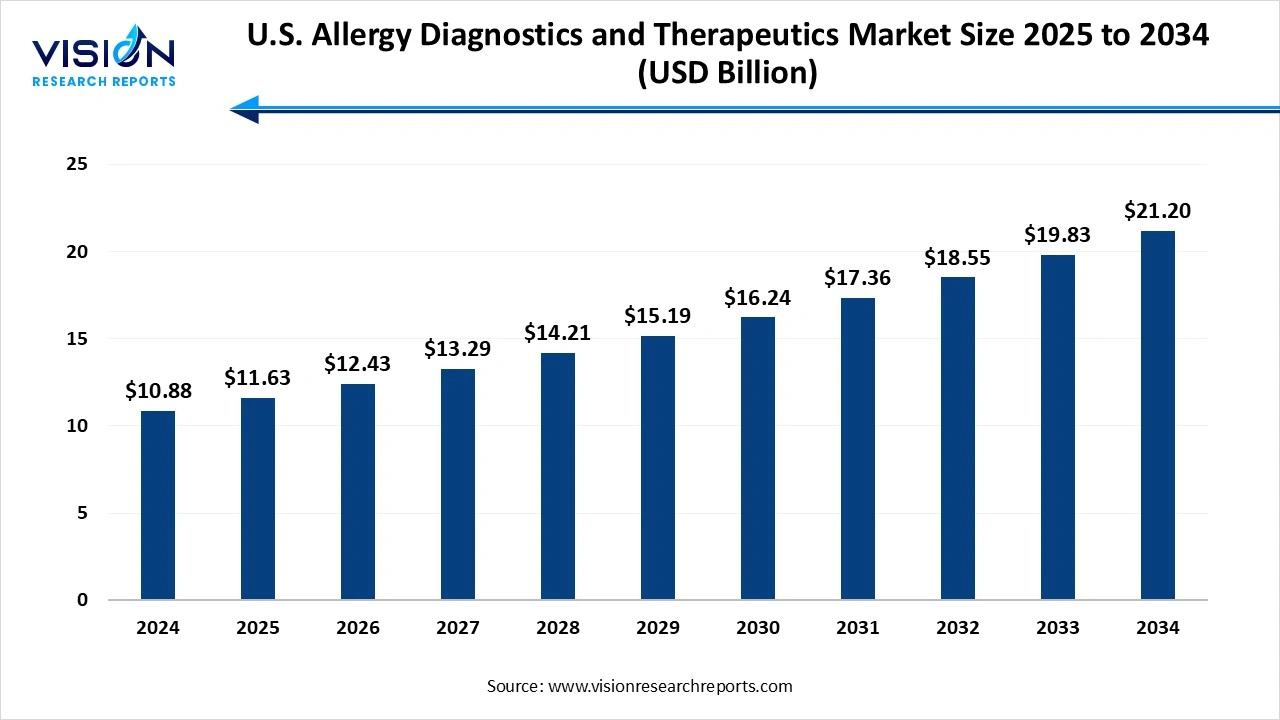

The U.S. allergy diagnostics and therapeutics market size was valued at around USD 10.88 billion in 2024 and it is projected to hit around USD 21.20 billion by 2034, growing at a CAGR of 6.9% from 2025 to 2034. The market growth is driven by the rising prevalence of allergic diseases and increasing awareness about early diagnostic interventions, the U.S. allergy diagnostics and therapeutics market is experiencing robust growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 10.88 billion |

| Revenue Forecast by 2034 | USD 21.20 billion |

| Growth rate from 2025 to 2034 | CAGR of 6.9% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Companies Covered | Thermo Fisher Scientific Inc., Danaher Corporation (Beckman Coulter), Siemens Healthineers AG, bioMérieux SA, Omega Diagnostics Group PLC, Stallergenes Greer, Bio-Rad Laboratories, Inc., Astellas Pharma Inc., DBV Technologies,ALK-Abelló A/S |

The U.S. allergy diagnostics and therapeutics market is witnessing significant growth, driven by the rising prevalence of allergic conditions such as asthma, rhinitis, food allergies, and atopic dermatitis. Increasing awareness among patients and healthcare providers regarding early diagnosis and treatment options is fueling the demand for both diagnostic tools and therapeutic solutions. Technological advancements in diagnostic methods, such as component-resolved diagnostics and point-of-care testing, are enhancing the accuracy and speed of allergy detection.

