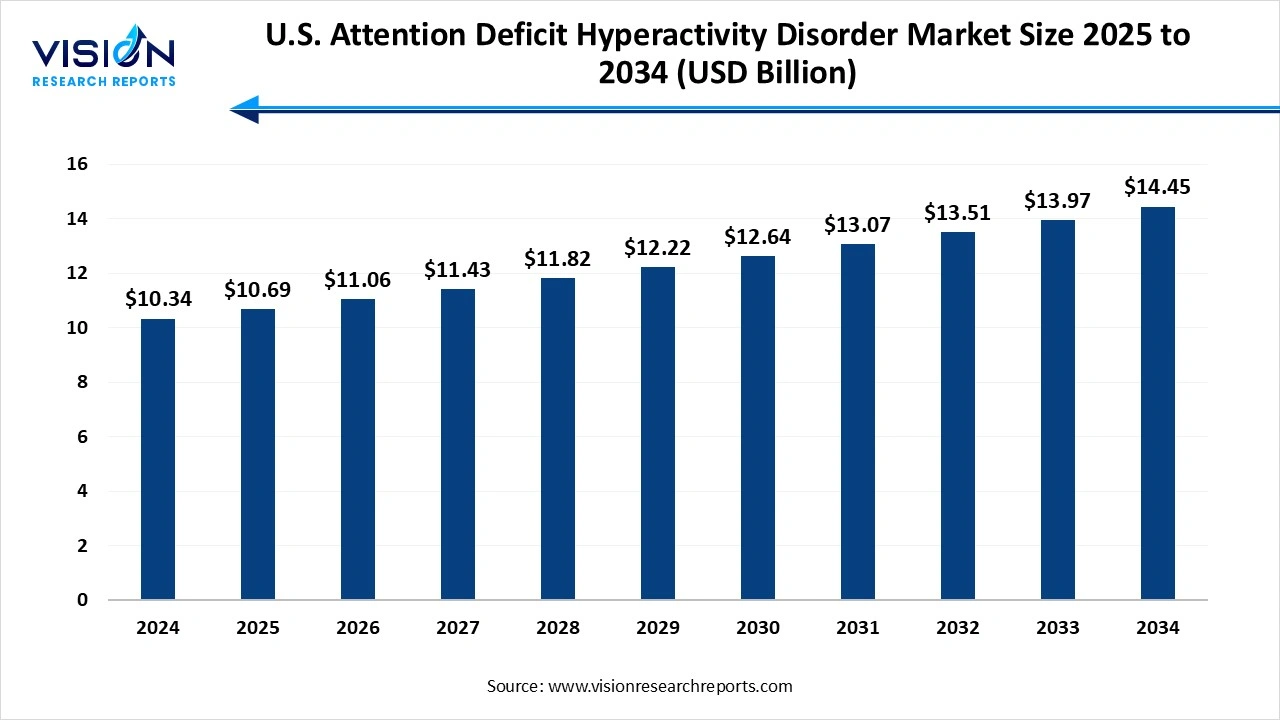

The U.S. attention deficit hyperactivity disorder market size was reached at USD 10.34 billion in 2024 and it is projected to hit around USD 14.45 billion by 2034, growing at a CAGR of 3.4% from 2025 to 2034. The market growth is driven by rising awareness of mental health, early diagnosis initiatives, and increasing use of digital tools for behavioral assessment, the U.S. Attention Deficit Hyperactivity Disorder (ADHD) market is experiencing robust growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 10.34 billion |

| Revenue Forecast by 2034 | USD 14.45 billion |

| Growth rate from 2025 to 2034 | CAGR of 3.4% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Companies Covered | Takeda Pharmaceutical Company Limited, Novartis AG Pfizer Inc., Eli Lilly and Company, Johnson & Johnson (Janssen Pharmaceuticals, Inc.), Supernus Pharmaceuticals, Inc., Tris Pharma, Inc., Neos Therapeutics, Inc.,Amneal Pharmaceuticals, Inc. Purdue Pharma L.P. |

The U.S. attention deficit hyperactivity disorder (ADHD) market has witnessed significant growth in recent years, driven by rising awareness, improved diagnostic rates, and expanding access to treatment options. ADHD is one of the most commonly diagnosed neurodevelopmental disorders in children and adolescents, with a growing number of adults also being diagnosed and treated. This has led to increased demand for both pharmacological and non-pharmacological therapies, creating a robust market landscape across the country.

Pharmaceutical interventions, particularly stimulant medications such as methylphenidate and amphetamines, continue to dominate the treatment landscape. However, non-stimulant options and behavioral therapies are also gaining traction, especially among parents and caregivers seeking alternative or complementary approaches.

The growth of the U.S. attention deficit hyperactivity disorder (ADHD) market is primarily driven by the increasing prevalence of the condition across both pediatric and adult populations. Growing awareness among parents, educators, and healthcare providers has significantly improved early diagnosis and intervention rates. Additionally, the rising acceptance of ADHD as a legitimate medical condition has reduced stigma, encouraging more individuals to seek diagnosis and treatment.

Another key growth factor is the continuous advancement in treatment options, including both medication and non-pharmacological therapies. The development of long-acting stimulants, novel non-stimulant drugs, and personalized treatment approaches has improved patient outcomes and compliance.

