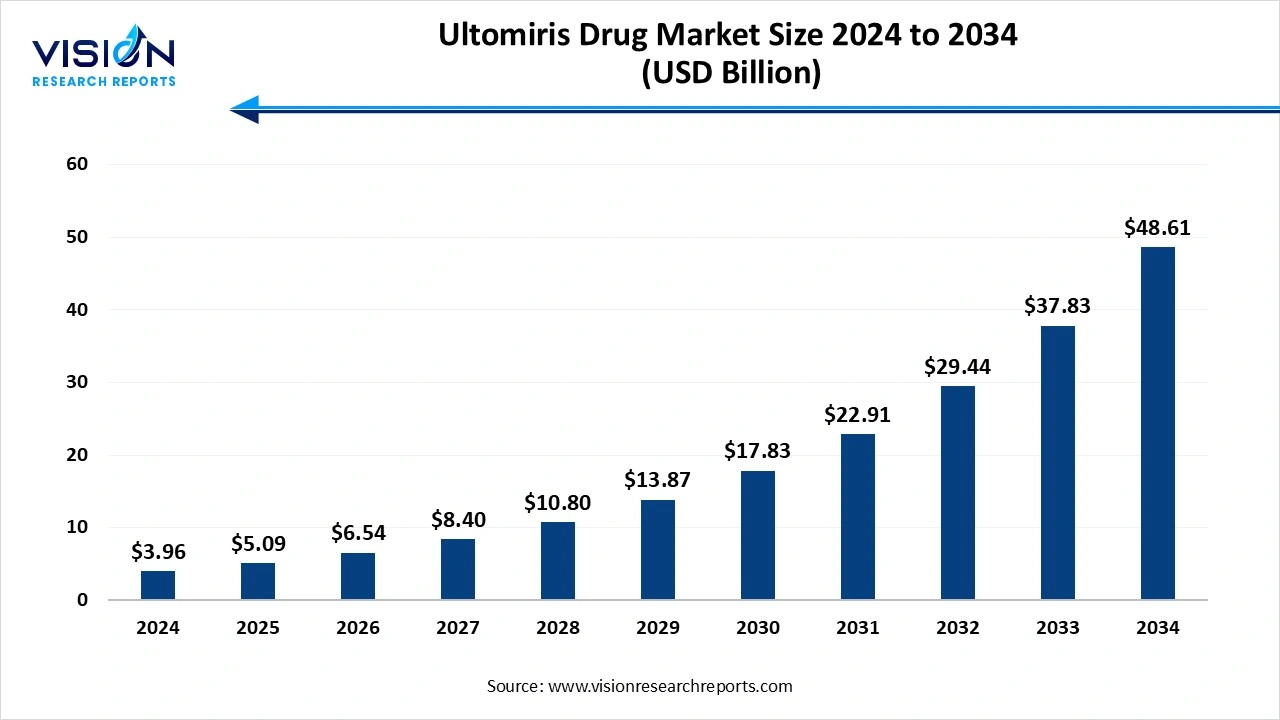

The ultomiris drug market size stood at USD 3.96 billion in 2024 and is estimated to reach USD 5.09 billion in 2025. It is projected to surge past USD 48.61 billion by 2034, registering a robust CAGR of 28.5% from 2025 to 2034. The extended dosing regimen, expanding clinical utility, increasing incidence of complement-mediated disorders and neurological conditions, and advanced diagnostic tools fuel the market growth.

Key Pointers

Key PointersUltomiris is a prescription-only, long-acting monoclonal antibody drug used to treat several rare autoimmune disorders by inhibiting a key protein in the immune system. The market growth is fueled by Ultomiris offering a significantly longer dosing interval (every 8 weeks) compared to its predecessor, Soliris, which enhances patient convenience and adherence.

This longer duration between treatments improves patient quality of life and reduces the burden associated with frequent infusions. Expanding clinical applications, rising prevalence of rare diseases. Ultomiris has demonstrated robust clinical performance and a manageable safety profile in the treatment of PNH and gMG, driving market growth.

