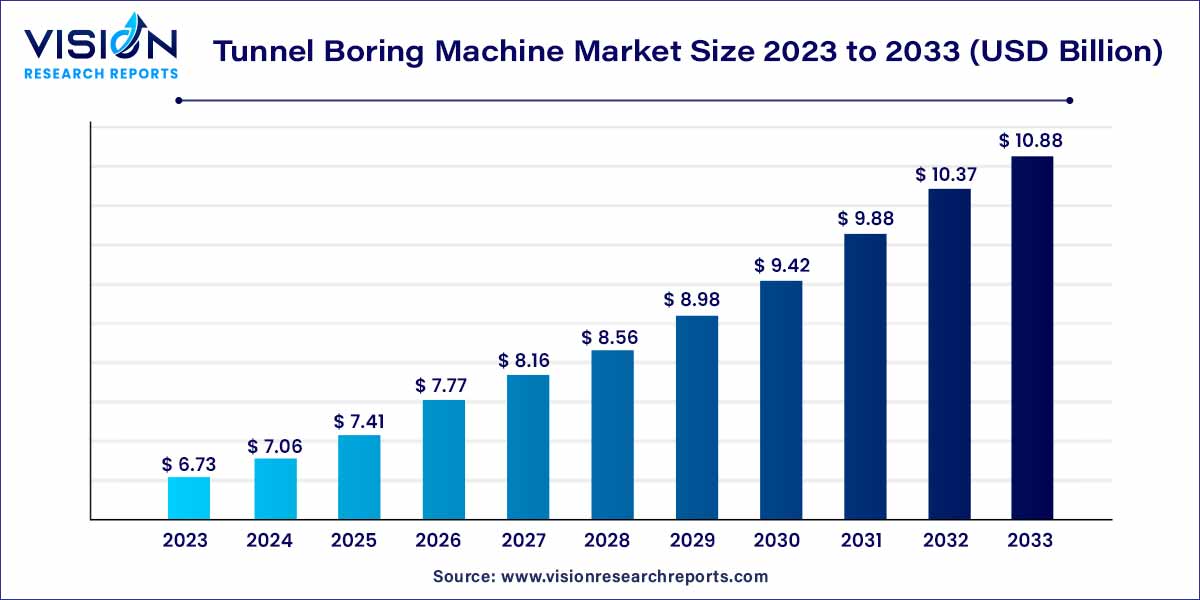

The global tunnel boring machine market size was estimated at around USD 6.73 billion in 2023 and it is projected to hit around USD 10.88 billion by 2033, growing at a CAGR of 4.92% from 2024 to 2033. The tunnel boring machine (TBM) market stands at the forefront of modern engineering and construction, representing a vital sector in the global infrastructure landscape. TBMs have gained prominence as sophisticated equipment that revolutionizes the way underground tunnels are excavated, offering efficient and precise solutions for diverse projects.

The tunnel boring machine (TBM) market is experiencing robust growth due to several key factors. Rapid urbanization and the increasing need for efficient transportation systems are driving the demand for underground tunnels, boosting the adoption of TBMs. Environmental concerns have also played a significant role, leading to the development of eco-friendly and sustainable tunneling solutions. Additionally, technological advancements, such as automation and real-time monitoring, have enhanced the efficiency and safety of TBMs, attracting more investments in this sector. The collaborative efforts between public and private sectors, coupled with the expanding infrastructural projects globally, further fuel the growth of the Tunnel Boring Machine market. These factors collectively contribute to the industry's expansion, promising a positive outlook for the future.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 10.88 billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.92% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The hard rock TBM segment held the highest market share in 2023. Hard Rock TBMs are engineered to navigate through challenging geological formations, characterized by robust rock structures. These TBMs are equipped with high-powered cutterheads designed to crush and excavate hard rock, ensuring efficient tunneling in granite, basalt, or other dense formations. Hard Rock TBMs are essential for projects such as mining, water conveyance, and infrastructure development in regions where solid rock conditions prevail. Their ability to withstand high-pressure environments and maintain stability in hard rock formations makes them indispensable in tunneling endeavors across the globe.

The soft ground TBM segment is expected to witness the highest CAGR over the forecast period. Soft Ground TBMs are specifically designed to address the complexities associated with loose soil, clay, sand, and other unstable ground conditions. These machines employ innovative technologies, including earth pressure balance mechanisms and slurry shield systems, to prevent tunnel collapses and ensure worker safety. Soft Ground TBMs are widely used in urban environments for subway construction, sewage systems, and utility tunnels. Their adaptability to unstable terrains, coupled with advanced soil conditioning techniques, enables precise excavation without compromising the integrity of surrounding structures, making them ideal for densely populated areas where stability and accuracy are paramount.

