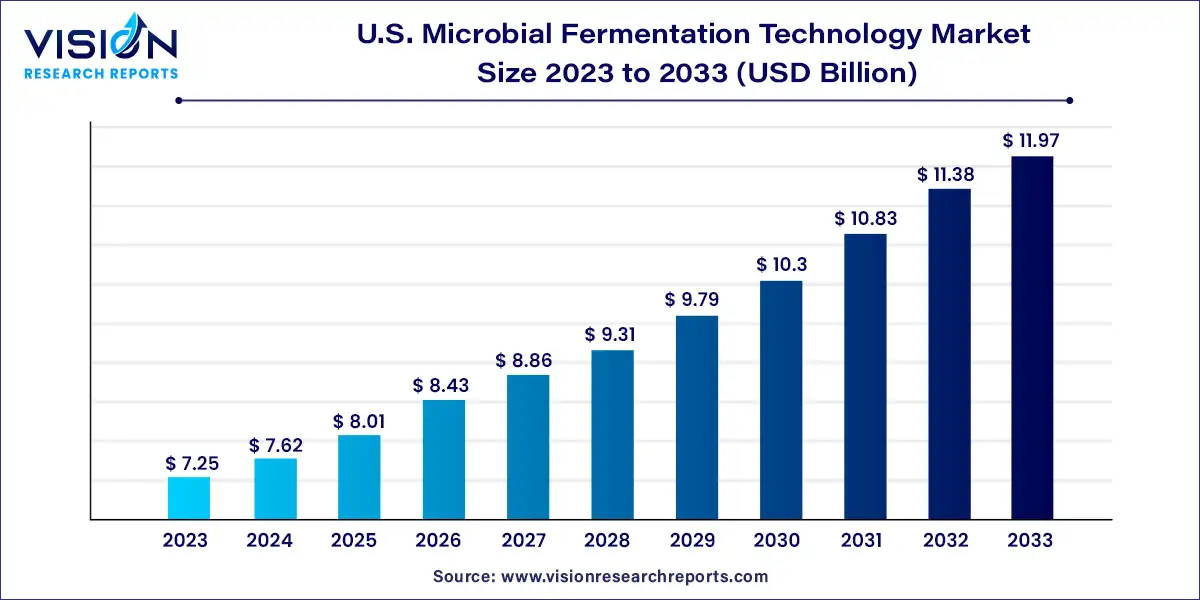

The U.S. microbial fermentation technology market size was estimated at around USD 7.25 billion in 2023 and it is projected to hit around USD 11.97 billion by 2033, growing at a CAGR of 5.14% from 2024 to 2033.

Microbial fermentation technology has emerged as a pivotal component of various industries, ranging from pharmaceuticals and biotechnology to food and beverage production. In the United States, the microbial fermentation technology market is witnessing significant growth, driven by advancements in bioprocessing techniques, increasing demand for bio-based products, and growing emphasis on sustainable manufacturing practices.

The growth of the U.S. microbial fermentation technology market is propelled by the technological advancements in bioprocessing techniques have enhanced the efficiency and scalability of microbial fermentation processes, driving increased adoption across various industries. Additionally, the rising demand for bio-based products, driven by growing environmental concerns and consumer preferences for sustainable alternatives, has spurred the utilization of microbial fermentation for the production of bio-based chemicals, materials, and ingredients. Moreover, the expansion of the biopharmaceutical sector, fueled by advancements in genetic engineering and bioproduction technologies, has further contributed to market growth, with microbial fermentation serving as a vital method for the production of therapeutic proteins, enzymes, and vaccines. Furthermore, initiatives aimed at promoting sustainability and reducing carbon emissions have led to the integration of eco-friendly fermentation practices, further augmenting market growth.

In 2023, the antibiotics segment emerged as the dominant application of microbial fermentation technology, capturing nearly 33% of the total revenue share. This segment is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) over the forecast period, driven by several factors. These include the persistent prevalence of infectious diseases, heightened attention to antibiotics following the pandemic, and the segment's inherent profitability. The urgency of this growth is underscored by data from the Centers for Disease Control and Prevention (CDC), which reports approximately 1.3 million cases of antibiotic-resistant infections annually, resulting in roughly 19,000 deaths. This emphasizes the critical need for sustained investment in antibiotic research and development to combat the escalating threat of antibiotic resistance.

Moreover, there is a notable surge in demand for Monoclonal Antibodies (mAbs), with projections indicating lucrative growth from 2024 to 2033. Recognizing this opportunity, numerous manufacturers are entering the market to meet the escalating demand for mAbs. To navigate the intricate regulatory landscape associated with mAbs, these companies are forging partnerships with Contract Development and Manufacturing Organizations (CDMOs) and Contract Manufacturing Organizations (CMOs).

In 2023, Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs) emerged as market leaders, commanding over 43% of the revenue share. They are projected to experience the fastest segment growth during the forecast period. This growth is fueled by the increasing demand for manufacturing biologics, which is driven by a surge in outsourcing to CMOs. To bolster productivity, CMOs are adopting advanced technologies like microbial fermentation. Additionally, they are employing various strategies such as mergers, acquisitions, and collaborations to expedite market approvals and facilitate rapid product launches for commercial use.

Biopharmaceutical companies also held a significant market share in 2023 and are expected to witness the second-fastest compound annual growth rate (CAGR) from 2024 to 2033. This growth is attributed to strategic initiatives undertaken by these companies, including product development, mergers and acquisitions, product approvals and launches, and global expansion efforts. Moreover, several players in the industry are collaborating to enhance their offerings in the microbial fermentation technology market. For instance, in March 2023, Cytovance Biologics partnered with Phenotypeca, merging Cytovance’s microbial fermentation capabilities with Phenotypeca’s yeast strain development technology. This collaboration aimed to strengthen Cytovance Biologics's leadership in microbial-derived Active Pharmaceutical Ingredients (APIs).

By Application

By End-user

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Microbial Fermentation Technology Market

5.1. COVID-19 Landscape: U.S. Microbial Fermentation Technology Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Microbial Fermentation Technology Market, By Application

8.1. U.S. Microbial Fermentation Technology Market, by Application, 2024-2033

8.1.1. Antibiotics

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Probiotics Supplements

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Monoclonal Antibodies

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Recombinant Proteins

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Biosimilars

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Vaccines

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Enzymes

8.1.7.1. Market Revenue and Forecast (2021-2033)

8.1.8. Small Molecules

8.1.8.1. Market Revenue and Forecast (2021-2033)

8.1.9. Other Applications

8.1.9.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Microbial Fermentation Technology Market, By End-user

9.1. U.S. Microbial Fermentation Technology Market, by End-user, 2024-2033

9.1.1. Biopharmaceutical Companies

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Contract Research Organizations

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. CMOs & CDMOs

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Academic & Research Organizations

Chapter 10. U.S. Microbial Fermentation Technology Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Application (2021-2033)

10.1.2. Market Revenue and Forecast, by End-user (2021-2033)

Chapter 11. Company Profiles

11.1. Biocon Ltd.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. BioVectra Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Danone

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. F. Hoffmann-La Roche AG

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Koninklijke DSM NV

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Lonza

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Novozymes A/S

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. TerraVia Holdings, Inc. (Corbion)

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. BIOZEEN

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Biovian Oy

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others