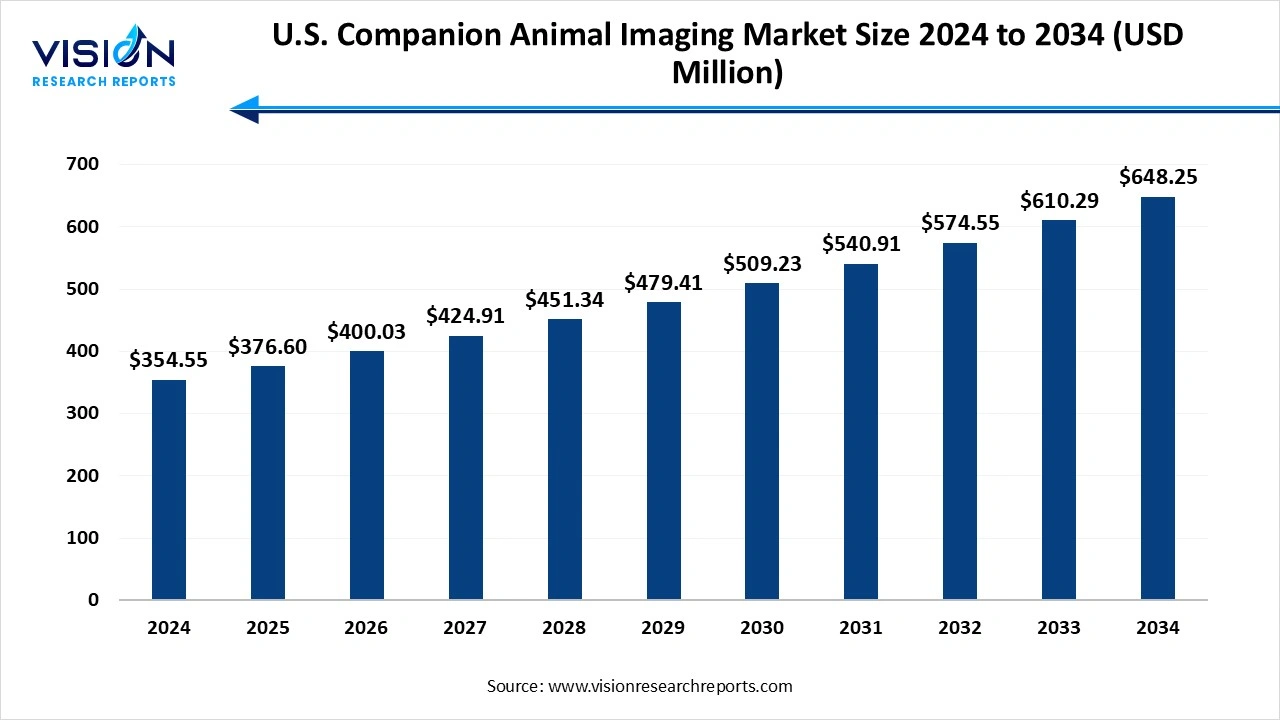

The U.S. companion animal imaging market size was valued at around USD 354.55 million in 2024 and it is projected to hit around USD 648.25 million by 2034, growing at a CAGR of 6.22% from 2025 to 2034.

The U.S. companion animal imaging market is witnessing significant growth, driven by the rising adoption of pets and increasing awareness among pet owners regarding advanced diagnostic technologies. Imaging plays a vital role in veterinary care, enabling early detection and accurate diagnosis of conditions such as fractures, tumors, cardiovascular issues, and neurological disorders in pets. As pet ownership becomes more prevalent, particularly among millennials and Gen Z, the demand for high-quality healthcare services for companion animals has intensified, propelling investments in imaging technologies.

One of the key growth factors driving the U.S. companion animal imaging market is the increasing pet population combined with the rising trend of pet humanization. As more households treat pets as family members, there is a growing demand for high-quality veterinary care, including advanced diagnostic imaging. This shift in perception has led pet owners to seek timely and accurate diagnosis for their animals, even for routine check-ups or early detection of chronic illnesses.

