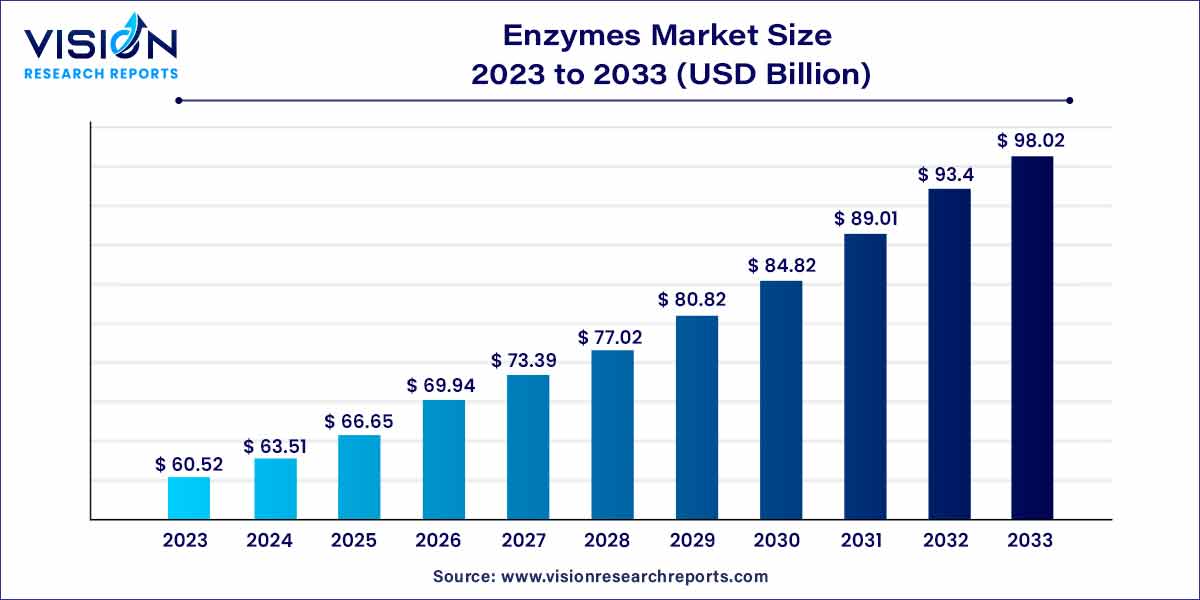

The global enzymes market size was estimated at around USD 60.52 billion in 2023 and it is projected to hit around USD 98.02 billion by 2033, growing at a CAGR of 4.94% from 2024 to 2033. The enzymes market is driven by the product demand is anticipated to be positively impacted throughout the projected period by the increased demand for food and beverage items, which may be attributed to consumers' growing health consciousness.

The enzymes market has emerged as a dynamic and influential sector, with enzymes serving as crucial catalysts in diverse industries. This overview delves into the key facets of the enzymes market, providing insights into market dynamics, major players, applications, and future trends.

The growth of the enzymes market is propelled by several key factors contributing to its expansion. Firstly, increasing awareness and emphasis on sustainable practices across industries have driven the demand for eco-friendly solutions, positioning enzymes as vital catalysts in the pursuit of greener alternatives. Furthermore, ongoing advancements in biotechnology and enzymology have led to the development of novel enzymes with improved characteristics, expanding their applicability and driving market growth. The broad spectrum of applications, spanning healthcare, food and beverage, agriculture, and bioenergy, underscores the versatility of enzymes, making them integral to diverse industrial processes. As major market players invest significantly in research and development, the continuous innovation in enzyme technology is poised to unlock new opportunities and further propel the growth of the enzymes market on a global scale.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 98.02 billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.94% |

