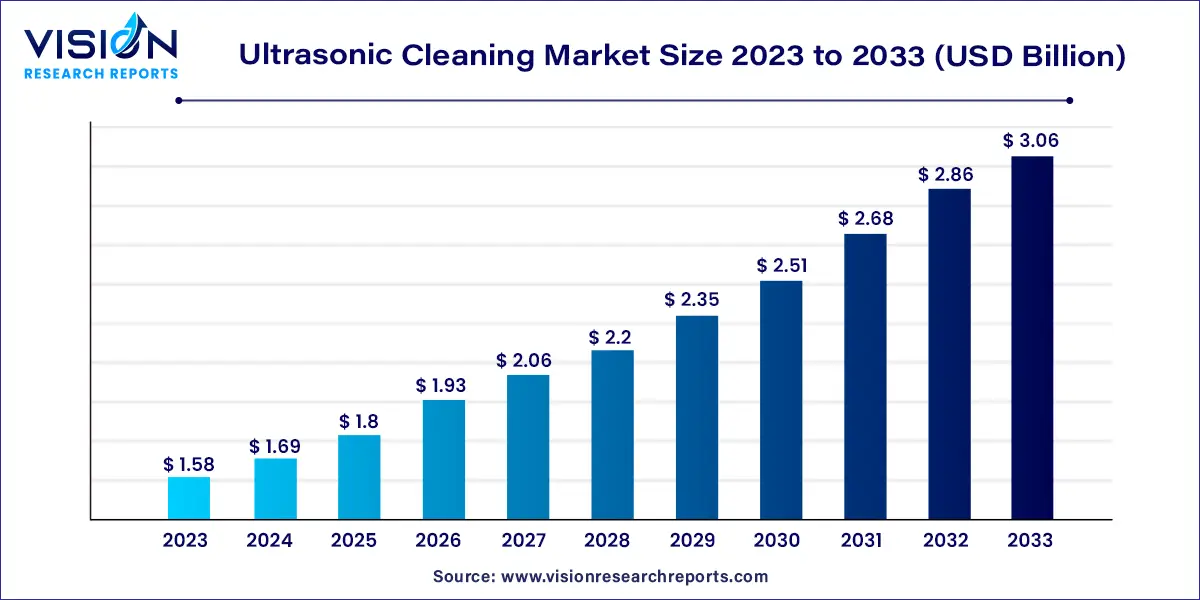

The global ultrasonic cleaning market was surpassed at USD 1.58 billion in 2023 and is expected to hit around USD 3.06 billion by 2033, growing at a CAGR of 6.82% from 2024 to 2033.

Ultrasonic cleaning involves the use of high-frequency sound waves to remove contaminants from intricate and delicate items. Unlike traditional cleaning methods, ultrasonic cleaners rely on the phenomenon of cavitation, where tiny bubbles created by ultrasonic waves implode, dislodging dirt and particles from surfaces. This method ensures thorough and consistent cleaning, even in hard-to-reach areas, making it highly effective for a wide range of applications.

The global ultrasonic cleaning market has witnessed a remarkable surge in recent years, driven by the need for efficient and precise cleaning solutions across diverse industries. Ultrasonic cleaning, a technique that utilizes high-frequency sound waves to clean various objects, has become a cornerstone in maintaining cleanliness standards and ensuring product quality in sectors ranging from manufacturing to healthcare.

The growth of the ultrasonic cleaning market is attributed to several key factors driving its expansion. One of the primary growth drivers is the continuous technological advancements in ultrasonic cleaning systems. Manufacturers are investing in research and development, leading to the creation of more powerful, energy-efficient, and versatile ultrasonic cleaners. These advancements enhance the cleaning efficiency, making ultrasonic cleaning a preferred choice across industries. Additionally, the increasing industrialization and stringent regulations related to cleanliness and hygiene standards in sectors such as healthcare, automotive, and aerospace are boosting the demand for ultrasonic cleaning solutions. The adoption of environmentally conscious practices, including the use of biodegradable detergents in ultrasonic cleaning processes, aligns with sustainability goals, further propelling market growth. These factors collectively contribute to the widespread adoption of ultrasonic cleaning technology, fostering its continual expansion in various sectors.

| Report Coverage | Details |

| Revenue Share of North America in 2023 | 30% |

| CAGR of Asia Pacific from 2024 to 2032 | 8.04% |

| Revenue Forecast by 2033 | USD 3.06 billion |

| Growth Rate from 2024 to 2033 | CAGR of 6.82% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

In terms of product, the benchtop segment has contributed more than 48% of revenue share in 2023. Benchtop ultrasonic cleaning systems are compact and versatile, making them ideal for small-scale applications and laboratories. These systems are characterized by their convenience, occupying minimal space while delivering efficient cleaning results. They find applications in various sectors, including jewelry cleaning, scientific laboratories, and electronics manufacturing. Benchtop systems are prized for their ease of use and ability to clean delicate items with precision, making them a popular choice for industries where space and accuracy are paramount.

