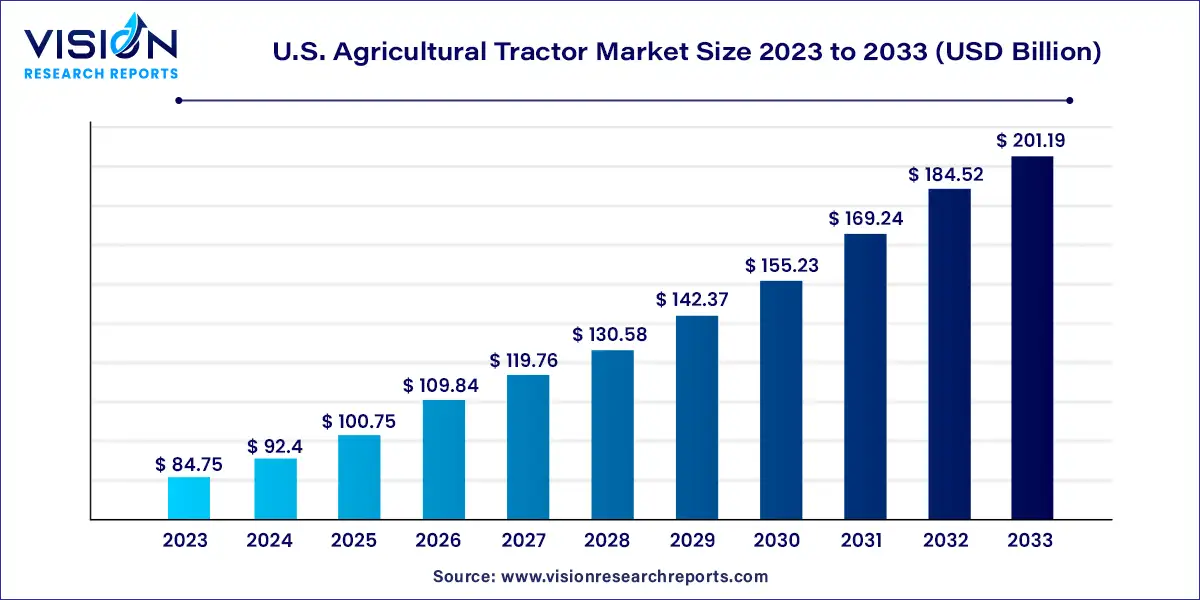

The U.S. agricultural tractor market size was estimated at around USD 84.75 billion in 2023 and it is projected to hit around USD 201.19 billion by 2033, growing at a CAGR of 9.03% from 2024 to 2033. The U.S. agricultural tractor market is driven by the trend towards larger, more consolidated farms is driving the demand for high-horsepower tractors capable of handling larger fields and heavier implements.

The agricultural tractor market in the United States is a dynamic sector that plays a pivotal role in the nation's agricultural industry. Tractors are indispensable machines used extensively in farming operations, ranging from plowing and planting to harvesting and transportation. Understanding the current landscape of the U.S. agricultural tractor market is crucial for stakeholders, including manufacturers, farmers, investors, and policymakers.

The growth of the U.S. agricultural tractor market is propelled by various factors contributing to its expansion. One key driver is the increasing adoption of mechanization in farming practices, driven by the need for higher efficiency and productivity. With farms expanding in size and labor becoming scarcer, farmers are increasingly turning to tractors to perform a wide range of tasks, from land preparation to harvesting. Additionally, technological advancements in tractor design and functionality, such as GPS guidance systems and precision farming technologies, are enhancing the capabilities of these machines, further driving market growth. Furthermore, government initiatives promoting mechanization and modernization in agriculture, coupled with favorable financing options for farmers, are bolstering the demand for tractors across the country. Overall, these growth factors are fueling the expansion of the U.S. agricultural tractor market, positioning it for continued growth in the foreseeable future.

In 2023, the sub-40 HP segment dominated the market with over 65% of the total volume share. This dominance is attributed to the cost-effectiveness, compactness, and enhanced convenience offered by tractors in this category for basic farming tasks. Moreover, the trend towards electrification within this segment is expected to gain momentum in the upcoming years, contributing to its growth. Projections suggest that this segment will experience the highest Compound Annual Growth Rate (CAGR) of 7.5% throughout the forecast period.

