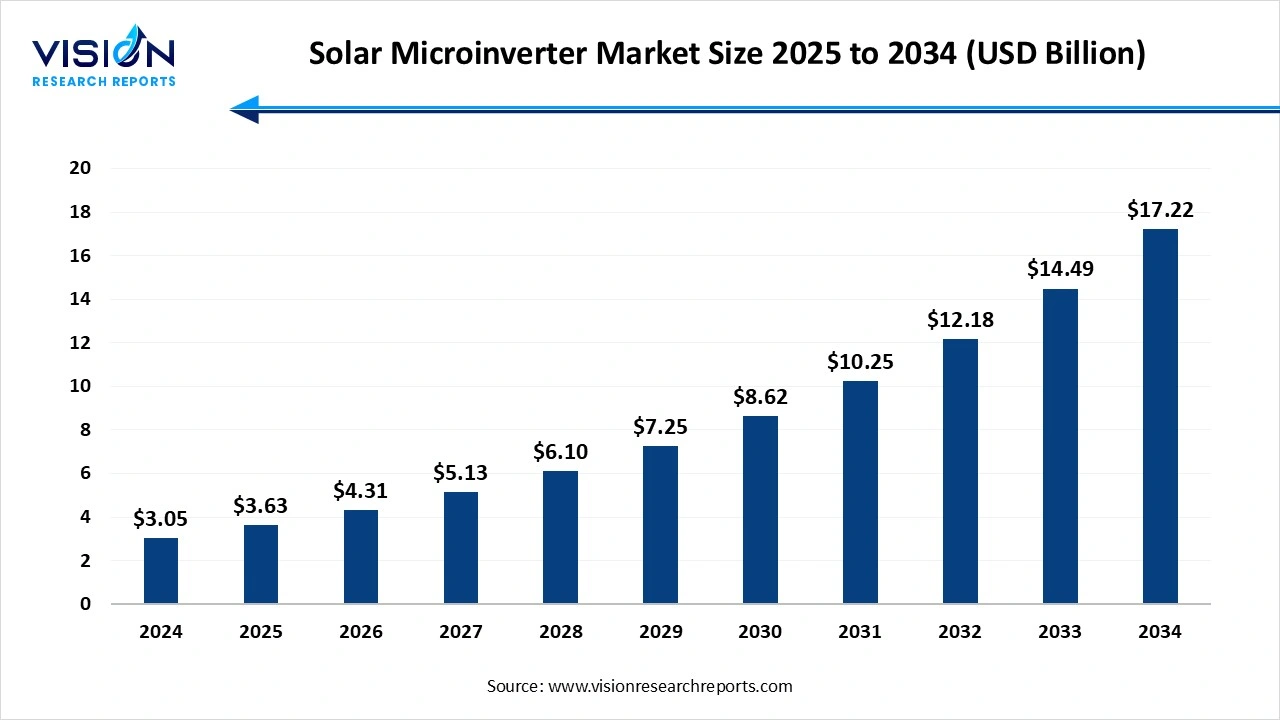

The global solar microinverter market size was accounted at around USD 3.05 billion in 2024 and it is projected to hit around USD 17.22 billion by 2034, growing at a CAGR of 18.90% from 2025 to 2034. The market growth is driven by increasing adoption of rooftop solar systems, advancements in panel-level power optimization, and supportive government incentives, the solar microinverter market is experiencing robust growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.05 billion |

| Revenue Forecast by 2034 | USD 17.22 billion |

| Growth rate from 2025 to 2034 | CAGR of 18.90% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Enphase Energy, Inc., APsystems, Darfon Electronics Corp., Siemens AG, SolarEdge Technologies, Inc, Altenergy Power System Canada Inc., Chilicon Power LLC, SMA Solar Technology AG, Hoymiles Power, Electronics Inc. |

The solar microinverter market has witnessed significant growth in recent years, driven by the rising adoption of distributed solar power generation and the increasing demand for enhanced energy efficiency. Unlike traditional string inverters, microinverters are installed at the individual solar panel level, allowing for optimized energy output, real-time monitoring, and improved system resilience. This technology is gaining strong traction, particularly in residential and small-scale commercial solar installations, due to its ability to mitigate power losses caused by shading or panel mismatch.

The growing emphasis on renewable energy adoption is a primary driver behind the expansion of the solar microinverter market. As governments and regulatory bodies worldwide push for carbon neutrality and cleaner energy alternatives, there has been a surge in residential and commercial solar PV installations. Microinverters, which convert direct current (DC) from each solar panel into alternating current (AC) individually, offer superior efficiency and reliability compared to traditional inverters. Their ability to maximize energy harvest, especially in partial shading or complex rooftop conditions, makes them a preferred choice among homeowners and small businesses.

