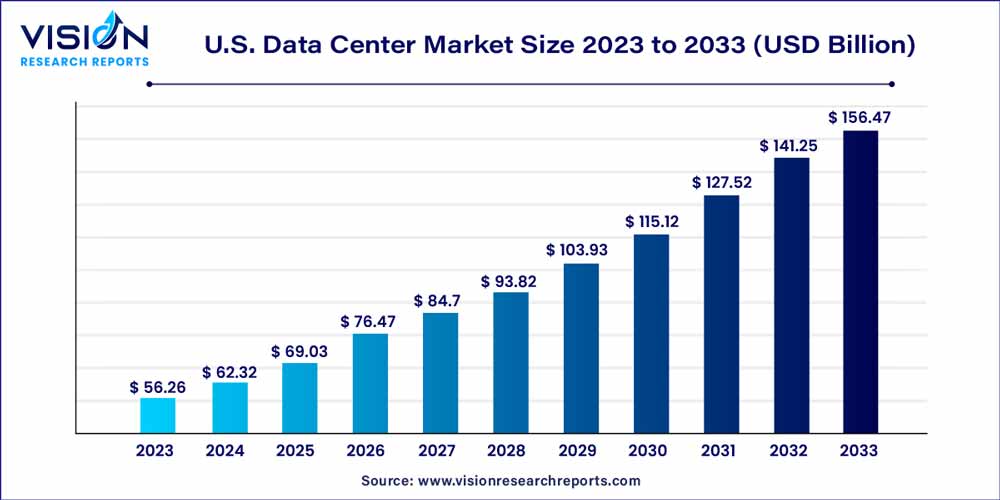

The U.S. data center market size was estimated at around USD 56.26 billion in 2023 and it is projected to hit around USD 156.47 billion by 2033, growing at a CAGR of 10.77% from 2024 to 2033. The U.S. data center market is driven by the imperative of digital transformation across industries, cloud adoption, increased connectivity requirements, data security and compliance, and artificial intelligence and machine learning.

In the rapidly evolving landscape of information technology, data centers play a pivotal role in supporting the digital infrastructure that fuels businesses, organizations, and everyday life. The U.S. data center market stands at the forefront of this technological revolution, serving as a cornerstone for innovation, connectivity, and data storage. This overview aims to shed light on the key aspects shaping the U.S. data center market, from its current status to future trends.

The growth of the U.S. data center market is propelled by several key factors. Firstly, the pervasive wave of digital transformation sweeping across industries has intensified the need for robust data storage and processing capabilities. Businesses, driven by the imperative to harness data-driven insights, are increasingly investing in advanced data center solutions. Furthermore, the ascent of cloud computing has significantly contributed to market expansion, with cloud service providers continually establishing new facilities to meet the escalating demand for diverse cloud-based services, including IaaS, PaaS, and SaaS. The advent of edge computing, spurred by the proliferation of IoT, has further augmented growth by necessitating strategically located data centers for reduced latency and enhanced real-time processing. These growth factors collectively underscore the dynamic nature of the U.S. data center market, positioning it as a critical pillar in supporting the evolving digital infrastructure landscape.

| Report Coverage | Details |

| Market Size in 2023 | USD 56.26 billion |

| Revenue Forecast by 2032 | USD 156.47 billion |

| Growth rate from 2024 to 2033 | CAGR of 10.77% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Based on the components, the U.S. data center market is segmented into hardware, software, and services. The hardware segment held the largest market share in 2023. The substantial growth of social media, digital transactions, and the Internet of Things (IoT) in the U.S. requires data centers to expand their storage and processing capabilities. The upgradation of hardware technologies such as CPU, servers, storage devices, GPU, and memory drives to store the burgeoning data requires data centers to update their hardware installations, thereby driving the hardware segment of the data center market. Further optimized hardware solutions are required to accelerate complex tasks and model training.

Based on the type, the U.S. data center market is segmented into on-premise, hyperscale, HPC, colocation, and edge. The on-premise segment had the largest market share in 2023. On-premise data centers provide enterprises with complete control over the security and data stored, following the stringent compliance requirements based on industry standards or sensitive data handling necessities. Also, managing and building on-premise data centers enables for the customization of infrastructure to fulfill the required needs of the business, performance demands, and application needs. On-premise data centers further form an ideal type for applications requiring high performance and low latency, as they help in faster data transmission and optimized user experience. These factors are collectively supporting the growth of the on-premise segment.