Another significant factor contributing to market expansion is the rapid advancement in imaging technologies and their integration into veterinary practices. Innovations such as 3D imaging, portable diagnostic equipment, and AI-enabled image analysis are enhancing diagnostic precision while reducing operational complexities for veterinary professionals. These technological breakthroughs not only support early disease detection and better treatment outcomes but also streamline workflows in veterinary clinics.

A prominent trend in the U.S. companion animal imaging market is the growing integration of digital and AI-powered imaging systems in veterinary diagnostics. Digital radiography and AI-enhanced image interpretation tools are transforming the accuracy and speed of diagnostics, enabling veterinarians to make quicker and more informed decisions. These technologies are particularly beneficial in detecting subtle changes in tissues or abnormalities that might be missed by the human eye. The demand for such precision tools is especially high in specialty veterinary practices focusing on oncology, cardiology, and neurology.

Another emerging trend is the increased use of portable and point-of-care imaging devices, particularly in smaller clinics and mobile veterinary units. These compact systems are helping expand access to diagnostic imaging services beyond large hospitals, reaching underserved or rural areas. Additionally, there is a growing interest in telemedicine and teleradiology services, allowing veterinarians to remotely share imaging results with specialists for expert consultations.

One of the major challenges faced by the U.S. companion animal imaging market is the high cost associated with advanced imaging equipment and diagnostic procedures. Technologies such as MRI and CT scans involve significant capital investment, which can be a financial burden for small or independent veterinary clinics.

Another critical challenge is the shortage of skilled veterinary radiologists and trained imaging technicians in the U.S. market. While the demand for advanced diagnostics continues to grow, the availability of professionals with specialized expertise in interpreting veterinary imaging results has not kept pace. This skills gap can lead to delays in diagnosis or the need to outsource imaging interpretations, increasing turnaround times and affecting the efficiency of veterinary practices.

The equipment segment accounted for the largest revenue share of 57% in 2024. companion animal imaging market. These devices enable non-invasive visualization of internal organs, bones, and tissues, which is crucial for detecting fractures, tumors, organ abnormalities, and neurological conditions. Technological advancements in imaging modalities, such as the introduction of high-resolution detectors, portable systems, and low-radiation technologies, are making these tools more accessible, efficient, and accurate.

The software segment is projected to register the fastest CAGR in the U.S. companion animal imaging market. These software platforms assist in capturing, storing, analyzing, and sharing imaging data across networks, thereby improving workflow efficiency and clinical decision-making. AI-enabled software is gaining traction for its ability to support automated image analysis, detect anomalies, and assist radiologists in generating accurate diagnostic reports. Cloud-based imaging software further enhances collaboration between veterinary professionals by enabling remote access to imaging results and facilitating teleradiology services.

The dogs segment led the U.S. companion animal imaging market in 2024, capturing a revenue share of 52%. Pet owners are increasingly prioritizing preventive care and early diagnosis for dogs, particularly as they age or show signs of chronic or degenerative diseases. Imaging modalities such as digital X-rays, ultrasounds, and MRIs are commonly used in diagnosing orthopedic issues, internal injuries, tumors, and neurological disorders in dogs. The strong emotional bond between dog owners and their pets, combined with increased spending on veterinary services and insurance coverage, has significantly contributed to the rising demand for advanced imaging services tailored for canines.

The cats represent the fastest-growing segment in the U.S. companion animal imaging market. Although cats tend to mask symptoms of illness more than dogs, imaging technologies are essential in uncovering internal problems such as kidney disease, gastrointestinal issues, and tumors that may not be apparent through physical exams alone. Ultrasound and digital radiography are particularly valuable in feline diagnostics due to their non-invasive nature and ability to provide real-time imaging.