One of the key challenges facing the U.S. attention deficit hyperactivity disorder (ADHD) market is the ongoing concern over misdiagnosis and overprescription, particularly in children. The symptoms of ADHD often overlap with other behavioral or psychological conditions, which can lead to incorrect diagnoses and inappropriate treatment plans. This not only affects the credibility of ADHD care but also contributes to public skepticism about the disorder.

Another significant hurdle is the disparity in access to care, particularly among underserved and rural populations. While telehealth has improved availability in some areas, many families still face barriers such as lack of insurance coverage, limited access to mental health professionals, and socioeconomic constraints.

The stimulants segment held the largest share of revenue in the U.S. attention deficit hyperactivity disorder industry, accounting for 70% of the market in 2024. These drugs, including amphetamine-based and methylphenidate-based formulations, are considered first-line therapies due to their rapid onset of action and high efficacy in reducing core symptoms such as inattention, hyperactivity, and impulsivity. Stimulants work by increasing dopamine and norepinephrine levels in the brain, which are typically lower in individuals with ADHD. Over the years, pharmaceutical companies have introduced extended-release versions to improve convenience, minimize dosage frequency, and reduce abuse potential.

The non-stimulants segment is projected to experience the highest compound annual growth rate of 7.6% throughout the forecast period. These drugs, which include atomoxetine, guanfacine, and clonidine, target different neurotransmitter pathways and offer more gradual symptom improvement with fewer risks of abuse. Non-stimulants are often preferred for individuals with co-existing conditions such as anxiety or those who experience adverse effects from stimulants.

The adult segment held the largest share of revenue in the market in 2024. ADHD is most commonly identified during early childhood, typically when behavioral symptoms begin to interfere with academic performance or social interactions. Pediatric diagnosis has significantly increased due to heightened awareness among parents, teachers, and healthcare providers, along with improved screening protocols.

The children’s segment (ages 2-17) is anticipated to register a notable CAGR in the U.S. attention deficit hyperactivity disorder industry over the forecast period. The children’s segment (ages 2–17) is projected to register a significant CAGR in the U.S. attention deficit hyperactivity disorder (ADHD) market throughout the forecast period, largely driven by enhanced early detection initiatives and growing emphasis on pediatric mental health. Initiatives such as the CDC’s Healthy Schools program and the widespread adoption of behavioral screenings in pediatric healthcare settings have led to a rise in ADHD diagnoses among children.

The retail pharmacy segment held the highest share of revenue in 2024. Patients and caregivers often prefer retail pharmacies for prescription refills and consultations, especially when managing long-term treatment regimens involving stimulant and non-stimulant medications. The rise in e-prescriptions and digital health platforms has further strengthened the role of retail pharmacies.

The hospital pharmacy segment is expected to witness substantial growth with a notable CAGR from 2025 to 2034. These settings are commonly involved in inpatient care, psychiatric assessments, and the administration of non-stimulant therapies or combination treatments under close supervision. Hospital pharmacies also ensure immediate access to medications during emergency interventions or when behavioral symptoms require short-term stabilization.

By Drug Type

By Demographics

By Distribution Channel

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Drug Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Attention Deficit Hyperactivity Disorder Market

5.1. COVID-19 Landscape: U.S. Attention Deficit Hyperactivity Disorder Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Attention Deficit Hyperactivity Disorder Market, By Drug Type

8.1. U.S. Attention Deficit Hyperactivity Disorder Market, by Drug Type

8.1.1 Stimulants

8.1.1.1. Market Revenue and Forecast

8.1.2. Amphetamine

8.1.2.1. Market Revenue and Forecast

8.1.3. Methylphenidate

8.1.3.1. Market Revenue and Forecast

8.1.4. Lisdexamfetamine

8.1.4.1. Market Revenue and Forecast

8.1.5. Dexmethylphenidate

8.1.5.1. Market Revenue and Forecast

8.1.6. Non-stimulants

8.1.6.1. Market Revenue and Forecast

8.1.7. Atomoxetine

8.1.7.1. Market Revenue and Forecast

8.1.8. Guanfacine

8.1.8.1. Market Revenue and Forecast

8.1.9. Clonidine

8.1.9.1. Market Revenue and Forecast

8.1.10. Others

8.1.10.1. Market Revenue and Forecast

Chapter 9. U.S. Attention Deficit Hyperactivity Disorder Market, By Demographics

9.1. U.S. Attention Deficit Hyperactivity Disorder Market, by Demographics

9.1.1. Children

9.1.1.1. Market Revenue and Forecast

9.1.2. Adults

9.1.2.1. Market Revenue and Forecast

Chapter 10. U.S. Attention Deficit Hyperactivity Disorder Market, By Distribution Channel

10.1. U.S. Attention Deficit Hyperactivity Disorder Market, by Distribution Channel

10.1.1. Retail Pharmacy

10.1.1.1. Market Revenue and Forecast

10.1.2. Hospital Pharmacy

10.1.2.1. Market Revenue and Forecast

Chapter 11. U.S. Attention Deficit Hyperactivity Disorder Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Drug Type

11.1.2. Market Revenue and Forecast, by Demographics

11.1.3. Market Revenue and Forecast, by Distribution Channel

Chapter 12. Company Profiles

12.1. Takeda Pharmaceutical Company Limited

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Novartis AG

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Pfizer Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Eli Lilly and Company

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Johnson & Johnson (Janssen Pharmaceuticals, Inc.)

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Supernus Pharmaceuticals, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Tris Pharma, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Neos Therapeutics, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Amneal Pharmaceuticals, Inc

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Purdue Pharma L.P.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others