The multistage segment is anticipated to register the fastest CAGR of 7.84% over the forecast period. Multistage ultrasonic cleaning systems, on the other hand, are engineered for larger-scale industrial applications that demand high throughput and complex cleaning processes. These systems consist of multiple cleaning stages, often incorporating ultrasonic cleaning, rinsing, and drying stages within a single integrated unit. Industries such as automotive, aerospace, and heavy machinery manufacturing benefit significantly from multistage systems. They are designed to handle large volumes of components or parts efficiently, ensuring thorough cleaning while streamlining the overall manufacturing process. Multistage systems are prized for their ability to handle diverse cleaning needs, making them indispensable in industrial setups where comprehensive cleaning and throughput efficiency are critical.

In terms of industry, the food & beverage segment led the market in 2023 with a revenue share of more than 23%. In the food and beverage industry, where hygiene is paramount, ultrasonic cleaning systems play a crucial role in ensuring the cleanliness of various equipment and components. These systems are widely employed for cleaning tools, machinery parts, containers, and utensils. Given the strict regulations and standards governing food safety, ultrasonic cleaning technology provides an efficient and effective solution. By utilizing high-frequency sound waves, these systems remove contaminants such as grease, oils, and food residues from surfaces, ensuring that equipment is thoroughly sanitized. This application is especially vital in industries producing perishable goods, where maintaining stringent hygiene levels is not just a matter of quality but also a question of consumer safety.

The automotive segment is anticipated to expand at a CAGR of 7.96% over the forecast period. In the automotive sector, ultrasonic cleaning has become an indispensable part of the manufacturing and maintenance processes. Automotive components, both large and small, often have intricate geometries that make traditional cleaning methods challenging. Ultrasonic cleaning technology addresses this issue effectively. Engine parts, fuel injectors, transmission components, and even entire automotive assemblies are cleaned using ultrasonic systems. The precision and consistency of ultrasonic cleaning ensure that even the smallest and most complex parts are thoroughly cleaned, leading to improved performance and longevity. Moreover, in the manufacturing phase, ultrasonic cleaning plays a vital role in preparing components for various treatments like coating and welding, ensuring optimal adhesion and functionality. As the automotive industry continues to innovate, ultrasonic cleaning technology remains a cornerstone, enhancing both the quality and reliability of vehicles worldwide.

North America dominated the market in 2022 with a revenue share of over 30%. North America stands as a significant hub for ultrasonic cleaning technology, with a robust market driven by a diverse range of industries. The region's advanced manufacturing sector, including automotive, aerospace, and electronics, heavily relies on ultrasonic cleaning for precision cleaning of intricate components. Moreover, stringent regulations in sectors such as healthcare and pharmaceuticals have led to widespread adoption of ultrasonic cleaning systems to meet cleanliness and hygiene standards. The presence of key market players, coupled with a focus on research and development, continues to drive innovation in ultrasonic cleaning technology in North America.

Asia Pacific is anticipated to grow at the fastest CAGR of 8.04% over the forecast period. The Asia-Pacific region is witnessing rapid growth in the ultrasonic cleaning market, primarily fueled by the burgeoning industrial sector in countries like China, Japan, and India. The region's manufacturing industries, including electronics, automotive, and medical devices, are adopting ultrasonic cleaning technology to enhance efficiency and product quality. The market is also benefiting from the region's focus on technological innovation and the increasing awareness of ultrasonic cleaning benefits in various applications. With a growing number of local manufacturers producing ultrasonic cleaning systems, Asia-Pacific has emerged as a key player in the global ultrasonic cleaning market.

By Product

By Industry

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Ultrasonic Cleaning Market

5.1. COVID-19 Landscape: Ultrasonic Cleaning Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Ultrasonic Cleaning Market, By Product

8.1. Ultrasonic Cleaning Market, by Product, 2024-2033

8.1.1. Benchtop

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Standalone

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Multistage

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Ultrasonic Cleaning Market, By Industry

9.1. Ultrasonic Cleaning Market, by Industry, 2024-2033

9.1.1. Automotive

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Healthcare

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Food & Beverage

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Metal

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Electrical & Electronics

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Aerospace & Defense

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Others

9.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Ultrasonic Cleaning Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Industry (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Industry (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Industry (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by Industry (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Industry (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Industry (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Industry (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Industry (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by Industry (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Industry (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Industry (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Industry (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Industry (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by Industry (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Industry (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Industry (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Industry (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Industry (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by Industry (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Industry (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Industry (2021-2033)

Chapter 11. Company Profiles

11.1. SharperTek

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Mettler Electronics Corp.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. L&R Manufacturing

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Elma Schmidbauer GmbH

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Steelco S.p.A.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Emerson Electric Co.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. GT Sonic

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Kemet International Limited

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Crest Ultrasonics Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Ultrasonic LLC

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others