The X-ray emerged as the leading modality in the U.S. companion animal imaging market, accounting for the highest revenue share of 39% in 2024. Digital radiography has revolutionized the traditional X-ray process by enabling faster image capture, improved resolution, and easier data storage and sharing. It is commonly used to evaluate skeletal structures, detect fractures, identify foreign objects, and assess the condition of vital organs such as the lungs and heart.

The video endoscopy is the most rapidly expanding segment in the U.S. companion animal imaging market. This technique uses a flexible tube with a camera and light source to visually examine areas such as the gastrointestinal tract, respiratory system, and urogenital organs. Video endoscopy is highly valued for its ability to provide live, high-definition internal views without the need for surgical intervention, significantly reducing recovery time and discomfort for pets. It is especially useful in procedures such as foreign body removal, biopsies, and monitoring of chronic internal conditions.

The orthopedics and traumatology segment dominated the U.S. companion animal imaging market in 2024, securing the highest revenue share at 39%. Diagnostic imaging is critical in evaluating bone fractures, joint disorders, ligament tears, and degenerative conditions such as arthritis or hip dysplasia. X-rays and CT scans are commonly used to provide detailed images of bone structures, enabling accurate assessment and surgical planning. The growing trend of pet owners opting for orthopedic surgeries and rehabilitation treatments has further driven the demand for high-quality imaging solutions in this field.

The oncology segment is experiencing the fastest growth in the market. Imaging plays a central role in identifying the presence, size, and spread of tumors, as well as in monitoring treatment response. Modalities such as ultrasound, MRI, and CT are extensively used for diagnosing internal masses and guiding biopsies with precision. As veterinary oncology becomes more specialized, the demand for advanced imaging systems that can support complex cancer diagnostics has intensified.

The fixed imaging systems accounted for a notable revenue share of 56% in the U.S. companion animal imaging market in 2024. These systems, often including advanced modalities such as digital radiography, CT, and MRI, are known for their superior image quality, precision, and ability to support complex diagnostic and treatment planning needs. Fixed imaging units are typically installed in dedicated imaging rooms and are used for a wide range of applications, including orthopedics, neurology, and oncology.

The portable imaging systems segment is witnessing the fastest growth in the market. These compact devices, including portable X-rays and ultrasound units, allow veterinarians to perform diagnostics in various settings outside of traditional clinics, such as during home visits, in rural areas, or in emergency scenarios. Portability reduces the need for transporting animals, which is especially beneficial for pets with limited mobility or high levels of stress in unfamiliar environments. Despite offering slightly lower image resolution compared to fixed systems, portable devices are increasingly being enhanced with wireless connectivity, cloud-based data storage, and user-friendly interfaces, making them a practical and valuable addition to veterinary practices of all sizes.

The veterinary hospitals and clinics represented the largest segment in the U.S. companion animal imaging market, capturing a significant revenue share of around 60% in 2024. These facilities commonly utilize a variety of imaging modalities, including digital X-rays, ultrasound, CT, and MRI, to diagnose and manage a broad spectrum of health conditions ranging from orthopedic issues to internal organ disorders. The increasing demand for preventive and diagnostic veterinary care, coupled with growing pet ownership, has driven investments in modern imaging infrastructure within these settings. Veterinary clinics are also benefiting from advancements in digital imaging that offer improved image quality, faster processing, and enhanced data sharing capabilities.

The specialty imaging centers are also emerging as vital end users within the U.S. companion animal imaging market, particularly as veterinary medicine becomes more specialized and technologically advanced. These centers focus on providing high-end imaging services, often equipped with sophisticated modalities such as MRI, CT, and fluoroscopy that may not be feasible for general clinics to maintain. Specialty imaging centers typically support referral-based models, working closely with primary care veterinarians to deliver advanced diagnostic support for complex cases involving neurology, oncology, cardiology, and soft tissue surgery.

By Product

By Type

By Animal Type

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others