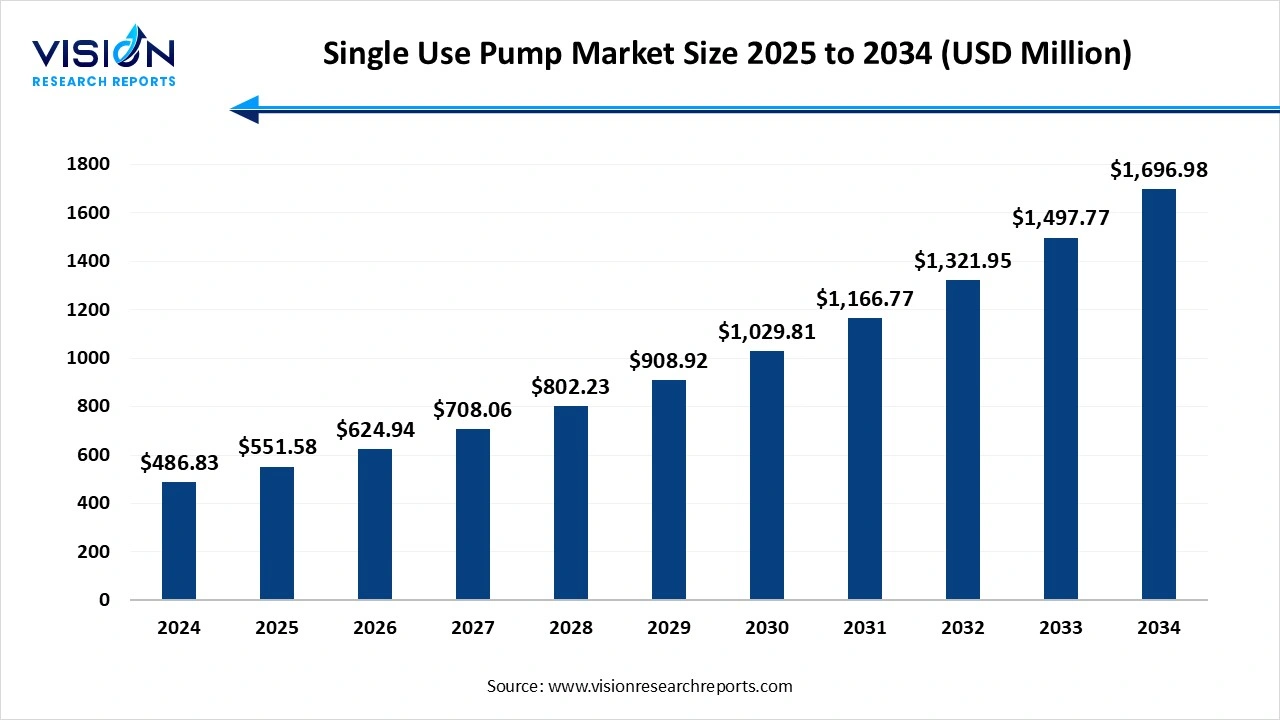

The global single-use pump market size was accounted at USD 486.83 million in 2024 and it is projected to hit around USD 1,696.98 million by 2034, growing at a CAGR of 13.3% from 2025 to 2034. The market growth is driven by the increasing demand for sterile and contamination-free fluid transfer in biopharmaceutical manufacturing, the single-use pump market is experiencing robust growth.

