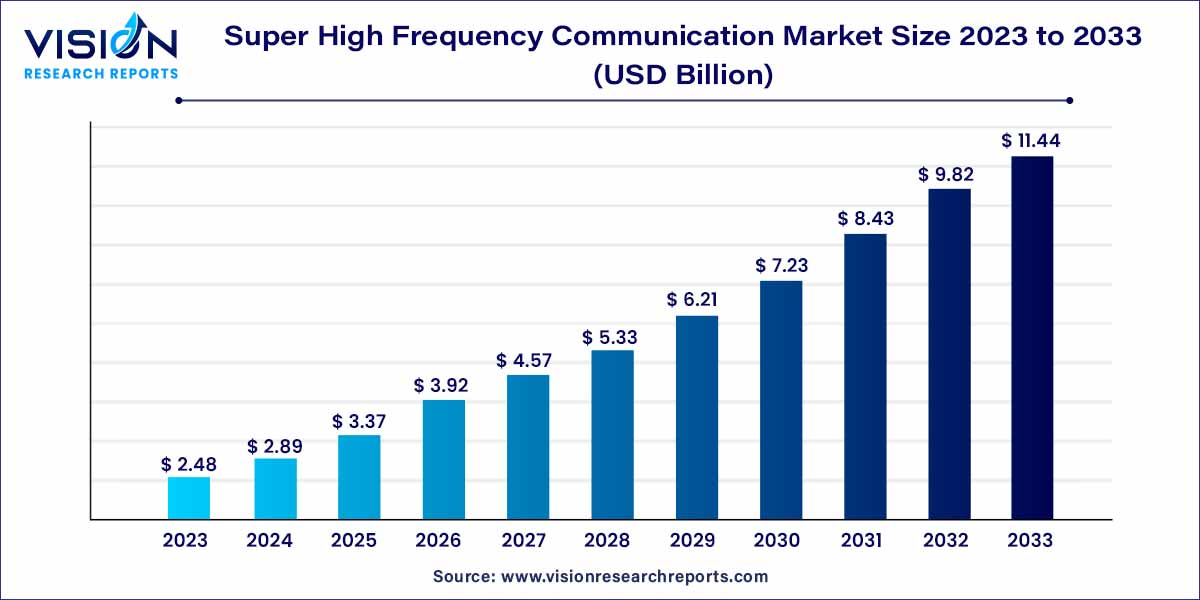

The global super high frequency communication market was surpassed at USD 2.48 billion in 2023 and is expected to hit around USD 11.44 billion by 2033, growing at a CAGR of 16.52% from 2024 to 2033. The global super high frequency (SHF) communication market is anticipated to grow at a rapid pace over the forecast period due to the rapidly increasing deployment of 5G radio antennas across several nations, including the United States, South Korea, Japan, and China, as well as the growing demand for high-frequency communications in a wide range of military applications.

The super high-frequency (SHF) communication market stands at the forefront of technological innovation, poised to redefine the landscape of global communication systems. Operating within the radio frequency spectrum, SHF communication brings forth a myriad of advantages, making it a key player in diverse industries.

The growth of the super high-frequency communication market can be attributed to a confluence of factors propelling its upward trajectory. A primary catalyst is the escalating demand for high-speed and reliable communication solutions in sectors such as aerospace, defense, and telecommunications. As industries increasingly prioritize data-intensive applications, the inherent ability of super high-frequency communication to deliver rapid data transfer with minimal latency becomes a critical advantage. The advent of 5G technology and the expanding footprint of satellite communication further amplify the market's growth, with super high-frequency systems proving instrumental in meeting the connectivity demands of these advanced networks. Additionally, the market benefits from ongoing technological innovations, ensuring that super high-frequency Communication remains at the forefront of cutting-edge solutions. The resilience of this technology in addressing evolving communication needs positions it as a key driver in the global market, promising sustained growth in the foreseeable future.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 16.52% |

