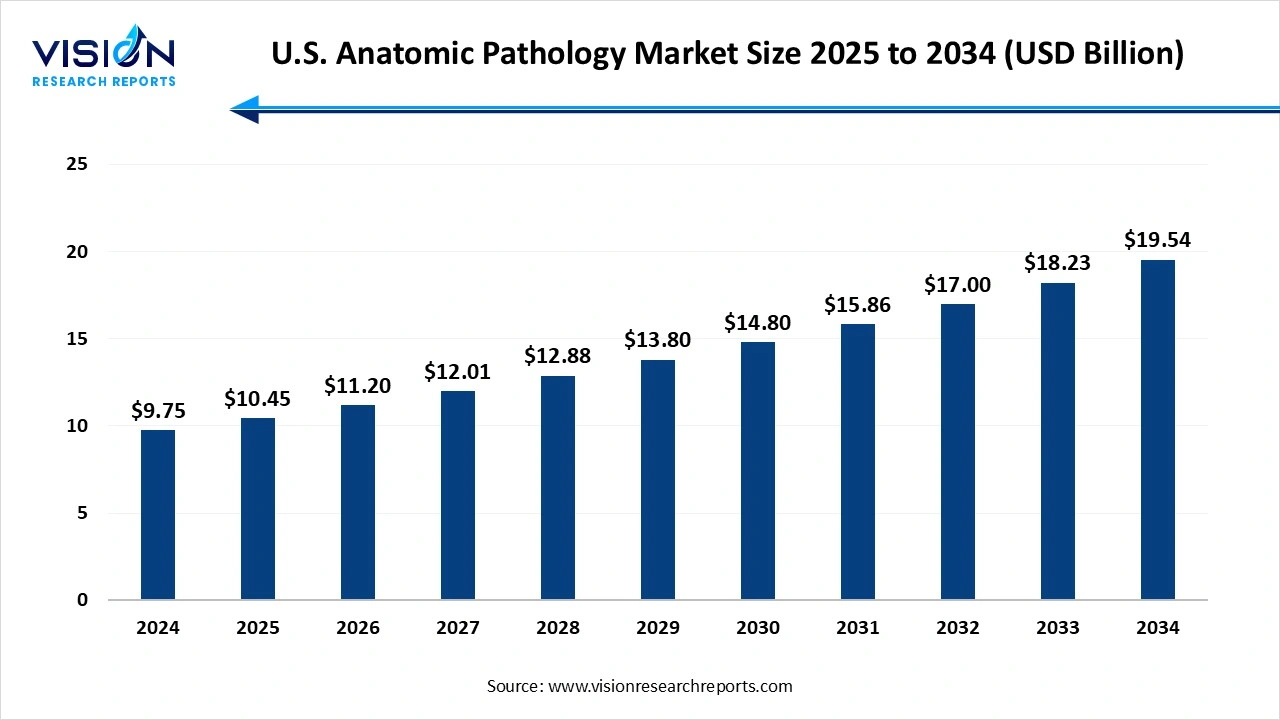

The U.S. anatomic pathology market size was accounted at USD 9.75 billion in 2024 and it is projected to hit around USD 19.54 billion by 2034, growing at a CAGR of 7.2% from 2025 to 2034. The market growth is driven by the rising prevalence of chronic diseases, growing demand for personalized medicine, and an increasing volume of diagnostic tests, the U.S. anatomic pathology market is experiencing steady growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.75 billion |

| Revenue Forecast by 2034 | USD 19.54 billion |

| Growth rate from 2025 to 2034 | CAGR of 7.2% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Companies Covered |

Danaher Corporation, Quest Diagnostics Incorporated, Labcorp, Agilent Technologies, Inc., Cardinal Health, Sakura Finetek USA, Inc., NeoGenomics Laboratories, Inc., BioGenex, Bio SB. |

The U.S. anatomic pathology market is witnessing steady growth, driven by the rising prevalence of chronic diseases, increasing cancer incidence, and the growing demand for early and accurate diagnostic techniques. Anatomic pathology plays a vital role in disease diagnosis, particularly in oncology, by enabling the examination of tissue samples to detect abnormalities at a cellular level. Technological advancements in digital pathology, automation, and molecular diagnostics are transforming traditional pathology practices, making processes more efficient and accurate. Moreover, the aging population, coupled with increased healthcare expenditure and a strong presence of leading diagnostic laboratories and healthcare infrastructure, further supports market expansion.

One of the primary growth drivers of the U.S. anatomic pathology market is the rising burden of chronic diseases, especially cancer. As cancer remains a leading cause of death in the country, the need for accurate tissue-based diagnosis has become critical for effective treatment planning. Anatomic pathology plays a crucial role in cancer detection and staging, which has led to a surge in demand for pathology services across hospitals, diagnostic laboratories, and research institutions.

Technological advancements are also significantly influencing the market's expansion. The integration of digital pathology, artificial intelligence (AI), and automation in laboratory processes is enhancing diagnostic accuracy, reducing turnaround time, and improving workflow efficiency. These innovations are enabling pathologists to handle higher volumes of complex cases with precision, thereby supporting broader adoption.

One of the major challenges confronting the U.S. anatomic pathology market is the shortage of skilled pathologists and laboratory professionals. As the demand for diagnostic services continues to rise particularly with the increasing incidence of cancer and other chronic diseases the existing workforce is struggling to keep pace. This shortage leads to higher workloads, delayed diagnoses, and reduced efficiency, especially in smaller or rural healthcare settings. Additionally, the aging pathologist workforce raises concerns about long-term capacity and continuity of expertise in the field.