An increase in the diagnosis and treatment of the rare, life-threatening hematologic and autoimmune conditions is indicated. The global incidence and prevalence of PNH and gMG contribute to a growing patient population. Advancements in diagnostic technology enable earlier and more accurate identification of these rare disorders, allowing for quicker treatment initiation with drugs like Ultomiris.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.96 billion |

| Revenue Forecast by 2034 | USD 48.61 billion |

| Growth rate from 2025 to 2034 | CAGR of 28.5% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Roche Holding AG, Novartis AG, Pfizer Inc., Sanofi S.A., Johnson & Johnson, Amgen Inc., Biogen Inc., Regeneron Pharmaceuticals, Inc., and Takeda Pharmaceutical Company Limited. |

The high cost significantly limits patient access, especially in countries with limited resources or restrictive budgets. Payers, including governments and private insurers, are hesitant to approve coverage without strong evidence of the drug's cost-effectiveness compared to other therapies. This creates significant negotiation and reimbursement constraints.

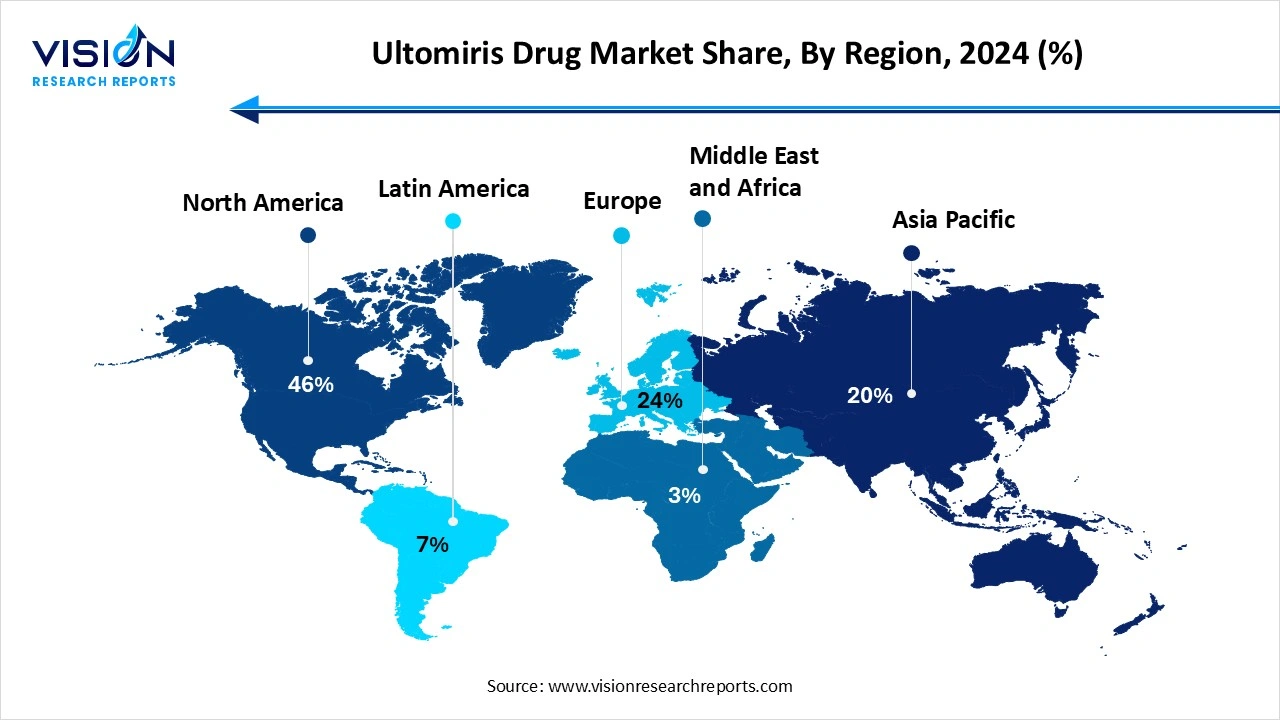

North America held a dominant position in the Ultomiris (ravulizumab) drug market in 2024, capturing over 46% of the total market share. The region has a sophisticated healthcare infrastructure, advanced diagnostic capabilities, robust clinical trial networks, and widespread specialized care centers. Early approvals of ultomeries, especially in the United States, have allowed for quicker uptake compared to other regions. Extensive awareness campaigns and robust clinical trial activity in North America have ensured that both healthcare professionals and patients are well-informed about Ultomiris and its potential to treat rare complement-mediated disorders.

United States Ultomiris Drug Market Trends

The Ultomiris' extended dosing interval offers increased patient convenience and compliance, making it a preferred choice over shorter-acting alternatives like Soliris. The drug has expanded its therapeutic reach beyond its initial uses in paroxysmal nocturnal hemoglobinuria (PNH) and atypical hemolytic uremic syndrome (aHUS).

