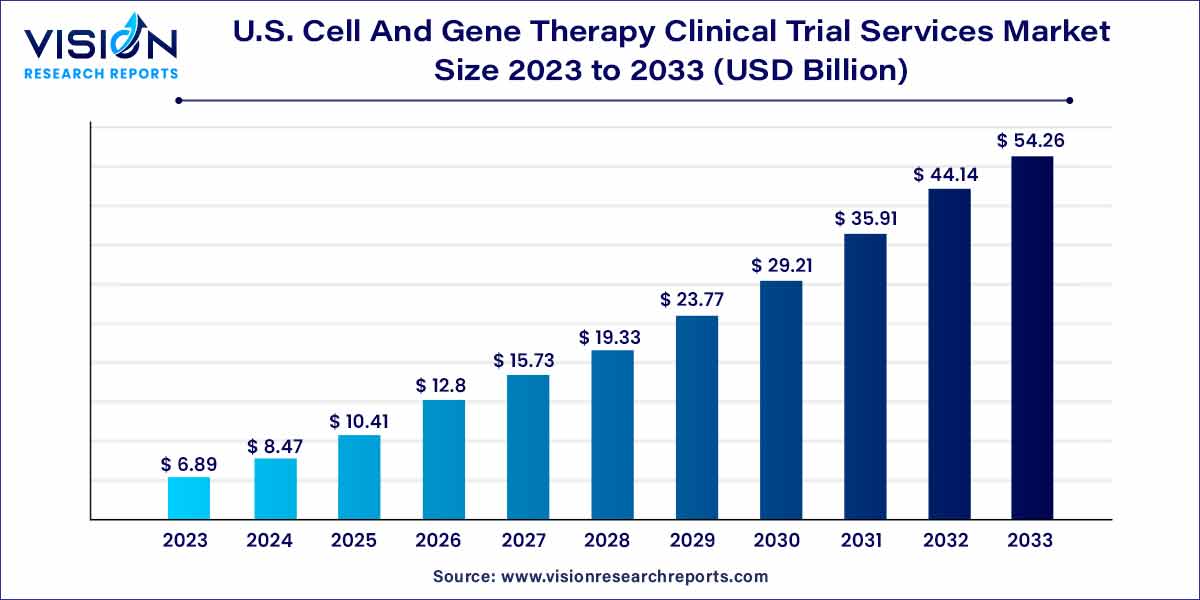

The U.S. cell and gene therapy clinical trial services market size was estimated at around USD 6.89 billion in 2023 and it is projected to hit around USD 54.26 billion by 2033, growing at a CAGR of 22.92% from 2024 to 2033. The U.S. cell and gene therapy clinical trial services market is witnessing unprecedented growth and innovation, driven by remarkable advancements in biotechnology and a shifting paradigm in the treatment of various diseases. Cell and gene therapies hold the potential to revolutionize healthcare by offering personalized and targeted treatments, addressing the root causes of genetic disorders, cancers, and other debilitating conditions.

The growth of the U.S. cell and gene therapy clinical trial services market is propelled by several key factors. Firstly, the increasing prevalence of genetic disorders and chronic diseases has heightened the demand for innovative therapies, driving research and clinical trials in the field. Secondly, rapid advancements in biotechnology, particularly gene editing techniques like CRISPR-Cas9, have paved the way for the development of novel and targeted therapies, accelerating the pace of clinical trials. Additionally, the supportive regulatory environment in the U.S., including expedited approval pathways for cell and gene therapies, has encouraged pharmaceutical companies and research institutions to invest in clinical trials. Moreover, collaborative efforts between academia, biotech firms, and pharmaceutical companies have fostered a synergistic approach, leading to shared knowledge and resources, thus accelerating research initiatives.

| Report Coverage | Details |

| Market Size in 2023 | USD 6.89 billion |

| Revenue Forecast by 2033 | USD 54.26 billion |

| Growth rate from 2024 to 2033 | CAGR of 22.92% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The regulatory services segment held the largest revenue share of 22% in 2023. Regulatory experts provide invaluable support to research organizations and pharmaceutical companies by navigating the complex landscape of regulatory requirements. These services encompass regulatory strategy development, preparation and submission of regulatory documents, interactions with regulatory agencies, and compliance monitoring throughout the clinical trial process. Given the evolving nature of regulations in the field of cell and gene therapies, regulatory services providers offer up-to-date expertise, enabling smooth progress through different phases of clinical trials. Their in-depth knowledge of global regulatory frameworks ensures that therapies meet international standards, facilitating market approvals and eventual patient access to these innovative treatments.

The supply and logistic services segment is anticipated to grow at the noteworthy CAGR of 23.36% over the forecast period. Supply and logistic services are critical components of the cell and gene therapy clinical trial ecosystem, addressing the intricate challenges associated with the transportation, storage, and handling of sensitive biological materials. These services ensure the integrity, safety, and efficacy of gene-edited cells, viral vectors, and other therapeutic components during transit. Specialized logistics providers utilize advanced technologies and adhere to stringent protocols to maintain optimal conditions throughout the supply chain. From the manufacturing facilities to clinical trial sites, these services facilitate the seamless movement of materials, allowing for timely and reliable delivery to researchers and clinicians.

