and Forecast, by Technology

12.1.6.3. Market Revenue and Forecast, by Targeted Population

12.1.6.4. Market Revenue and Forecast, by Distribution Channel

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type

12.2.2. Market Revenue and Forecast, by Technology

12.2.3. Market Revenue and Forecast, by Targeted Population

12.2.4. Market Revenue and Forecast, by Distribution Channel

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type

12.2.5.2. Market Revenue and Forecast, by Technology

12.2.5.3. Market Revenue and Forecast, by Targeted Population

12.2.5.4. Market Revenue and Forecast, by Distribution Channel

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type

12.2.6.2. Market Revenue and Forecast, by Technology

12.2.6.3. Market Revenue and Forecast, by Targeted Population

12.2.6.4. Market Revenue and Forecast, by Distribution Channel

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type

12.2.7.2. Market Revenue and Forecast, by Technology

12.2.7.3. Market Revenue and Forecast, by Targeted Population

12.2.7.4. Market Revenue and Forecast, by Distribution Channel

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type

12.2.8.2. Market Revenue and Forecast, by Technology

12.2.8.3. Market Revenue and Forecast, by Targeted Population

12.2.8.4. Market Revenue and Forecast, by Distribution Channel

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type

12.3.2. Market Revenue and Forecast, by Technology

12.3.3. Market Revenue and Forecast, by Targeted Population

12.3.4. Market Revenue and Forecast, by Distribution Channel

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type

12.3.5.2. Market Revenue and Forecast, by Technology

12.3.5.3. Market Revenue and Forecast, by Targeted Population

12.3.5.4. Market Revenue and Forecast, by Distribution Channel

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type

12.3.6.2. Market Revenue and Forecast, by Technology

12.3.6.3. Market Revenue and Forecast, by Targeted Population

12.3.6.4. Market Revenue and Forecast, by Distribution Channel

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type

12.3.7.2. Market Revenue and Forecast, by Technology

12.3.7.3. Market Revenue and Forecast, by Targeted Population

12.3.7.4. Market Revenue and Forecast, by Distribution Channel

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type

12.3.8.2. Market Revenue and Forecast, by Technology

12.3.8.3. Market Revenue and Forecast, by Targeted Population

12.3.8.4. Market Revenue and Forecast, by Distribution Channel

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type

12.4.2. Market Revenue and Forecast, by Technology

12.4.3. Market Revenue and Forecast, by Targeted Population

12.4.4. Market Revenue and Forecast, by Distribution Channel

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type

12.4.5.2. Market Revenue and Forecast, by Technology

12.4.5.3. Market Revenue and Forecast, by Targeted Population

12.4.5.4. Market Revenue and Forecast, by Distribution Channel

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type

12.4.6.2. Market Revenue and Forecast, by Technology

12.4.6.3. Market Revenue and Forecast, by Targeted Population

12.4.6.4. Market Revenue and Forecast, by Distribution Channel

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type

12.4.7.2. Market Revenue and Forecast, by Technology

12.4.7.3. Market Revenue and Forecast, by Targeted Population

12.4.7.4. Market Revenue and Forecast, by Distribution Channel

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type

12.4.8.2. Market Revenue and Forecast, by Technology

12.4.8.3. Market Revenue and Forecast, by Targeted Population

12.4.8.4. Market Revenue and Forecast, by Distribution Channel

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type

12.5.2. Market Revenue and Forecast, by Technology

12.5.3. Market Revenue and Forecast, by Targeted Population

12.5.4. Market Revenue and Forecast, by Distribution Channel

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type

12.5.5.2. Market Revenue and Forecast, by Technology

12.5.5.3. Market Revenue and Forecast, by Targeted Population

12.5.5.4. Market Revenue and Forecast, by Distribution Channel

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type

12.5.6.2. Market Revenue and Forecast, by Technology

12.5.6.3. Market Revenue and Forecast, by Targeted Population

12.5.6.4. Market Revenue and Forecast, by Distribution Channel

Chapter 13. Company Profiles

13.1. GSK plc

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Pfizer Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. AstraZeneca plc

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Moderna, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Sanofi S.A.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Bavarian Nordic A/S

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Novavax, Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Johnson & Johnson (Janssen Pharmaceuticals)

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Merck & Co., Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Meissa Vaccines, Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others