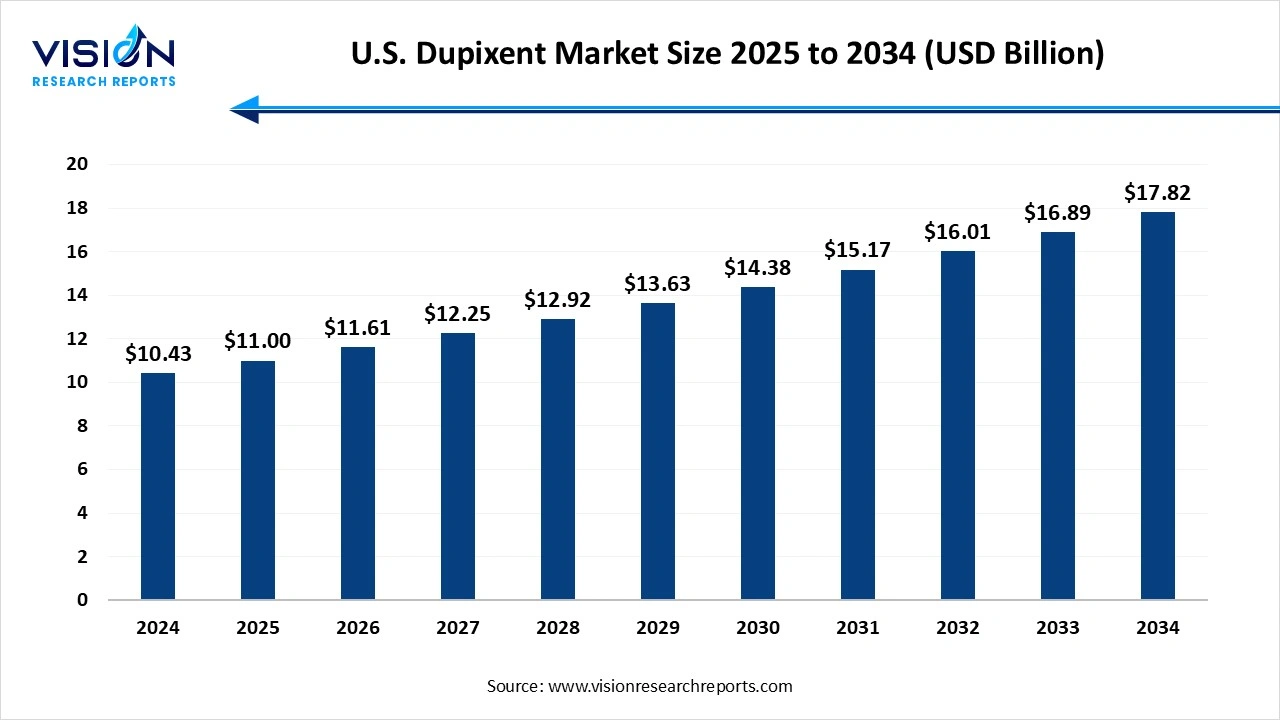

The U.S. dupixent market size was surpassed at USD 10.43 billion in 2024 and it is projected to hit around USD 17.82 billion by 2034, growing at a CAGR of 5.5% from 2025 to 2034. The merket growth is driven by expanding indications across multiple inflammatory conditions, including atopic dermatitis, asthma, and chronic rhinosinusitis with nasal polyps, the U.S. Dupixent market is experiencing robust growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 10.43 billion |

| Revenue Forecast by 2034 | USD 17.82 billion |

| Growth rate from 2025 to 2034 | CAGR of 5.5% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Companies Covered | Sanofi S.A., CVS Health Corporation (Specialty Pharmacy Division), Walgreens Boots Alliance, Inc., Cigna Corporation, OptumRx, Inc. (UnitedHealth Group), Kroger Specialty Pharmacy, Diplomat Specialty Pharmacy, Express Scripts Holding Company (Evernorth) Humana Specialty Pharmacy |

The U.S. dupixent market has witnessed significant growth in recent years, driven by the increasing prevalence of chronic inflammatory conditions such as atopic dermatitis, asthma, and chronic rhinosinusitis with nasal polyps. Dupixent (dupilumab), developed by Regeneron Pharmaceuticals and Sanofi, has established itself as a leading biologic therapy due to its targeted mechanism of action and favorable safety profile. Its expanding label approvals and growing physician confidence have contributed to higher adoption rates across various therapeutic areas.

