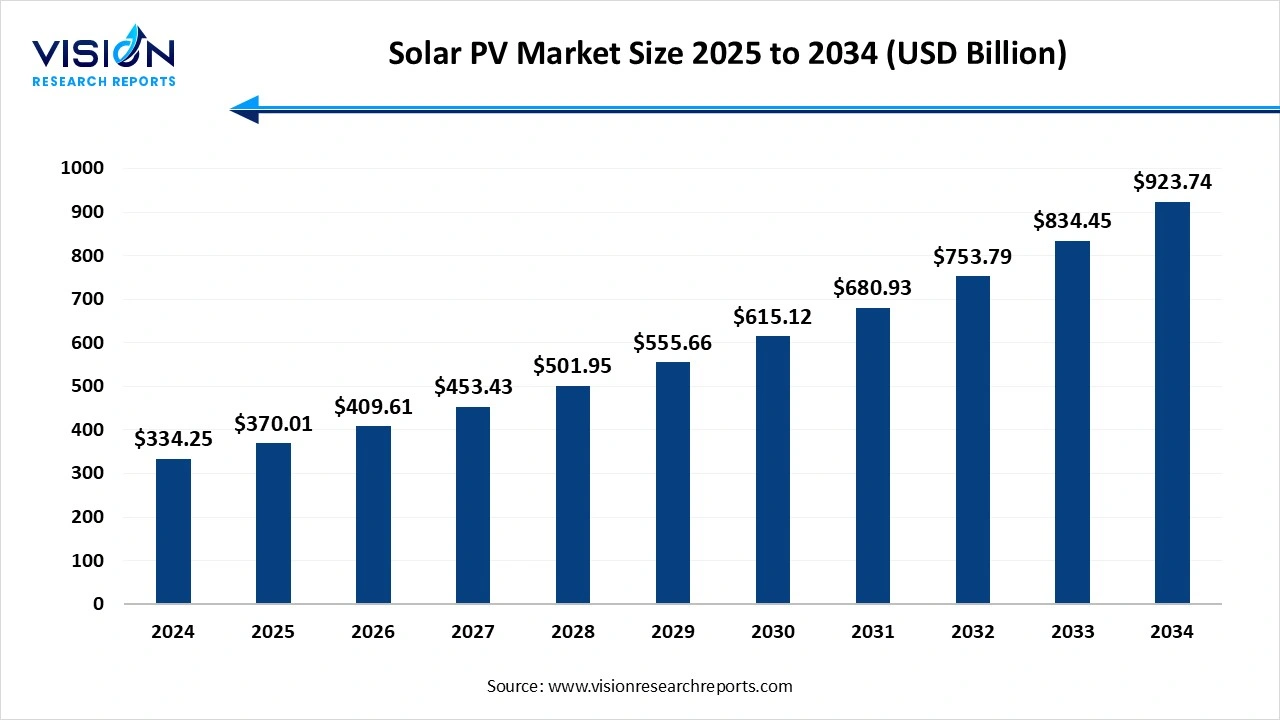

The global solar PV market size was reached at around USD 334.25 billion in 2024 and it is projected to hit around USD 923.74 billion by 2034, growing at a CAGR of 10.70% from 2025 to 2034. The market growth is driven by declining solar panel costs, government incentives, and growing environmental concerns, the Solar PV market is experiencing robust growth.

The global Solar Photovoltaic (PV) market has witnessed robust growth over the past decade, driven by increasing demand for clean and sustainable energy sources, rapid advancements in PV technology, and supportive government policies across various regions. Solar PV systems, which convert sunlight directly into electricity using semiconductor materials, have become a key component of the renewable energy transition. Falling installation costs, improved energy conversion efficiency, and growing awareness of climate change have significantly accelerated the adoption of solar PV solutions in both developed and emerging economies.

The growth of the solar photovoltaic (PV) market is primarily driven by the increasing global focus on clean energy and sustainability. Governments across the world are implementing favorable policies, subsidies, and tax incentives to promote the adoption of solar energy, thereby accelerating the deployment of solar PV systems. International commitments to reduce carbon emissions, such as those outlined in the Paris Agreement, have further encouraged investments in solar infrastructure.

