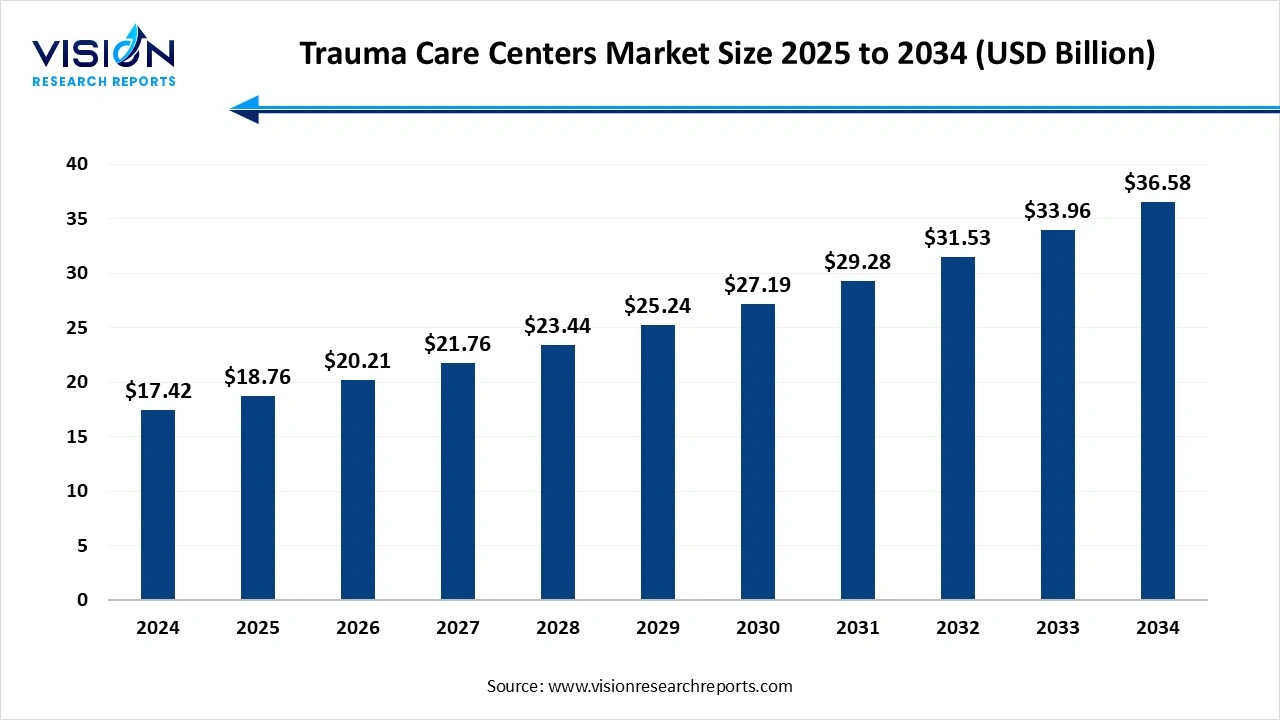

The global trauma care centres market size stood at USD 17.42 billion in 2024 and is estimated to reach USD 18.76 billion in 2025. It is projected to surge past USD 36.58 billion by 2034, registering a robust CAGR of 7.7% from 2025 to 2034. The increasing incidences of trauma, the rising global geriatric population, and growing demand for specialized critical care services in hospitals and standalone facilities drive the expansion of trauma centres.

A specialized medical facility equipped and staffed to provide immediate, comprehensive treatment for patients with severe or life-threatening injuries caused by accidents, falls, violence, or other emergencies. The market growth is driven by the increasing number of road accidents, people requiring emergency medical attention, and treatment at trauma centres. The integration of advanced medical devices, such as wearable sensors, portable ultrasound machines, and AI-powered diagnostic tools, improves the speed and accuracy of treatment. Innovation in pre-hospital emergency medical services, advanced life support training for paramedics rising demand for trauma centers.

