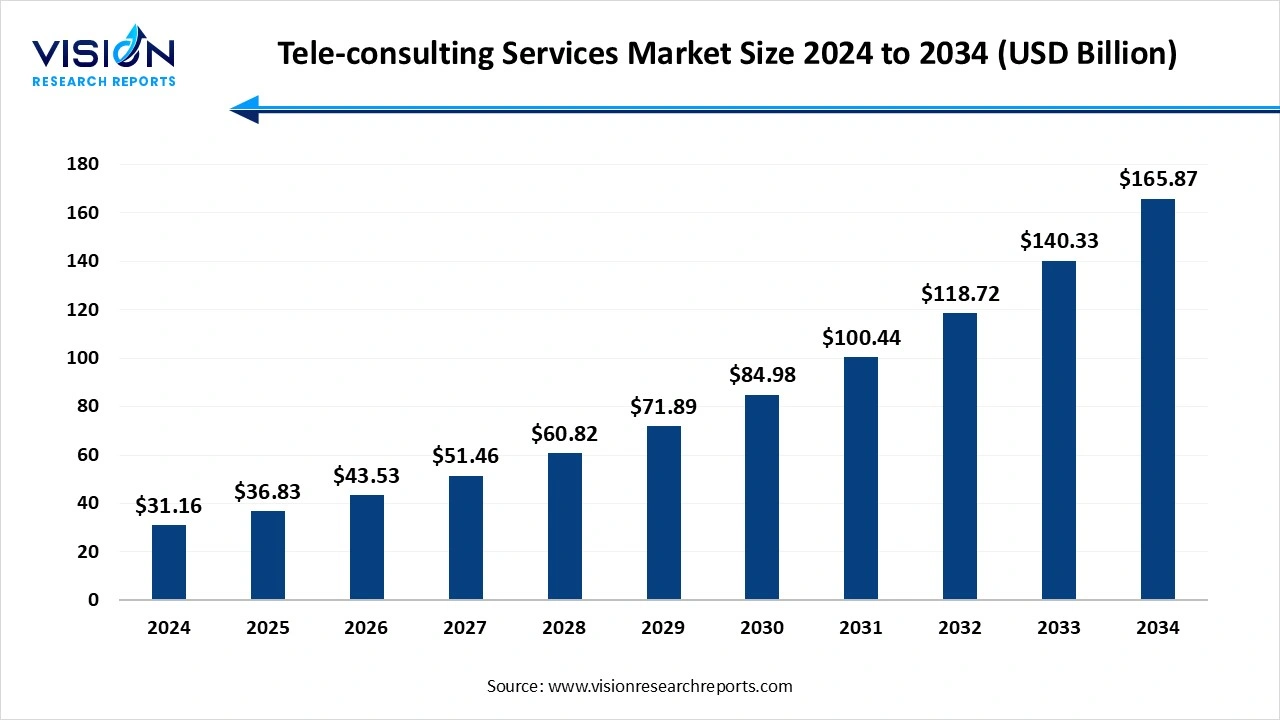

The global tele-consulting services market size was estimated at around USD 31.16 billion in 2024, expected to reach USD 36.83 billion in 2025, and projected to hit USD 165.87 billion by 2034, growing at a CAGR of 18.2% from 2025 to 2034. The market growth is driven by rising demand for affordable virtual healthcare, increasing smartphone and internet penetration, supportive government policies, and advancements in AI and digital health technologies. Post-pandemic adoption of telemedicine and integration of wearable devices further boost market expansion.

Key Pointers

Key Pointers The tele-consulting services market has witnessed significant growth in recent years, driven by advancements in digital health technologies and an increasing demand for accessible, cost-effective healthcare solutions. This market consists of different virtual medical consultations that spans across various specialties, enabling patients to connect with healthcare professionals remotely via video, phone or chat platforms.

The COVID-19 pandemic played a vital role in accelerating its adoption, with regulatory support and insurance coverage reforms further fueling expansion. Key players in the market are increasingly investing in AI-driven platforms, electronic health record integration and enhanced user interfaces to improve service delivery and patient outcomes.

One of the primary growth drivers of the tele-consulting services market is the increasing global demand for accessible and affordable healthcare. With rising healthcare costs and a shortage of medical professionals, especially in rural and underserved regions, tele-consulting provides a scalable solution that bridges the gap between patients and providers. The proliferation of smartphones, high-speed internet connectivity, and user-friendly telehealth platforms has further empowered patients to seek medical consultations without the need for physical visits.

