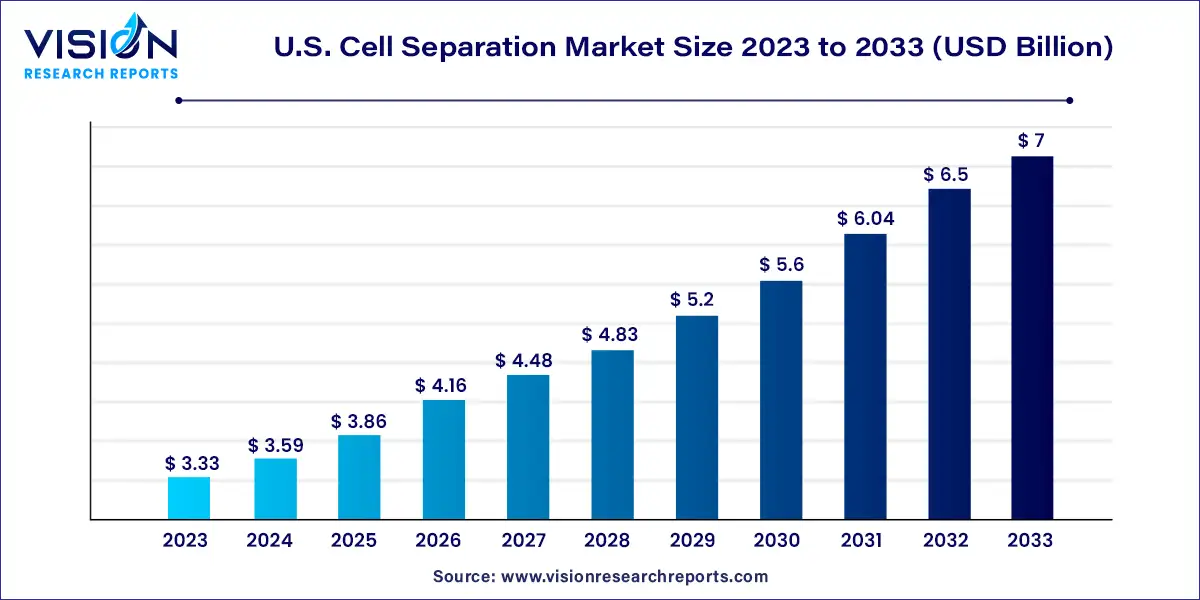

The U.S. cell separation market was estimated to be at USD 3.33 billion in 2023, which is expected to grow with a CAGR of 7.72% and reach USD 7 billion by 2033.

The cell separation market in the United States is witnessing significant growth driven by advancements in cell-based research, expanding applications in biotechnology and biopharmaceutical industries, and rising demand for personalized medicine. Cell separation, also known as cell sorting or cell isolation, plays a crucial role in various fields, including cancer research, immunology, stem cell therapy, and regenerative medicine.

The growth of the U.S. cell separation market is driven by an advancement in cell-based research and biotechnology are expanding the scope of applications for cell separation techniques. Additionally, the increasing prevalence of chronic diseases, such as cancer and autoimmune disorders, is fueling the demand for personalized cell therapies and diagnostics, thus boosting market growth. Moreover, technological innovations, including flow cytometry and magnetic-activated cell sorting (MACS), are enhancing the efficiency and accuracy of cell separation methods, driving further adoption. Furthermore, the rising investments in healthcare infrastructure and research and development activities are supporting market expansion by facilitating the development of novel cell separation technologies and therapies.

In 2023, consumable antibodies dominated the market with a share of 61%, and this segment is poised to experience the most rapid growth throughout the forecast period. This growth can be attributed to the frequent procurement of consumables. Moreover, the increased investment in research and development by biotechnology and biopharmaceutical companies aimed at developing advanced biologics, such as monoclonal antibodies and vaccines, contributes to its significant market share.

The consumables segment is further segmented into reagents, kits, media, and sera; beads; and disposables. Leading vendors like Thermo Fisher Scientific, Merck KGaA, and R&D Systems, Inc., offer state-of-the-art reagents and kits for single marker depletion, single marker positive selection, and full lineage depletion. For example, R&D Systems, Inc. provides the Human/Mouse CD44 Antibody for the detection of mouse and human CD44 in flow cytometry. Merck offers the Accuspin system histopaque, utilized for separating mononuclear cells from bone marrow or human peripheral blood.

In 2023, animal cells dominated the market with a share of 53%. Drug discovery and development heavily rely on animal cells to assess the initial toxicity, efficacy, and pharmacokinetics of newly developed drug compounds. Thermo Fisher Scientific, Inc., manufactures Dynabeads Mouse CD43 (Untouched B Cells), facilitating the isolation of pure and viable untouched B cells from mouse lymphoid organs through negative isolation. Similarly, STEMCELL Technologies, Inc., offers the EasySep Mouse B Cell Isolation Kit, aiding in the separation of B cells from single-cell suspensions of splenocytes or other tissues via negative selection.

Human cells are expected to exhibit significant growth during the forecast period. The increasing prevalence of chronic diseases like cancer and infectious diseases has spurred demand for cell-based research in disease diagnosis. Moreover, government investments in cancer research and human stem cell studies have further propelled research and development in cell isolation processes, resulting in the introduction of technologically advanced products for human cell isolation. For example, Thermo Fisher Scientific offers a human T-cell isolation product that is affordable, pure, and user-friendly, ensuring the isolation of untouched and viable cells.

Centrifugation claimed the largest market share of 41% in 2023. Cell separation commonly employs both differential centrifugation and density gradient centrifugation techniques. Differential centrifugation utilizes a lysate to rupture cell membranes and separate particles, while density gradient centrifugation relies on the molecular weights of particles for separation. Both methods require various consumables, including reagents and disposables, to ensure successful cell isolation in the medium.

Surface markers are projected to experience the fastest compound annual growth rate (CAGR) from 2024 to 2033. These markers play a crucial role in characterizing and identifying different subpopulations of leukocytes. Identifying cell surface markers is essential for drug discovery, enabling the development of drugs to combat diseases like cancer and HIV. With the rise of personalized medicine, drugs are tailored based on genetics, enhancing drug efficacy

Biomolecule isolation commanded the largest market share of 29% in 2023, and this segment is anticipated to demonstrate the highest growth rate throughout the forecast period. Biomolecule isolation plays a crucial role in the development of various biosimilars and biopharmaceuticals. Major classes of biomolecules include lipids, carbohydrates, nucleic acids, and proteins.

Primarily, proteins and nucleic acids are utilized in the production of biopharmaceuticals and biosimilars. The growing demand for these biomolecules necessitates advanced cell isolation techniques, thus driving market expansion. Biomolecule isolation typically involves centrifugation, adsorption, filtration, and magnetic separation techniques.

Biotechnology and biopharmaceutical companies dominated the revenue share with 43% in 2023, and this segment is poised to exhibit the fastest growth rate during the forecast period. These companies are extensively engaged in research and development efforts focused on next-generation therapeutics, which necessitate advanced cell separation techniques. Areas of focus include protein therapeutics, monoclonal antibodies, stem cells, cryobanking, and cell-based assays.

The rising preference for personalized medicines is expanding the growth opportunities for this segment. Cell separation techniques play a crucial role in efficiently identifying antibodies, which are integral to the development of personalized medicine. Therefore, the increasing R&D activities undertaken by these companies are expected to drive market growth over the forecast period.

By Product

By Cell Type

By Technique

By Application

By End-use

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others