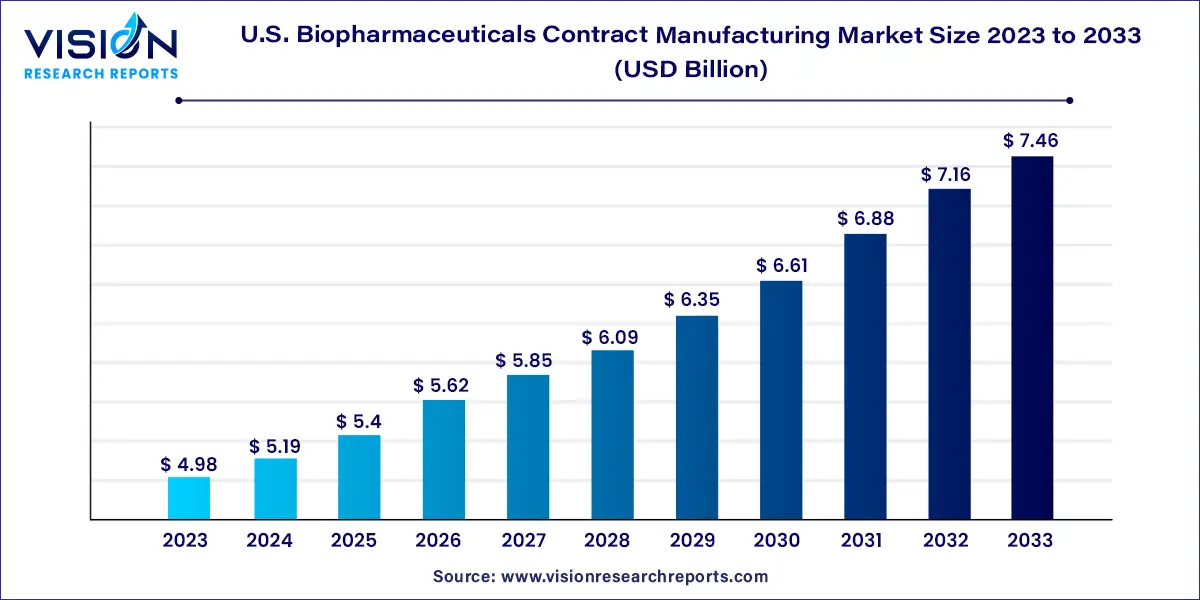

The U.S. biopharmaceuticals contract manufacturing market size was estimated at around USD 4.98 billion in 2023 and it is projected to hit around USD 7.46 billion by 2033, growing at a CAGR of 4.12% from 2024 to 2033.

The U.S. biopharmaceuticals contract manufacturing market stands at the forefront of the rapidly evolving pharmaceutical industry. As an integral component of the healthcare ecosystem, contract manufacturing plays a pivotal role in the development, production, and distribution of biopharmaceuticals. This overview aims to shed light on the key dynamics, trends, and factors shaping the landscape of the U.S. biopharmaceuticals contract manufacturing market.

The U.S. Biopharmaceuticals Contract Manufacturing market has witnessed substantial growth, propelled by various key factors. One significant driver is the increasing demand for specialized expertise in biopharmaceutical production. As pharmaceutical companies focus on core competencies, outsourcing manufacturing processes to specialized contract manufacturing organizations (CMOs) becomes a strategic choice. This trend is further accentuated by the complexity of biopharmaceutical manufacturing, which often requires advanced technologies and specialized facilities. Additionally, the need for cost-effective and efficient production processes has led pharmaceutical companies to leverage the capabilities of contract manufacturers. The competitive landscape, stringent regulatory requirements, and the growing pipeline of biopharmaceutical products also contribute to the expanding role of contract manufacturing in the U.S. biopharmaceutical sector.

In 2023, the mammalian source segment secured the highest share at 57%, primarily driven by the elevated costs associated with acquiring products from these sources. Key players offering contract services utilizing mammalian cell culture, such as AbbVie Contract Manufacturing, AMRI, Avid Bioservices, Boehringer Ingelheim Biopharmaceuticals Gmbh, and Catalent Pharma Solutions, contributed to this growth. Consequently, industry leaders like Lonza and Charles River Laboratories are making substantial investments to expand their manufacturing facilities for mammalian cell culture, specifically tailored for biologics and biosimilar development.

On the other hand, the non-mammalian segment is poised to experience the fastest Compound Annual Growth Rate (CAGR) throughout the forecast period. The widely adopted non-mammalian cell culture for biopharmaceutical production is non-mammalian cell line E. coli, recognized for its rapid accessibility and cost-effective cultivation. The development of transgenic non-mammalian expression systems presents an opportunistic avenue for market expansion. Notable Contract Manufacturing Organizations (CMOs) utilizing microbial cultures include Abbott Bioresearch, Avecia Biotechnology, BioReliance, Biovitrum AB, Dow Pharmaceutical, and Celltrion.

In 2023, process development services took the lead in the market, securing a substantial share of 33%. This dominance is attributed to the considerable capital expenditure involved in downstream processing. Downstream operations, critical for final product recovery and purification, demand meticulous attention to uphold product quality and minimize wastage. Contract Manufacturing Organizations (CMOs) have played a pivotal role by offering a comprehensive range of services to biopharmaceutical players, spanning from cell cultivation to the final packaging of the product.