The growth of the trauma care centers market is primarily driven by the increasing prevalence of traumatic injuries resulting from road traffic accidents, natural disasters, industrial incidents, and interpersonal violence. As urbanization and motor vehicle use rise globally, so does the demand for specialized emergency care. Additionally, aging populations in many countries are more vulnerable to falls and fractures, further contributing to the surge in trauma-related hospitalizations. The need for immediate, specialized intervention in such critical conditions has made trauma centers a crucial part of healthcare infrastructure.

Moreover, advancements in trauma diagnostics, surgical equipment, and critical care technologies have significantly improved patient outcomes, encouraging healthcare providers to invest in state-of-the-art trauma care facilities. Government support in the form of funding for trauma systems, accreditation programs, and regional trauma networks is also boosting market growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 17.42 billion |

| Revenue Forecast by 2034 | USD 36.58 billion |

| Growth rate from 2025 to 2034 | CAGR of 7.7% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Community Health Systems, Inc., HCA Healthcare, Inc., Tenet Healthcare Corporation, Northwell Health, Sanford Health, Ascension Health, Cleveland Clinic, Mayo Clinic, Massachusetts General Hospital (Partners HealthCare) |

Rising road accidents and injuries

The growing number of accidents, road accidents, remains a leading cause of traumatic injuries globally, and an increase in traffic accidents often requires immediate and complex medical interventions, including surgeries and rehabilitation. Trauma care centers equipped with specialized resources and personnel are crucial for managing these cases and improving patient outcomes.

The elderly population is more susceptible to injuries, especially falls, due to age-related physiological changes such as decreased bone density, slower reflexes, and a higher prevalence of comorbidities. The leading cause of trauma in older adults is falls are a significant cause of injuries in individuals aged 65 and older, making them the leading type of trauma treated in trauma centers. The increasing geriatric population necessitates specialized trauma care services, including tailored rehabilitation programs and multidisciplinary approaches that address the unique needs of older patients.

The government and private sectors are rising investing in building and modernizing healthcare facilities, including specialized trauma centers, to address the needs of their populations. The increasing incidence of accidents and injuries, creating a greater demand for trauma care services. The increasing disposable income and healthcare spending, and a greater demand for quality medical services, including trauma care. The digital health solutions, including telemedicine and mobile health technologies, offer promising avenues for the trauma care centers market, particularly in emerging economies and areas with limited access to specialized care. Their various applications, such as improved access to care, enhanced efficiency and effectiveness, cost-effectiveness, and enhanced training and education, drive market growth.

The establishment and maintenance of advanced trauma facilities requires substantial investment in infrastructure, specialized equipment, skilled personnel, and round-the-clock emergency services. Many trauma centers operate at a financial loss due to underfunding, especially level I and level ll centers that are crucial for high-acuity cases and often function as safety-net hospitals. The low reimbursement rates and insufficient funding initiatives hinder the market growth. A shortage of skilled medical professionals, including trauma surgeons, emergency physicians, and critical care specialists.