The phase II segment held the maximum revenue share of 49% in 2023. Phase II clinical trials mark a significant advancement in the evaluation of cell and gene therapies, focusing on both safety and efficacy. In this phase, a larger cohort of patients receives the experimental treatment, allowing researchers to assess its effectiveness in treating the targeted condition. Cell and gene therapy clinical trial services providers contribute substantially to Phase II trials by refining trial protocols, enhancing patient recruitment strategies, and optimizing data management processes. Their role extends to ensuring robust monitoring of patients’ responses and adverse reactions, enabling comprehensive analysis of the therapy's efficacy in a diverse patient population. Phase II trials provide crucial insights into the therapy’s effectiveness, helping researchers identify potential benefits and risks associated with the treatment.

The phase I segment is predicted to grow at the remarkable CAGR of 23.25% during the forecast period. Phase I clinical trials represent the initial stage in the rigorous process of testing cell and gene therapies. During this phase, experimental treatments are administered to a small group of carefully selected patients to evaluate their safety, dosage levels, and potential side effects. Cell and gene therapy clinical trial services providers play a crucial role in designing these trials, ensuring meticulous planning and adherence to ethical standards. Their expertise in protocol development, patient recruitment strategies, and regulatory compliance enables the seamless execution of Phase I trials.

The oncology segment contributed the largest market share of 57% in 2023. Oncology stands at the forefront of cell and gene therapy research, representing one of the most promising therapeutic areas in the clinical trial landscape. Cell and gene therapies offer a paradigm shift in cancer treatment, targeting specific genetic mutations and harnessing the body’s immune system to combat malignant cells. Within the realm of oncology, clinical trial services providers play a vital role in the development of groundbreaking therapies. Their expertise in trial design and patient recruitment, particularly in complex oncological conditions, ensures the careful selection of participants for trials. Additionally, these providers facilitate the seamless integration of cutting-edge technologies, such as CAR-T (Chimeric Antigen Receptor T-cell) therapies, into clinical trials. Their contribution extends to data management and analysis, enabling researchers to evaluate the therapies' efficacy, safety, and long-term outcomes.

The central nervous system (CNS) disorders segment is anticipated to register the fastest CAGR of 24.78% during the forecast period. Central Nervous System disorders represent a complex and challenging therapeutic area, encompassing conditions such as neurodegenerative diseases, genetic disorders, and psychiatric illnesses. Cell and gene therapies have the potential to revolutionize the treatment landscape for these disorders by addressing underlying genetic abnormalities and promoting neural regeneration. Clinical trial services providers specializing in CNS disorders play a pivotal role in advancing research in this domain. Their expertise in protocol development, particularly tailored to the intricate nature of CNS disorders, ensures the comprehensive evaluation of experimental therapies. Patient recruitment for CNS disorder trials demands specialized knowledge and careful consideration of the unique challenges faced by individuals and their families. Clinical trial services providers adeptly navigate these challenges, facilitating the involvement of eligible participants.

The cell therapy segment generated the maximum market share of 41% in 2023. Cell therapy, a revolutionary branch of regenerative medicine, involves the transplantation or infusion of living cells into a patient's body to replace damaged or dysfunctional cells, promote tissue regeneration, or enhance the immune response. Stem cells, immune cells, and other specialized cells are utilized in cell therapy treatments, holding the potential to address a wide array of diseases, including cancers, autoimmune disorders, and degenerative conditions. In the context of clinical trials, specialized clinical trial services providers play a pivotal role in advancing cell therapy research. Their expertise encompasses protocol design, ensuring the careful selection and manipulation of cells, as well as the establishment of robust quality control measures. Clinical trial services providers facilitate the seamless integration of cutting-edge technologies, such as CRISPR-Cas9 gene editing, into cell therapy protocols.

The gene-modified cell therapy segment is expected to grow at the notable CAGR of 23.66% during the forecast period. Gene-modified cell therapy represents a groundbreaking approach in the treatment of various diseases, particularly cancer. This therapy involves genetically modifying a patient's own cells, often T cells, to enhance their ability to target and eradicate cancer cells. The modified cells are then infused back into the patient, where they mount a more effective immune response against the malignancy. Clinical trial services providers specializing in gene-modified cell therapy play a pivotal role in optimizing and advancing this innovative treatment. Their expertise is instrumental in the precise editing of genes within immune cells, ensuring the accurate modification necessary for therapeutic efficacy. These providers also contribute to the development of sophisticated delivery methods, enabling the safe and targeted administration of gene-modified cells. Additionally, their involvement in trial design and patient recruitment ensures that clinical trials are conducted ethically, adhering to stringent regulatory guidelines.

By Service

By Phase

By Therapeutic Areas

By Therapy Type

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others