Another critical factor contributing to the market's growth is the evolving regulatory landscape and insurance reimbursement models. Governments and health agencies across the globe have introduced favorable policies to integrate telehealth into mainstream care, especially following the COVID-19 pandemic. This includes relaxed licensing regulations, expanded service coverage, and digital infrastructure investments. Simultaneously, advances in artificial intelligence, wearable health devices, and cloud-based EHR systems are enhancing the quality and efficiency of tele-consulting services, making them a viable long-term solution for both primary and specialized care.

| Report Coverage | Details |

| Market Size in 2024 | USD 31.16 Billion |

| Revenue Forecast by 2034 | USD 165.87 Billion |

| Growth rate from 2025 to 2034 | CAGR of 18.2% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Teladoc Health, Inc., Amwell (American Well Corporation), MDLIVE, Inc., Doctor on Demand, Inc., Babylon Health, Ping An Good Doctor, CVS Health Corporation (MinuteClinic Virtual Care), Practo Technologies Pvt. Ltd., 1mg Technologies Pvt. Ltd., Zocdoc, Inc., HealthTap, Inc., GlobalMed, Doxy.me, Virtuwell (HealthPartners), and Philips Healthcare. |

Key drivers propelling the market forward is the global momentum for digital access to healthcare, increased burden of chronic diseases and the growing demand for virtual care in real-time. The lack of healthcare workers, especially in rural and underserved areas has driven up the demand of tele-consulting services.

Investments in telehealth software and wearables integration is also another key driver. The market’s expansion has further been driven by regulatory developments, including the FDA's expanded telehealth guidelines and the digital health interoperability strategies set by the European Commission. These investments and innovations are showcasing improved doctor-patient connectivity, shorter consultation time and increased has also increased access, pushing the tele-consulting services market.

Despite several growth prospects, the market does have its fair share of challenges. One such challenge is the complex regulatory frameworks governing teleconsulting services across different jurisdictions. This may create operational challenges for service providers. Healthcare licensing requirements traditionally operate within geographical boundaries, and teleconsulting services cross these jurisdictional lines.

Thus, medical practitioners are forced to navigate each varying state, national and international licensing requirements in order to provide virtual consultations. These regulatory burdens impact innovative startups, small scale companies and regional providers, limiting market competition and innovation and also slowing down growth and development.

The teleconsulting services market is witnessing a high degree of innovation and is opening up new avenues of opportunities. One such key opportunity is the introduction of new technologies and methods. Integrating artificial intelligence and machine learning into teleconsulting platforms and services is completely revolutionizing healthcare delivery. These technologies assist healthcare providers in analyzing patient data remotely and thoroughly, enabling them to provide a more personalized and effective way acare.

The tele-consulting services market is also witnessing a rise of merger and acquisitions activity through global leading players. This rise is due to several factors, including the desire to expand the business to cater to the growing demand for teleconsultation services and to maintain a competitive advantage.