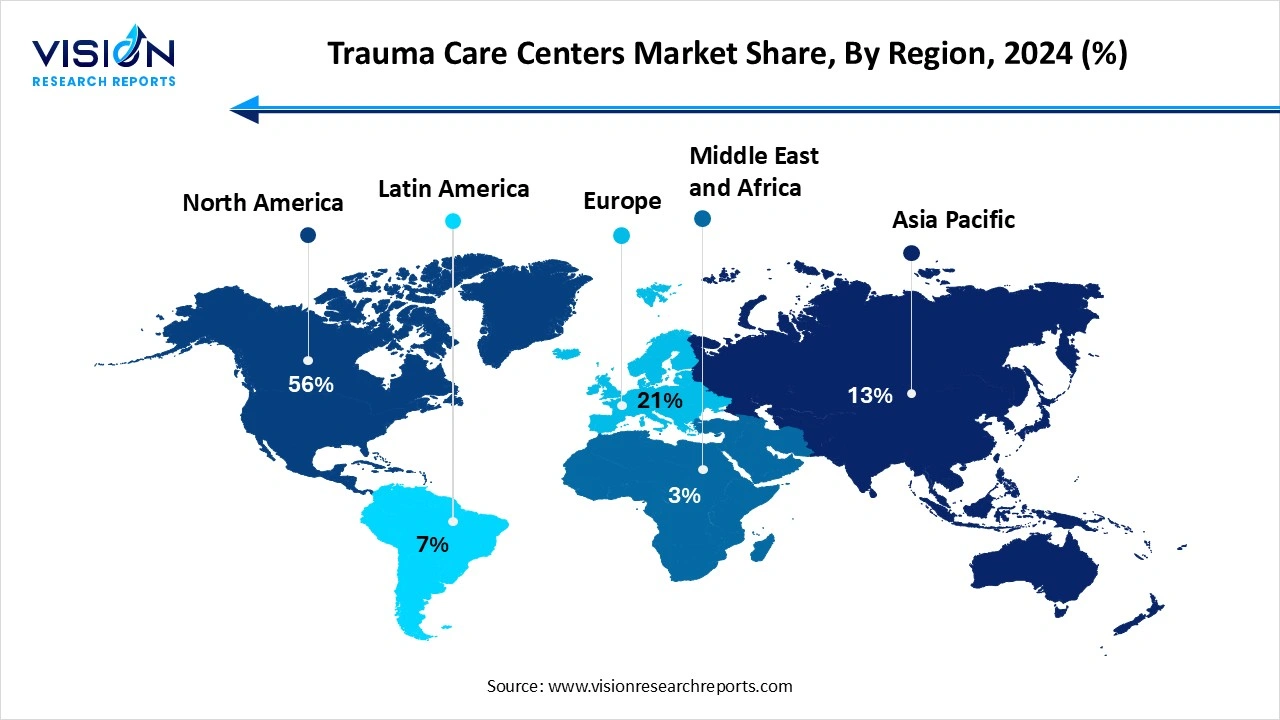

North America led the global trauma care centers market, accounting for a dominant revenue share of 56% in 2024. North America boasts a highly developed and advanced healthcare infrastructure, including numerous well-equipped trauma centers. The region experiences a significant trauma-related injury, such as road accidents, falls, and violence, driving the demand. The advanced medical technology, cutting-edge technologies in trauma care, such as AI, robotics, and telemedicine, are leading to better patient outcomes. The increasing disposable incomes and greater awareness about healthcare drive the demand for advanced trauma treatment. The region has a well-established healthcare infrastructure, a high incidence of medical cases expansion of market growth.

United States Trauma Care Centers Market Trends:

The United States is a major contributor to the trauma care centers market. The region in which rising trauma incidence, such as road accidents, falls, violence, and sports injuries, is boosting demand for trauma services. The falls are a major cause of serious injury among older adults, and the growing elderly population drives the need for trauma care.

The adoption of technology, such as AI diagnostics, telemedicine, and data analytics, is improving patient monitoring, triage, and treatment effectiveness. The increase in investment and government support is enhancing emergency medical services and upgrading trauma care services are dynamic to market expansion.

The US Army military civilian trauma team training program, program allows military personnel to train at high-volume civilian trauma centers. This improves military medical readiness and provides civilian centers with additional skilled staff. (Source: PubMed)

Why is Asia Pacific Significantly Growing in the Trauma Care Centers Market?

Asia Pacific expects significant growth in the market during the forecast period. The rising incidence of traumatic injuries, such as road traffic accidents, falls, and other injuries are major cause of trauma. The emerging economies like China and India are investing heavily in healthcare infrastructure, leading to the development and upgrade of trauma care facilities. Experiencing a significant rise in the elderly population, a demographic prone to fall-related injury.

China Trauma Care Centers Market Trends

China is growing in the trauma care centers market. The rapid urbanization leads to an increased demand for advanced trauma centers in city centers to handle the increasing number of road accidents and work-related injuries. The country's expanding medical tourism industry fuels the development of advanced, high-tech trauma centers, positioning China as a leader in emergency medical care.

Why did the In-House Segment Dominate the Trauma Care Centers Market?