| Market Revenue by 2033 | USD 11.44 billion |

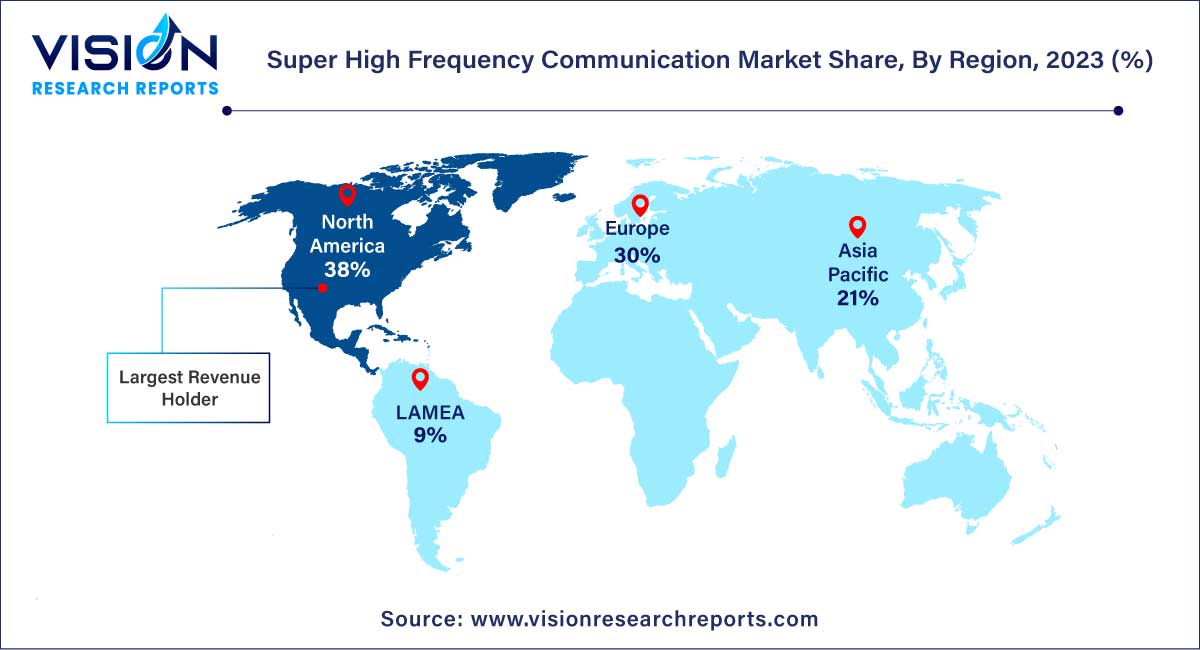

| Revenue Share of North America in 2023 | 38% |

| CAGR of Asia Pacific from 2024 to 2033 | 17.54% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

High-Speed Data Transfer Demands:

The insatiable demand for rapid data transfer across industries, particularly in applications where low latency is critical, drives the adoption of super high-frequency Communication. Its ability to facilitate high-speed data transmission positions it as a crucial solution for meeting evolving connectivity needs.

Aerospace Applications:

In the aerospace sector, super high-frequency communication is instrumental in enabling swift and reliable communication between aircraft and ground stations. This is essential for navigation, safety, and real-time data exchange, contributing to the market's growth.

Spectrum Congestion:

As demand for high-frequency spectrum increases, congestion becomes a concern. The limited availability of spectrum bands for super high-frequency communication can result in interference and reduced system efficiency, posing challenges for seamless and reliable communication.

Complexity in Integration:

The integration of super high-frequency communication systems into existing infrastructures can be complex. Compatibility issues and the need for specialized expertise in implementation may pose challenges for organizations looking to adopt or upgrade their communication systems.

Satellite Communication Evolution:

The continuous evolution of satellite communication technologies opens doors for SHF Communication market growth. As satellites become more advanced and versatile, the demand for high-capacity data transfer through SHF systems in satellite communication applications is expected to rise.

Rise in Internet of Things (IoT) Connectivity:

The proliferation of IoT devices across various industries requires robust and reliable communication systems. super high-frequency communication, with its high-speed capabilities and low latency, is well-positioned to support the increasing connectivity demands of the IoT ecosystem, presenting a lucrative opportunity for market players.

The radar segment accounted for the largest revenue share of 49% in 2023. The high segment share is attributable to the significant deployment of SHF communication systems across the military, ship, and commercial radar applications. Further, radar systems are used in key military applications, which include target recognition, target detection, weapon guidance in a missile system, and tracking enemy locations. The growing use of radar systems in military & defense applications further drives the segment’s growth.

The 5G mm wave segment is expected to grow at the fastest CAGR of 47.15% during the forecast period. With the evolution of 5G technologies, several key market players such as Nokia, Ericsson, Huawei, Fujitsu, ZTE, Samsung, NEC, and others are heavily investing in developing and deploying new 5G small cell antenna equipment. These radio antennas support different frequency bands, such as 5G sub-6.0 GHz (Below 6.0 GHz) and millimeter-wave frequency bands (Above 24.0 GHz).

On the other hand, the significant focus on releasing mm-Wave frequency bands across key countries such as the U.S., Japan, China, and others has raised the demand for 5G mm-Wave radio antennas, thereby propelling the market’s growth.

The 10 - 20 GHz segment held the largest revenue share of 36% in 2023. The high segment market share is attributable to the extensive offerings of communication systems, supporting a frequency range between 10 and 20 GHz. Several crucial applications, such as military aircraft, airborne weather radar, fire control radar, ground mapping radar, missile tracking radar, and surface moving target identification, mainly operate on frequencies between 10 to 20 GHz.

Additionally, the rising demand for such applications across the military, commercial, and naval sectors is estimated to help the 10 - 20 GHz segment grow notably during the forecast period.