One of the primary growth drivers of the U.S. dupixent market is the rising incidence of chronic inflammatory and allergic diseases, including atopic dermatitis, asthma, and chronic rhinosinusitis with nasal polyps. With increasing awareness about these conditions and a shift towards long-term, targeted treatment options, Dupixent has gained significant traction due to its proven efficacy and safety profile. The growing demand for biologics that offer symptom relief and improved quality of life has further propelled its adoption among healthcare providers and patients alike.

Another key factor contributing to market growth is the drug’s expanding therapeutic reach through FDA approvals for additional indications. Ongoing clinical trials and research are paving the way for Dupixent to be used in treating diseases such as eosinophilic esophagitis, prurigo nodularis, and chronic spontaneous urticaria.

One of the major challenges in the U.S. dupixent market is its high cost, which can limit accessibility for patients without comprehensive insurance coverage. Despite its clinical benefits, the out-of-pocket expenses associated with biologic therapies like Dupixent can be a barrier for many individuals, especially those with chronic conditions requiring long-term treatment. Additionally, formulary restrictions and prior authorization requirements by insurance providers may delay or restrict patient access, affecting overall market penetration.

Another significant challenge is the increasing competition from other biologics and biosimilars targeting similar indications. As the market grows, pharmaceutical companies are investing in the development of alternative therapies with competitive pricing or novel mechanisms of action. This rising competition may impact Dupixent’s market share, particularly if newer therapies demonstrate comparable efficacy with improved dosing convenience or cost-effectiveness.

The atopic dermatitis segment dominated the market, accounting for the highest revenue share of 74% in 2024. The rising prevalence of moderate-to-severe atopic dermatitis, particularly among both adolescents and adults, has led to a surge in demand for targeted biologic therapies like Dupixent. Its ability to effectively manage symptoms such as persistent itching, inflammation, and skin lesions, along with its favorable safety and tolerability profile, has made it the preferred treatment option among dermatologists. The growing number of FDA approvals for use in younger age groups and the increasing awareness of the benefits of early intervention have further boosted its adoption.

The chronic obstructive pulmonary disease (COPD) segment is expected to register the fastest CAGR throughout the forecast period. Although it is not yet a primary approved use, ongoing clinical trials and research have shown encouraging results in targeting COPD patients with elevated eosinophil counts. The high disease burden associated with COPD in the U.S., especially among the aging population and smokers, creates a significant opportunity for Dupixent if regulatory approvals are granted.

The hospital pharmacies segment dominated the market, accounting for the highest revenue share of 56% in 2024. These settings are equipped to manage chronic and severe cases of atopic dermatitis, asthma, and other conditions for which Dupixent is prescribed. Hospital pharmacies ensure the availability of the drug within clinical environments where healthcare providers can closely monitor the patient’s response, manage potential side effects, and adjust treatment plans as needed.

The other segment, which includes online pharmacies, is expected to witness the fastest CAGR during the forecast period, driven by the growing adoption of telehealth services that facilitate Dupixent refills. Specialty pharmacies, in particular, offer patient-centric services such as benefit verification, prior authorization support, and medication counseling, which are crucial for biologics requiring long-term administration and monitoring. The integration of telehealth services and digital prescription systems has further accelerated the adoption of these channels, making it easier for patients to refill prescriptions and receive medications at their doorstep.

By Indication

By Distribution Channel

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Dupixent Market

5.1. COVID-19 Landscape: U.S. Dupixent Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Dupixent Market, By Indication

8.1. U.S. Dupixent Market, by Indication, 2024-2033

8.1.1. Atopic Dermatitis (AD)

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Asthma

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Chronic Rhinosinusitis with Nasal Polyps (CRSwNP)

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Chronic Obstructive Pulmonary Disease (COPD)

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Dupixent Market, By Distribution Channel

9.1. U.S. Dupixent Market, by Distribution Channel, 2024-2033

9.1.1. Hospital Pharmacies

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Retail Pharmacies

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Dupixent Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Indication (2021-2033)

10.1.2. Market Revenue and Forecast, by Distribution Channel (2021-2033)

Chapter 11. Company Profiles

11.1. Sanofi S.A.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. CVS Health Corporation (Specialty Pharmacy Division)

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Walgreens Boots Alliance, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Cigna Corporation

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. OptumRx, Inc. (UnitedHealth Group)

11.5. Intermountain Life Sciences

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Kroger Specialty Pharmacy

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Diplomat Specialty Pharmacy

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Express Scripts Holding Company (Evernorth)

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Evoqua Water Technologies

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Humana Specialty Pharmacy

11.10. Nexus Pharmaceuticals

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others