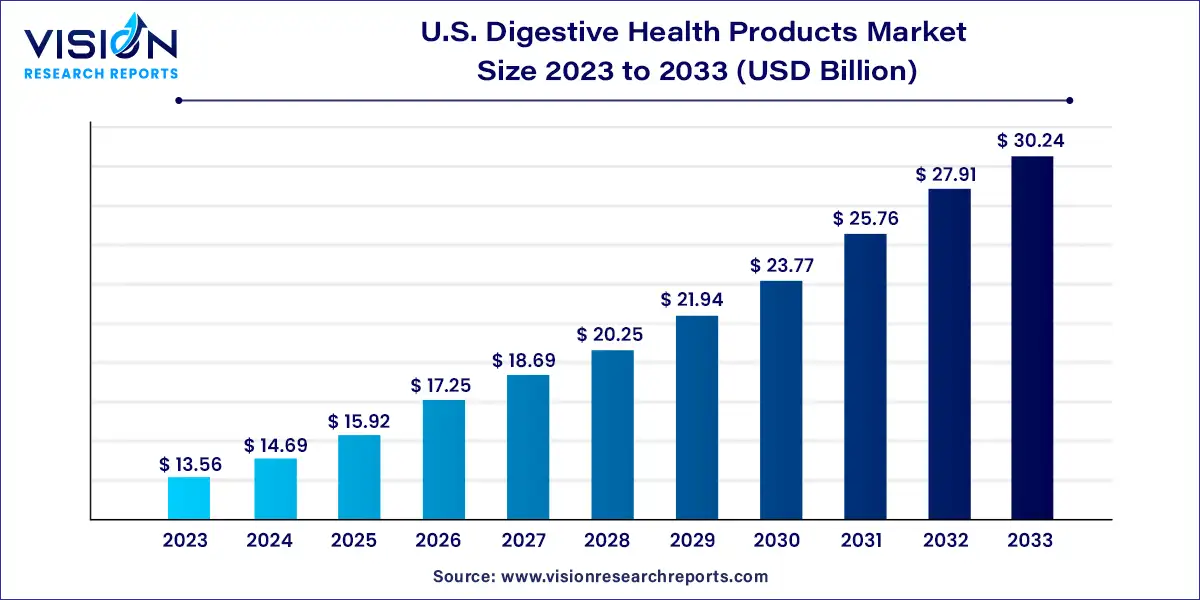

The U.S. digestive health products market size was valued at USD 13.56 billion in 2023 and is anticipated to reach around USD 30.24 billion by 2033, growing at a CAGR of 8.35% from 2024 to 2033.

The U.S. digestive health products market is witnessing significant growth driven by increasing consumer awareness about gastrointestinal wellness and the rising prevalence of digestive disorders. This overview aims to provide insights into the current landscape, key trends, market drivers, and future prospects of the digestive health products industry in the United States.

The growth of the U.S. digestive health products market is driven by an increasing awareness among consumers about the importance of gastrointestinal wellness and the correlation between digestive health and overall well-being has driven demand for related products. Additionally, the rising prevalence of digestive disorders such as irritable bowel syndrome (IBS), gastroesophageal reflux disease (GERD), and inflammatory bowel disease (IBD) has created a greater need for effective solutions, further fueling market growth. Moreover, the shift towards preventive healthcare and the growing preference for natural and organic digestive health products have contributed to the expansion of the market. Furthermore, advancements in formulation technologies and innovative product offerings have enhanced consumer choices and stimulated market growth.

In 2023, the U.S. market for digestive dairy products claimed a significant revenue share of approximately 75%. These products, abundant in probiotics and other ingredients beneficial for digestive health, play a pivotal role in enhancing gut health and fostering overall wellness. The escalating demand for dairy items stems from various factors, including the increasing per capita income, heightened consumer consciousness regarding nutritious foods, and augmented government involvement in overseeing dairy product growth and production.

Furthermore, the U.S. market for digestive health supplements is anticipated to exhibit a compound annual growth rate (CAGR) of 8.53% throughout the forecast period. Major drivers for this surge include the aging population and escalating concerns about gut health. As individuals age, their digestive systems may become less efficient, predisposing them to various health complications. Digestive health supplements serve to bolster gut health and fortify overall well-being, thereby addressing these concerns. Additionally, the rise in consumer expenditure on products conducive to intestinal health is poised to further propel the demand for digestive health products in the foreseeable future

In 2023, the probiotics segment commanded a substantial revenue share of 89%. Probiotics, live microorganisms beneficial for the host when consumed adequately, are commonly referred to as "good bacteria." They play a vital role in maintaining a healthy gut microbiome and supporting overall health. Probiotics occur naturally in fermented foods like yogurt, kefir, sauerkraut, and kimchi, or they can be consumed as supplements in various forms such as capsules, tablets, or powders. The market is witnessing a surge in new product launches driven by the increasing popularity of probiotics. For instance, in March 2023, Good Culture partnered with the largest U.S. dairy co-op to introduce a new product called Good Culture Probiotic Milk. This lactose-free, long-life milk contains the BC30 probiotic (Bacillus coagulans GBI-30, 6086), offering consumers a healthy option to promote gut health and improve digestion.

On the other hand, the food enzymes segment is forecasted to grow at a CAGR of 9.24% from 2024 to 2033. The burgeoning awareness regarding healthy eating and the demand for natural, organic, and clean-label products are driving the growth of the enzymes market. Consumers are increasingly seeking alternatives to synthetic ingredients and chemical additives. Food enzymes, with their specific functions, are derived from various sources including plants, animals, and microorganisms. For instance, amylase breaks down carbohydrates, protease breaks down proteins, and lipase breaks down fats. There's a rising demand for food enzymes in digestive health products owing to the prevalence of digestive issues like bloating, gas, and indigestion. Enzymes aid in breaking down food molecules, thereby alleviating these symptoms and enhancing digestive wellness.

By Product

By Ingredient

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others