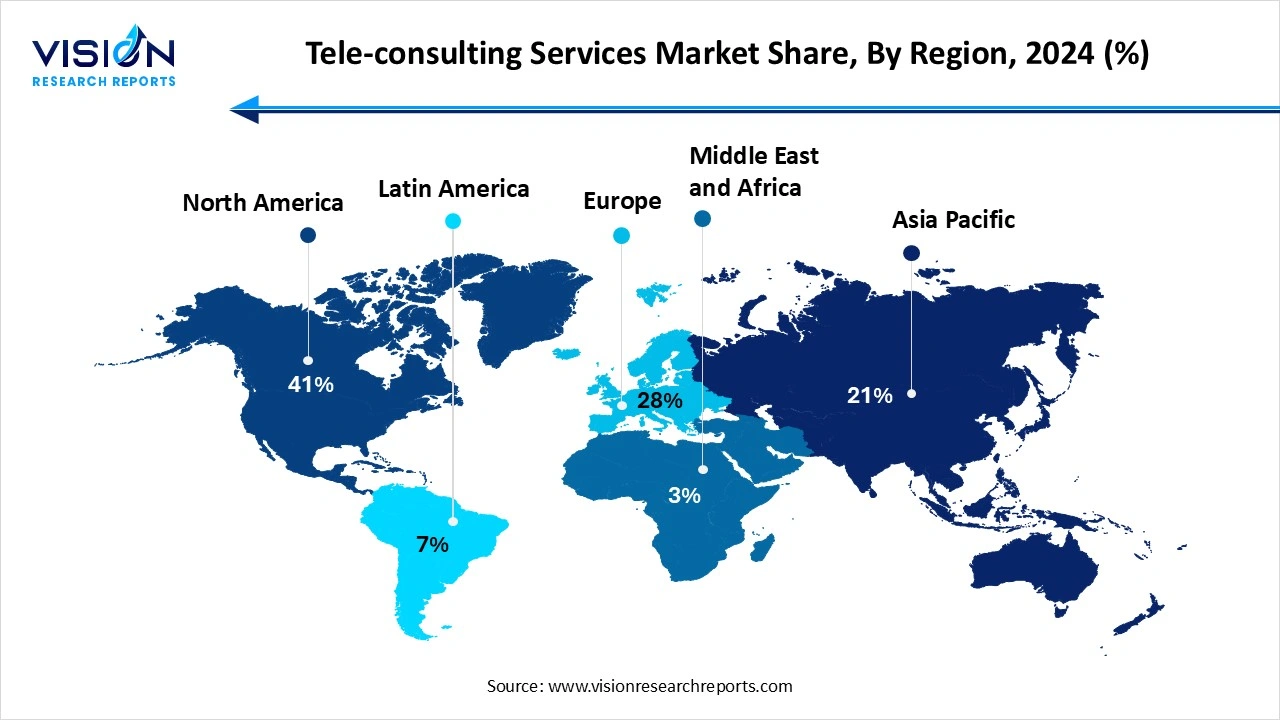

North America led the global tele-consulting services market is accounting for 41% of the total revenue share in 2024. This dominance is driven by its robust digital health ecosystems, high internet penetration and strong government support for telemedicine. The region benefits from favorable reimbursement policies, widespread insurance coverage and the quicks adoption of advanced telehealth systems and platforms. There are several public healthcare initiatives taking place in the region, especially in U.S and Canada that emphasize on remote care to address vast populations.

Asia Pacific is seen to experience the fastest growth rate during the forecast period. This rapid growth is due to the region’s increasing healthcare demands, expanding internet access and several government initiatives being deployed that are set on promoting digital health in countries like China, India, Japan and Australia. The region’s vast population base and rising chronic disease prevalence further heightens the need for advanced tele-consulting services.

The mental health segment dominated the market share 37% in 2024. The global stigma surrounding mental illness coupled with limited access to licensed therapists in several areas has made virtual consultations a preferable option for many patients. Tele-consulting mental health platforms offer discreet, timely, safe and flexible access to mental health professionals, helping individuals receive therapy, counseling, and psychiatric evaluations without any barriers.

The dermatology segment is expected to experience the fastest growth throughout the forecast period. Through high-resolution image sharing and video consultations, dermatologists are able to effectively assess and provide guidance on a wide range of issues, including acne, rashes, eczema, and chronic conditions like psoriasis. This segment is especially beneficial for patients in remote areas who may lack access to specialized care. The market is also driven by increased awareness regarding aesthetic treatments.

Which Modality Type led the market in 2024?

The real-time segment accounted for the largest market share, capturing 40% of the total in 2024. This is because it allows patients and healthcare professionals to engage in live audio or video consultations, creating a simulation of a traditional face-to-face visit. Real-time tele-consulting is highly valuable for primary care, mental health services and emergency medical advice, where prompt interaction is crucial for diagnosis and treatment. The adoption of this modality has risen more due to the widespread use of smartphones and the integration of user-friendly platforms.

The others segment is anticipated to witness the fastest growth over the forecast period. In this model, patients or healthcare providers capture and transmit medical data such as images, reports or recorded videos to specialists who review the information later. This approach is especially effective in specialties like dermatology, radiology and pathology, where detailed visuals or test results are analyzed before diagnosis. It is a flexible and cost-effective solution, beneficial for regions who have limited access to specialists.

Which delivery model is dominating the market this year?

The web and mobile segment accounted for the largest market share at 79% in 2024. This is because it allows patients to schedule appointments, engage in video or chat-based consultations, access medical records and even receive prescriptions through user-friendly applications. The increasing penetration of smartphones, widespread internet access and the evolution of secure health apps has revolutionized how patients interact with healthcare providers. The advantage of this segment lies in its convenience, real-time accessibility and integration with wearable devices that supports remote monitoring.