Meanwhile, the 40 HP to 100 HP segment is poised for significant growth from 2024 to 2033. Factors such as the increasing adoption of technology among farmers, rising income levels, and improved after-sales services are anticipated to drive growth within this segment. Additionally, there is a rising demand for higher-powered tractors, especially among farms exceeding 10 hectares in size, which is expected to be a key driver of growth in this segment over the forecast period.

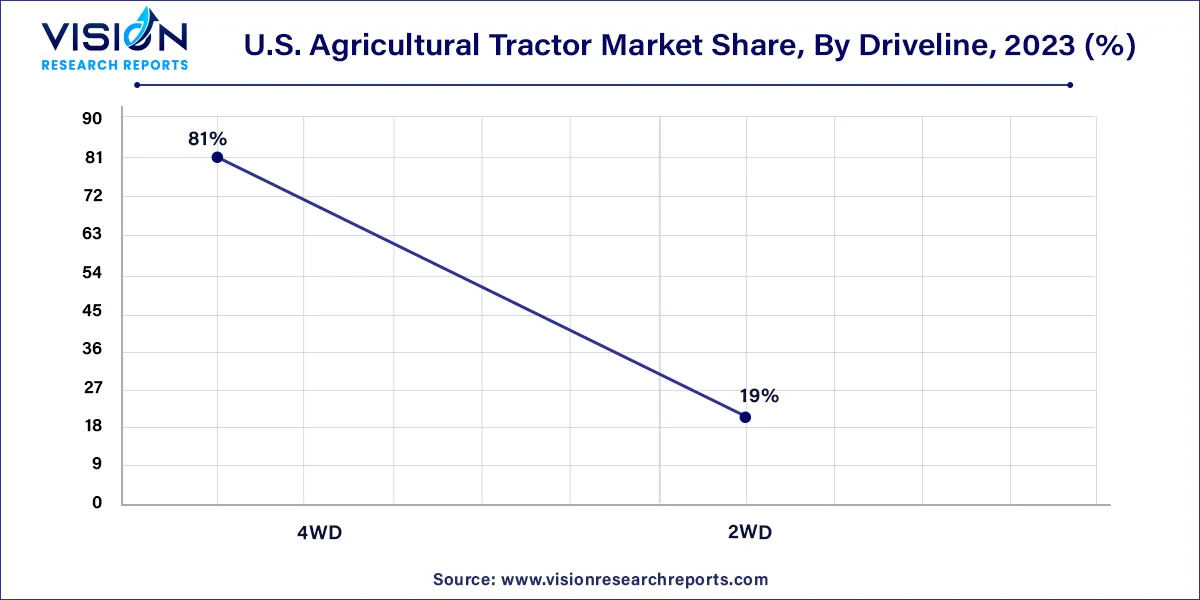

In 2023, the 2WD segment commanded over 81% of the market share in terms of volume. Projections indicate that this segment will also exhibit the fastest Compound Annual Growth Rate (CAGR) from 2024 to 2033. This growth is primarily attributed to the low initial costs and superior maneuverability characteristics associated with 2WD tractors. Ideal for primary farming tasks like sowing and planting, these tractors find extensive use in livestock, orchards, vineyards, and crop farms, where agility and sharp turning capabilities are prioritized over sheer pulling power.

Following closely behind the 2WD segment, 4WD tractors offer heightened traction, increased pulling capacity, and enhanced versatility. With power distributed to all four wheels, 4WD variants excel in navigating challenging terrains such as hills, mud, snow, and uneven surfaces. Their superior traction capabilities enable them to handle heavier loads and operate without the risk of getting stuck or losing traction, making them indispensable for heavy-duty agricultural operations.

In a typical tractor setup, various auxiliary components are essential for its functioning. These include hydraulic and coolant pumps, air brake and A/C compressors, and a radiator fan. Traditionally, these auxiliaries have been linked to the engine, with their performance tied to the engine speed. However, in fully electric tractors, there's no continuous running engine to power these auxiliaries. Consequently, electrifying these auxiliaries can lead to a reduction in the required engine size. Moreover, decoupling the auxiliaries from the engine allows for more efficient engine operation while enabling the auxiliaries to operate independently at optimal performance levels, all while providing power on demand.

Electric tractors offer notable advantages in terms of compatibility with evolving regulatory standards and cost-effectiveness due to reduced maintenance requirements. This transition underscores the industry's dedication to sustainability and aligns with global initiatives aimed at curbing carbon emissions and fostering the adoption of eco-friendly technologies in agriculture.

By Engine Power

By Driveline

By Propulsion

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others