| Report Coverage | Details |

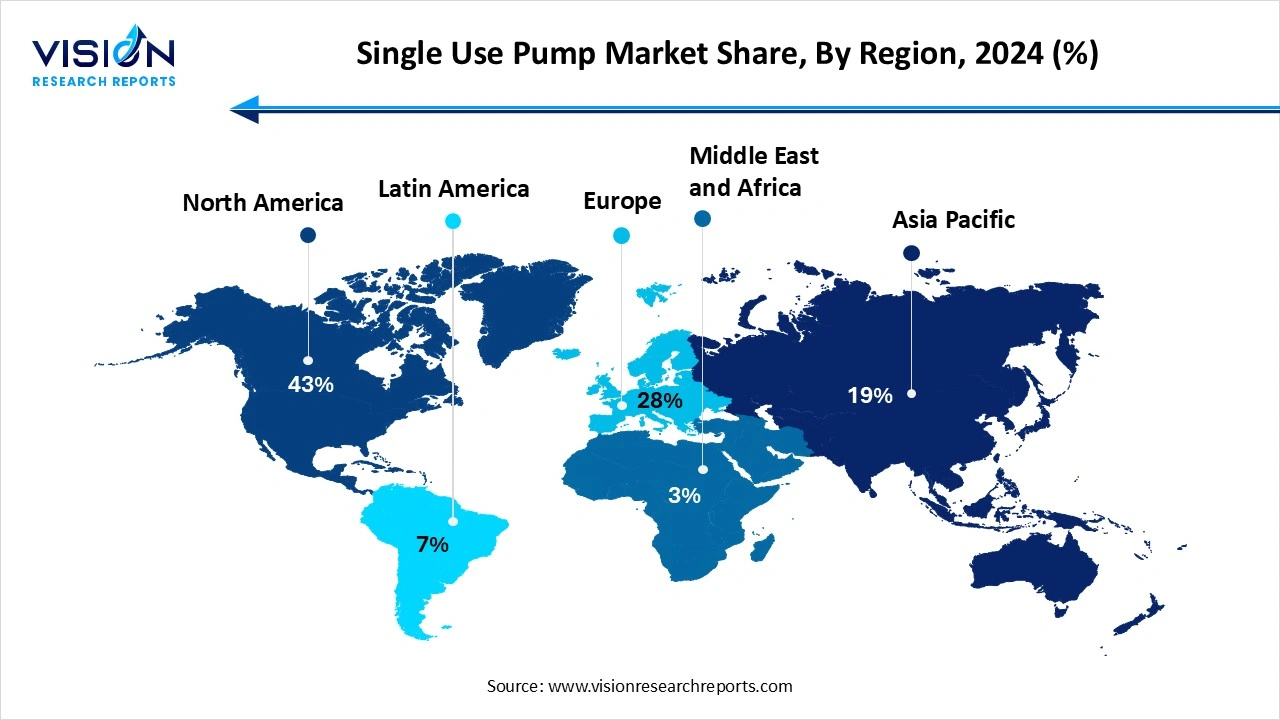

| Revenue Share of North America in 2024 | 43% |

| Revenue Forecast by 2034 | USD 1,696.98 million |

| Growth Rate from 2025 to 2034 | CAGR of 13.3% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Dover Corp.; Spirax-Sarco Engineering plc; Colly Flowtech; Levitronix; PumpCell; Fluid Flow Products, Inc.; PerfuseCell A/S; ALMATECHNIK AG; ESI Technologies Ltd.; Avantor Inc |

The single-use pump market has been gaining significant traction in recent years, driven by the growing demand for cost-effective and contamination-free fluid handling solutions in biopharmaceutical and biotechnology industries. These pumps are designed for one-time use, which reduces the need for cleaning and sterilization, thereby enhancing operational efficiency and minimizing cross-contamination risks. Their disposable nature makes them particularly suitable for processes requiring high levels of hygiene and flexibility, such as vaccine production, cell therapy, and monoclonal antibody manufacturing. As the global focus on personalized medicine, biologics, and small-batch production continues to rise, single-use technologies like these pumps are becoming essential components in modern bioprocessing workflows.

The growth of the single-use pump market is primarily driven by the rising adoption of single-use technologies in the biopharmaceutical industry. These pumps play a critical role in maintaining sterility and reducing the risk of cross-contamination during drug manufacturing, especially in processes involving sensitive biologics and small-batch production. As the demand for personalized medicines, cell and gene therapies, and monoclonal antibodies continues to expand, manufacturers are increasingly turning to single-use systems to achieve faster turnaround times, lower operational costs, and greater process flexibility.

The market is benefiting from technological advancements and increased investment in pharmaceutical infrastructure, especially in emerging markets. Improvements in pump design, materials, and performance are enhancing the reliability and scalability of single-use systems. Moreover, regulatory support for single-use technologies, along with the growing focus on sustainable and eco-friendly manufacturing practices, is encouraging companies to adopt disposable solutions.

One of the major challenges faced by the single-use pump market is the environmental impact of disposable systems. As these pumps are designed for one-time use, they contribute significantly to plastic waste, raising concerns about sustainability and regulatory compliance in waste management. Many healthcare and biopharmaceutical organizations are under pressure to balance the benefits of single-use technologies with their corporate environmental responsibilities, prompting a demand for recyclable or biodegradable materials, which are still in developmental stages and may add to production costs.

Another key challenge lies in the compatibility and standardization of single-use components across various systems and manufacturers. Lack of interoperability can lead to integration issues during production setup, resulting in delays and increased operational complexity. Additionally, limited availability of certain pump materials that are both sterile and chemically resistant can restrict their use in some high-demand applications.