Call center-based delivery models are expected to grow at the fastest rate. This is because they play an important role in the global tele-consulting ecosystem, especially in regions that have limited digital infrastructure or among populations who are not quite familiar with smartphones and web applications. These models operate through centralized hubs where trained medical professionals and support staff provide healthcare guidance, triage services, appointment scheduling, and follow-ups over the phone. Additionally, they serve as a link in hybrid care models, supporting both digital and in-person services.

Which End user Held the Largest Market Share in 2024?

The patients segment accounted for the largest market share, capturing 37% of the total in 2024. For patients, tele-consulting offers unparalleled convenience, enabling remote consultations that save time, reduce travel expenses, and provide access to specialists who may not be locally available. This accessibility is particularly beneficial for those living in rural or underserved areas, as well as for patients managing chronic conditions who require frequent monitoring and follow-up. The flexibility of tele-consulting empowers patients to take a more active role in their healthcare decisions, fostering greater adherence to treatment plans and promoting preventive care.

The healthcare providers segment is estimated to have the fastest growth rate throughout the forecast period. Tele-consulting enables providers to optimize appointment scheduling, reduce no-show rates and manage patient loads in a more effective manner. Providers are able to deliver timely care, conduct follow-ups and engage in multidisciplinary collaborations without any geographic constraints. This not only helps to enhance patient outcomes but also deals with physician shortages.

By Application

By Modality

By Payment Model

By Delivery Model

By Facility

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. End Use Procurement Analysis

4.3.2. Sales and Distribution Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Tele-consulting Services Market

5.1. COVID-19 Landscape: Tele-consulting Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Tele-consulting Services Market, By Application

8.1. Tele-consulting Services Market, by Application

8.1.1. Primary Care

8.1.1.1. Market Revenue and Forecast

8.1.2. Mental Health

8.1.2.1. Market Revenue and Forecast

8.1.3. Cardiology

8.1.3.1. Market Revenue and Forecast

8.1.4. Dermatology

8.1.4.1. Market Revenue and Forecast

8.1.5. thers (Endocrinology, Orthopedics, Gynecology, etc.)

8.1.5.1. Market Revenue and Forecast

Chapter 9. Global Tele-consulting Services Market, By Modality

9.1. Tele-consulting Services Market, by Modality

9.1.1. Store and forward

9.1.1.1. Market Revenue and Forecast

9.1.2. Real time

9.1.2.1. Market Revenue and Forecast

9.1.3. Others

9.1.3.1. Market Revenue and Forecast

Chapter 10. Global Tele-consulting Services Market, By Payment Model

10.1. Tele-consulting Services Market, by Payment Model

10.1.1. Self-Pay (Out-of-pocket)

10.1.1.1. Market Revenue and Forecast

10.1.2. Insurance Reimbursement

10.1.2.1. Market Revenue and Forecast

10.1.3. Employer-sponsored

10.1.3.1. Market Revenue and Forecast

10.1.4. Government/Public Payers

10.1.4.1. Market Revenue and Forecast

10.1.5. Others

10.1.5.1. Market Revenue and Forecast

Chapter 11. Global Tele-consulting Services Market, By Delivery Model

11.1. Tele-consulting Services Market, by Delivery Model

11.1.1. Web/Mobile

11.1.1.1. Market Revenue and Forecast

11.1.2. Call Centers

11.1.2.1. Market Revenue and Forecast

Chapter 12. Global Tele-consulting Services Market, By Facility

12.1. Tele-consulting Services Market, by Facility

12.1.1. Tele-hospitals

12.1.1.1. Market Revenue and Forecast

12.1.2. Tele-home

12.1.2.1. Market Revenue and Forecast

Chapter 13. Global Tele-consulting Services Market, By End Use

13.1. Tele-consulting Services Market, by End Use

13.1.1. Patients

13.1.1.1. Market Revenue and Forecast

13.1.2. Payers

13.1.2.1. Market Revenue and Forecast

13.1.3. Providers

13.1.3.1. Market Revenue and Forecast

13.1.4. Others

13.1.4.1. Market Revenue and Forecast

Chapter 14. Global Tele-consulting Services Market, Regional Estimates and Trend Forecast