Asia Pacific expects significant growth in the Ultomiris drug market during the forecast period. The growing awareness and diagnosis of rare diseases, rapid economic growth in countries such as China and India, have led to enhanced healthcare infrastructure. The availability of high-efficacy biologic drugs for rare autoimmune and blood disorders is increasing in the region. Healthcare professionals are becoming increasingly familiar with complement inhibitors like Ultomiris, leading to greater confidence in prescribing it. Increased patient and caregiver awareness about rare conditions and available treatment options contributes to higher adoption rates of Ultomiris.

Why did the Paroxysmal Nocturnal Hemoglobinuria (PNH) Segment Dominate the Ultomiris Drug Market?

The paroxysmal nocturnal hemoglobinuria (PNH) segment dominated the Ultomiris Drug market share 49% in 2024. Ultomiris offered a significantly more convenient dosing schedule than its predecessor, Soliris. This improvement, combined with its strong clinical efficacy and comparable safety profile, drove a widespread patient switch from Soliris to Ultomiris. As the first indication approved for Ultomiris, the well-established PNH patient population fueled the drug's initial market success. This strategic market conversion for a rare disease ultimately cemented PNH's dominant position.

The generalized myasthenia gravis (gMG) segment is the fastest-growing in the Ultomiris drug market during the forecast period. The Ultomiris's strong clinical effectiveness and convenient, long-acting dosing schedule. Regulatory approvals and the expanding utility of the drug for gMG patients have further boosted its market position. This combination of clinical benefits, ease of use, and strategic market expansion has cemented the gMG segment as a key driver of Ultomiris's market success.

How the Adult Segment hold the Largest Share in the Ultomiris Drug Market?

The adult segment held the largest revenue share in the Ultomiris Drug market in 2024. The higher prevalence of its primary indications, PNH and aHUS, in adults. The market share is further solidified by established adult treatment protocols, the drug's extended dosing interval, and the widespread transition of patients from older therapies like Soliris. This preference for a less burdensome, long-acting treatment, supported by a well-developed healthcare infrastructure, reinforces the adult segment's market dominance. While the pediatric market is growing, the adult population's higher disease burden currently ensures its leading position.

The pediatric segment is experiencing the fastest growth in the market during the forecast period. The better standardized pediatric formulations and dosing protocols are promoting wider usage of Ultomiris in children. Increasing awareness of rare diseases in children among caregivers and healthcare professionals, along with improved diagnostic tools, supports earlier detection and treatment initiation. Increasing awareness of rare diseases in children among caregivers and healthcare professionals, along with improved diagnostic tools, supports earlier detection and treatment initiation.

How the Hospital Pharmacies Segment hold the Largest Share in the Ultomiris Drug Market?

The hospital pharmacies segment held the largest revenue share in the Ultomiris drug market in 2024. The specialized care and controlled environments are required for treating rare diseases like PNH and gMG. These pharmacies ensure safe handling, storage, and administration, often managing complex treatment protocols and patient monitoring. Hospital pharmacies possess the necessary expertise and infrastructure to handle and store high-cost biologics like Ultomiris, maintaining quality and ensuring patient safety.

The online pharmacies segment is experiencing the fastest growth in the market during the forecast period. The Ultomiris drug market is experiencing rapid growth driven by increased patient demand for convenience and accessibility. This growth is supported by the rise of home infusion services, which online specialty pharmacies are equipped to handle, and integration with digital health tools for prescription management and patient support. This technological shift enhances patient adherence and reduces hospital visits, positioning online pharmacies as the fastest-growing distribution channel.