North America accounted for the largest share of the single-use pump market, capturing 43% of the total market in 2024. The region benefits from the presence of key market players, high investment in biologics manufacturing, and a growing demand for flexible and contamination-free processing solutions. The United States, in particular, is a major contributor to market expansion, driven by the increasing adoption of single-use technologies in bioprocessing and a favorable regulatory environment that supports innovation and commercialization of advanced fluid handling systems.

The Asia-Pacific region is expected to witness the fastest growth over the coming years. This growth is fueled by the expanding pharmaceutical industry, rising biologics production, and increasing government support for healthcare infrastructure in countries like China, India, and South Korea. As these regions continue to invest in advanced manufacturing capabilities, the adoption of single-use pumps is anticipated to grow substantially, making them essential components in modern bioprocessing systems.

The Asia-Pacific region is expected to witness the fastest growth over the coming years. This growth is fueled by the expanding pharmaceutical industry, rising biologics production, and increasing government support for healthcare infrastructure in countries like China, India, and South Korea. As these regions continue to invest in advanced manufacturing capabilities, the adoption of single-use pumps is anticipated to grow substantially, making them essential components in modern bioprocessing systems.

The equipment segment dominated the market, holding the largest share of 75% in 2024. These pumps are engineered to offer efficient and contamination-free transfer of sensitive liquids, eliminating the need for time-consuming cleaning and sterilization procedures. As the pharmaceutical industry shifts towards flexible and scalable production systems, single-use pump equipment provides enhanced operational efficiency, reduced downtime, and lower risk of cross-contamination.

The growing need for automation and precision in bioprocessing has spurred advancements in single-use pump equipment design. Manufacturers are focusing on developing pumps with improved flow accuracy, robust material compatibility, and seamless integration into disposable systems. These innovations are not only streamlining production workflows but also ensuring regulatory compliance in critical applications such as vaccine manufacturing and cell therapy.

The biopharmaceutical and pharmaceutical companies segment accounted for 43% of the global market share in 2024. These companies heavily rely on single-use pumps for processes such as media and buffer preparation, fermentation, filtration, and downstream purification. The growing emphasis on producing complex biologics, including monoclonal antibodies, vaccines, and cell and gene therapies, has created a need for technologies that can ensure contamination-free operations and reduce turnaround times between production cycles.

Additionally, the trend towards modular and scalable manufacturing in the pharmaceutical sector is further accelerating the adoption of single-use technologies. Single-use pumps enable companies to respond quickly to changing production volumes, support multi-product facilities, and comply with stringent regulatory guidelines. Their integration into closed systems also enhances safety and maintains product integrity throughout the manufacturing process.

The polypropylene (PP) pump segment captured a 53% share of the market in 2024. These pumps are widely used in biopharmaceutical and pharmaceutical manufacturing processes where compatibility with a wide range of chemicals and solvents is essential. Their high thermal stability and mechanical strength make them suitable for applications involving rigorous operational demands. Additionally, PP is a widely accepted material in regulatory environments, making these pumps ideal for use in sterile and contamination-sensitive settings. As the demand for reliable and high-performance single-use systems continues to rise, polypropylene pumps are expected to maintain their strong position in the market.

The Polyethylene (PE) pump segment is projected to experience the highest CAGR of 13.88% between 2025 and 2034. These pumps are commonly used in fluid transfer processes within bioprocessing, laboratory, and diagnostic environments. Polyethylene low reactivity and high purity make it a preferred material for handling sensitive biological fluids, ensuring product integrity during critical manufacturing steps.

By Product

By Material

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Single-use Pump Market

5.1. COVID-19 Landscape: Single-use Pump Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Single-use Pump Market, By Product

8.1. Single-use Pump Market, by Product, 2023-2034

8.1.1 Equipment

8.1.1.1. Market Revenue and Forecast (2025-2034)

8.1.2. Accessories

8.1.2.1. Market Revenue and Forecast (2025-2034)

Chapter 9. Global Single-use Pump Market, By Material

9.1. Single-use Pump Market, by Material, 2023-2034

9.1.1. Polypropylene (PP) Pumps

9.1.1.1. Market Revenue and Forecast (2025-2034)

9.1.2. Polyethylene (PE) Pumps

9.1.2.1. Market Revenue and Forecast (2025-2034)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2025-2034)

Chapter 10. Global Single-use Pump Market, By End-use

10.1. Single-use Pump Market, by End-use, 2025-2034

10.1.1. Biopharmaceutical & Pharmaceutical Companies

10.1.1.1. Market Revenue and Forecast (2025-2034)

10.1.2. CROs & CMOs

10.1.2.1. Market Revenue and Forecast (2025-2034)

10.1.3. Academic & Research Institutes

10.1.3.1. Market Revenue and Forecast (2025-2034)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2025-2034)

Chapter 11. Global Single-use Pump Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2025-2034)