14.1. North America

14.1.1. Market Revenue and Forecast, by Application

14.1.2. Market Revenue and Forecast, by Modality

14.1.3. Market Revenue and Forecast, by Payment Model

14.1.4. Market Revenue and Forecast, by Delivery Model

14.1.5. Market Revenue and Forecast, by Facility

14.1.6. Market Revenue and Forecast, by End Use

14.1.7. U.S.

14.1.7.1. Market Revenue and Forecast, by Application

14.1.7.2. Market Revenue and Forecast, by Modality

14.1.7.3. Market Revenue and Forecast, by Payment Model

14.1.7.4. Market Revenue and Forecast, by Delivery Model

14.1.8. Market Revenue and Forecast, by Facility

14.1.8.1. Market Revenue and Forecast, by End Use

14.1.9. Rest of North America

14.1.9.1. Market Revenue and Forecast, by Application

14.1.9.2. Market Revenue and Forecast, by Modality

14.1.9.3. Market Revenue and Forecast, by Payment Model

14.1.9.4. Market Revenue and Forecast, by Delivery Model

14.1.10. Market Revenue and Forecast, by Facility

14.1.11. Market Revenue and Forecast, by End Use

14.1.11.1.

14.2. Europe

14.2.1. Market Revenue and Forecast, by Application

14.2.2. Market Revenue and Forecast, by Modality

14.2.3. Market Revenue and Forecast, by Payment Model

14.2.4. Market Revenue and Forecast, by Delivery Model

14.2.5. Market Revenue and Forecast, by Facility

14.2.6. Market Revenue and Forecast, by End Use

14.2.7.

14.2.8. UK

14.2.8.1. Market Revenue and Forecast, by Application

14.2.8.2. Market Revenue and Forecast, by Modality

14.2.8.3. Market Revenue and Forecast, by Payment Model

14.2.9. Market Revenue and Forecast, by Delivery Model

14.2.10. Market Revenue and Forecast, by Facility

14.2.10.1. Market Revenue and Forecast, by End Use

14.2.11. Germany

14.2.11.1. Market Revenue and Forecast, by Application

14.2.11.2. Market Revenue and Forecast, by Modality

14.2.11.3. Market Revenue and Forecast, by Payment Model

14.2.12. Market Revenue and Forecast, by Delivery Model

14.2.13. Market Revenue and Forecast, by Facility

14.2.14. Market Revenue and Forecast, by End Use

14.2.14.1.