Another critical challenge is the high cost and complexity of adopting advanced technologies, such as digital pathology systems and AI-powered diagnostic tools. While these innovations offer improved accuracy and workflow benefits, their implementation requires substantial investment in infrastructure, software integration, data storage, and staff training. Smaller laboratories and community hospitals often face financial and operational barriers to adopting these technologies.

The consumables segment held the largest market share, accounting for 69% in 2024. Consumables include reagents, staining solutions, fixatives, embedding materials, and antibodies used in histopathology and cytopathology. The frequent and recurring use of these materials in tissue processing, slide preparation, and staining makes them indispensable in pathology labs. The increasing volume of diagnostic testing, particularly for cancer and other chronic diseases, has led to a higher demand for high-quality consumables that ensure accuracy and reliability in results.

The instruments segment is expected to register the highest CAGR during the forecast period from 2025 to 2034.

The instruments segment is anticipated to register the highest CAGR during the forecast period from 2025 to 2034.

These include tissue processors, microtomes, slide strainers, embedding systems, and digital pathology scanners. The growing trend toward laboratory automation and the rising need for high-throughput diagnostic solutions have accelerated the demand for sophisticated instrumentation. These advanced instruments help reduce manual errors, enhance processing speed, and improve diagnostic accuracy, particularly in high-volume pathology labs. Additionally, the integration of digital imaging and artificial intelligence into pathology instruments is transforming traditional pathology practices, enabling remote slide analysis and enhancing collaboration among pathologists.

The disease diagnosis segment accounted for the largest share of the market in 2024. This discipline plays a crucial role in the early detection, classification, and staging of a wide range of diseases, particularly cancer. By examining tissue and cell samples at the microscopic level, pathologists provide definitive diagnoses that guide therapeutic decisions and patient management strategies. The increasing prevalence of chronic illnesses, such as cardiovascular disorders, autoimmune diseases, and neurological conditions, is further fueling the demand for accurate and timely pathological evaluations.

The drug discovery and development is projected to exhibit the highest CAGR over the forecast period. Pharmaceutical and biotechnology companies rely heavily on tissue analysis and histopathological data to assess the safety and efficacy of new drug candidates during preclinical and clinical trials. Anatomic pathology helps identify biomarkers, understand disease mechanisms, and evaluate drug-induced tissue changes, which are critical for regulatory submissions and therapeutic validation. The integration of advanced imaging techniques and digital pathology has further enhanced the ability to conduct high-resolution tissue analysis, supporting more efficient and cost-effective drug development processes.

The hospital segment accounted for the largest share of the market in 2024. These facilities handle a high volume of surgical and biopsy specimens that require pathological evaluation, particularly in departments such as oncology, surgery, and internal medicine. With the growing prevalence of chronic conditions and cancer-related procedures, hospitals rely heavily on in-house or affiliated pathology departments to ensure accurate and timely diagnostic results. The presence of advanced infrastructure, experienced pathologists, and integration with electronic health record systems allows hospitals to deliver comprehensive pathology services efficiently.

The diagnostic laboratories segment is expected to register the highest CAGR during the forecast period. These laboratories typically manage a large volume of specimens and are equipped with state-of-the-art equipment and skilled professionals to deliver high-precision results. Their growing importance is fueled by the increasing demand for cost-effective and scalable diagnostic solutions, especially in regions facing a shortage of pathologists or limited access to advanced pathology infrastructure. Diagnostic labs are also at the forefront of adopting digital technologies, enabling remote slide interpretation, AI-powered diagnostics, and cloud-based data management.

By Product & Services

By Application

By End Use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product & Services Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Anatomic Pathology Market

5.1. COVID-19 Landscape: U.S. Anatomic Pathology Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Anatomic Pathology Market, By Product & Services

8.1. U.S. Anatomic Pathology Market, by Product & Services

8.1.1 Instruments

8.1.1.1. Market Revenue and Forecast

8.1.2. Consumables

8.1.2.1. Market Revenue and Forecast

8.1.3. Services

8.1.3.1. Market Revenue and Forecast

Chapter 9. U.S. Anatomic Pathology Market, By Application

9.1. U.S. Anatomic Pathology Market, by Application

9.1.1. Disease Diagnosis

9.1.1.1. Market Revenue and Forecast

9.1.2. Drug Discovery and Development

9.1.2.1. Market Revenue and Forecast

9.1.3. Others

9.1.3.1. Market Revenue and Forecast

Chapter 10. U.S. Anatomic Pathology Market, By End Use

10.1. U.S. Anatomic Pathology Market, by End Use

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast

10.1.2. Research Laboratories

10.1.2.1. Market Revenue and Forecast

10.1.3. Diagnostic Laboratories

10.1.3.1. Market Revenue and Forecast

10.1.4. Others

10.1.4.1. Market Revenue and Forecast

Chapter 11. U.S. Anatomic Pathology Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Product & Services

11.1.2. Market Revenue and Forecast, by Application

11.1.3. Market Revenue and Forecast, by End Use

Chapter 12. Company Profiles

12.1. Danaher Corporation.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Quest Diagnostics Incorporated.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Labcorp.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Agilent Technologies, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Cardinal Health.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Sakura Finetek USA, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. NeoGenomics Laboratories, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. BioGenex

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Bio SB.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others