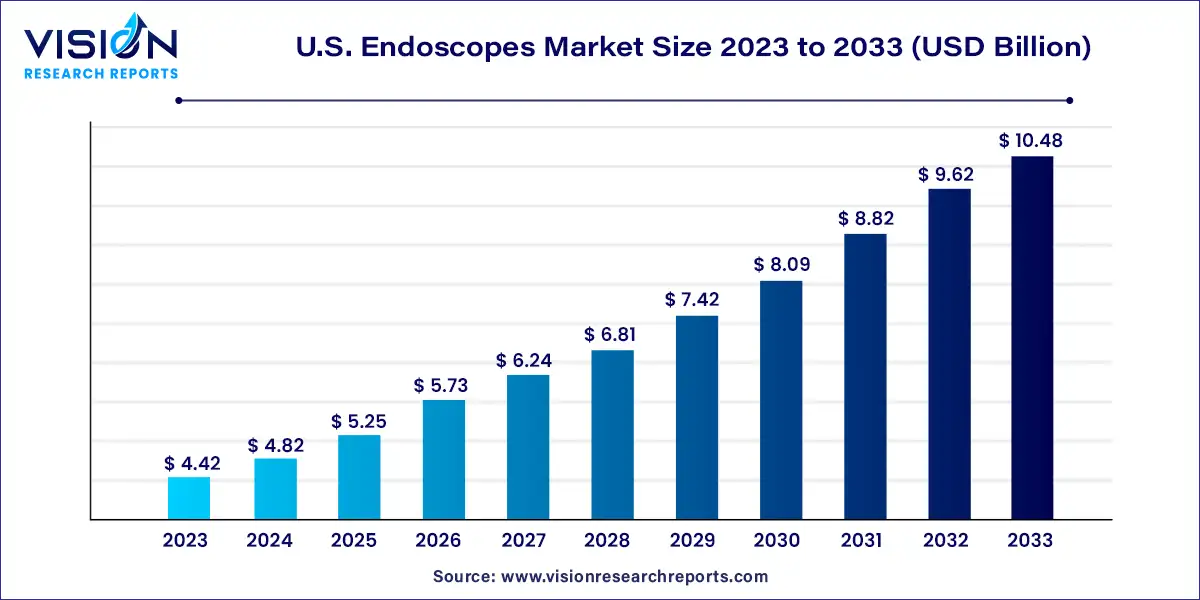

The U.S. endoscopes market size was estimated at around USD 4.42 billion in 2023 and it is projected to hit around USD 10.48 billion by 2033, growing at a CAGR of 9.02% from 2024 to 2033.

The U.S. endoscopes market stands as a pivotal segment within the broader medical device industry, witnessing significant growth and innovation over recent years. Endoscopic procedures have revolutionized diagnostic and therapeutic interventions, offering minimally invasive solutions for a wide array of medical conditions.

The growth of the U.S. endoscopes market is driven by an increasing prevalence of gastrointestinal disorders and other medical conditions necessitating endoscopic interventions drives market demand. Furthermore, advancements in endoscopic imaging and visualization technologies enhance diagnostic accuracy and therapeutic outcomes, fostering adoption among healthcare professionals. The rising preference for minimally invasive surgeries, coupled with the aging population and escalating healthcare expenditure, further propels market growth. However, challenges such as high procedural costs and reimbursement issues remain significant considerations.

The U.S. endoscopes market is categorized into rigid endoscopes, capsule endoscopes, robot-assisted endoscopes, flexible endoscopes, and disposable endoscopes. In 2023, the flexible endoscopes segment emerged as the dominant force in the U.S. endoscopes market. Flexible endoscopes are equipped with optical devices that transmit light and deliver images to observers. These devices feature bendable transparent fibers. Due to their numerous benefits over competing products, coupled with a rise in new releases and increasing popularity, the flexible endoscopes segment is projected to continue its upward trajectory throughout the forecast period.

Endoscopes are extensively utilized in diagnostic procedures for various chronic disorders, including inflammatory bowel disease (IBD), stomach cancer, colon cancer, respiratory infections, and respiratory cancers. Consequently, there is a significant increase in demand for flexible endoscopes due to the high prevalence of these disorders.

The disposable endoscopes segment is witnessing the fastest growth rate during the forecast period. Disposable endoscopes mitigate the risk of infection associated with reusable endoscopes. Reusable endoscopes necessitate extensive cleaning, sterilization, and maintenance processes, which can accrue substantial costs over time. Disposable endoscopes eliminate these ongoing expenses.

The U.S. endoscopes market is divided into several segments, including arthroscopy, urology endoscopy, laparoscopy, gastrointestinal (GI) endoscopy, bronchoscopy, mediastinoscopy, gynecology endoscopy, otoscopy, laryngoscopy, and others. In 2023, the GI endoscopy segment emerged as the leader in the U.S. endoscopes market. The rising prevalence of gastrointestinal disorders such as colorectal cancer, gastroesophageal reflux disease (GERD), and inflammatory bowel disease (IBD) has significantly contributed to the increased demand for GI endoscopy procedures.

Furthermore, continuous technological advancements, including enhancements in imaging quality, the introduction of high-definition and ultra-high-definition endoscopes, and the integration of advanced imaging techniques such as narrow-band imaging (NBI) and confocal laser endomicroscopy (CLE), have substantially improved the diagnostic capabilities of GI endoscopes. Consequently, this trend is expected to fuel the growth of the U.S. endoscopes market.

The U.S. endoscopes market is segmented into ambulatory surgery centers, hospitals, and other healthcare facilities. In 2023, the hospitals segment commanded the largest share of the market. Endoscopes play a critical role in both minimally invasive surgeries and diagnostic procedures. Hospitals are increasingly embracing endoscopic techniques due to their numerous benefits, including shortened patient recovery times, reduced hospital stays, and decreased risks of complications.

Furthermore, the growing prevalence of gastrointestinal and respiratory diseases, such as colorectal cancer, GERD, and lung disorders, contributes to the demand for endoscopic procedures in hospitals. Gastrointestinal endoscopy and bronchoscopy are commonly conducted in hospitals to diagnose and treat these conditions.

By Product

By Application

By End-Use

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others