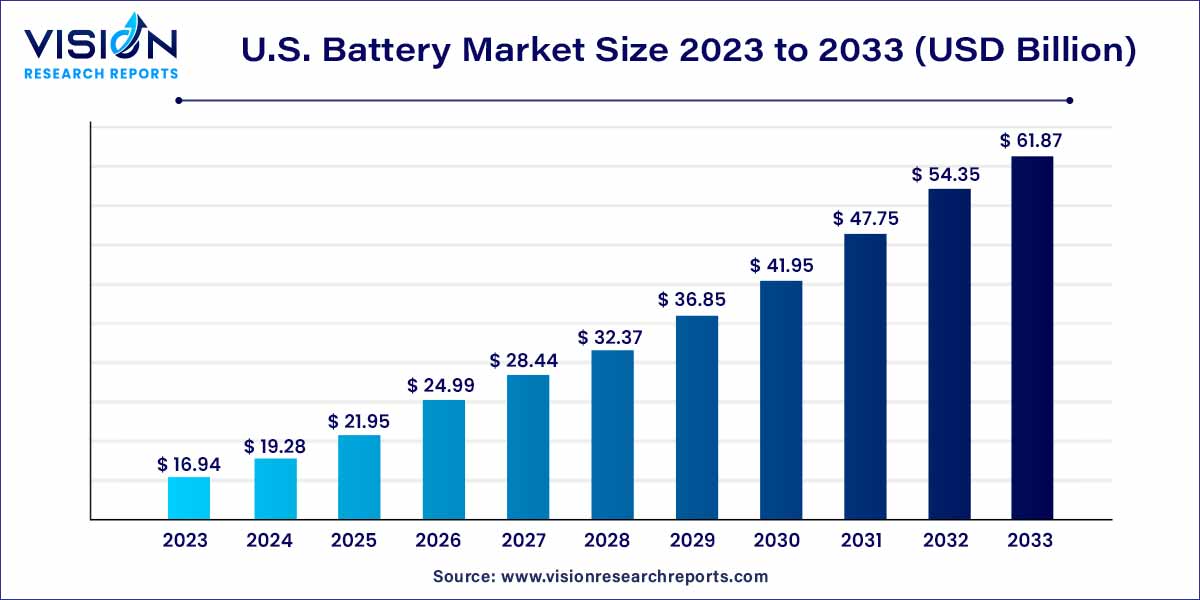

The U.S. battery market size was estimated at around USD 16.94 billion in 2023 and it is projected to hit around USD 61.87 billion by 2033, growing at a CAGR of 13.83% from 2024 to 2033. The U.S. battery market is driven by advancements in technology, growing demand for energy storage solutions, and a shift towards sustainable energy sources.

The growth of the U.S. battery market is propelled by several key factors. Technological advancements stand at the forefront, with ongoing research and development leading to enhanced battery performance, energy density, and lifespan. The increasing demand for energy storage solutions across residential, commercial, and industrial sectors is another significant growth factor. Batteries play a pivotal role in addressing the intermittency challenges associated with renewable energy sources, fostering their integration into the mainstream power grid. Moreover, the surge in electric vehicle adoption contributes substantially to market expansion, driving innovation in high-performance battery technologies. As sustainability gains prominence, manufacturers have the opportunity to invest in eco-friendly battery solutions and recycling processes, aligning with environmental standards. These growth factors collectively position the U.S. battery market for sustained development in the foreseeable future.

The lithium-ion battery segment secured the largest share of revenue at 42% in 2023 and is anticipated to exhibit the fastest Compound Annual Growth Rate (CAGR) throughout the forecast period. While electric vehicles (EVs) contribute significantly to the lithium-ion segment, these batteries find broad applications in consumer electronics, crucial defense systems, and stationary storage for the electric grid. The increasing electrification of the U.S. transportation sector is generating employment growth associated with EVs. Recognizing the strategic importance of battery development and production, the U.S. places emphasis on these aspects both as part of the transition to a clean-energy economy and as a crucial element for maintaining competitiveness in the automotive industry.

Nickel-metal hydride batteries are poised for significant growth with an anticipated noteworthy CAGR from 2024 to 2033. Renowned for their reasonable energy and specific power capabilities, these batteries are commonly employed in computers and medical equipment due to their extended life cycle and safety features. Their longer life cycle and safety attributes make nickel-metal hydride batteries a preferred choice, especially in Hybrid Electric Vehicles (HEVs). However, they come with inherent challenges, including high cost, a notable self-discharge rate, heat generation at elevated temperatures, and the need for hydrogen loss control.

In 2023, the automobile segment asserted its dominance in the market, holding a substantial share of 33%. Transportation, constituting approximately 28% of total U.S. greenhouse gas (GHG) emissions, stands as the primary contributor to the country's GHG output. Electrifying the transportation sector becomes crucial in mitigating climate deterioration, fostering a sustainable and clean-energy economy that benefits all communities equitably and justly. Projections indicate a global sale of 56 million passenger Electric Vehicles (EVs) by 2040, with the U.S. market accounting for 17% (approximately 9.6 million EVs).

The energy storage segment is anticipated to experience the fastest Compound Annual Growth Rate (CAGR) from 2024 to 2033. This surge is attributed to the escalating demand for uninterrupted electricity in heavy industries and the widespread installation of power grids throughout the country. According to the Energy Information Administration (EIA), in 2019, over 60% of the major battery system capacity for storing and supplying energy in the United States was concentrated in regions under local grid operators, including the California Independent System Operator (CAISO) and PJM Interconnection (PJM).

In 2023, industrial batteries took the lead in revenue share, claiming a significant portion at 37%. This dominance is attributed to the escalating demand for energy storage systems and efficient power backup solutions in diverse industries, including power generation, marine, agricultural equipment and machinery, recreation equipment, and chemical manufacturing. The surge in demand for compact lithium-ion batteries, especially in consumer electronics like portable devices, is anticipated to be a key driver propelling the growth of the U.S. battery market.

Forecasts indicate that automotive batteries will witness the fastest Compound Annual Growth Rate (CAGR) from 2024 to 2033. This accelerated growth is fueled by the heightened production of passenger cars and advancements in autonomous vehicle technologies, positioning the automotive battery segment as a pivotal driver in the evolving landscape of the U.S. battery market.

By Product

By End-use

By Application

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others