Technological advancements are also fueling market growth. Innovations such as integrated monitoring systems, plug-and-play installation, and the development of hybrid microinverters compatible with energy storage solutions have significantly enhanced the value proposition of these devices.

One of the major challenges facing the solar microinverter market is the higher initial cost compared to traditional string or central inverters. While microinverters offer superior performance and reliability, their per-watt cost is generally higher, which can deter price-sensitive consumers, particularly in developing regions. The cost factor becomes more prominent in large-scale commercial or utility projects where centralized inverters may offer more economical scalability.

Another significant challenge is limited compatibility and durability concerns in harsh environments. Some microinverters may face issues with heat dissipation and long-term reliability, especially in high-temperature or humid regions. Although manufacturers are making strides in enhancing durability, concerns around maintenance and lifespan compared to traditional systems persist.

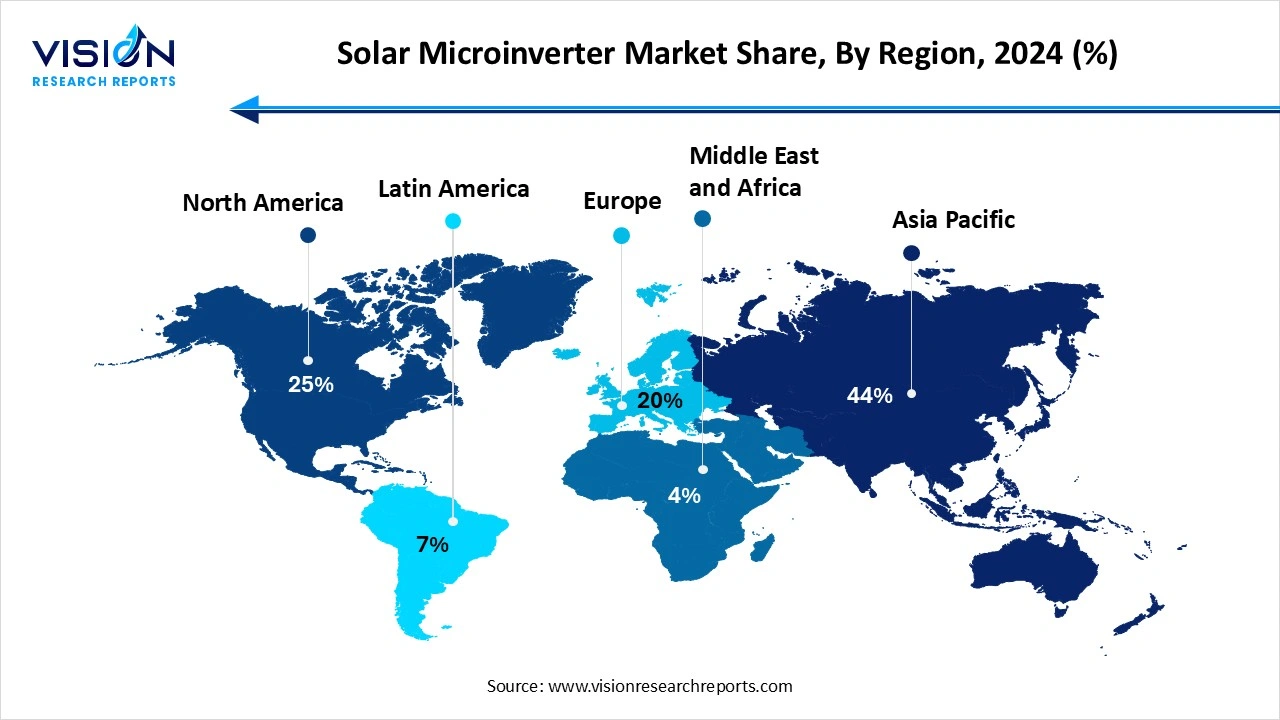

The Asia Pacific region led the solar microinverter market, capturing a significant revenue share of 44% in 2024. Countries like China, India, Australia, and Japan are investing heavily in solar energy, with a growing shift toward residential and decentralized energy systems where microinverters offer significant advantages. Although string inverters have traditionally dominated these markets, increased awareness, improving economic conditions, and falling technology costs are creating new opportunities for microinverter adoption, especially in remote and off-grid areas. North America held a substantial share of the market in 2024 and is projected to experience the fastest growth rate of 19.8% throughout the forecast period. The United States, in particular, has seen significant growth due to tax incentives, net metering programs, and growing awareness of clean energy. The presence of major microinverter manufacturers and high consumer preference for panel-level optimization technologies have further solidified the region's leadership.

