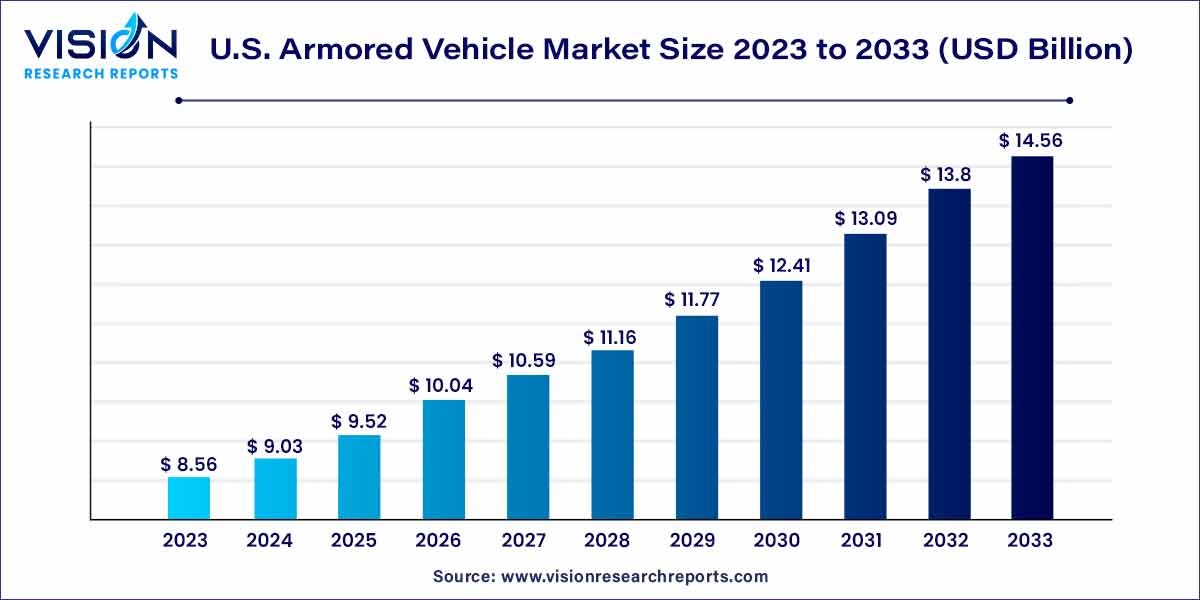

The U.S. armored vehicle market size was estimated at around USD 8.56 billion in 2023 and it is projected to hit around USD 14.56 billion by 2033, growing at a CAGR of 5.45% from 2024 to 2033. The primary drivers of this development are the necessity for armed forces modernization and rising geopolitical tensions, which have led to greater military spending by the US government.

The growth of the U.S. armored vehicle market is propelled by several key factors that collectively contribute to its sustained expansion. Firstly, geopolitical tensions and the evolving nature of global security challenges drive the demand for advanced armored vehicles, fostering a continual need for modernization within the defense sector. Additionally, strategic initiatives aimed at enhancing national defense capabilities play a pivotal role, encouraging investments in cutting-edge technologies and innovative solutions. The integration of advanced materials, artificial intelligence, and autonomous systems further amplifies the market's growth trajectory, enabling the development of armored vehicles with heightened mobility, firepower, and survivability.

| Report Coverage | Details |

| Market Size in 2023 | USD 8.56 billion |

| Revenue Forecast by 2033 | USD 14.56 billion |

| Growth rate from 2024 to 2033 | CAGR of 5.45% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The combat vehicles segment held the largest revenue share of 35% in 2023. The segment is anticipated to retain its dominance throughout the forecast period. The constantly evolving threat environment has made the use of these vehicles more critical in security and military operations. The scenario draws attention to the need to develop new technologies and capabilities, such as weapon systems, advanced armor, and electronic warfare capabilities. As an increasing number of market players focus on designing products that offer these capabilities, combat vehicles are becoming increasingly versatile, with the ability to perform various missions and tasks. This includes the development of vehicles that can operate in multiple environments, such as amphibious vehicles that can operate on land and in water.

The cash in transit vehicles segment is predicted to foresee significant growth in the forecast period driven by the vital role these vehicles play in the security and financial sectors. The continued popularity of cash transactions, despite the growth of digital payments, continues to necessitate the secure and efficient transportation of physical currency. Furthermore, the rising concerns over security and the need to protect valuable assets have prompted financial institutions and CIT service providers to invest in technologically advanced and fortified vehicles.

The conventional armored vehicles segment contributed the largest market share of 96% in 2023. Conventional armored vehicles have proven their worth in a wide range of military and security applications owing to the stability and reliability offered. These vehicles are trusted for their battle-hardened design, robust construction, and proven track record in protecting military personnel and crucial assets in high-threat environments. Moreover, while there is a growing interest in technologically advanced armored vehicles, the conventional segment remains appealing due to its cost-effectiveness. Upgrading and modernizing existing fleets of conventional armored vehicles is often more budget-friendly than procuring entirely new, cutting-edge platforms.