Technological advancements also play a crucial role in the market's expansion. Innovations such as high-efficiency solar cells, bifacial panels, and energy storage integration are enhancing system performance and reliability. Furthermore, the growing need for decentralized power generation, especially in remote or off-grid areas, is fueling demand for compact and portable solar PV solutions. The rising awareness among consumers about energy independence and the environmental benefits of solar energy is also contributing to increased adoption.

Despite its rapid growth, the solar PV market faces several challenges that could hinder its widespread adoption. One of the primary concerns is the intermittency of solar power generation, which depends heavily on weather conditions and daylight availability. Without efficient energy storage systems or robust grid infrastructure, maintaining a consistent and reliable energy supply can be difficult.

Another significant challenge lies in supply chain constraints and material dependency. The production of solar PV modules requires critical raw materials such as polysilicon, silver, and rare earth elements, which are subject to price volatility and geopolitical tensions. Environmental concerns related to the disposal and recycling of end-of-life solar panels also pose a long-term sustainability issue.

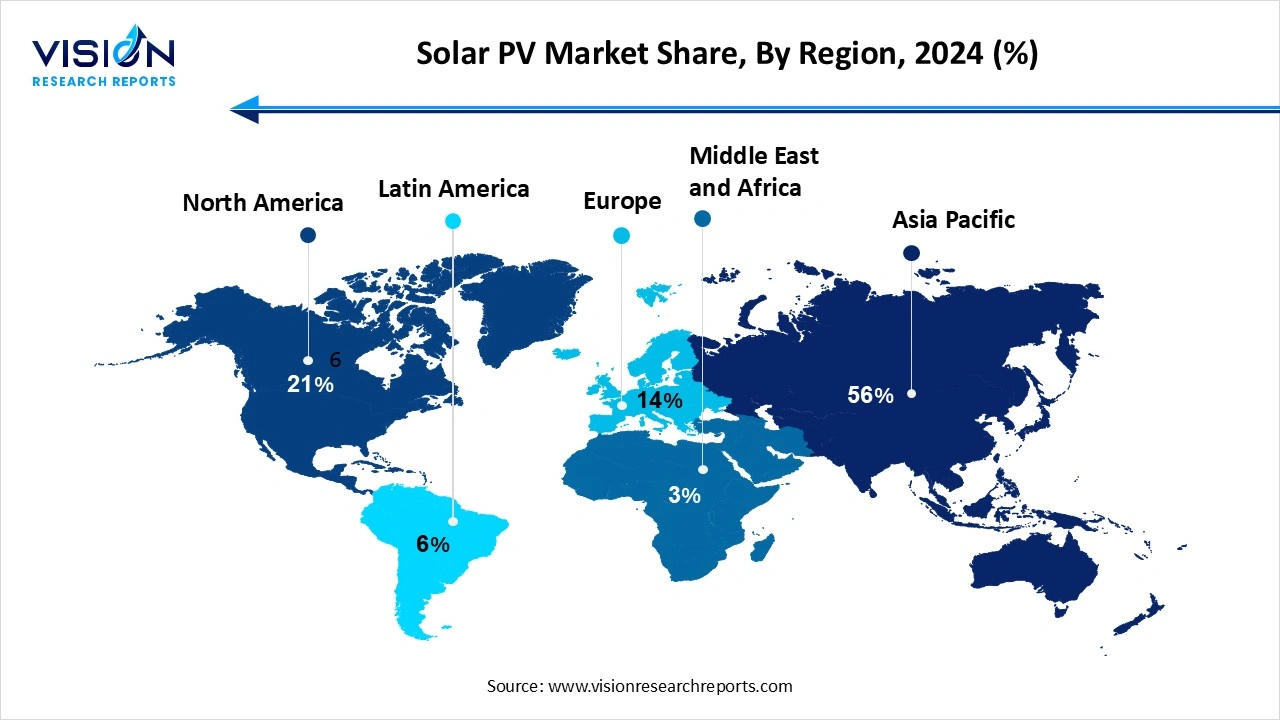

The Asia Pacific led the global solar PV market in 2024, capturing the largest revenue share of 56% in 2024. Countries such as China, India, Japan, and South Korea are making significant investments in solar infrastructure to diversify their energy mix and reduce carbon emissions. China, in particular, dominates both manufacturing and deployment, accounting for a substantial share of global solar PV installations.