The 20 - 30 GHz segment is estimated to register the fastest CAGR of 24.44% over the forecast period. Leading telecom operators such as AT&T., Verizon, T-Systems, NTT Docomo, China Telecom, China Mobile, SK Telecom, BT Group, Vodafone, and others are substantially focused on deploying 5G sub-6.0 GHz equipment across their respective nations. This, in turn, is expected to boost the overall demand for SHF communication systems. Furthermore, the rapid increase in LEO satellite launch, supporting Ku and Ka bands of frequencies, is expected to boost the 20-30 GHz segment demand growth, notably from 2022 to 2032.

The sandwich segment contributed the largest market share of 63% in 2023. The high segment share is primarily attributed to significant offerings by prominent manufacturers such as L3HARRIS, INC., Saint-Gobain, Cob Ham Limited, and others in the global market. A sandwich radome is widely adopted due to its simple structure, high broadband capabilities, and exceptional strength-to-weight ratio compared to the radome types.

Sandwich radome comes in three categories: A-Sandwich, B-Sandwich, and C-Sandwich. Moreover, the robust demand for sandwich radome for multiple applications such as military and civil radar, SATCOM, broadcast equipment, telecommunications, coastal surveillance, microwave, and others is anticipated to propel the segment growth during the forecast period.

The multi-layer system segment is expected to grow at the fastest CAGR of 19.32% over the forecast period. Multi-layer radome delivers high bandwidth and a long scanning range. Another benefit, such as a high strength-to-weight ratio over other radome types, is quite suitable for a few key applications, including spacecraft. Moreover, the multi-layer radome provides high thermal resistance and high bending strength. Owing to these benefits mentioned above, the multi-layer segment is anticipated to expand at a significant growth rate from 2022 to 2032.

North America dominated the market with the largest revenue share of 38% in 2023. The rapidly increasing military spending in the U.S. is expected to boost the adoption of advanced technologies, such as improvements in military aircraft, SATCOM equipment, surveillance systems, and others. For instance, in the U.S., military spending arrived at USD 778.0 billion in 2020, growing at 4.4% from 2019.

Asia Pacific is anticipated to grow at the fastest CAGR of 17.54% during the forecast period. The growth can be attributed to the robust investments in deploying radar antennas, SATCOM antennas, and others. In Asian countries, the deployment of both 5G sub-6.0GHz and 5G mm-wave equipment is growing at a rapid pace.

By Technology Type

By Frequency Range

By Radome Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Technology Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Super High Frequency Communication Market

5.1. COVID-19 Landscape: Super High Frequency Communication Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Super High Frequency Communication Market, By Technology Type

8.1. Super High Frequency Communication Market, by Technology Type, 2024-2033

8.1.1 5G sub-6.0 GHz

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. 5G mm-Wave

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. LEO SATCOM

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Radar

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Super High Frequency Communication Market, By Frequency Range

9.1. Super High Frequency Communication Market, by Frequency Range, 2024-2033

9.1.1. 3 - 10 GHz

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. 10 - 20 GHz

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. 20 - 30 GHz

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. 30 - 40 GHz

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Above 40 GHz

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Super High Frequency Communication Market, By Radome Type

10.1. Super High Frequency Communication Market, by Radome Type, 2024-2033

10.1.1. Sandwich

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Solid Laminate

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Multi-layer System

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Tensioned Fabric

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Other

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Super High Frequency Communication Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Technology Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Frequency Range (2021-2033)

11.1.3. Market Revenue and Forecast, by Radome Type (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Technology Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Frequency Range (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Radome Type (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Technology Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Frequency Range (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Radome Type (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Technology Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Frequency Range (2021-2033)

11.2.3. Market Revenue and Forecast, by Radome Type (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Technology Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Frequency Range (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Radome Type (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Technology Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Frequency Range (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Radome Type (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Technology Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Frequency Range (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Radome Type (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Technology Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Frequency Range (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Radome Type (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Technology Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Frequency Range (2021-2033)

11.3.3. Market Revenue and Forecast, by Radome Type (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Technology Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Frequency Range (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Radome Type (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Technology Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Frequency Range (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Radome Type (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Technology Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Frequency Range (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Radome Type (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Technology Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Frequency Range (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Radome Type (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Technology Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Frequency Range (2021-2033)

11.4.3. Market Revenue and Forecast, by Radome Type (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Technology Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Frequency Range (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Radome Type (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Technology Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Frequency Range (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Radome Type (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Technology Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Frequency Range (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Radome Type (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Technology Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Frequency Range (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Radome Type (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Technology Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Frequency Range (2021-2033)

11.5.3. Market Revenue and Forecast, by Radome Type (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Technology Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Frequency Range (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Radome Type (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Technology Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Frequency Range (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Radome Type (2021-2033)

Chapter 12. Company Profiles

12.1. Astronics Corporation.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Cobham Limited.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Raycap.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. General Dynamics Corporation.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Hensoldt.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. JENOPTIK AG

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. L3Harris Technologies, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Northrop Grumman

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Saint-Gobain.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. The NORDAM Group LLC

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others