11.1.2. Market Revenue and Forecast, by Material (2025-2034)

11.1.3. Market Revenue and Forecast, by End-use (2025-2034)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2025-2034)

11.1.4.2. Market Revenue and Forecast, by Material (2025-2034)

11.1.4.3. Market Revenue and Forecast, by End-use (2025-2034)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2025-2034)

11.1.5.2. Market Revenue and Forecast, by Material (2025-2034)

11.1.5.3. Market Revenue and Forecast, by End-use (2025-2034)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2025-2034)

11.2.2. Market Revenue and Forecast, by Material (2025-2034)

11.2.3. Market Revenue and Forecast, by End-use (2025-2034)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2025-2034)

11.2.4.2. Market Revenue and Forecast, by Material (2025-2034)

11.2.4.3. Market Revenue and Forecast, by End-use (2025-2034)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2025-2034)

11.2.5.2. Market Revenue and Forecast, by Material (2025-2034)

11.2.5.3. Market Revenue and Forecast, by End-use (2025-2034)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2025-2034)

11.2.6.2. Market Revenue and Forecast, by Material (2025-2034)

11.2.6.3. Market Revenue and Forecast, by End-use (2025-2034)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2025-2034)

11.2.7.2. Market Revenue and Forecast, by Material (2025-2034)

11.2.7.3. Market Revenue and Forecast, by End-use (2025-2034)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2025-2034)

11.3.2. Market Revenue and Forecast, by Material (2025-2034)

11.3.3. Market Revenue and Forecast, by End-use (2025-2034)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2025-2034)

11.3.4.2. Market Revenue and Forecast, by Material (2025-2034)

11.3.4.3. Market Revenue and Forecast, by End-use (2025-2034)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2025-2034)

11.3.5.2. Market Revenue and Forecast, by Material (2025-2034)

11.3.5.3. Market Revenue and Forecast, by End-use (2025-2034)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2025-2034)

11.3.6.2. Market Revenue and Forecast, by Material (2025-2034)

11.3.6.3. Market Revenue and Forecast, by End-use (2025-2034)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2025-2034)

11.3.7.2. Market Revenue and Forecast, by Material (2025-2034)

11.3.7.3. Market Revenue and Forecast, by End-use (2025-2034)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2025-2034)

11.4.2. Market Revenue and Forecast, by Material (2025-2034)

11.4.3. Market Revenue and Forecast, by End-use (2025-2034)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2025-2034)

11.4.4.2. Market Revenue and Forecast, by Material (2025-2034)

11.4.4.3. Market Revenue and Forecast, by End-use (2025-2034)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2025-2034)

11.4.5.2. Market Revenue and Forecast, by Material (2025-2034)

11.4.5.3. Market Revenue and Forecast, by End-use (2025-2034)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2025-2034)

11.4.6.2. Market Revenue and Forecast, by Material (2025-2034)

11.4.6.3. Market Revenue and Forecast, by End-use (2025-2034)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2025-2034)

11.4.7.2. Market Revenue and Forecast, by Material (2025-2034)

11.4.7.3. Market Revenue and Forecast, by End-use (2025-2034)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2025-2034)

11.5.2. Market Revenue and Forecast, by Material (2025-2034)

11.5.3. Market Revenue and Forecast, by End-use (2025-2034)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2025-2034)

11.5.4.2. Market Revenue and Forecast, by Material (2025-2034)

11.5.4.3. Market Revenue and Forecast, by End-use (2025-2034)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2025-2034)

11.5.5.2. Market Revenue and Forecast, by Material (2025-2034)

11.5.5.3. Market Revenue and Forecast, by End-use (2025-2034)

Chapter 12. Company Profiles

12.1. Dover Corp.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Spirax-Sarco Engineering plc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Colly Flowtech.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Levitronix.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. PumpCell

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Fluid Flow Products, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. PerfuseCell A/S.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. ALMATECHNIK AG

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. ESI Technologies Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Avantor Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others