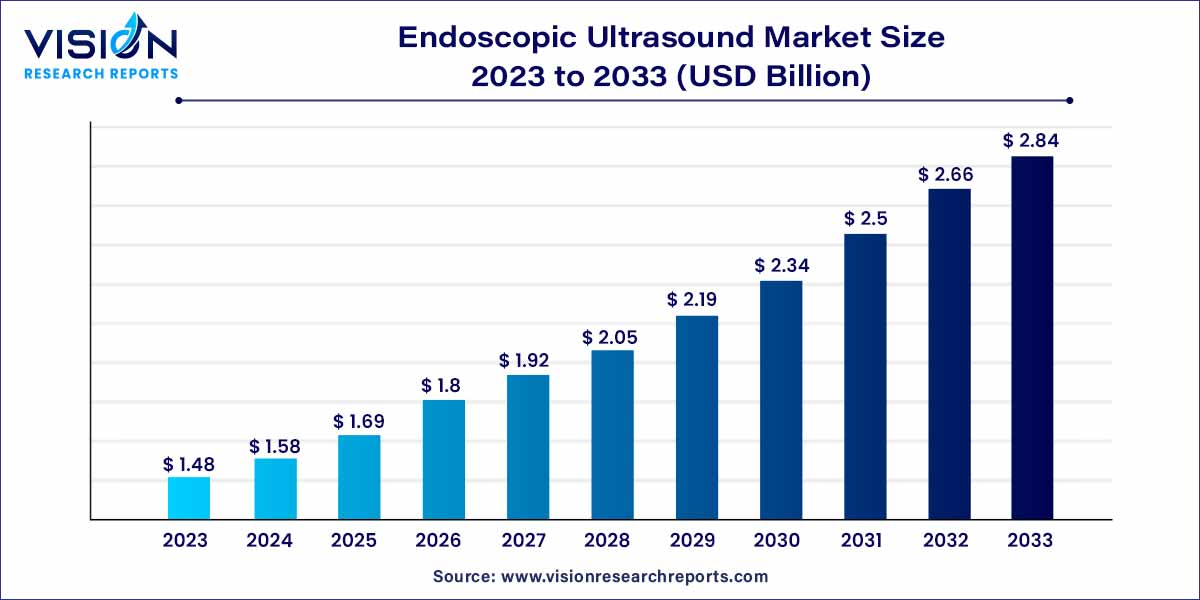

The global endoscopic ultrasound market was estimated at USD 1.48 billion in 2022 and it is expected to surpass around USD 2.84 billion by 2033, poised to grow at a CAGR of 6.75% from 2024 to 2033.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 2.84 billion |

| Growth Rate from 2024 to 2033 | CAGR of 6.75% |

| Revenue Share of North America in 2023 | 31% |

| CAGR of Asia Pacific from 2024 to 2033 | 7.66% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The market is experiencing growth driven by multiple factors, including the increasing incidence of gastrointestinal cancer, advancements in technology, and a rising prevalence of pancreaticobiliary malignancies. For instance, the American Cancer Society's projections for 2023 indicate approximately 64,050 new cases of pancreatic cancer in the U.S., with an anticipated 50,550 deaths attributed to pancreatic cancer. Globally, lung cancer remains a leading cause of cancer-related fatalities, as highlighted by the Lung Cancer Research Foundation, which estimates that 1 in 16 individuals will be diagnosed with lung cancer during their lifetime.

In March 2023, Cancer.Net reported approximately 238,340 new cases of lung cancer diagnosed in the U.S., with a global total of 2,206,771 cases in 2020. Colorectal cancer (CRC) ranks as the second-leading cause of cancer-related deaths worldwide. The American Cancer Society projects nearly 153,020 new CRC cases and 52,550 deaths in the U.S. in 2023, underscoring its significant impact. These statistics provide insights into the potential market growth during the forecast period.

Furthermore, increased investment in research and development within the field of endoscopic ultrasound is poised to drive market expansion. A noteworthy development, as highlighted in a June 2023 article from the National Institutes of Health, involves the integration of white light and ultrasound imaging into a secure capsule, known as ultrasound capsule endoscopy (USCE). This innovation, designed for superficial and submucosal imaging of the esophagus, represents a notable advancement.

Additionally, various devices for interventional endoscopic ultrasound, such as puncture needles, guidewires, tract dilation devices, stents, and troubleshooting devices, have been developed. The American Society for Gastrointestinal Endoscopy emphasizes these advancements. Key companies are contributing to market growth through increased research and development activities, exemplified by the introduction of the Olympus EU-ME3 endoscopic ultrasound processor platform in October 2022. This platform enhances diagnostics for conditions like pancreatitis, pancreatic cancer, and facilitates the detection of invasion in stomach and esophageal cancers.

The endoscope segment dominated the market with the highest revenue share of 34% in 2023. This dominance can be attributed to factors, such as an increasing number of echo-endoscopy procedures, an increase in awareness about the benefits of early detection of diseases, and advancement in endoscope technology. For instance, in May 2023, Olympus Corp. announced the FDA clearance of the EVIS X1 endoscopy system, with two compatible gastrointestinal endoscopes i.e., GIF-1100 gastrointestinal videoscope and CF-HQ1100DL/I colonovideoscope. Medical professionals use Olympus GI endoscopy devices to aid in the diagnosis, treatment, and observation of diseases and disorders of the upper and lower GI tract, including acid reflux, ulcers, Crohn's disease, Celiac disease, and colon cancer.