The transport segment contributed the largest market share of 33% in 2023. In the transportation sector, TBMs play a fundamental role in the construction of underground transit systems, roadways, and railways. Rapid urbanization, particularly in densely populated cities, has led to the demand for efficient and space-saving transportation solutions. TBMs are pivotal in creating subway tunnels, connecting urban areas and mitigating traffic congestion. Moreover, TBMs are instrumental in crafting tunnels for high-speed railways, facilitating faster and seamless travel between cities. In the realm of roadways, TBMs are deployed for highway tunnels, enhancing connectivity and reducing travel time. Their precision and efficiency are crucial in ensuring the safe and timely completion of transportation projects, making them indispensable in the modernization of transportation networks worldwide.

The oil & gas segment is expected to witness the highest CAGR over the forecast period. The oil & gas industry represents another vital end-use sector for TBMs. These machines are employed to construct tunnels for oil and gas pipelines, ensuring the efficient transport of hydrocarbon products from extraction sites to processing facilities and distribution points. TBMs navigate challenging terrains, including rocky landscapes, ensuring the integrity of the pipelines over long distances. By creating secure pathways underground, TBMs minimize the environmental impact associated with surface-level pipelines and enhance the overall safety and reliability of the oil & gas infrastructure. In addition to hydrocarbon transportation, TBMs are utilized in the construction of underground storage facilities, ensuring the secure containment of oil, gas, and strategic reserves. These storage spaces are essential for maintaining a stable supply of energy resources and supporting the energy needs of nations.

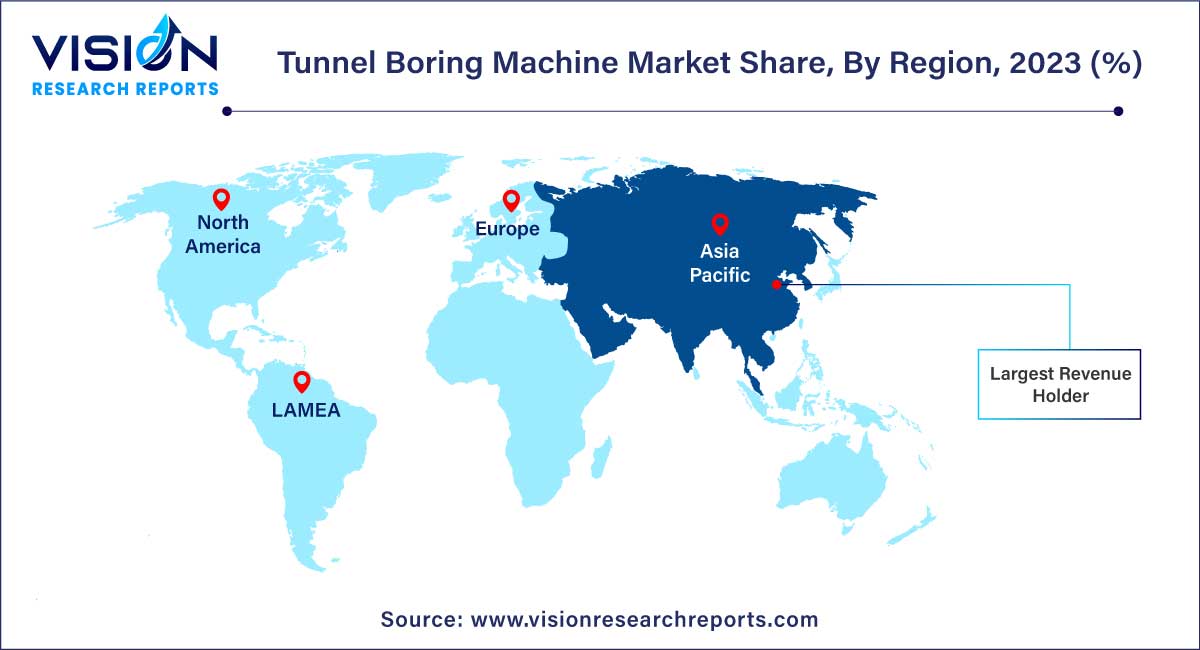

Asia Pacific is predicted to grow at the fastest CAGR during the forecast period. In the Asia-Pacific region, rapid urbanization and the need for efficient transportation networks are propelling the TBM market forward. China, in particular, stands as a powerhouse in tunnel construction, investing significantly in large-scale infrastructure projects, including high-speed rail networks and metro systems.

Emerging economies like India are also embracing TBMs to address their growing urban transport needs. Additionally, Southeast Asian countries are witnessing a rise in tunneling projects, driven by the development of smart cities and expanding underground utility networks.

By Product Type

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others