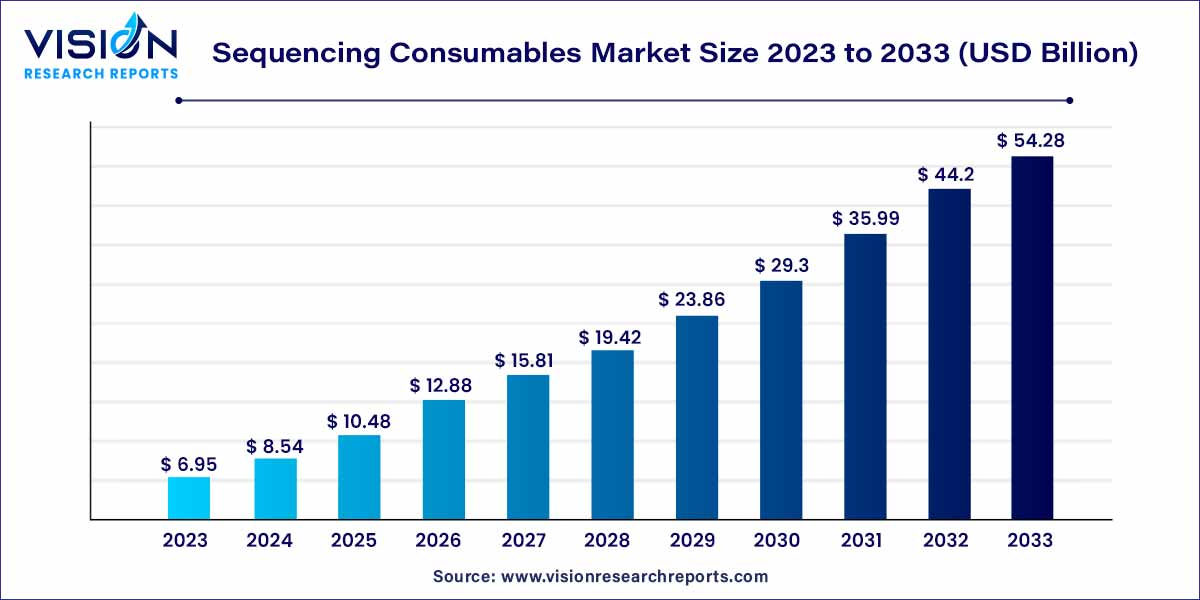

The global sequencing consumables market size was estimated at around USD 6.95 billion in 2023 and it is projected to hit around USD 54.28 billion by 2033, growing at a CAGR of 22.82% from 2024 to 2033. The sequencing consumables market stands as a critical component within the rapidly expanding realm of genomic research and molecular diagnostics. Characterized by an escalating demand for high-throughput sequencing techniques, this market has become instrumental in driving advancements in personalized medicine and pushing the boundaries of genetic exploration.

The growth trajectory of the sequencing consumables market is propelled by a confluence of key factors that collectively underscore its significance in the realm of genomics. First and foremost, the escalating demand for personalized medicine has emerged as a primary driver, urging a deeper exploration of individual genetic codes. Additionally, substantial investments in genomics research have infused the market with both financial backing and a spirit of innovation, fostering the development of advanced consumables. The continuous evolution of sequencing technologies, particularly next-generation sequencing (NGS) platforms, further fuels market expansion, demanding consumables that ensure precision, reproducibility, and compatibility. Collaborative efforts between industry leaders and research institutions amplify growth, fostering an environment where cutting-edge consumables meet the demands of evolving genetic research.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 22.82% |

| Market Revenue by 2033 | USD 54.28 billion |

| Revenue Share of North America in 2023 | 52% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

Kits dominated the market with a revenue share of 81% in 2023. The dominance of the segment is due to their convenience, efficiency, and comprehensive nature. By providing pre-optimized and quality-controlled components, kits reduce the risk of errors and variability, making them attractive to users seeking reliable and standardized results. Hence, the ease of use and reduced hands-on time associated with kits make them particularly well-suited for high-throughput sequencing. Key players are investing in the development of innovative kits to meet their heightened demand in the market. In December 2021, Singular Genomics Systems, Inc. launched its next-generation sequencing (NGS) G4 kit, which includes multiple cycle configurations in each consumable kit, providing greater flexibility for various applications.

The reagents segment is anticipated to grow at a CAGR of 20.25% from 2024 to 2033. Reagents play a fundamental role in DNA and RNA profiling, serving as crucial elements in sample preparation, amplification, and profiling procedures. With the continuous advancement and diversification of profiling technologies, there is an increasing demand for specialized reagents customized for specific applications, like library preparation and target enrichment. Sequencing consumable reagents produce various layers of genomic data vital for drug development, ranging from studying genomic alterations to profiling the transcriptome. This versatility is anticipated to drive substantial growth in this market segment.

The second-generation sequencing consumables segment contributed the largest market share of 67% in 2023. 2nd generation sequencing consumables are integral components in workflows that include technologies such as Illumina's sequencing platforms. These consumables are meticulously crafted to support the specific requirements of short-read sequencing methods, encompassing a spectrum of reagents and kits essential for sample preparation, library construction, and subsequent sequencing reactions. The popularity of 2nd generation platforms in genomics research has significantly propelled the demand for consumables that can seamlessly integrate with these high-throughput systems.