The solar PV market in North America is projected to experience substantial growth over the forecast period. Supportive regulatory frameworks, tax incentives such as the Investment Tax Credit (ITC), and increasing adoption of residential and commercial solar systems are key drivers of market growth in the region. Canada and Mexico are also expanding their solar capacities through utility-scale projects and clean energy initiatives aimed at reducing greenhouse gas emissions. The region is witnessing a growing trend of integrating solar PV systems with energy storage solutions, enhancing grid reliability and consumer energy independence.

The solar PV market in North America is projected to experience substantial growth over the forecast period. Supportive regulatory frameworks, tax incentives such as the Investment Tax Credit (ITC), and increasing adoption of residential and commercial solar systems are key drivers of market growth in the region. Canada and Mexico are also expanding their solar capacities through utility-scale projects and clean energy initiatives aimed at reducing greenhouse gas emissions. The region is witnessing a growing trend of integrating solar PV systems with energy storage solutions, enhancing grid reliability and consumer energy independence.

The on-grid connectivity segment accounted for the largest revenue share of 75% in 2024, dominating the market. On-grid solar PV systems are directly linked to the public electricity grid and are widely adopted in urban, industrial, and utility-scale applications due to their ability to deliver surplus power back to the grid. This connectivity allows consumers to benefit from net metering and feed-in tariff policies, making solar installations more economically attractive.

The off-grid segment is projected to register the fastest CAGR of 13.5% during the forecast period. These systems operate independently of the grid and often include battery storage to ensure uninterrupted power supply. Off-grid solar is particularly vital in regions of Africa, Asia, and Latin America, where it plays a crucial role in electrifying underserved communities and supporting decentralized energy models.

The ground-mounted systems dominated the market, capturing the largest revenue share of 63% in 2024. These systems are typically installed on open land and allow for the deployment of a large number of solar panels, making them ideal for generating high volumes of electricity. Ground-mounted installations offer flexibility in design and orientation, which can be optimized for maximum sunlight exposure using fixed tilt or tracking systems.

The rooftop segment is anticipated to grow at a CAGR of 13.8% over the forecast period, driven by increasing adoption of rooftop-mounted solar PV systems. Rooftop solar systems offer the advantage of utilizing existing building spaces, reducing the need for additional land and infrastructure. These installations are increasingly popular in urban areas where land availability is limited, and they provide consumers with the opportunity to reduce electricity bills and gain energy independence.

The utility segment dominated the market, securing the largest revenue share of 58% in 2024. Utility-scale solar projects involve the deployment of extensive ground-mounted solar farms that are directly connected to the power grid, supplying electricity to public utilities or wholesale electricity markets. Governments and private sector players across the globe are investing heavily in utility-scale solar infrastructure to reduce reliance on fossil fuels, achieve climate goals, and enhance energy security.

The commercial and industrial segment is projected to witness the fastest CAGR of 12.2% between 2025 and 2034. Businesses and manufacturing facilities are increasingly adopting solar PV systems to reduce their carbon footprint, lower operational costs, and meet environmental, social, and governance (ESG) targets. Rooftop and ground-mounted solar installations in commercial buildings, warehouses, and industrial complexes enable companies to generate their own electricity and hedge against volatile energy prices.