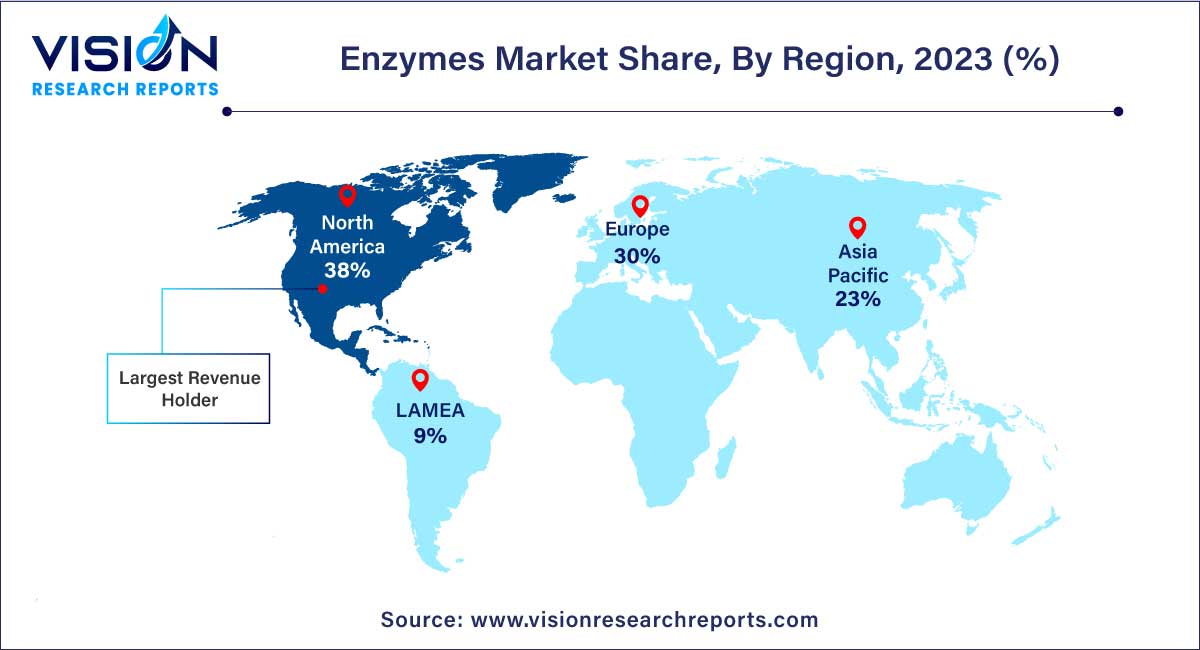

| Revenue Share of North America in 2023 | 38% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Enzymes Market Drivers

The industrial sector dominated the global market with the largest market share of 57% in 2023. This dominance is attributed to the increasing demand in various end-use industries, including food & beverage, detergent, animal feed, textile, paper & pulp, and wastewater treatment, among others. The rise in detergent usage, both in industrial and household applications, particularly in emerging economies such as Brazil, China, and India, is expected to drive the inclusion of the product in detergent formulations.

Enzymes play a crucial role in the conversion of cellulosic materials for the production of cellulosic ethanol. With the depletion of fossil fuels on the rise, there is an anticipated increase in the demand for biofuels, consequently driving the demand for these enzymes. Furthermore, the growing preference for environmentally friendly alternatives and the increased use of paper in the packaging sector, driven by environmental concerns, lightweight properties, and ease of use, are expected to contribute to the demand for these enzymes in the pulp & paper processing sector.

These enzymes also have applications in research & biotechnology, where they are extensively utilized across various industries. Enzymes like anhydrase, catalase, dismutase, elastase, protease, and tyrosinase find use in biotechnology due to their ability to facilitate cellular reactions. The rising demand for medicinal drugs is projected to further boost industry growth in the foreseeable future.

The carbohydrase segment held the largest revenue share of 48% in 2023. This prominence is attributed to the increasing demand across various end-use applications, including food & beverages, animal feed, and pharmaceuticals, among others. The heightened need for enzymes like pectinases and amylases in the processing of fruit juices, for purposes such as liquefaction, clarification, and maceration to enhance both the quantity and quality of the final product, is anticipated to propel the demand for carbohydrases throughout the forecast period.

Protease, widely utilized for the catalytic hydrolysis of protein peptides into amino acids, finds extensive application in diverse sectors, including detergents, animal feed, food processing, chemicals, and pharmaceuticals, among others. The burgeoning growth of pharmaceutical, detergent, and chemical industries in emerging economies such as China, India, and Brazil is expected to further drive market expansion in the foreseeable future.

Lipases, utilized for the digestion, transportation, and processing of various dietary lipids such as fats, oils, and triglycerides, contribute to the market demand for phospholipase as a biocatalyst. This demand spans various end-use applications, including agriculture, biodiesel production, bioremediation, cosmetics, detergents, food processing, leather production, nutraceuticals, and oil processing, among others, thereby contributing to the overall growth of the enzyme industry.