The electric armored vehicles segment is expected to showcase significant growth over the forecast period. As concerns over climate change and air pollution continue to grow, there is an increasing demand for environmentally friendly solutions such as Electric Vehicles (EVs) across various industries, including the military and security sectors. Advances in battery technology have made it possible to develop armored electric vehicles with sufficient power and range to meet the needs of military and security applications.

The wheeled segment generated the maximum market share of 82% in 2023. Wheeled armored vehicles offer superior mobility compared to tracked vehicles, particularly on highways and roads, making them well-suited for swift deployment in a wide range of environments, including urban areas. These vehicles are known for their relatively lower maintenance requirements, resulting in reduced long-term operating costs. With ongoing advancements in technology and design, wheeled armored vehicles are expected to become increasingly advanced and capable, thereby becoming a more critical asset in military and security operations across various landscapes.

The tracked segment will witness significant growth in the coming years. Tracked vehicles are typically used for military or security applications such as armored reconnaissance, combat operations, and logistical support. These vehicles are often developed to offer robust heavy armor protection, which makes them particularly well-suited for high-risk conditions and combat operations. Their tracked configuration offers a low center of gravity, enhancing stability and diminishing the risk of tipping over, a crucial advantage in challenging terrains.

The manned armored vehicles segment captured the maximum market share of 86% in 2023. The high share can be attributed to their effectiveness in protecting the occupants against a wide range of threats, including small arms fire and Improvised Explosive Devices (IEDs), which make them essential for personnel safety in high-risk environments. Armored vehicle manufacturers provide customization options, making them ideal for military forces, government agencies, and private security firms, thus driving segment growth. These vehicles are designed to transport personnel safely in high-threat environments.

The unmanned armored vehicles segment will witness significant growth in the coming years. Unmanned armored vehicles, also known as Unmanned Ground Vehicles (UGVs), are a type of armored vehicle that can operate without a human operator on board. These vehicles are remotely controlled or can operate autonomously. They are equipped with various sensors and other advanced technology that allow them to perform various tasks, including logistics, surveillance, and combat operations. Unmanned armored vehicles are designed to operate in a wide range of environments and conditions and can be customized to meet specific mission requirements.

The OEM segment had the largest market share of 83% in 2023. The growth can be attributed to OEMs serving as the primary manufacturers and suppliers of armored vehicles to governments and militaries worldwide. Their product portfolios include a diverse range of armored vehicles, encompassing main battle tanks, infantry fighting vehicles, armored personnel carriers, and mine-resistant ambush-protected vehicles. With the increasing demand for armored vehicles, OEMs are capitalizing on opportunities to expand their offerings and cater to clients in the military, security, and law enforcement sectors. These companies are actively investing in cutting-edge technologies and capabilities to develop more advanced and effective armored vehicles, ensuring they remain at the forefront of the market's growth and innovation.

The retrofit segment will witness significant growth in the coming years. This growth is driven by the aging armored vehicle fleet within the U.S. military, where upgrading and retrofitting these vehicles proves to be a more cost-effective option compared to procuring new ones. In addition, continuous technological advancements, such as active protection systems, enhanced situational awareness systems, and new weaponry, provide opportunities to improve the performance and survivability of existing armored vehicles.

By Product

By Vehicle Type

By Mobility

By Mode of Operation

By Point of Sale

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Armored Vehicle Market

5.1. COVID-19 Landscape: U.S. Armored Vehicle Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Armored Vehicle Market, By Product

8.1. U.S. Armored Vehicle Market, by Product, 2024-2033

8.1.1. Combat Vehicles

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Combat Support Vehicles

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Armored Supply Trucks

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Cash in Transit Vehicles

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Law Enforcement Vehicles

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Armored Vehicle Market, By Vehicle Type

9.1. U.S. Armored Vehicle Market, by Vehicle Type, 2024-2033

9.1.1. Electric Armored Vehicles

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Conventional Armored Vehicles

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Armored Vehicle Market, By Mobility

10.1. U.S. Armored Vehicle Market, by Mobility, 2024-2033

10.1.1. Wheeled

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Tracked

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Armored Vehicle Market, By Mode of Operation

11.1. U.S. Armored Vehicle Market, by Mode of Operation, 2024-2033

11.1.1. Manned Armored Vehicles

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Unmanned Armored Vehicles

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Armored Vehicle Market, By Point of Sale

12.1. U.S. Armored Vehicle Market, by Point of Sale, 2024-2033

12.1.1. OEM

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Retrofit

12.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 13. U.S. Armored Vehicle Market, Regional Estimates and Trend Forecast

13.1. U.S.

13.1.1. Market Revenue and Forecast, by Product (2021-2033)

13.1.2. Market Revenue and Forecast, by Vehicle Type (2021-2033)

13.1.3. Market Revenue and Forecast, by Mobility (2021-2033)

13.1.4. Market Revenue and Forecast, by Mode of Operation (2021-2033)

13.1.5. Market Revenue and Forecast, by Point of Sale (2021-2033)

Chapter 14. Company Profiles

14.1. BAE Systems

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. BMW AG

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Mercedes-Benz Group AG

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Elbit Systems Ltd.

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Ford Motor Company

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. General Dynamics Corporation

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. INKAS Armored Vehicle Manufacturing

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. International Armored Group

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Iveco Group N. V

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Krauss-Maffei Wegmann GmbH & Co. (KMW)

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others