14.2.15. France

14.2.15.1. Market Revenue and Forecast, by Application

14.2.15.2. Market Revenue and Forecast, by Modality

14.2.15.3. Market Revenue and Forecast, by Payment Model

14.2.15.4. Market Revenue and Forecast, by Delivery Model

14.2.16. Market Revenue and Forecast, by Facility

14.2.16.1. Market Revenue and Forecast, by End Use

14.2.17. Rest of Europe

14.2.17.1. Market Revenue and Forecast, by Application

14.2.17.2. Market Revenue and Forecast, by Modality

14.2.17.3. Market Revenue and Forecast, by Payment Model

14.2.17.4. Market Revenue and Forecast, by Delivery Model

14.2.18. Market Revenue and Forecast, by Facility

14.2.18.1. Market Revenue and Forecast, by End Use

14.3. APAC

14.3.1. Market Revenue and Forecast, by Application

14.3.2. Market Revenue and Forecast, by Modality

14.3.3. Market Revenue and Forecast, by Payment Model

14.3.4. Market Revenue and Forecast, by Delivery Model

14.3.5. Market Revenue and Forecast, by Facility

14.3.6. Market Revenue and Forecast, by End Use

14.3.7. India

14.3.7.1. Market Revenue and Forecast, by Application

14.3.7.2. Market Revenue and Forecast, by Modality

14.3.7.3. Market Revenue and Forecast, by Payment Model

14.3.7.4. Market Revenue and Forecast, by Delivery Model

14.3.8. Market Revenue and Forecast, by Facility

14.3.9. Market Revenue and Forecast, by End Use

14.3.10. China

14.3.10.1. Market Revenue and Forecast, by Application

14.3.10.2. Market Revenue and Forecast, by Modality

14.3.10.3. Market Revenue and Forecast, by Payment Model

14.3.10.4. Market Revenue and Forecast, by Delivery Model

14.3.11. Market Revenue and Forecast, by Facility

14.3.11.1. Market Revenue and Forecast, by End Use

14.3.12. Japan

14.3.12.1. Market Revenue and Forecast, by Application

14.3.12.2. Market Revenue and Forecast, by Modality

14.3.12.3. Market Revenue and Forecast, by Payment Model

14.3.12.4. Market Revenue and Forecast, by Delivery Model

14.3.12.5. Market Revenue and Forecast, by Facility

14.3.12.6. Market Revenue and Forecast, by End Use

14.3.13. Rest of APAC

14.3.13.1. Market Revenue and Forecast, by Application

14.3.13.2. Market Revenue and Forecast, by Modality

14.3.13.3. Market Revenue and Forecast, by Payment Model

14.3.13.4. Market Revenue and Forecast, by Delivery Model

14.3.13.5. Market Revenue and Forecast, by Facility

14.3.13.6. Market Revenue and Forecast, by End Use

14.4. MEA

14.4.1. Market Revenue and Forecast, by Application

14.4.2. Market Revenue and Forecast, by Modality

14.4.3. Market Revenue and Forecast, by Payment Model

14.4.4. Market Revenue and Forecast, by Delivery Model

14.4.5. Market Revenue and Forecast, by Facility

14.4.6. Market Revenue and Forecast, by End Use

14.4.7. GCC

14.4.7.1. Market Revenue and Forecast, by Application

14.4.7.2. Market Revenue and Forecast, by Modality

14.4.7.3. Market Revenue and Forecast, by Payment Model

14.4.7.4. Market Revenue and Forecast, by Delivery Model

14.4.8. Market Revenue and Forecast, by Facility

14.4.9. Market Revenue and Forecast, by End Use

14.4.10. North Africa

14.4.10.1. Market Revenue and Forecast, by Application

14.4.10.2. Market Revenue and Forecast, by Modality

14.4.10.3. Market Revenue and Forecast, by Payment Model

14.4.10.4. Market Revenue and Forecast, by Delivery Model

14.4.11. Market Revenue and Forecast, by Facility

14.4.12. Market Revenue and Forecast, by End Use

14.4.13. South Africa

14.4.13.1. Market Revenue and Forecast, by Application

14.4.13.2. Market Revenue and Forecast, by Modality

14.4.13.3. Market Revenue and Forecast, by Payment Model

14.4.13.4. Market Revenue and Forecast, by Delivery Model

14.4.13.5. Market Revenue and Forecast, by Facility

14.4.13.6. Market Revenue and Forecast, by End Use

14.4.14. Rest of MEA

14.4.14.1. Market Revenue and Forecast, by Application

14.4.14.2. Market Revenue and Forecast, by Modality

14.4.14.3. Market Revenue and Forecast, by Payment Model

14.4.14.4. Market Revenue and Forecast, by Delivery Model

14.4.14.5. Market Revenue and Forecast, by Facility

14.4.14.6. Market Revenue and Forecast, by End Use

14.5. Latin America

14.5.1. Market Revenue and Forecast, by Application

14.5.2. Market Revenue and Forecast, by Modality

14.5.3. Market Revenue and Forecast, by Payment Model

14.5.4. Market Revenue and Forecast, by Delivery Model

14.5.5. Market Revenue and Forecast, by Facility

14.5.6. Market Revenue and Forecast, by End Use

14.5.7. Brazil

14.5.7.1. Market Revenue and Forecast, by Application

14.5.7.2. Market Revenue and Forecast, by Modality

14.5.7.3. Market Revenue and Forecast, by Payment Model

14.5.7.4. Market Revenue and Forecast, by Delivery Model

14.5.8. Market Revenue and Forecast, by Facility

14.5.8.1. Market Revenue and Forecast, by End Use

14.5.9. Rest of LATAM

14.5.9.1. Market Revenue and Forecast, by Application

14.5.9.2. Market Revenue and Forecast, by Modality

14.5.9.3. Market Revenue and Forecast, by Payment Model

14.5.9.4. Market Revenue and Forecast, by Delivery Model

14.5.9.5. Market Revenue and Forecast, by Facility

14.5.9.6. Market Revenue and Forecast, by End Use

Chapter 15. Company Profiles

15.1. Teladoc Health, Inc.

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. Amwell (American Well Corporation)

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. MDLIVE, Inc.

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. Doctor on Demand, Inc.

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. Babylon Health

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. Ping An Good Doctor

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. CVS Health Corporation (MinuteClinic Virtual Care)

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. Practo Technologies Pvt. Ltd.

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

15.9. 1mg Technologies Pvt. Ltd.

15.9.1. Company Overview

15.9.2. Product Offerings

15.9.3. Financial Performance

15.9.4. Recent Initiatives

15.10. Zocdoc, Inc.

15.10.1. Company Overview

15.10.2. Product Offerings

15.10.3. Financial Performance

15.10.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others