Based on the server rack density, the U.S. data center market is segmented into <10kW, 10-19kW, 20-29kW, 30-39kW, 40-49kW, and >50kW. The 10-19kW segment contributed the largest market share in 2023. The 10-19kW server rack density is known for its medium to high power consumption. Data centers with 10-19kW power densities mainly apply across industries, effectively supporting high-performance computing tasks. Engineering simulations, scientific research, and financial modeling need substantial computing power. This growing demand is expected to boost segmental growth, thereby fueling the growth of the U.S. data center market across regions.

Based on the redundancy, the U.S. data center market is segmented into N+1, 2N, N+2, and N. The N+1 segment held the highest market share in 2023. N+1 redundancy provides high processing and minimized downtime to data centers. Downtime in business processes leads to significant financial losses and damage to an enterprise’s position. N+1 redundancy offers a backup system, allowing operations to continue even after any failure in the component. Many businesses are adopting cloud-based services and online transactions, where uninterrupted availability is important. The N+1 redundancy segment offers this service, thereby propelling the U.S. data center market growth.

Based on the PUE, the U.S. data center market is segmented into Less than 1.2, 1.2 - 1.5, 1.5 - 2.0, and, greater than 2.0. Data centers with 1.2 to 1.5 power usage efficiency (PUE) are considered highly efficient in terms of energy consumption. The growing demand for environmentally friendly and sustainable operations is accelerating the adoption of advanced technology solutions such as 1.2-1.5 PUE, thereby propelling the demand for the U.S. data center market. Furthermore, the need for long-term financial savings through lower operational costs and reduced energy consumption is anticipated to generate huge demand for the segment.

Based on the tier level, the U.S. data center market is segmented into tier 1, tier 2, tier 3, and tier 4. The tier 3 segment generated the maximum market share in 2023. The demand for efficient and reliable data processing and storage solutions is expected to grow for the segment. The continuous digital transformation across sectors needs more processing power, connectivity, and data storage, which tier 3 level data centers mainly provide. Further, the government has been adopting stringent data protection and security regulations, where tier 3 level data centers are highly adopted by organizations to meet the standards.

Based on the enterprise size, the U.S. data center market is segmented into large enterprises and SMEs. The large enterprise segment captured the maximum market share in 2023. Large enterprises create and handle massive data from multiple sources, such as customer transactions, interactions, and operations. Further, there has been a rise in the adoption of cloud computing to boost operations, enhance scalability, and minimize costs. The data center offers capabilities to support advanced technologies and applications. It is vital in housing cloud infrastructure, promising reliable access to cloud services. The growing global operations and advanced technologies are driving the growth of the market across large enterprises.

Based on the end-use, the U.S. data center market is segmented into cloud service providers, technology providers, telecom, healthcare, BFSI, retail & e-commerce, entertainment & media, energy, and others. The adoption of cloud computing services by organizations, businesses, and people is likely to increase demand for data centers, which will fuel market expansion. Data accessibility and company continuity are ensured by the disaster recovery and backup capabilities offered by cloud services. Additionally, edge computing services that permit data closer to its sources and hence reduce latency are advantageous to cloud service provider end users. These elements are promoting the expansion of the U.S. data center industry.

By Component

By Type

By Server Rack Density

By Redundancy

By PUE

By Tier Level

By Enterprise Size

By End-Use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. U.S. Data Center Market, By Component

7.1. U.S. Data Center Market, by Component, 2024-2033

7.1.1. Hardware

7.1.1.1. Market Revenue and Forecast (2021-2033)

7.1.2. Software

7.1.2.1. Market Revenue and Forecast (2021-2033)

7.1.3. Services

7.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 8. U.S. Data Center Market, By Type

8.1. U.S. Data Center Market, by Type, 2024-2033

8.1.1. On-Premise

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Hyperscale

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Hpc

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Colocation

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Edge

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Data Center Market, By Server Rack Density