An endoscope is often utilized for screening colonoscopies, in which a doctor examines the lining of the colon and removes any polyps that could potentially be malignant growths. Physicians may find it easier to see anomalies with the inclusion of modern imaging technologies. The needle segment is expected to grow at the highest CAGR of 8.05% from 2023 to 2032. The needle is commonly used to obtain tissue samples from various organs and lesions within the gastrointestinal tract, such as the pancreas, liver, lymph nodes, and gastrointestinal wall. Also, the fine-needle aspiration of lymph nodes and adjacent structures helps in staging tumors accurately. In addition, the rising prevalence of gastrointestinal diseases is expected to propel the market growth. For instance, as per the American Cancer Society Journal, in January 2023, about 21,560 new cases were estimated for esophagus cancer in the U.S., and 26,500 cases were estimated for stomach cancer.

On the basis of application, the lung cancer segment dominated the market with a share of 43% in 2023. The rising prevalence of lung cancer is the major factor propelling the market growth. As per the American Cancer Society, about 21,560 new cases of lung cancer will be diagnosed in the U.S. in 2023. Lung cancer can be caused by several factors, such as tobacco smoking, previous radiation therapy, and exposure to radon gases. According to statistics published by the Center for Disease Control and Prevention in May 2023, about 28.3 million adults in the U.S. smoke cigarettes, about 3.08 million middle and secondary school students in the U.S. use at minimum one tobacco product, including e-cigarettes, an estimated 1,600 U.S. youth smoke their first cigarette every day.

Nearly 500,000 Americans die prematurely each year as a result of smoking or being exposed to secondhand smoke. Another 16 million people suffer from a severe illness brought on by smoking. The U.S. spends about USD 225 billion annually on medical treatment to treat diseases brought on by adult smoking. The gastrointestinal cancer segment is expected to grow at the highest CAGRof 7.6% from 2024 to 2033. The rising prevalence of gastrointestinal cancer is expected to boost market growth. GI tract cancer includes anal cancer, bile duct cancer, colon cancer, esophageal cancer, gallbladder cancer, liver cancer, rectal cancer, gastrointestinal stromal cancer, small intestine cancer, and stomach cancer.

For instance, as per the American Cancer Society Journal published in January 2023, about 348,840 new cases will be estimated for digestive system cancer in the U.S. in 2023.Every year, 1.5% of all new cancer cases in the U.S. are diagnosed as stomach cancer. Usually, older people of average age 68 years and above get diagnosed with stomach cancer. Each year, 6 out of 10 instances of stomach cancer are diagnosed in patients aged 65 years or older. Men are at higher risk of developing stomach cancer (approximately 1 in 96) than women (about 1 in 152).

The hospital segment held the largest share of 40% in 2023. This growth can be attributed to the favorable health reimbursement for minimally invasive processes, developed and advanced healthcare infrastructure, and an increase in the number of trained and qualified endoscopists. For instance, as per the American Hospital Association, in May 2023, there were a total of 6129 hospitals present in the U.S. Moreover, the rising geriatric population is expected to boost the hospital segment growth as most hospitalizations in the United States are related to people aged 65 years and over.

The ambulatory surgical centers segment is expected to grow at the highest CAGR of 7.22% from 2024 to 2033. The increasing prevalence of gastrointestinal diseases, such as esophageal cancer, gastric (stomach) cancer, colorectal cancer, liver cancer, and pancreaticobiliary diseases, such as gallbladder disease, pancreas disease, and bile duct disease, is expected to boost segment growth. For instance, as per the Cancer.Net, about 26,500 new cases of stomach cancer will be diagnosed in the U.S. In addition, ASCs provide a more convenient and comfortable environment for patients, which can lead to higher patient satisfaction and increased demand for EUS procedures.

North America dominated the global market with the largest share of 31% in 2023. Increasing investment in R&D by the government & key companies present in the region, well-developed healthcare infrastructure, and technological development in endoscopic ultrasound in North America contribute to its growth. For instance, in July 2023, Cook Medical launched the high-resolution ultrasound biopsy needle i.e., EchoTip ProCore, which allows clinicians to collect larger tissue samples from the inaccessible region using minimally invasive endoscopic ultrasound procedures.

Asia Pacific is expected to grow at the highest CAGR of 7.66% from 2024 to 2033. Increasing awareness among people about the early detection of diseases and rising instances of CRC in the Asia Pacific region is expected to boost demand for endoscopic ultrasound in this region. In addition, the rising geriatric population is boosting the demand for endoscopic ultrasound in Asia Pacific. For instance, as per the NIH, in August 2022, the Asia Pacific region had the largest number of CRC cases and the highest rate of mortality.

By Product

By Application

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Endoscopic Ultrasound Market

5.1. COVID-19 Landscape: Endoscopic Ultrasound Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Endoscopic Ultrasound Market, By Product

8.1. Endoscopic Ultrasound Market, by Product, 2024-2033

8.1.1 Endoscope

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Ultrasound Probe

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Needle

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Accessories

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Ultrasonic Processors

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Endoscopic Ultrasound Market, By Application

9.1. Endoscopic Ultrasound Market, by Application, 2024-2033

9.1.1. Gastrointestinal Cancer

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Lung Cancer

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Pancreaticobiliary Disease

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Endoscopic Ultrasound Market, By End-use

10.1. Endoscopic Ultrasound Market, by End-use, 2024-2033

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Ambulatory Surgical Centers

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Endoscopic Ultrasound Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Boston Scientific Corporation.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Medtronic.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. ConMed.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Olympus Corporation.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Steris.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. SonoScape Medical Corp.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. PENTEX Medical.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. FUJIFILM India Private Limited

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Cook Medical.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Sezzle

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others