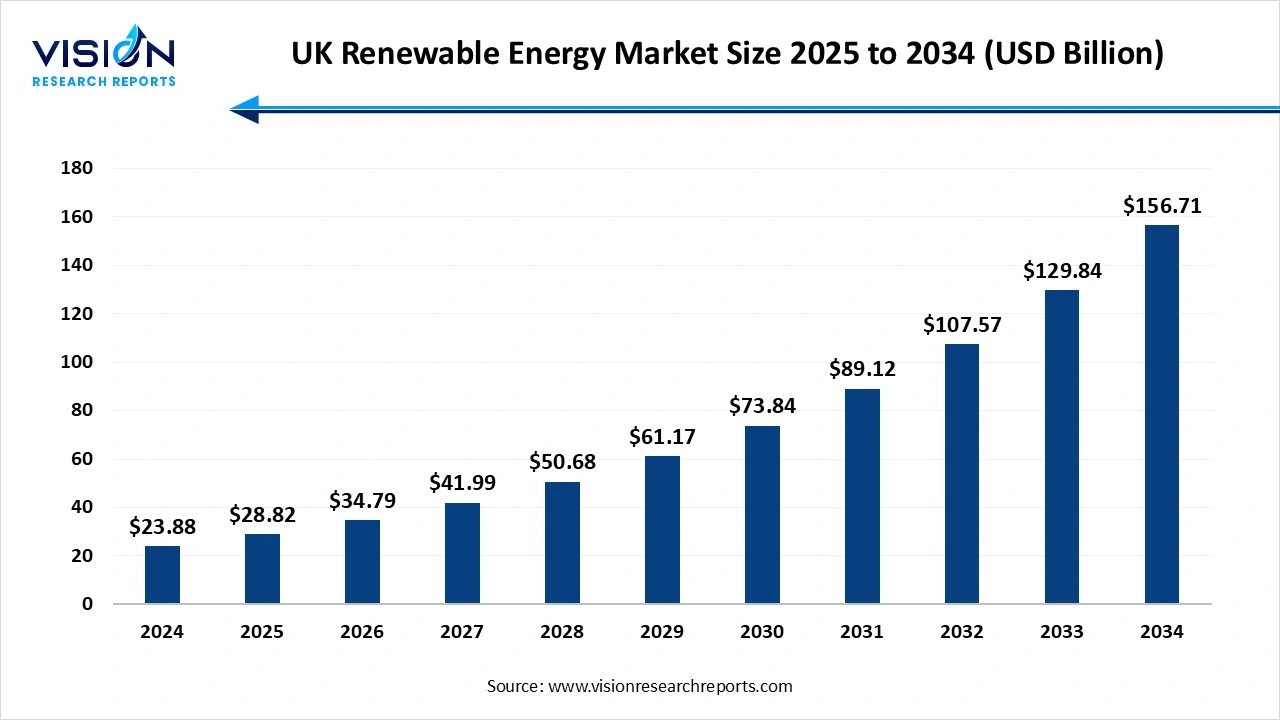

The UK renewable energy market size was reached at around USD 23.88 billion in 2024 and it is projected to hit around USD 156.71 billion by 2034, growing at a CAGR of 20.7% from 2025 to 2034. The market growth is driven by strong government policies, net-zero emission targets, and increased investments in offshore wind and solar projects, the UK renewable energy market is experiencing robust growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 23.88 billion |

| Revenue Forecast by 2034 | USD 156.71 billion |

| Growth rate from 2025 to 2034 | CAGR of 20.7% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Companies Covered | SSE Renewables, ScottishPower Renewables (Iberdrola), Vattenfall UK, RES Group (Renewable Energy Systems), Octopus Energy,Lightsource bp, Good Energy |

The UK renewable energy market has experienced significant transformation over the past decade, emerging as one of the leading green energy hubs in Europe. Driven by ambitious climate targets and strong governmental support, the country has steadily diversified its energy mix, moving away from f ossil fuels and investing heavily in renewables such as wind, solar, biomass, and hydroelectric power. The UK's legal commitment to achieve net-zero carbon emissions by 2050 has been a major catalyst for growth, influencing both policy frameworks and private sector investment.

Several key factors are driving the growth of the UK renewable energy market. Foremost among them is the government's strong policy support, including its legally binding commitment to achieve net-zero carbon emissions by. Strategic initiatives such as the Contracts for Difference (CfD) scheme, Renewable Energy Guarantees of Origin (REGO), and substantial public funding for low-carbon technologies have created a stable and attractive environment for investors.

Technological advancements and cost reductions are also fueling market expansion. Innovations in wind turbine efficiency, solar panel technology, and battery storage systems are making renewable energy more reliable and cost-effective. The UK’s leadership in offshore wind development, bolstered by favorable geography and infrastructure, continues to attract global investments.

Despite strong momentum, the UK renewable energy market faces several challenges that could impact its growth trajectory. One of the primary issues is infrastructure and grid limitations. The aging national grid was not originally designed to handle the decentralized and intermittent nature of renewable energy sources. As more wind and solar power comes online, transmission bottlenecks and constraints on grid capacity are becoming more apparent, particularly in remote areas where renewable resources are abundant.

Regulatory and planning delays also pose notable hurdles. Securing approvals for new renewable projects, especially onshore wind and large-scale solar farms, can be a lengthy and complex process due to local opposition, environmental concerns, and bureaucratic red tape. Additionally, fluctuations in government policies and the uncertainty surrounding post-Brexit trade and environmental standards can create instability for investors.

The wind power segment led the UK renewable energy industry, capturing over 37% of the total revenue share in 2024. The UK is recognized globally for its leadership in offshore wind energy, hosting several of the largest and most advanced offshore wind farms. The sector has benefited significantly from the government’s Contracts for Difference (CfD) scheme, which has driven down costs and ensured long-term price stability for developers. Onshore wind also contributes substantially to the renewable energy mix, especially in Scotland and other rural regions where wind resources are abundant.

The solar energy power segment is projected to record the highest CAGR of 21.9% during the forecast period. While the country’s climate presents certain limitations in terms of solar irradiance, the widespread adoption of rooftop solar panels and utility-scale solar farms has enabled significant capacity growth over recent years. The falling cost of photovoltaic (PV) systems, combined with supportive government schemes such as the Smart Export Guarantee (SEG), has encouraged both residential and commercial users to invest in solar power. Solar energy also plays a key role in local energy generation and consumption, particularly when integrated with battery storage solutions.

The industrial segment led the UK renewable energy industry, accounting for over 60% of the total revenue share in 2024. Large-scale industrial users are adopting renewable energy solutions such as wind and solar power to reduce reliance on fossil fuels and meet stringent environmental regulations. Many manufacturing facilities, logistics centers, and data centers are integrating on-site renewable systems or entering into Power Purchase Agreements (PPAs) to secure clean electricity.

The residential segment is expected to experience the highest CAGR over the forecast period. Homeowners are increasingly adopting rooftop solar panels, small-scale wind turbines, and energy storage systems to reduce their energy bills and carbon footprint. Government initiatives such as the Smart Export Guarantee (SEG) and various local authority grants have supported the expansion of decentralized renewable energy generation at the household level.

By Product

By Application

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others