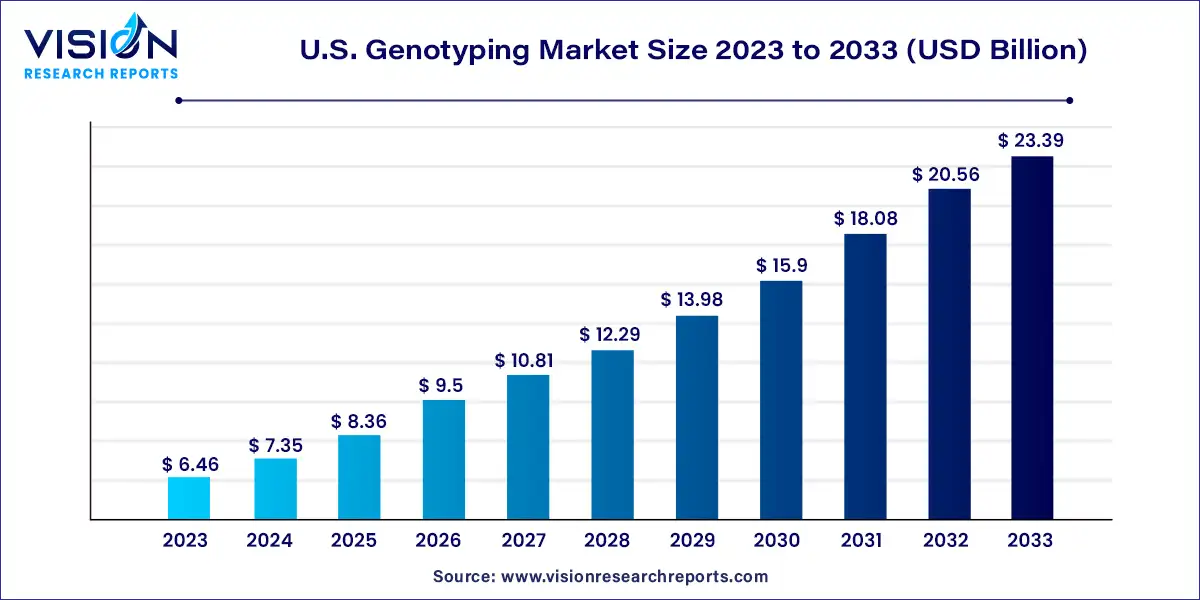

The U.S. genotyping market was estimated at USD 6.46 billion in 2023 and it is expected to surpass around USD 23.39 billion by 2033, poised to grow at a CAGR of 13.73% from 2024 to 2033.

The U.S. genotyping market represents a dynamic and rapidly evolving sector within the broader landscape of biotechnology and genetic research. Genotyping, the process of analyzing genetic variations in an individual's DNA, plays a pivotal role in various fields, including personalized medicine, agriculture, and forensic science.

The growth of the U.S. genotyping market is driven by the technological advancements, particularly in high-throughput genotyping platforms and next-generation sequencing (NGS) technologies, have revolutionized the field, enabling faster, more accurate, and cost-effective analysis of genetic variations. Secondly, the increasing demand for personalized medicine has fueled the adoption of genotyping technologies to identify genetic markers associated with disease susceptibility, drug response, and treatment outcomes. Thirdly, the expansion of direct-to-consumer genetic testing services has democratized access to genotyping, driving consumer interest and market growth. Additionally, genotyping plays a crucial role in agriculture and animal breeding, contributing to enhanced crop yield, disease resistance, and livestock traits.

Reagents and kits emerged as the dominant force in the market, capturing the largest revenue share of 62% in 2023. This segment is projected to exhibit the fastest compound annual growth rate (CAGR) throughout the forecast period. These products play a pivotal role in establishing standardized workflows, assisting researchers across diverse domains such as food testing, cancer and genetic disease detection, and forensics. The segment's significant market share can be attributed to technological advancements, substantial investments in healthcare by various research organizations, increasing demand for genetic testing, and a surge in genotyping testing volumes.

Similarly, services are poised to witness notable growth with a projected CAGR of 13.62% during the forecast period. This surge is primarily driven by the escalating adoption of software-based services by research laboratories and academic institutions. Particularly, bioinformatics solutions play a pivotal role in this expansion by refining sequencing techniques and mitigating errors inherent in conventional methodologies. These bioinformatics solutions find widespread utility across various sectors including agrigenomics, human diseases, animal husbandry, and microbial studies. By refining sequencing methodologies and minimizing errors, these services contribute significantly to advancements in diverse fields, fostering innovation and efficiency. Overall, the increased uptake of software-based services, especially bioinformatics solutions, is anticipated to fuel market growth by addressing critical requirements in research and academic settings, thereby driving progress and development across numerous scientific domains.