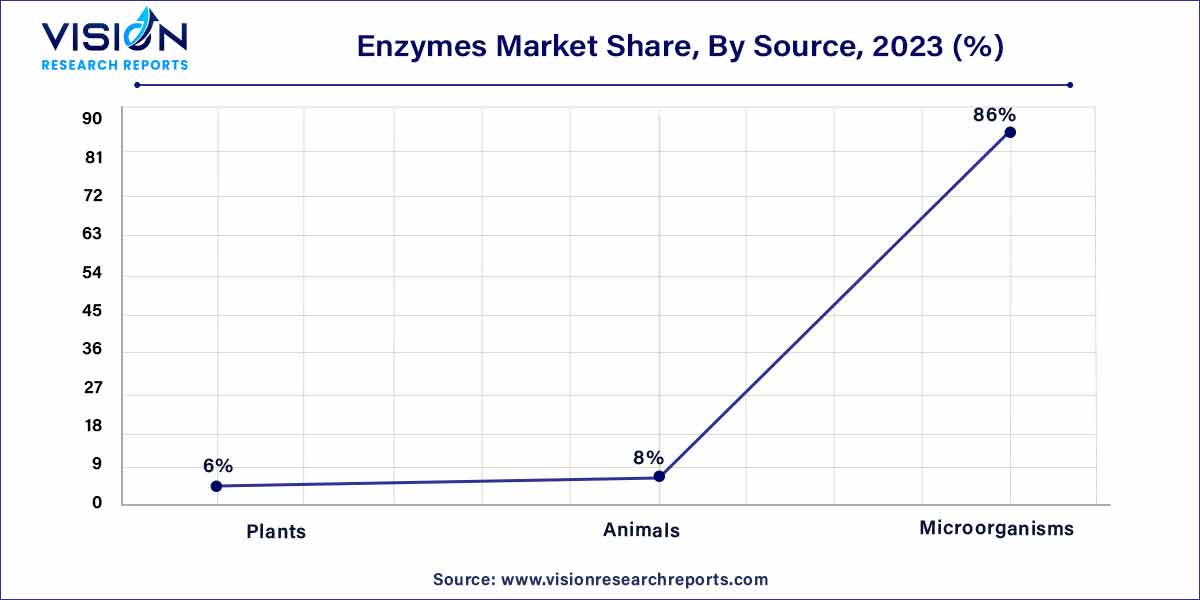

The microorganisms source segment had the largest market share of 86% in 2023. This dominance is credited to the escalating demand for enzymes sourced from microorganisms, particularly those derived from fungi, across diverse end-use applications. Fungi-based enzymes, renowned for their compatibility with vegetarian diets, are a key driver for this dominance, positively influencing the overall product demand.

Following microorganisms, the animal source segment represents another substantial category, accounting for an 8.4% revenue share in 2023. Enzymes sourced from animals are typically extracted from the stomach and pancreas of swine and cattle. These animal-based enzymes find applications in the pharmaceutical sector, particularly in the treatment of pancreatic cancer, exocrine pancreatic insufficiency, and pancreatitis, thereby contributing to the segment's steady demand.

Plant-based enzymes, derived from plants, form another significant category. Notable among them is bromelain, extracted from pineapple. Plant-based enzymes, including lipase, protease, cellulase, and amylase, cater to the growing demand for products derived from plants. Their consumption is on the rise due to their ability to alleviate acid indigestion, heartburn, acid reflux, and various other digestive disorders, further driving their market demand.

The North America region dominated the market with the largest market share of 38% in 2023. This dominance is ascribed to the concentration of end-use manufacturers in industries such as food & beverage, laundry detergent, personal care & cosmetics, and pharmaceuticals. The region boasts a high potential for research and development activities, particularly in major countries, further contributing to its market leadership.

The Asia Pacific region is poised for exponential growth, driven by the burgeoning meat production, notably in China. There is a substantial and increasing demand for protease and carbohydrase in the country, fueled by their use in the pharmaceutical and food & beverage industries. The biotechnology sector is also witnessing a surge in the use of nuclease and polymerase enzymes, further accelerating industry growth.

Rapid expansion in the textile and food & beverage industries is expected to propel market growth in emerging countries like Brazil and Colombia. This expansion is fueled by a growing population and increasing income levels in these regions. In the Middle East & Africa (MEA), the pharmaceutical and cosmetic industries are anticipated to experience growth. Factors such as rising health awareness, growing disposable income, and an increasing demand for high-end cosmetic products are expected to stimulate demand in these industries in the aforementioned region.

To improve and eliminate lactose from dairy products, DSM-Friedenich introduced MaxilactNext in May 2023. It is the fastest pure lactase enzyme available.

The acquisition of Agrivida Inc., a biotech company, was announced in January 2023 by Novus International, Inc., a global company serving animal health and nutrition needs. The flagship INTERIUSTM technology created by Agrivida to implant feed additives in grain was acquired by Novus as a result of this transaction.

Adisseo declared in December 2022 that it would be taking part in the Chinese First Agri-food closing round. Activities highlighting the contemporary change in livestock and agriculture are the main focus of this investment.

By Type

By Product

By Source

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Enzymes Market

5.1. COVID-19 Landscape: Enzymes Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Enzymes Market, By Type

8.1. Enzymes Market, by Type, 2024-2033

8.1.1 Industrial Enzymes

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Specialty Enzymes

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Enzymes Market, By Product

9.1. Enzymes Market, by Product, 2024-2033

9.1.1. Carbohydrases

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Proteases

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Lipases

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Polymerases & Nucleases

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Enzymes Market, By Source

10.1. Enzymes Market, by Source, 2024-2033

10.1.1. Plants

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Animals

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Microorganisms

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Enzymes Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.3. Market Revenue and Forecast, by Source (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Source (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Source (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.3. Market Revenue and Forecast, by Source (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Source (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Source (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Source (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Source (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.3. Market Revenue and Forecast, by Source (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Source (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Source (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Source (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Source (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.3. Market Revenue and Forecast, by Source (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Source (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Source (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Source (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Source (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.5.3. Market Revenue and Forecast, by Source (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Source (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Source (2021-2033)

Chapter 12. Company Profiles

12.1. BASF SE.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Novozymes.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. DuPont Danisco.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. DSM.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Novus International.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Adisseo

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Associated British Foods Plc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Chr. Hansen Holding A/S

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Advanced Enzyme Technologies.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Lesaffre

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others