North America held a substantial share of the market in 2024 and is projected to experience the fastest growth rate of 19.8% throughout the forecast period. The United States, in particular, has seen significant growth due to tax incentives, net metering programs, and growing awareness of clean energy. The presence of major microinverter manufacturers and high consumer preference for panel-level optimization technologies have further solidified the region's leadership.

The single-phase segment dominated the market in 2024, contributing more than 79% of the total revenue share. These systems are ideally suited for small-scale solar power installations, typically found in individual homes or small commercial buildings. Single-phase microinverters offer ease of installation, lower upfront costs, and are compatible with standard household electrical systems. Their ability to optimize the performance of each solar panel independently makes them particularly attractive for rooftop installations where shading, panel orientation, or varying sunlight conditions can affect overall output.

The three-phase segment is projected to witness the fastest growth of 20.8% over the forecast period. These systems are designed to handle higher power loads and offer improved efficiency over longer distances, making them suitable for commercial buildings, warehouses, and multi-unit residential complexes. The deployment of three-phase microinverters supports better load balancing, reduced transmission losses, and smoother integration with local utility grids. As commercial and utility-scale solar installations grow across emerging markets and industrial hubs, the demand for robust and scalable three-phase microinverter systems is expected to increase steadily.

The residential segment dominated the market in 2024, capturing a substantial share of the overall revenue. Microinverters are particularly favored in residential settings due to their ability to optimize power output from each individual panel, which is essential in scenarios where shading, roof angles, or panel mismatches can impact performance. Homeowners are drawn to the simplicity of installation, enhanced safety features, and real-time monitoring capabilities offered by microinverters.

The industrial/utility segment is projected to experience the highest growth rate during the forecast period. The use of microinverters in commercial and utility-scale applications is expanding due to their benefits in energy optimization, system redundancy, and ease of maintenance. Industrial facilities and solar farms are increasingly exploring microinverter deployment to achieve maximum power yield, especially in installations spread across complex terrains or where environmental factors may affect uniform panel performance.

The 250 W to 500 W segment dominated the solar microinverter market in 2024, capturing a notable share of the total revenue. These units are well-suited for both residential and small-scale commercial applications, offering an ideal balance between efficiency, compatibility, and cost. Their ability to deliver higher power output per panel makes them effective in maximizing energy harvest in diverse environmental conditions, including partial shading and roof layout variations.

The below 250 W power rating segment is expected to register the fastest CAGR throughout the forecast period. These systems are typically seen in early-generation residential solar installations, educational setups, or off-grid environments where smaller loads are managed independently. While they offer cost advantages and are suitable for compact installations, their limited power handling capacity restricts their use in larger or high-performance solar projects.

The offline segment dominated the solar microinverter market in 2024, holding the largest share of the total revenue. Offline channels, including authorized dealers, distributors, electrical wholesalers, and retail outlets, provide personalized support, on-site consultations, and after-sales services that are crucial for technical products like microinverters. Installers and contractors often prefer offline purchases, as they can physically inspect the product, verify specifications, and ensure compatibility with existing solar systems.

The online distribution channel segment is expected to record the highest CAGR over the forecast period. Online sales of solar microinverters are expanding as both residential users and small businesses seek convenience, competitive pricing, and access to a wider range of products. Manufacturers and third-party platforms are increasingly offering detailed product descriptions, user reviews, and virtual support tools to build consumer confidence in online purchases.

By Type

By Application

By Power Rating

By Distribution

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Solar Microinverter Market

5.1. COVID-19 Landscape: Solar Microinverter Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Solar Microinverter Market, By Type

8.1. Solar Microinverter Market, by Type

8.1.1. Single Phase

8.1.1.1. Market Revenue and Forecast

8.1.2. Three Phase

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global Solar Microinverter Market, By Application

9.1. Solar Microinverter Market, by Application

9.1.1. Residential

9.1.1.1. Market Revenue and Forecast

9.1.2. Commercial

9.1.2.1. Market Revenue and Forecast

9.1.3. Industrial / Utility

9.1.3.1. Market Revenue and Forecast

Chapter 10. Global Solar Microinverter Market, By Power Rating

10.1. Solar Microinverter Market, by Power Rating

10.1.1. Below 250 W

10.1.1.1. Market Revenue and Forecast

10.1.2. 250 W to 500 W

10.1.2.1. Market Revenue and Forecast

10.1.3. Above 500 W

10.1.3.1. Market Revenue and Forecast

Chapter 11. Global Solar Microinverter Market, By Distribution

11.1. Solar Microinverter Market, by Distribution

11.1.1. Online

11.1.1.1. Market Revenue and Forecast

11.1.2. Offline

11.1.2.1. Market Revenue and Forecast

11.1.3. Direct Sales

11.1.3.1. Market Revenue and Forecast

11.1.4. Indirect Sales

11.1.4.1. Market Revenue and Forecast

Chapter 12. Global Solar Microinverter Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type