By Indication

By End Use

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Indication Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Ultomiris Drug Market

5.1. COVID-19 Landscape: Ultomiris Drug Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Ultomiris Drug Market, By Indication

8.1. Ultomiris Drug Market, by Indication

8.1.1 Paroxysmal Nocturnal Hemoglobinuria (PNH)

8.1.1.1. Market Revenue and Forecast

8.1.2. Atypical Hemolytic Uremic Syndrome (aHUS)

8.1.2.1. Market Revenue and Forecast

8.1.3. Generalized Myasthenia Gravis (gMG)

8.1.3.1. Market Revenue and Forecast

8.1.4. Neuromyelitis Optica Spectrum Disorder (NMOSD)

8.1.4.1. Market Revenue and Forecast

Chapter 9. Global Ultomiris Drug Market, By End Use

9.1. Ultomiris Drug Market, by End Use

9.1.1. Adult

9.1.1.1. Market Revenue and Forecast

9.1.2. Pediatric

9.1.2.1. Market Revenue and Forecast

Chapter 10. Global Ultomiris Drug Market, By Distribution Channel

10.1. Ultomiris Drug Market, by Distribution Channel

10.1.1. Hospital Pharmacies

10.1.1.1. Market Revenue and Forecast

10.1.2. Retail Pharmacies

10.1.2.1. Market Revenue and Forecast

10.1.3. Online Pharmacies

10.1.3.1. Market Revenue and Forecast

Chapter 11. Global Ultomiris Drug Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Indication

11.1.2. Market Revenue and Forecast, by End Use

11.1.3. Market Revenue and Forecast, by Distribution Channel

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Indication

11.1.4.2. Market Revenue and Forecast, by End Use

11.1.4.3. Market Revenue and Forecast, by Distribution Channel

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Indication

11.1.5.2. Market Revenue and Forecast, by End Use

11.1.5.3. Market Revenue and Forecast, by Distribution Channel

11.2. Europe

11.2.1. Market Revenue and Forecast, by Indication

11.2.2. Market Revenue and Forecast, by End Use

11.2.3. Market Revenue and Forecast, by Distribution Channel

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Indication

11.2.4.2. Market Revenue and Forecast, by End Use

11.2.4.3. Market Revenue and Forecast, by Distribution Channel

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Indication

11.2.5.2. Market Revenue and Forecast, by End Use

11.2.5.3. Market Revenue and Forecast, by Distribution Channel

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Indication

11.2.6.2. Market Revenue and Forecast, by End Use

11.2.6.3. Market Revenue and Forecast, by Distribution Channel

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Indication

11.2.7.2. Market Revenue and Forecast, by End Use

11.2.7.3. Market Revenue and Forecast, by Distribution Channel

11.3. APAC

11.3.1. Market Revenue and Forecast, by Indication

11.3.2. Market Revenue and Forecast, by End Use

11.3.3. Market Revenue and Forecast, by Distribution Channel

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Indication

11.3.4.2. Market Revenue and Forecast, by End Use

11.3.4.3. Market Revenue and Forecast, by Distribution Channel

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Indication

11.3.5.2. Market Revenue and Forecast, by End Use

11.3.5.3. Market Revenue and Forecast, by Distribution Channel

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Indication

11.3.6.2. Market Revenue and Forecast, by End Use

11.3.6.3. Market Revenue and Forecast, by Distribution Channel

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Indication

11.3.7.2. Market Revenue and Forecast, by End Use

11.3.7.3. Market Revenue and Forecast, by Distribution Channel

11.4. MEA

11.4.1. Market Revenue and Forecast, by Indication

11.4.2. Market Revenue and Forecast, by End Use

11.4.3. Market Revenue and Forecast, by Distribution Channel

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Indication

11.4.4.2. Market Revenue and Forecast, by End Use

11.4.4.3. Market Revenue and Forecast, by Distribution Channel

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Indication

11.4.5.2. Market Revenue and Forecast, by End Use

11.4.5.3. Market Revenue and Forecast, by Distribution Channel

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Indication

11.4.6.2. Market Revenue and Forecast, by End Use

11.4.6.3. Market Revenue and Forecast, by Distribution Channel

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Indication

11.4.7.2. Market Revenue and Forecast, by End Use

11.4.7.3. Market Revenue and Forecast, by Distribution Channel

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Indication

11.5.2. Market Revenue and Forecast, by End Use

11.5.3. Market Revenue and Forecast, by Distribution Channel

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Indication

11.5.4.2. Market Revenue and Forecast, by End Use

11.5.4.3. Market Revenue and Forecast, by Distribution Channel

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Indication

11.5.5.2. Market Revenue and Forecast, by End Use

11.5.5.3. Market Revenue and Forecast, by Distribution Channel

Chapter 12. Company Profiles

12.1. Roche Holding AG.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Novartis AG.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Pfizer Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Sanofi S.A.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Johnson & Johnson.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Amgen Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Biogen Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Regeneron Pharmaceuticals, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Takeda Pharmaceutical Company Limited.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others