Sequencing emerged as the dominant force in this market, commanding the largest revenue market share of 22% in 2023, and is expected to exhibit the fastest compound annual growth rate (CAGR) during the forecast period. This growth is primarily driven by an upsurge in genome profiling initiatives, intensified research and development efforts for new drugs, and a decline in the cost and size of DNA sequencers. Notably, products like MinION, developed by Oxford Nanopore Technologies, represent a significant advancement in the field, being the only portable device for RNA and DNA sequencing weighing less than 100 grams. Sequencing technologies encompass a range of processes, including DNA sequencing and emerging Next Generation Sequencing (NGS) technologies such as sequencing platforms and RNA sequencing.

Polymerase Chain Reaction (PCR) secured the second-largest market revenue share in 2023. PCR serves as the fundamental and initial step preceding any genetic material-related tests. The increasing utilization of genotyping in diverse areas such as pharmacogenomics, drug discovery and development, AIDS, and cancer research directly drives the demand for PCR technologies. Additionally, factors such as the escalating need for advanced diagnostic methods, the proliferation of Contract Research Organizations (CROs), forensic and research laboratories, and the rising incidence of diseases such as chronic diseases and genetic disorders are expected to fuel market growth.

Diagnostics and personalized medicine emerged as the dominant forces in the market, commanding the largest revenue share of 34% in 2023. This can be attributed to the increasing adoption of genotyping products for research purposes and the growing necessity to diagnose genetic diseases. Genotyping enables researchers to identify genetic variants, including significant structural changes in DNA and Single Nucleotide Polymorphisms (SNPs). High-throughput genomic technologies such as microarrays and next-generation sequencing provide deeper insights into disease etiology at a molecular level. Technological advancements and the rising demand for genotype testing contribute significantly to the segment's high market share. Additionally, the increasing prevalence of infectious diseases is anticipated to further drive market growth. There is a heightened demand for automated and efficient products in the market, which is expected to fuel diagnostic research.

Pharmacogenomics is poised to exhibit the fastest CAGR of 14.53% during the forecast period. Genotyping techniques play a crucial role in pharmacogenomics by extensively testing New Chemical Entities (NCEs) for developing tailored drugs based on specific genetic profiles. Analyzing individual drug responses helps establish the link between nucleotide polymorphisms and drug metabolism, identifying responsive and non-responsive subsets of the population. This facilitates the delivery of personalized treatment to individuals with varying genetic backgrounds and enables the development of medications tailored to specific subsets of the population afflicted by particular diseases, thus paving the way for personalized medicine.

Diagnostics and research laboratories emerged as the dominant players in this market, capturing the largest revenue share of 37% in 2023 and are projected to exhibit the fastest compound annual growth rate (CAGR) during the forecast period. Genotyping studies conducted in these settings enable researchers to identify genetic variations, encompassing DNA structural changes and Single Nucleotide Polymorphisms (SNPs). Advanced genomic technologies such as genotyping, microarray, and Next Generation Sequencing (NGS) provide a comprehensive understanding of disease origins at a molecular level. Factors such as increased awareness of personalized medicine, a surge in demand for cost-effective services, and ongoing technological advancements are anticipated to drive growth in this segment.

The pharmaceutical and biopharmaceutical companies segment is poised to witness the second-fastest CAGR of 14.05% during the forecast period. The increasing adoption of pharmacogenomics in drug development, coupled with the FDA's recommendation to incorporate pharmacogenomics studies and genotyping in the drug discovery process, is anticipated to fuel market growth. Companies are actively leveraging pharmacogenomics to innovate and create novel medications. For instance, Pfizer is conducting clinical trials based on genotyping to evaluate the efficacy of Talazoparib in patients with somatic BRCA mutant-resistant metastatic breast cancer. Consequently, the growing number of pharmacogenomics-based clinical trials is expected to drive growth in this sector.

By Product

By Technology

By Application

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Genotyping Market

5.1. COVID-19 Landscape: U.S. Genotyping Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global U.S. Genotyping Market, By Product

8.1. U.S. Genotyping Market, by Product, 2024-2033

8.1.1. Instruments

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Reagents & Kits

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Software and Services

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global U.S. Genotyping Market, By Technology

9.1. U.S. Genotyping Market, by Technology, 2024-2033

9.1.1. PCR

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Capillary Electrophoresis

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Microarrays

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Sequencing

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Mass Spectrometry

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Genotyping Market, By Application

10.1. U.S. Genotyping Market, by Application, 2024-2033

10.1.1. Pharmacogenomics

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Diagnostics and Personalized Medicine

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Agricultural Biotechnology

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Animal Genetics

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Genotyping Market, By End-use

11.1. U.S. Genotyping Market, by End-use, 2024-2033

11.1.1. Pharmaceutical and Biopharmaceutical Companies

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Diagnostics and Research Laboratories

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Academic Institutes

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Genotyping Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.2. Market Revenue and Forecast, by Technology (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 13. Company Profiles

13.1. Illumina Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Thermo Fisher Scientific Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. QIAGEN

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. F. Hoffmann-La Roche Ltd.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Fluidigm Corporation

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Danaher Corporation

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Agilent Technologies

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Eurofins Scientific Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. GE Healthcare Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Bio-Rad Laboratories Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others