The in-house segment led the market in 2024, accounting for over 72% of the total revenue. The in-house trauma centers, integrated within larger hospitals, can utilize existing resources like operating rooms, intensive care units, imaging equipment, and laboratory services without the need for significant independent investment. The availability of specialized staff is crucial for managing complex trauma cases. The integration of trauma care within a general hospital facilitates a more coordinated and efficient approach to treatment approach to treatment from initial rehabilitation.

The standalone facility type segment is projected to register the fastest CAGR throughout the forecast period. The in-house trauma centers, integrated within larger hospitals, can utilize existing resources like operating rooms, intensive care units, imaging equipment, and laboratory services without the need for significant independent investment. The availability of specialized staff is crucial for managing complex trauma cases. The integration of trauma care within a general hospital facilitates a more coordinated and efficient approach to treatment approach to treatment from initial rehabilitation.

How the Falls Segment Held the Largest Share in the Trauma Care Centers Market?

The Falls segment held the largest revenue share in the trauma care centers market in 2024. The increase in the global elderly population, falls are a frequent cause of injury, requiring medical attention, occurring each year globally a considerable demand for trauma care services. The rising need for immediate and specialized care for fall victims, particularly those with complex injuries, is increasing the demand for trauma care centers equipped to handle these cases. In some regions, governments are actively involved in promoting the establishment of trauma centers and implementing initiatives to minimize falls among high-risk groups, including the elderly. A rising awareness about the importance of timely and specialized trauma intervention for fall victims, innovations of dedicated trauma care units within hospitals, and stand-alone facilities.

The burn injury segment is experiencing the fastest growth in the market during the forecast period. The increasing incidence of burn injury in fire, scalds, chemicals, and electricity, with an increasing worldwide incidence, is seen in developing countries due to inadequate safety standards. Burn injury causes tissue damage, fluid loss, and life-threatening complications. Inhalation injuries demand the specialized resources, critical care services, and expertise found in dedicated burn units within advanced trauma centers. The innovation in treatment, rising awareness, and expenditure contribute to the demand for comprehensive burn care services.

The outpatient segment dominated the trauma care centers market in 2024. The outpatient care offers a more affordable and less time-consuming alternative to inpatient hospital stays, making it an attractive selection for many patients and customers. The rising establishment of standalone medical and trauma care services has expanded access and capacity for outpatient-based treatment. The shift towards value-based healthcare value-based care the use of less expensive non-hospital services. The outpatient care services are generally more affordable than inpatient stays, with convenience and accessibility, and the expansion of the market growth.

The inpatient segment is the fastest-growing in the market during the forecast period. The increasing incidence of trauma cases, such as road accidents, violence, and falls, especially in the aging worldwide population, directly impacts inpatient admissions for trauma victims. The multiple organ damage requires admission to intensive care units and prolonged inpatient treatment. The advancement in trauma care teams and in-house trauma centers is increasing inpatient capacity and services. The rising focus on specialized, critical, and inpatient facilities in both public and private hospitals is boosting demand for inpatient care services.

By Facility Type

By Trauma Type

By Service Type

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Facility Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Trauma Care Centers Market

5.1. COVID-19 Landscape: Trauma Care Centers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Trauma Care Centers Market, By Facility Type

8.1. Trauma Care Centers Market, by Facility Type

8.1.1 In-house

8.1.1.1. Market Revenue and Forecast

8.1.2. Standalone

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global Trauma Care Centers Market, By Trauma Type

9.1. Trauma Care Centers Market, by Trauma Type

9.1.1. Falls

9.1.1.1. Market Revenue and Forecast

9.1.2. Traffic-related Injuries

9.1.2.1. Market Revenue and Forecast

9.1.3. Stab/Wound/Cut

9.1.3.1. Market Revenue and Forecast

9.1.4. Burn Injury

9.1.4.1. Market Revenue and Forecast

9.1.5. Brain Injury

9.1.5.1. Market Revenue and Forecast

9.1.6. Other Injuries

9.1.6.1. Market Revenue and Forecast

Chapter 10. Global Trauma Care Centers Market, By Service Type

10.1. Trauma Care Centers Market, by Service Type

10.1.1. Inpatient

10.1.1.1. Market Revenue and Forecast

10.1.2. Outpatient

10.1.2.1. Market Revenue and Forecast

10.1.3. Rehabilitation

10.1.3.1. Market Revenue and Forecast

Chapter 11. Global Trauma Care Centers Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Facility Type