By Connectivity

By Mounting

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Connectivity Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Solar PV Market

5.1. COVID-19 Landscape: Solar PV Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Solar PV Market, By Connectivity

8.1. Solar PV Market, by Connectivity

8.1.1 On Grid

8.1.1.1. Market Revenue and Forecast

8.1.2. Off Grid

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global Solar PV Market, By Mounting

9.1. Solar PV Market, by Mounting

9.1.1. Ground Mounted

9.1.1.1. Market Revenue and Forecast

9.1.2. Roof Top

9.1.2.1. Market Revenue and Forecast

Chapter 10. Global Solar PV Market, By End Use

10.1. Solar PV Market, by End Use

10.1.1. Residential

10.1.1.1. Market Revenue and Forecast

10.1.2. Commercial & Industrial

10.1.2.1. Market Revenue and Forecast

10.1.3. Utility

10.1.3.1. Market Revenue and Forecast

Chapter 11. Global Solar PV Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Connectivity

11.1.2. Market Revenue and Forecast, by Mounting

11.1.3. Market Revenue and Forecast, by End Use

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Connectivity

11.1.4.2. Market Revenue and Forecast, by Mounting

11.1.4.3. Market Revenue and Forecast, by End Use

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Connectivity

11.1.5.2. Market Revenue and Forecast, by Mounting

11.1.5.3. Market Revenue and Forecast, by End Use

11.2. Europe

11.2.1. Market Revenue and Forecast, by Connectivity

11.2.2. Market Revenue and Forecast, by Mounting

11.2.3. Market Revenue and Forecast, by End Use

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Connectivity

11.2.4.2. Market Revenue and Forecast, by Mounting

11.2.4.3. Market Revenue and Forecast, by End Use

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Connectivity

11.2.5.2. Market Revenue and Forecast, by Mounting

11.2.5.3. Market Revenue and Forecast, by End Use

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Connectivity

11.2.6.2. Market Revenue and Forecast, by Mounting

11.2.6.3. Market Revenue and Forecast, by End Use

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Connectivity

11.2.7.2. Market Revenue and Forecast, by Mounting

11.2.7.3. Market Revenue and Forecast, by End Use

11.3. APAC

11.3.1. Market Revenue and Forecast, by Connectivity

11.3.2. Market Revenue and Forecast, by Mounting

11.3.3. Market Revenue and Forecast, by End Use

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Connectivity

11.3.4.2. Market Revenue and Forecast, by Mounting

11.3.4.3. Market Revenue and Forecast, by End Use

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Connectivity

11.3.5.2. Market Revenue and Forecast, by Mounting

11.3.5.3. Market Revenue and Forecast, by End Use

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Connectivity

11.3.6.2. Market Revenue and Forecast, by Mounting

11.3.6.3. Market Revenue and Forecast, by End Use

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Connectivity

11.3.7.2. Market Revenue and Forecast, by Mounting

11.3.7.3. Market Revenue and Forecast, by End Use

11.4. MEA

11.4.1. Market Revenue and Forecast, by Connectivity

11.4.2. Market Revenue and Forecast, by Mounting

11.4.3. Market Revenue and Forecast, by End Use

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Connectivity

11.4.4.2. Market Revenue and Forecast, by Mounting

11.4.4.3. Market Revenue and Forecast, by End Use

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Connectivity

11.4.5.2. Market Revenue and Forecast, by Mounting

11.4.5.3. Market Revenue and Forecast, by End Use

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Connectivity

11.4.6.2. Market Revenue and Forecast, by Mounting

11.4.6.3. Market Revenue and Forecast, by End Use

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Connectivity

11.4.7.2. Market Revenue and Forecast, by Mounting

11.4.7.3. Market Revenue and Forecast, by End Use

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Connectivity

11.5.2. Market Revenue and Forecast, by Mounting

11.5.3. Market Revenue and Forecast, by End Use

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Connectivity

11.5.4.2. Market Revenue and Forecast, by Mounting

11.5.4.3. Market Revenue and Forecast, by End Use

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Connectivity

11.5.5.2. Market Revenue and Forecast, by Mounting

11.5.5.3. Market Revenue and Forecast, by End Use

Chapter 12. Company Profiles

12.1. First Solar, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. LONGi Green Energy Technology Co., Ltd.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Trina Solar Limited.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. JA Solar Technology Co., Ltd.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Canadian Solar Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Risen Energy Co., Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. SunPower Corporation.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Talesun Solar Technologies Co., Ltd.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others