The third-generation sequencing consumables segment is anticipated to grow at the fastest CAGR of 43.93% from 2023 to 2032. 3rd generation sequencing consumables mark a paradigm shift. Catering to platforms like those developed by Pacific Biosciences (PacBio) and Oxford Nanopore Technologies, these consumables are tailored for long-read sequencing methodologies. The unique challenges posed by the extended read lengths and real-time sequencing capabilities of 3rd generation platforms necessitate consumables with a distinct set of characteristics. Reagents and kits designed for sample preparation, as well as specialized buffers and enzymes, play a critical role in maximizing the potential of long-read sequencing technologies.

The cancer diagnostics segment generated the maximum market share of 27% in 2023. Within the context of cancer diagnostics, sequencing consumables play an indispensable role in unraveling the intricate genomic landscape of tumors. Sample preparation kits and reagents, meticulously designed for accuracy and sensitivity, enable researchers and clinicians to delve into the genetic mutations, alterations, and signatures that characterize various cancers. The precision offered by sequencing consumables in cancer diagnostics not only aids in accurate disease classification but also informs treatment decisions by identifying potential therapeutic targets.

The pharmacogenomics segment is projected to exhibit a lucrative CAGR of 23.44% over the forecast period. In the domain of pharmacogenomics, sequencing consumables contribute significantly to the realization of tailored and efficient drug therapies. These consumables facilitate the exploration of an individual's genetic makeup, allowing for the identification of genetic variations that influence drug metabolism, efficacy, and potential adverse reactions. Pharmacogenomic insights, driven by the meticulous use of consumables, empower healthcare providers to prescribe medications with greater precision, minimizing adverse effects and optimizing therapeutic outcomes.

The hospitals and laboratories segment captured the maximum market share of 37% in 2023. In hospitals and laboratories, sequencing consumables serve as indispensable tools in the diagnosis and monitoring of various genetic disorders and diseases. Sample preparation kits and reagents form the backbone of genomic workflows, enabling healthcare professionals to obtain accurate and reliable genetic information from patient samples. The high-throughput nature of sequencing consumables aligns seamlessly with the demands of clinical settings, facilitating rapid and precise analysis critical for informed treatment decisions.

Simultaneously, academic research institutes stand as crucibles of innovation and discovery, driving advancements in genomics and molecular biology. Within these research-intensive environments, sequencing consumables contribute to the exploration of fundamental biological questions, the identification of novel genes, and the elucidation of intricate genetic pathways. Researchers at academic institutions leverage consumables to conduct experiments, generate sequencing data, and contribute to the collective knowledge shaping the understanding of genetic phenomena.

North America dominated the market with a revenue share of 52% in 2023. In North America, a stronghold for innovation and technological advancements, the sequencing consumables market thrives on a robust infrastructure and substantial investments in research and development. The region's leading position is further accentuated by a high prevalence of genomics-focused initiatives and a strong presence of key industry players. The demand for cutting-edge sequencing consumables in North America aligns with the region's commitment to precision medicine and its leadership in driving genomic discoveries.

By Product

By Platform

By Application

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Sequencing Consumables Market

5.1. COVID-19 Landscape: Sequencing Consumables Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Sequencing Consumables Market, By Product

8.1. Sequencing Consumables Market, by Product, 2024-2033

8.1.1. Kits

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Reagents

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Accessories

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Sequencing Consumables Market, By Platform

9.1. Sequencing Consumables Market, by Platform, 2024-2033

9.1.1. 1st Generation Sequencing Consumables

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. 2nd Generation Sequencing Consumables

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. 3rd Generation Sequencing Consumables

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Sequencing Consumables Market, By Application

10.1. Sequencing Consumables Market, by Application, 2024-2033

10.1.1. Cancer Diagnostics

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Infectious Disease Diagnostics

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Reproductive Health Diagnostics

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Pharmacogenomics

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Agrigenomics

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Sequencing Consumables Market, By End-use

11.1. Sequencing Consumables Market, by End-use, 2024-2033

11.1.1. Pharmaceutical And Biotechnology Companies

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Hospitals And Laboratories

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Academic Research Institutes

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Sequencing Consumables Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.2. Market Revenue and Forecast, by Platform (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Platform (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Platform (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.2. Market Revenue and Forecast, by Platform (2021-2033)

12.2.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Platform (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Platform (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Platform (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Platform (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.2. Market Revenue and Forecast, by Platform (2021-2033)

12.3.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Platform (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Platform (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Platform (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Platform (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.2. Market Revenue and Forecast, by Platform (2021-2033)

12.4.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Platform (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Platform (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Platform (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Platform (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.2. Market Revenue and Forecast, by Platform (2021-2033)

12.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Platform (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Platform (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 13. Company Profiles

13.1. Hoffmann-La Roche Ltd.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. QIAGEN

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Agilent Technologies

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Millipore Sigma

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Takara Bio Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Beckman Coulter, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Eurofins Genomics

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Oxford Nanopore Technologies Ltd.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Thermo Fisher Scientific, Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. BGI Genomics

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others