11.1.2. Market Revenue and Forecast, by Trauma Type

11.1.3. Market Revenue and Forecast, by Service Type

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Facility Type

11.1.4.2. Market Revenue and Forecast, by Trauma Type

11.1.4.3. Market Revenue and Forecast, by Service Type

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Facility Type

11.1.5.2. Market Revenue and Forecast, by Trauma Type

11.1.5.3. Market Revenue and Forecast, by Service Type

11.2. Europe

11.2.1. Market Revenue and Forecast, by Facility Type

11.2.2. Market Revenue and Forecast, by Trauma Type

11.2.3. Market Revenue and Forecast, by Service Type

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Facility Type

11.2.4.2. Market Revenue and Forecast, by Trauma Type

11.2.4.3. Market Revenue and Forecast, by Service Type

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Facility Type

11.2.5.2. Market Revenue and Forecast, by Trauma Type

11.2.5.3. Market Revenue and Forecast, by Service Type

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Facility Type

11.2.6.2. Market Revenue and Forecast, by Trauma Type

11.2.6.3. Market Revenue and Forecast, by Service Type

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Facility Type

11.2.7.2. Market Revenue and Forecast, by Trauma Type

11.2.7.3. Market Revenue and Forecast, by Service Type

11.3. APAC

11.3.1. Market Revenue and Forecast, by Facility Type

11.3.2. Market Revenue and Forecast, by Trauma Type

11.3.3. Market Revenue and Forecast, by Service Type

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Facility Type

11.3.4.2. Market Revenue and Forecast, by Trauma Type

11.3.4.3. Market Revenue and Forecast, by Service Type

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Facility Type

11.3.5.2. Market Revenue and Forecast, by Trauma Type

11.3.5.3. Market Revenue and Forecast, by Service Type

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Facility Type

11.3.6.2. Market Revenue and Forecast, by Trauma Type

11.3.6.3. Market Revenue and Forecast, by Service Type

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Facility Type

11.3.7.2. Market Revenue and Forecast, by Trauma Type

11.3.7.3. Market Revenue and Forecast, by Service Type

11.4. MEA

11.4.1. Market Revenue and Forecast, by Facility Type

11.4.2. Market Revenue and Forecast, by Trauma Type

11.4.3. Market Revenue and Forecast, by Service Type

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Facility Type

11.4.4.2. Market Revenue and Forecast, by Trauma Type

11.4.4.3. Market Revenue and Forecast, by Service Type

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Facility Type

11.4.5.2. Market Revenue and Forecast, by Trauma Type

11.4.5.3. Market Revenue and Forecast, by Service Type

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Facility Type

11.4.6.2. Market Revenue and Forecast, by Trauma Type

11.4.6.3. Market Revenue and Forecast, by Service Type

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Facility Type

11.4.7.2. Market Revenue and Forecast, by Trauma Type

11.4.7.3. Market Revenue and Forecast, by Service Type

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Facility Type

11.5.2. Market Revenue and Forecast, by Trauma Type

11.5.3. Market Revenue and Forecast, by Service Type

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Facility Type

11.5.4.2. Market Revenue and Forecast, by Trauma Type

11.5.4.3. Market Revenue and Forecast, by Service Type

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Facility Type

11.5.5.2. Market Revenue and Forecast, by Trauma Type

11.5.5.3. Market Revenue and Forecast, by Service Type

Chapter 12. Company Profiles

12.1. Community Health Systems, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. HCA Healthcare, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Tenet Healthcare Corporation

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Northwell Health

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Sanford Health

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Ascension Health

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Cleveland Clinic

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Mayo Clinic

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Massachusetts General Hospital (Partners HealthCare).

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others