9.1. U.S. Data Center Market, by Server Rack Density, 2024-2033

9.1.1. <10kw

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. 10-19kw

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. 20-29kw

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. 30-39kw

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. 40-49kw

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. >50kw

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Data Center Market, By Redundancy

10.1. U.S. Data Center Market, by Redundancy, 2024-2033

10.1.1. N+1

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. 2n

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. N+2

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. N

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Data Center Market, By PUE

11.1. U.S. Data Center Market, by PUE, 2024-2033

11.1.1. Less Than 1.2

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. 1.2

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. - 1.5

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. 1.5

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. - 2.0

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Greater Than 2.0

11.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Data Center Market, By Tier Level

12.1. U.S. Data Center Market, by Tier Level, 2024-2033

12.1.1. Tier 1

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Tier 2

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Tier 3

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Tier 4

12.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 13. U.S. Data Center Market, By Enterprise Size

13.1. U.S. Data Center Market, by Enterprise Size, 2024-2033

13.1.1. Large Enterprises

13.1.1.1. Market Revenue and Forecast (2021-2033)

13.1.2. SMEs

13.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 14. U.S. Data Center Market, By End-Use

14.1. U.S. Data Center Market, by End-Use, 2024-2033

14.1.1. Cloud Service Providers

14.1.1.1. Market Revenue and Forecast (2021-2033)

14.1.2. Technology Providers

14.1.2.1. Market Revenue and Forecast (2021-2033)

14.1.3. Telecom

14.1.3.1. Market Revenue and Forecast (2021-2033)

14.1.4. Healthcare

14.1.4.1. Market Revenue and Forecast (2021-2033)

14.1.5. BFSI

14.1.5.1. Market Revenue and Forecast (2021-2033)

14.1.6. Retail & E-Commerce

14.1.6.1. Market Revenue and Forecast (2021-2033)

14.1.7. Entertainment & Media

14.1.7.1. Market Revenue and Forecast (2021-2033)

14.1.8. Energy

14.1.8.1. Market Revenue and Forecast (2021-2033)

14.1.9. Others

14.1.9.1. Market Revenue and Forecast (2021-2033)

Chapter 15. U.S. Data Center Market, Regional Estimates and Trend Forecast

15.1. U.S.

15.1.1. Market Revenue and Forecast, by Component (2021-2033)

15.1.2. Market Revenue and Forecast, by Type (2021-2033)

15.1.3. Market Revenue and Forecast, by Server Rack Density (2021-2033)

15.1.4. Market Revenue and Forecast, by Redundancy (2021-2033)

15.1.5. Market Revenue and Forecast, by PUE (2021-2033)

15.1.6. Market Revenue and Forecast, by Enterprise Size (2021-2033)

15.1.7. Market Revenue and Forecast, by Tier Level (2021-2033)

15.1.8. Market Revenue and Forecast, by End-Use (2021-2033)

Chapter 16. Company Profiles

16.1. Alibaba Cloud

16.1.1. Company Overview

16.1.2. Product Offerings

16.1.3. Financial Performance

16.1.4. Recent Initiatives

16.2. Amazon Web Services Inc.

16.2.1. Company Overview

16.2.2. Product Offerings

16.2.3. Financial Performance

16.2.4. Recent Initiatives

16.3. AT&T Intellectual Property

16.3.1. Company Overview

16.3.2. Product Offerings

16.3.3. Financial Performance

16.3.4. Lumen Technologies (CenturyLink)

16.4. ClipperCreek, Inc.

16.4.1. Company Overview

16.4.2. Product Offerings

16.4.3. Financial Performance

16.4.4. Recent Initiatives

16.5. China Telecom Americas Inc.

16.5.1. Company Overview

16.5.2. Product Offerings

16.5.3. Financial Performance

16.5.4. Recent Initiatives

16.6. CoreSite

16.6.1. Company Overview

16.6.2. Product Offerings

16.6.3. Financial Performance

16.6.4. Recent Initiatives

16.7. CyrusOne

16.7.1. Company Overview

16.7.2. Product Offerings

16.7.3. Financial Performance

16.7.4. Recent Initiatives

Chapter 17. Research Methodology

17.1. Primary Research

17.2. Secondary Research

17.3. Assumptions

Chapter 18. Appendix

18.1. About Us

18.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others