Anticipated to experience the fastest Compound Annual Growth Rate (CAGR) from 2024 to 2033, the analytical & QC studies segment holds significant promise. This projection is driven by the escalating concerns about quality and regulatory changes in biopharmaceutical development, paving the way for future growth opportunities within this segment. Market players showcase analytical capabilities and expertise, offering a diverse array of technologies and services crucial for the successful market launch of products. These capabilities extend to Monoclonal Antibodies (MAbs), fusion proteins, chemically conjugated proteins, hormones, enzymes, and other biopharmaceuticals. Additionally, entities provide validated analytical methods to facilitate the release of early-phase clinical products.

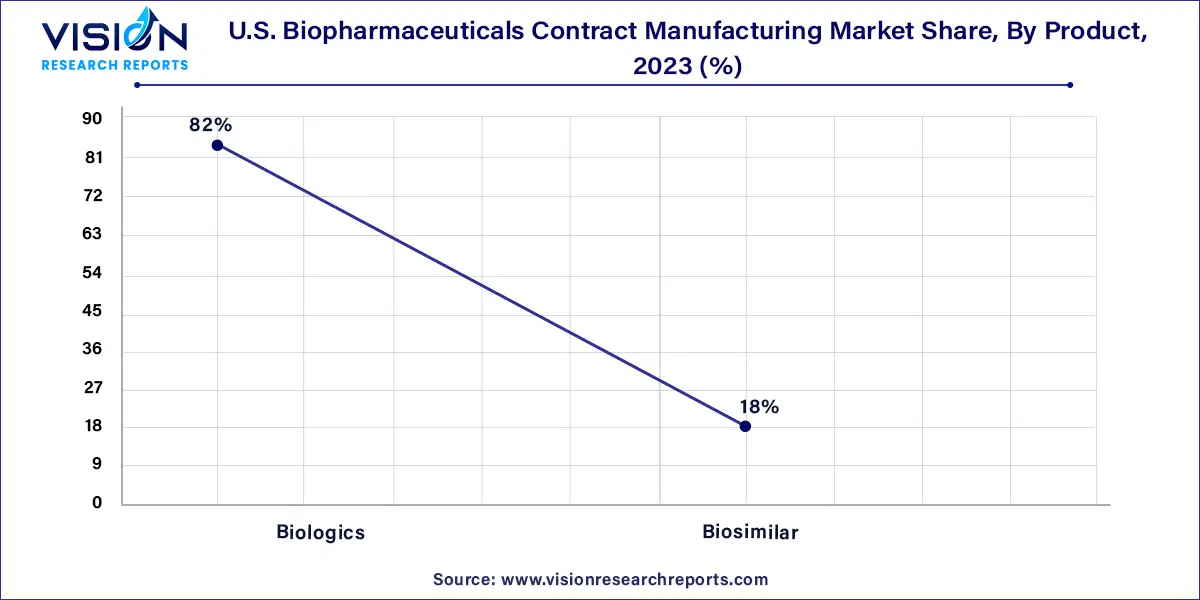

In 2023, the biologics product segment emerged as the market leader, claiming a dominant share of over 82%. Contract manufacturers have played a pivotal role in the success of both biologics and biosimilars, a trend underscored by the substantial commercial success of biologics, as evidenced by the presence of numerous FDA-approved biologics in the market. Within the biologics category, Monoclonal Antibodies (MAb) took the lead in 2023, capturing the largest market share. The significant capital investment required for establishing a MAb plant has accelerated the adoption of contract services for MAb production, contributing significantly to the segment's predominant share.

The biosimilar segment is poised for notable growth from 2024 to 2033. Biosimilar production is regarded as a key strategy for business expansion, offering a quicker market reach for biopharmaceuticals compared to biologics. Additionally, biosimilars have been instrumental in supporting the biopharmaceutical Contract Manufacturing Organization (CMO) industry, thanks to their cost-saving advantages. The combination of lower production costs and the increasing expiration of patents for blockbuster biologics has further heightened the demand for manufacturing services, including outsourced services.

By Source

By Service

By Product

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Source Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Biopharmaceuticals Contract Manufacturing Market

5.1. COVID-19 Landscape: U.S. Biopharmaceuticals Contract Manufacturing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Biopharmaceuticals Contract Manufacturing Market, By Source

8.1. U.S. Biopharmaceuticals Contract Manufacturing Market, by Source, 2024-2033

8.1.1 Mammalian

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Non-mammalian

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Biopharmaceuticals Contract Manufacturing Market, By Service

9.1. U.S. Biopharmaceuticals Contract Manufacturing Market, by Service, 2024-2033

9.1.1. Process Development

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Fill & Finish Operations

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Analytical & QC studies

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Packaging

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Biopharmaceuticals Contract Manufacturing Market, By Product

10.1. U.S. Biopharmaceuticals Contract Manufacturing Market, by Product, 2024-2033

10.1.1. Biologics

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Biosimilar

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Biopharmaceuticals Contract Manufacturing Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Source (2021-2033)

11.1.2. Market Revenue and Forecast, by Service (2021-2033)

11.1.3. Market Revenue and Forecast, by Product (2021-2033)

Chapter 12. Company Profiles

12.1. Lonza.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. WuXi Biologics.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. FUJIFILM Diosynth Biotechnologies U.S.A., Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Boehringer Ingelheim.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Thermo Fisher Scientific Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Samsung BioLogics

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. AGC Biologics.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Catalent Pharma Solutions

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Rentschler Biopharma SE.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Eurofins Scientific SE

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others