12.1.2. Market Revenue and Forecast, by Application

12.1.3. Market Revenue and Forecast, by Power Rating

12.1.4. Market Revenue and Forecast, by Distribution

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type

12.1.5.2. Market Revenue and Forecast, by Application

12.1.5.3. Market Revenue and Forecast, by Power Rating

12.1.5.4. Market Revenue and Forecast, by Distribution

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type

12.1.6.2. Market Revenue and Forecast, by Application

12.1.6.3. Market Revenue and Forecast, by Power Rating

12.1.6.4. Market Revenue and Forecast, by Distribution

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type

12.2.2. Market Revenue and Forecast, by Application

12.2.3. Market Revenue and Forecast, by Power Rating

12.2.4. Market Revenue and Forecast, by Distribution

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type

12.2.5.2. Market Revenue and Forecast, by Application

12.2.5.3. Market Revenue and Forecast, by Power Rating

12.2.5.4. Market Revenue and Forecast, by Distribution

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type

12.2.6.2. Market Revenue and Forecast, by Application

12.2.6.3. Market Revenue and Forecast, by Power Rating

12.2.6.4. Market Revenue and Forecast, by Distribution

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type

12.2.7.2. Market Revenue and Forecast, by Application

12.2.7.3. Market Revenue and Forecast, by Power Rating

12.2.7.4. Market Revenue and Forecast, by Distribution

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type

12.2.8.2. Market Revenue and Forecast, by Application

12.2.8.3. Market Revenue and Forecast, by Power Rating

12.2.8.4. Market Revenue and Forecast, by Distribution

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type

12.3.2. Market Revenue and Forecast, by Application

12.3.3. Market Revenue and Forecast, by Power Rating

12.3.4. Market Revenue and Forecast, by Distribution

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type

12.3.5.2. Market Revenue and Forecast, by Application

12.3.5.3. Market Revenue and Forecast, by Power Rating

12.3.5.4. Market Revenue and Forecast, by Distribution

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type

12.3.6.2. Market Revenue and Forecast, by Application

12.3.6.3. Market Revenue and Forecast, by Power Rating

12.3.6.4. Market Revenue and Forecast, by Distribution

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type

12.3.7.2. Market Revenue and Forecast, by Application

12.3.7.3. Market Revenue and Forecast, by Power Rating

12.3.7.4. Market Revenue and Forecast, by Distribution

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type

12.3.8.2. Market Revenue and Forecast, by Application

12.3.8.3. Market Revenue and Forecast, by Power Rating

12.3.8.4. Market Revenue and Forecast, by Distribution

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type

12.4.2. Market Revenue and Forecast, by Application

12.4.3. Market Revenue and Forecast, by Power Rating

12.4.4. Market Revenue and Forecast, by Distribution

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type

12.4.5.2. Market Revenue and Forecast, by Application

12.4.5.3. Market Revenue and Forecast, by Power Rating

12.4.5.4. Market Revenue and Forecast, by Distribution

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type

12.4.6.2. Market Revenue and Forecast, by Application

12.4.6.3. Market Revenue and Forecast, by Power Rating

12.4.6.4. Market Revenue and Forecast, by Distribution

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type

12.4.7.2. Market Revenue and Forecast, by Application

12.4.7.3. Market Revenue and Forecast, by Power Rating

12.4.7.4. Market Revenue and Forecast, by Distribution

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type

12.4.8.2. Market Revenue and Forecast, by Application

12.4.8.3. Market Revenue and Forecast, by Power Rating

12.4.8.4. Market Revenue and Forecast, by Distribution

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type

12.5.2. Market Revenue and Forecast, by Application

12.5.3. Market Revenue and Forecast, by Power Rating

12.5.4. Market Revenue and Forecast, by Distribution

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type

12.5.5.2. Market Revenue and Forecast, by Application

12.5.5.3. Market Revenue and Forecast, by Power Rating

12.5.5.4. Market Revenue and Forecast, by Distribution

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type

12.5.6.2. Market Revenue and Forecast, by Application

12.5.6.3. Market Revenue and Forecast, by Power Rating

12.5.6.4. Market Revenue and Forecast, by Distribution

Chapter 13. Company Profiles

13.1. Enphase Energy, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. APsystems

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Darfon Electronics Corp.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Siemens AG

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. SolarEdge Technologies, Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Altenergy Power System Canada Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Chilicon Power LLC

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. SMA Solar Technology AG

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Hoymiles Power Electronics Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others