The growth of the U.S. allergy diagnostics and therapeutics market is primarily driven by the rising incidence of allergic diseases across various age groups. Factors such as environmental pollution, changing dietary habits, and increased exposure to allergens have contributed to a higher prevalence of conditions like allergic rhinitis, food allergies, and asthma. According to the Centers for Disease Control and Prevention (CDC), millions of Americans suffer from allergies annually, creating a sustained demand for accurate diagnostic tools and effective treatment options.

Technological advancements in both diagnostics and therapeutics are also major contributors to the market’s expansion. Innovations such as molecular-based allergy testing, component-resolved diagnostics, and multiplex assays are improving the precision and speed of allergy detection. On the therapeutic side, the development of targeted immunotherapies and biologics is enhancing treatment outcomes for chronic and severe allergy sufferers.

One of the key challenges facing the U.S. allergy diagnostics and therapeutics market is the high cost associated with advanced diagnostic tools and innovative therapies. While technologies like molecular allergy testing and biologics offer greater accuracy and effectiveness, they often come with elevated prices, limiting accessibility for a portion of the population.

Another significant hurdle is the lack of standardized diagnostic protocols and variability in test results. Inconsistent methodologies across laboratories can lead to discrepancies in diagnosis, impacting the quality of care and patient outcomes. Furthermore, limited awareness among primary care providers regarding the latest allergy diagnostic and treatment options can result in underdiagnosis or delayed referrals to specialists.

The therapeutics segment dominated the market in 2024, capturing a substantial share of 82%. This segment includes antihistamines, corticosteroids, leukotriene receptor antagonists, mast cell stabilizers, decongestants, and immunotherapy agents. Immunotherapy, particularly subcutaneous immunotherapy (SCIT) and sublingual immunotherapy (SLIT) is gaining traction due to its long-term benefits and disease-modifying potential. Biologic therapies, such as monoclonal antibodies targeting IgE and interleukins, are increasingly being used in the treatment of severe asthma and chronic urticaria, offering more targeted and effective relief.

The diagnostics segment is projected to record the fastest growth, with a CAGR of 10.17% during the forecast period. This includes skin prick testing (SPT), intradermal testing, patch testing, and in vitro assays such as specific IgE blood tests and component-resolved diagnostics. Technological advancements have significantly improved the sensitivity and specificity of allergy diagnostics, allowing for more accurate and individualized assessments. Component-resolved diagnostics, in particular, enable clinicians to detect individual allergenic proteins, enhancing the ability to tailor treatment plans.

The inhaled segment held the leading position in the market in 2024. These allergens primarily include pollen from trees, grasses, and weeds, as well as mold spores, dust mites, and pet dander. The increasing prevalence of respiratory allergies, driven by urbanization, air pollution, and climate change, has heightened the need for effective diagnostic tools and targeted treatment strategies. Accurate identification of inhaled allergens through skin prick tests and molecular diagnostics enables clinicians to develop precise and long-term management plans, including allergen avoidance and immunotherapy.

The food segment is expected to register the highest CAGR throughout the forecast period. Common food allergens include peanuts, tree nuts, milk, eggs, soy, wheat, fish, and shellfish, which account for the majority of food-related allergic responses. The growing incidence of food allergies, especially among children, has prompted increased demand for early and reliable diagnostics, such as serum-specific IgE testing and oral food challenges. On the therapeutic front, research into oral immunotherapy (OIT), biologics, and tolerance-inducing treatments is gaining momentum.

The in vitro segment accounted for the largest share of the U.S. allergy diagnostics and therapeutics market. These tests involve analyzing a patient’s blood sample to measure the presence of specific IgE antibodies against various allergens. Common in vitro tests include enzyme-linked immunosorbent assay (ELISA), radioallergosorbent test (RAST), and advanced component-resolved diagnostics. In vitro testing offers advantages such as safety, especially for patients with a high risk of severe allergic reactions, and the ability to test multiple allergens simultaneously without direct exposure.

The in vivo test segment is projected to experience strong growth, registering a lucrative CAGR during the forecast period. The most widely used in vivo methods are skin prick tests, intradermal tests, and patch testing. These tests offer rapid results, high sensitivity, and are often considered the first line of diagnosis for allergic diseases, particularly in respiratory and dermatological allergies. Skin testing allows for real-time observation of allergic responses, helping clinicians confirm a diagnosis and assess the severity of allergic sensitization.

By Type

By Allergen Type

By Test Type

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others